Emailing Tax Paperwork

Introduction to Emailing Tax Paperwork

Emailing tax paperwork is a convenient and efficient way to share and submit tax-related documents. With the advancement of technology, many tax professionals and government agencies now accept electronic submissions of tax paperwork. This method not only saves time but also reduces the risk of lost or damaged documents. In this blog post, we will explore the benefits and best practices of emailing tax paperwork, as well as provide tips on how to do it securely and efficiently.

Benefits of Emailing Tax Paperwork

There are several benefits to emailing tax paperwork, including: * Convenience: Emailing tax paperwork allows you to submit documents from the comfort of your own home or office, without having to physically visit a tax professional or government agency. * Time-saving: Emailing tax paperwork saves time, as you don’t have to wait in line or spend time traveling to a physical location. * Reduced risk of loss or damage: Electronic documents are less likely to be lost or damaged, as they can be easily stored and retrieved digitally. * Environmentally friendly: Emailing tax paperwork reduces the need for paper and ink, making it a more environmentally friendly option.

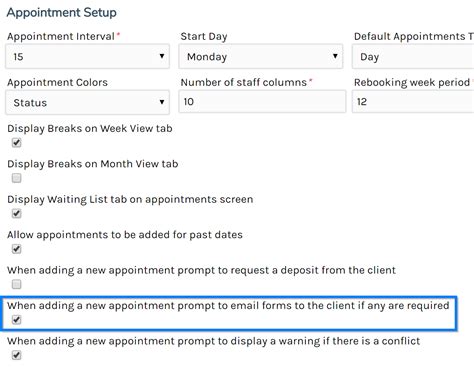

Best Practices for Emailing Tax Paperwork

To ensure that your tax paperwork is emailed securely and efficiently, follow these best practices: * Use a secure email service: Choose an email service that provides end-to-end encryption, such as Gmail or Outlook. * Use a strong password: Use a strong and unique password for your email account to prevent unauthorized access. * Verify the recipient’s email address: Make sure you have the correct email address for the recipient, and verify it before sending sensitive documents. * Use a secure file transfer method: Consider using a secure file transfer method, such as a password-protected zip file or a secure online portal.

