5 Tips on Daycare Tax Paperwork

Introduction to Daycare Tax Paperwork

Running a daycare can be a challenging yet rewarding experience, especially when it comes to managing the financial aspects of the business. One crucial part of this management is handling daycare tax paperwork. Accurate and timely tax filings are essential to avoid any legal or financial issues. In this article, we will explore five tips to help you navigate through the complex world of daycare tax paperwork.

Understanding Daycare Business Structure

Before diving into the tips, it’s essential to understand the structure of your daycare business. This can be either a sole proprietorship, partnership, limited liability company (LLC), or corporation. Each structure has its own tax implications, so it’s crucial to consult with a tax professional to determine which one suits your business best.

Tips for Daycare Tax Paperwork

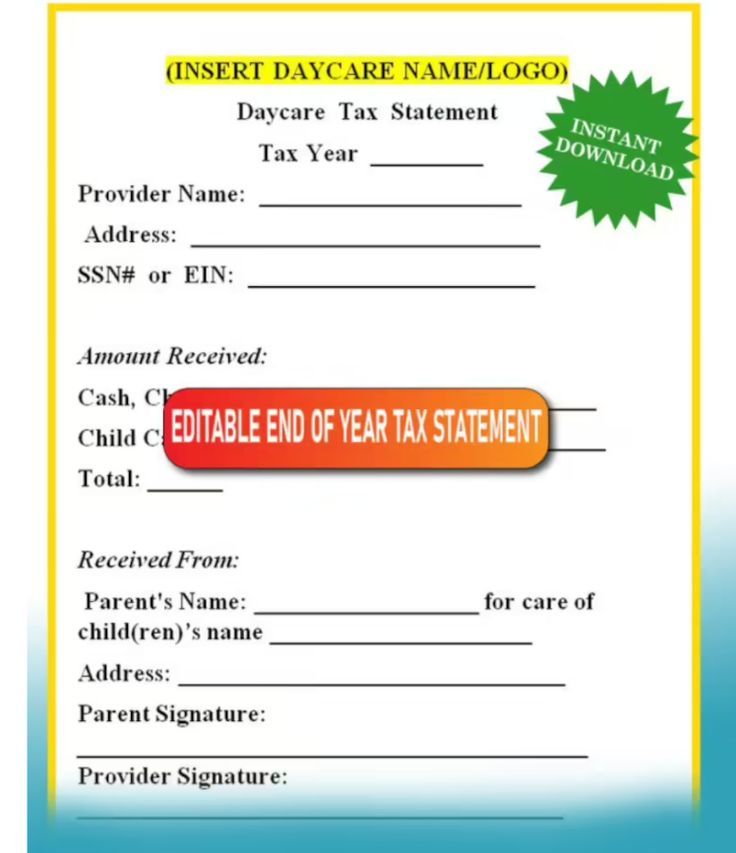

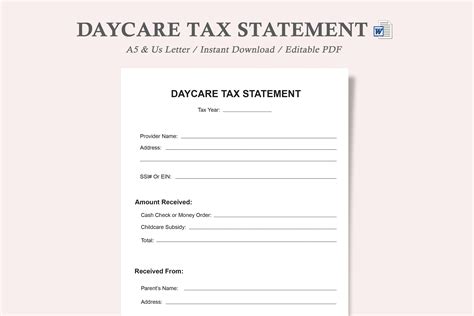

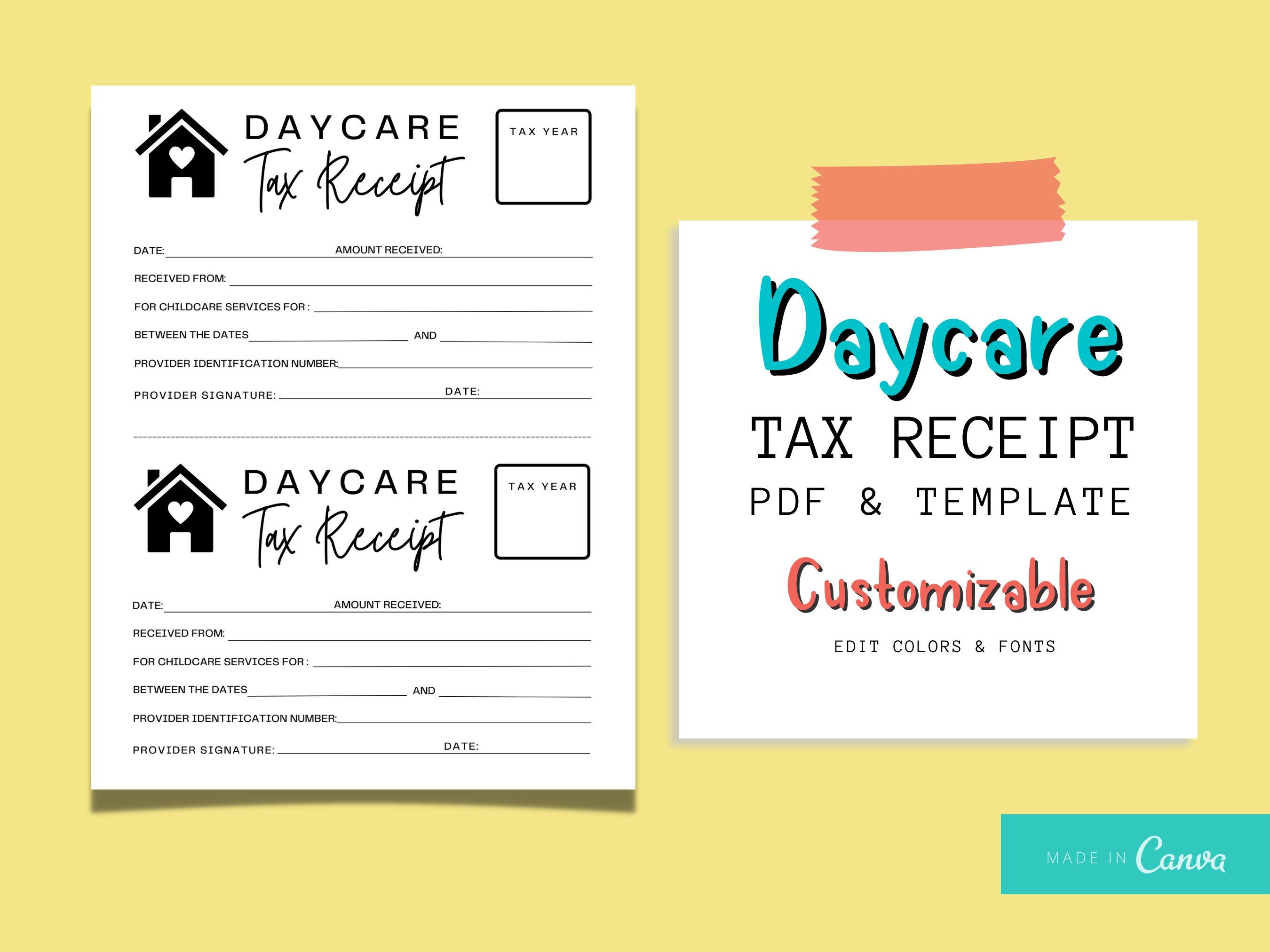

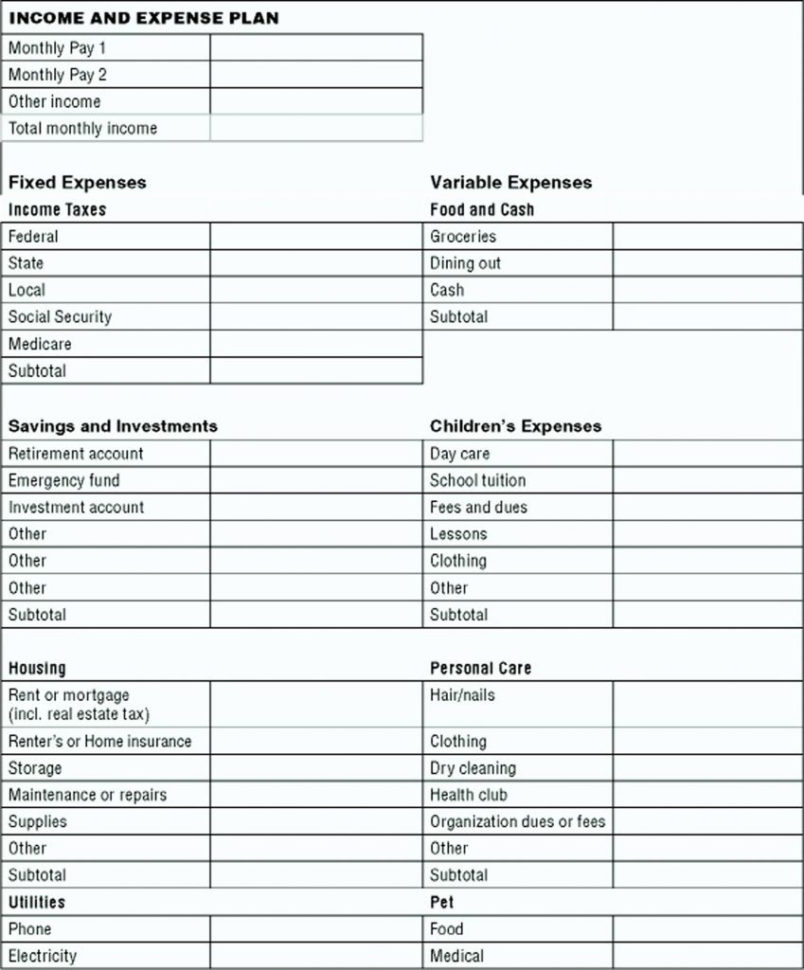

Here are five tips to help you manage your daycare tax paperwork efficiently: * Keep Accurate Records: Maintaining accurate and detailed records of all income and expenses is vital for tax purposes. This includes receipts, invoices, bank statements, and employee records. Consider investing in accounting software to make this process easier. * Claim Business Use Percentage: If you run your daycare from home, you can claim a business use percentage of your home expenses on your tax return. This can include mortgage