FMLA Paperwork Fees Allowed

Understanding the Family and Medical Leave Act (FMLA)

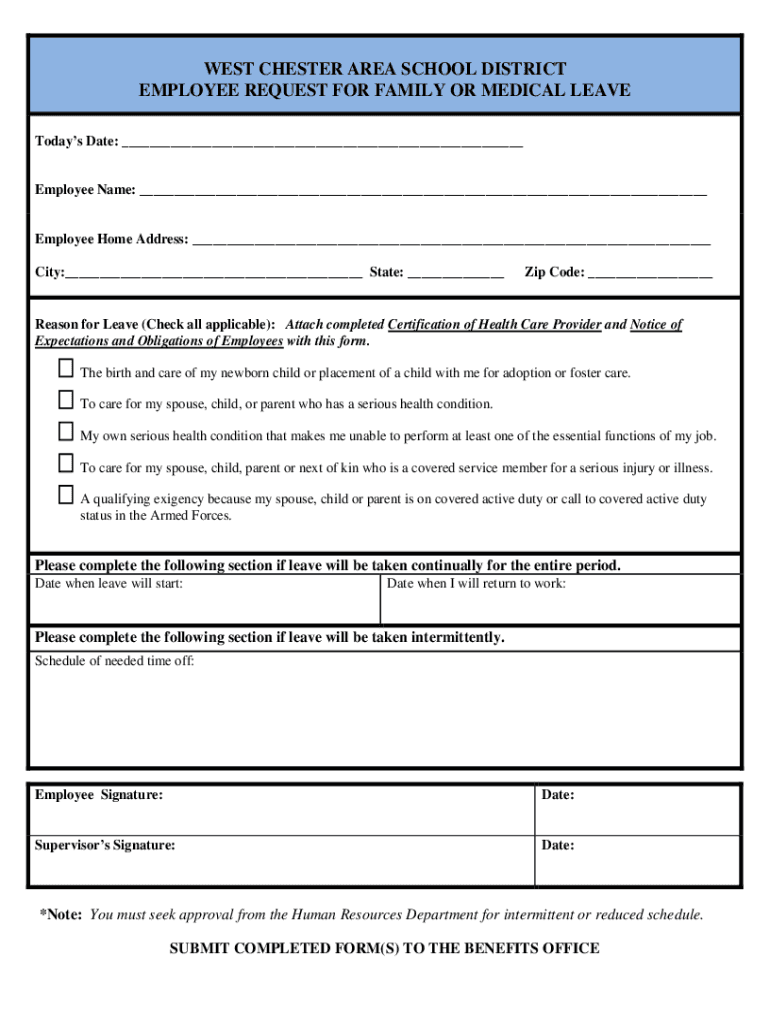

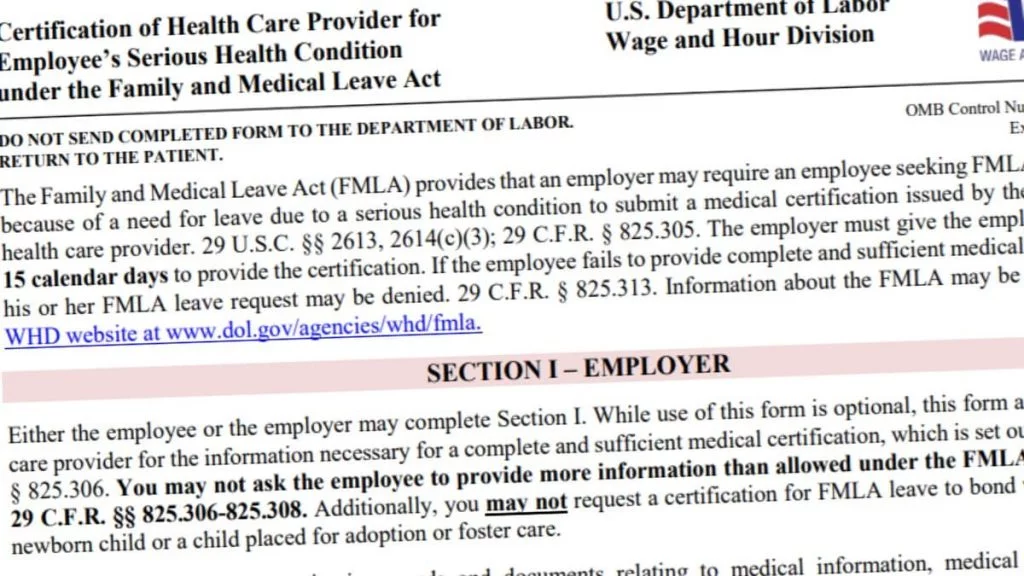

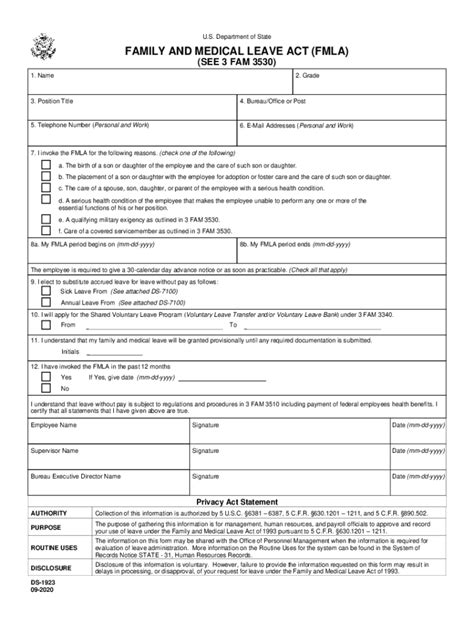

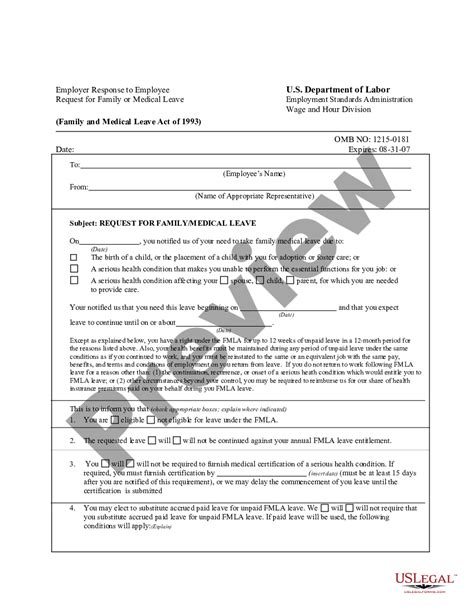

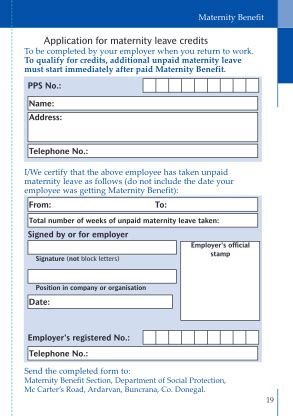

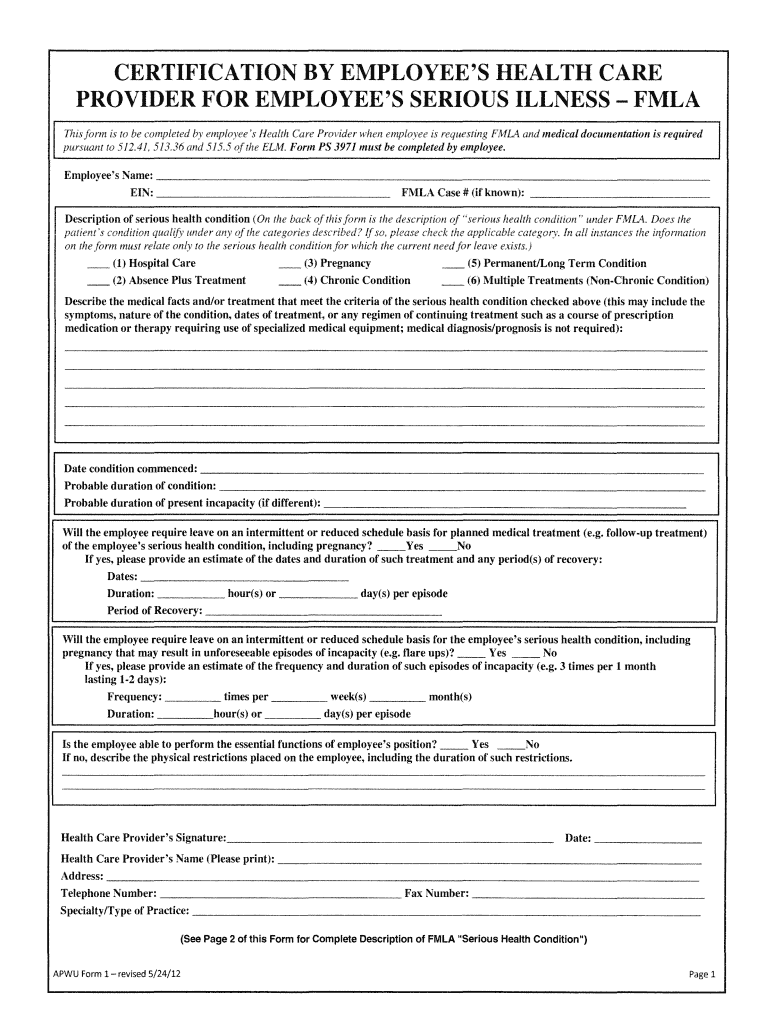

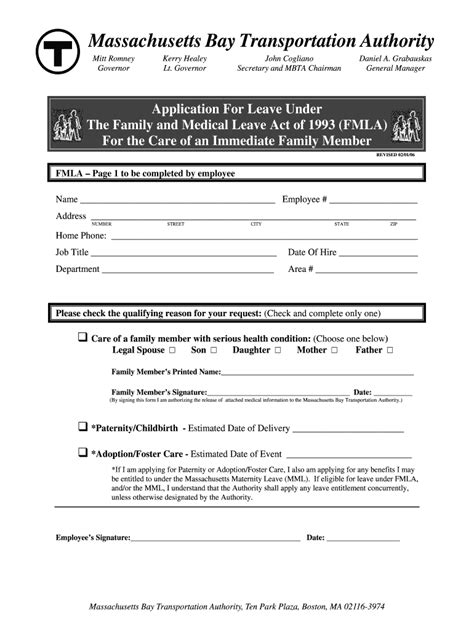

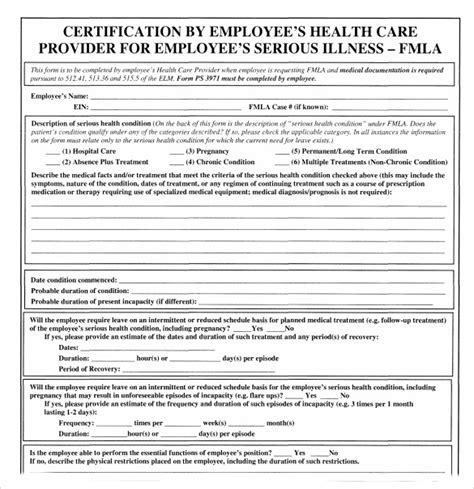

The Family and Medical Leave Act (FMLA) is a federal law that provides eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons. The law is designed to help employees balance their work and family responsibilities while also protecting their jobs. One of the key aspects of the FMLA is the paperwork and administrative process involved in requesting and approving leave. In this context, the question of whether employers can charge employees for FMLA paperwork fees has been a topic of discussion.

Can Employers Charge for FMLA Paperwork Fees?