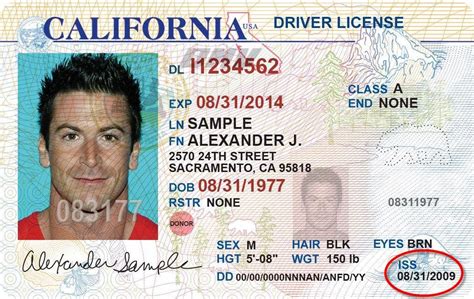

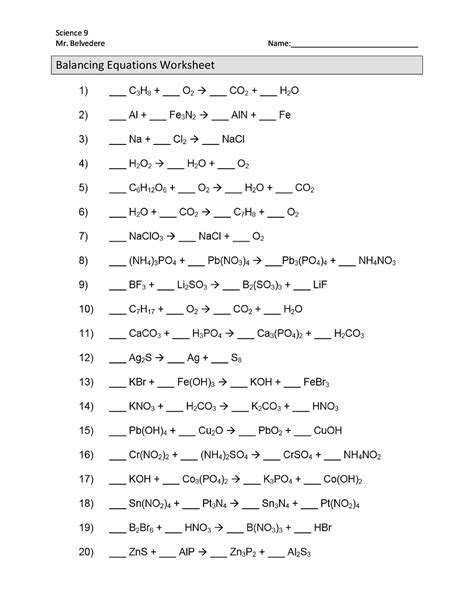

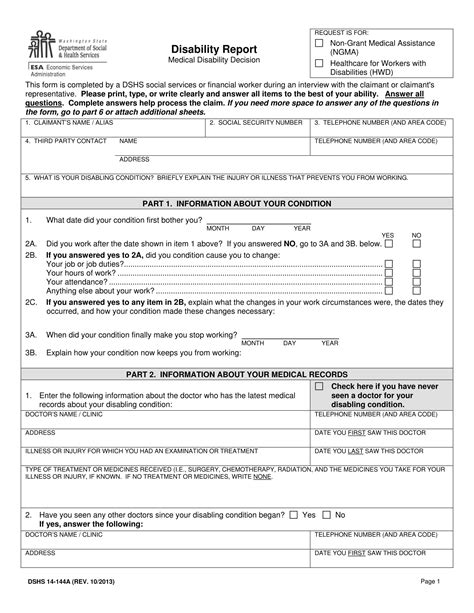

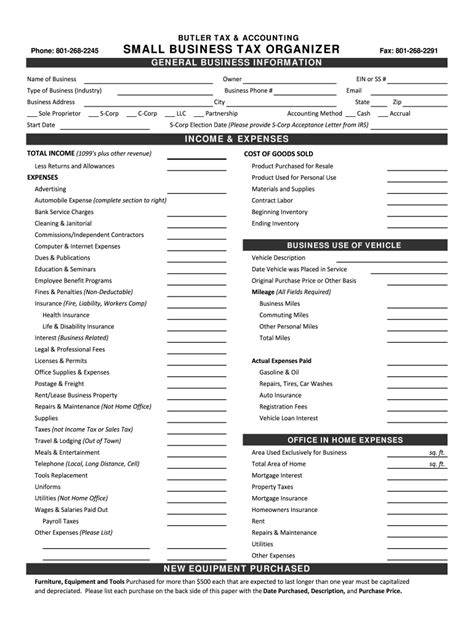

Types of Tax Paperwork that Can be Emailed

The following types of tax paperwork can be emailed: * Tax returns * W-2 forms * 1099 forms * Tax receipts * Other supporting documentation

📝 Note: Always check with the recipient before emailing sensitive documents, as some may have specific requirements or restrictions.

How to Email Tax Paperwork Securely

To email tax paperwork securely, follow these steps: * Scan or save the documents electronically: Use a scanner or save the documents electronically in a format such as PDF. * Attach the documents to an email: Attach the documents to an email, making sure to use a secure email service and a strong password. * Use a secure file transfer method: Consider using a secure file transfer method, such as a password-protected zip file or a secure online portal. * Verify the recipient’s email address: Make sure you have the correct email address for the recipient, and verify it before sending sensitive documents.

Tips for Organizing and Managing Tax Paperwork

To stay organized and manage your tax paperwork effectively, consider the following tips: * Keep a digital copy of your tax paperwork: Keep a digital copy of your tax paperwork, such as in a cloud storage service or on an external hard drive. * Use a tax preparation software: Use a tax preparation software, such as TurboTax or H&R Block, to help you prepare and organize your tax paperwork. * Create a folder for tax paperwork: Create a folder for tax paperwork, both physical and digital, to keep all your documents in one place.

| Type of Tax Paperwork | Required Documentation |

|---|---|

| Tax Returns | W-2 forms, 1099 forms, tax receipts |

| Business Tax Returns | Business income statements, expense reports, tax receipts |

To summarize, emailing tax paperwork is a convenient and efficient way to share and submit tax-related documents. By following best practices and using secure email services and file transfer methods, you can ensure that your tax paperwork is emailed securely and efficiently. Additionally, staying organized and managing your tax paperwork effectively can help reduce stress and make the tax preparation process easier.

In final thoughts, it is essential to prioritize the security and organization of your tax paperwork, whether you are emailing it or storing it physically. By taking the necessary precautions and following the tips outlined in this blog post, you can ensure that your tax paperwork is handled efficiently and securely.

What types of tax paperwork can be emailed?

+

The following types of tax paperwork can be emailed: tax returns, W-2 forms, 1099 forms, tax receipts, and other supporting documentation.

How can I ensure that my tax paperwork is emailed securely?

+

To ensure that your tax paperwork is emailed securely, use a secure email service, a strong password, and a secure file transfer method. Additionally, verify the recipient’s email address before sending sensitive documents.

What are some tips for organizing and managing tax paperwork?

+

Some tips for organizing and managing tax paperwork include keeping a digital copy of your tax paperwork, using a tax preparation software, and creating a folder for tax paperwork. Additionally, consider using a secure online portal or a password-protected zip file to store and transfer sensitive documents.