Paperwork

Tax Paperwork Mailing Requirement

Understanding Tax Paperwork Mailing Requirements

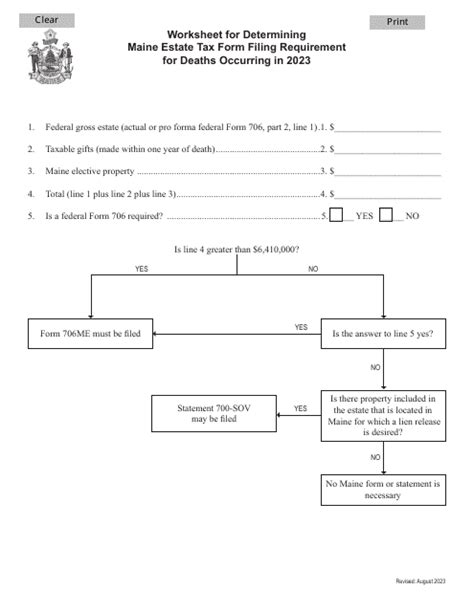

The process of filing taxes involves a multitude of steps, from gathering necessary documents to submitting the final return. One crucial aspect that often gets overlooked until the last minute is the mailing requirement for tax paperwork. Timely and accurate mailing of tax documents is essential to avoid delays, penalties, and potential audits. This process can be daunting, especially for those who are new to filing taxes or have complex tax situations. In this guide, we will break down the key elements of tax paperwork mailing requirements to help ensure a smooth and compliant tax filing experience.

Who Needs to Mail Tax Paperwork?

Not everyone needs to mail their tax paperwork. The requirement to mail tax documents typically applies to individuals and businesses that cannot or choose not to file electronically. This includes those who: - Have returns that are too complex for electronic filing. - Prefer a paper trail for their records. - Are required to submit additional forms or supporting documentation that cannot be attached electronically. - Do not have access to electronic filing options.

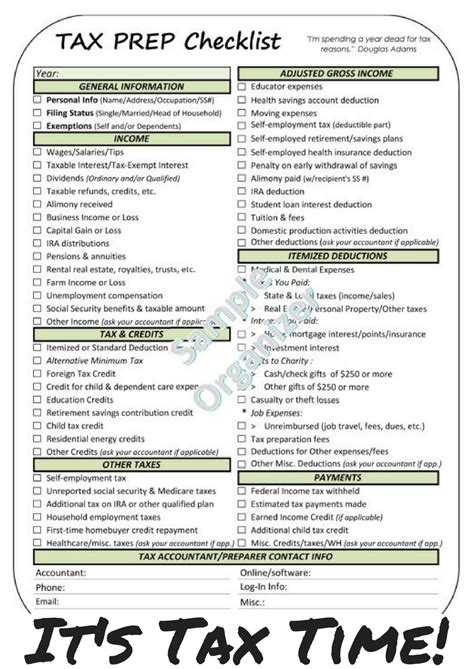

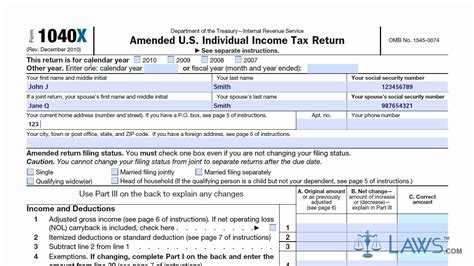

What Tax Paperwork Needs to Be Mailed?

The specific tax paperwork that needs to be mailed can vary based on individual circumstances, such as income level, sources of income, deductions claimed, and more. Common examples include: - Form 1040 and its associated schedules for personal income tax returns. - Form 1120 for corporate income tax returns. - Form 1065 for partnership returns. - Any additional forms or schedules required for specific deductions, credits, or income types. - Supporting documentation, such as W-2s, 1099s, receipts for deductions, and proof of identity.

How to Mail Tax Paperwork

Mailing tax paperwork requires attention to detail to ensure it reaches the correct destination in a timely manner. Here are steps to follow: - Use the Correct Mailing Address: The IRS provides specific mailing addresses based on the type of return and the taxpayer’s location. It’s crucial to use the correct address to avoid delays. - Use Certified Mail: It’s recommended to use certified mail with return receipt requested. This provides proof that the documents were sent and received, which can be important in case of disputes or audits. - Keep Copies: Always keep a copy of the mailed documents for personal records. This can be useful for tracking purposes and in case the original documents are lost or misplaced. - Meet the Deadline: Ensure that the tax paperwork is mailed on or before the tax filing deadline to avoid late filing penalties.

Important Considerations

When mailing tax paperwork, several factors must be considered to ensure compliance and avoid complications: - Deadlines: The IRS has strict deadlines for filing taxes. Missing these deadlines can result in penalties and interest on the owed amount. - Accuracy: Ensure all information is accurate and complete. Errors can lead to processing delays or even audits. - Security: Be cautious when mailing sensitive financial information. Using traceable mail services can help protect against loss or theft.

Benefits of Electronic Filing

While mailing tax paperwork is still an option, the IRS and tax professionals often recommend electronic filing for several reasons: - Faster Refunds: Electronic filers typically receive their refunds faster than those who mail paper returns. - Accuracy: Electronic filing reduces the risk of human error, as the software checks for mistakes and missing information. - Convenience: Electronic filing can be done from anywhere with an internet connection, at any time, making it more convenient for many taxpayers. - Environmentally Friendly: It reduces the need for paper, which can be more environmentally friendly.

📝 Note: Always check the IRS website for the most current information on tax filing requirements and deadlines, as these can change from year to year.

Preparing for Tax Season

To make the tax filing process smoother, whether filing electronically or by mail, it’s essential to be prepared: - Gather Documents Early: Start collecting necessary documents as soon as they become available. - Understand Tax Law Changes: Tax laws and regulations can change annually, so it’s crucial to understand how these changes affect your tax situation. - Seek Professional Help: If unsure about any aspect of the tax filing process, consider consulting a tax professional.

In wrapping up the discussion on tax paperwork mailing requirements, it’s clear that understanding and adhering to these guidelines is vital for a hassle-free tax filing experience. By being informed and prepared, individuals and businesses can navigate the tax season with confidence, ensuring they meet all necessary deadlines and requirements. Whether choosing to file electronically or by mail, the key to success lies in attention to detail, timely action, and seeking help when needed.