interest, property taxes, insurance, and utilities. Make sure to calculate this percentage accurately to avoid any audit issues. * Take Advantage of Tax Credits: There are several tax credits available for daycare businesses, such as the Child and Dependent Care Credit and the Earned Income Tax Credit (EITC). Research these credits and claim them if you’re eligible to reduce your tax liability. * Consult a Tax Professional: Tax laws and regulations can be complex and change frequently. Consider hiring a tax professional who has experience with daycare businesses to ensure you’re taking advantage of all the deductions and credits available to you. * Stay Organized and Meet Deadlines: Make sure to stay organized throughout the year and meet all tax deadlines to avoid any penalties or interest on your tax bill. Create a tax calendar to keep track of important dates and deadlines.

Common Daycare Expenses

Here are some common expenses you may be able to claim on your daycare tax return:

| Expense | Description |

|---|---|

| Food and Snacks | Cost of meals and snacks provided to children |

| Toys and Equipment | Cost of toys, furniture, and equipment used in the daycare |

| Utilities | Cost of electricity, gas, water, and internet used in the daycare |

| Insurance | Cost of liability insurance and other insurance premiums |

| Employee Salaries and Benefits | Cost of employee salaries, benefits, and payroll taxes |

📝 Note: Keep all receipts and records of these expenses throughout the year to ensure you can claim them on your tax return.

Importance of Accurate Tax Filings

Accurate and timely tax filings are crucial for any business, including daycare centers. Inaccurate or late tax filings can result in penalties, interest, and even audits. Make sure to double-check your tax return for any errors or discrepancies before submitting it to the IRS.

To summarize, managing daycare tax paperwork requires attention to detail, organization, and a good understanding of tax laws and regulations. By following these five tips and staying on top of your finances, you can ensure your daycare business remains compliant and profitable.

As we finalize our discussion on daycare tax paperwork, it’s essential to remember that staying informed and seeking professional advice are key to navigating the complex world of taxes. By doing so, you can focus on what matters most - providing quality care to the children in your daycare.

What is the deadline for filing daycare tax returns?

+

The deadline for filing daycare tax returns is typically April 15th of each year, but it’s essential to check with the IRS or a tax professional for specific deadlines and requirements.

Can I claim business use percentage of my home expenses on my tax return?

+

Yes, if you run your daycare from home, you can claim a business use percentage of your home expenses on your tax return. This can include mortgage interest, property taxes, insurance, and utilities.

What are some common expenses I can claim on my daycare tax return?

+

Some common expenses you can claim on your daycare tax return include food and snacks, toys and equipment, utilities, insurance, and employee salaries and benefits.