The U.S. Department of Labor has provided guidance on the issue of charging employees for FMLA-related fees. According to the department, employers are generally not allowed to charge employees for the costs associated with administering the FMLA, including paperwork fees. This means that employers cannot require employees to pay for the costs of verifying their eligibility for FMLA leave, obtaining medical certifications, or completing other paperwork required by the law.

Permitted Charges Under the FMLA

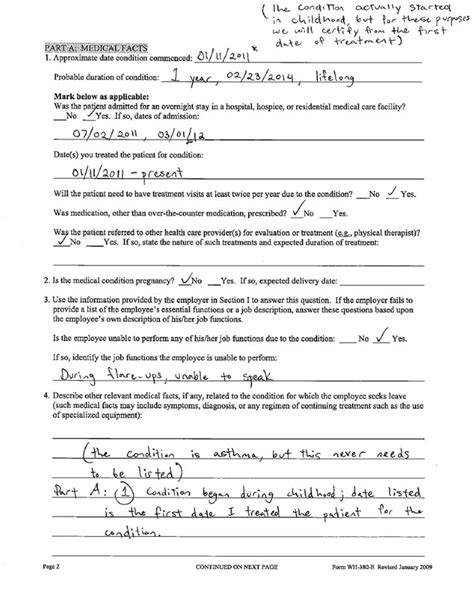

While employers are not allowed to charge employees for most FMLA-related fees, there are some exceptions. For example, employers may require employees to pay for the costs of obtaining a second or third medical opinion, as long as the employer pays for the initial medical certification. Additionally, employers may charge employees for the costs of substituting paid leave for unpaid FMLA leave, such as the costs of maintaining health insurance coverage during the leave period.

Important Considerations for Employers

Employers must be careful when administering the FMLA to avoid violating the law. Some key considerations include: * Ensuring that all employees are aware of their rights and responsibilities under the FMLA * Providing clear and concise notice to employees regarding their eligibility for FMLA leave * Maintaining accurate and detailed records of all FMLA-related paperwork and communications * Avoiding any actions that could be seen as retaliating against employees who request or take FMLA leave

Consequences of Violating the FMLA

Employers who violate the FMLA can face significant consequences, including: * Back pay and benefits for employees who were denied FMLA leave or retaliated against for requesting leave * Civil penalties for failing to comply with the law * Reinstatement of employees who were terminated or otherwise penalized for taking FMLA leave * Damage to the employer’s reputation and potential loss of business

📝 Note: Employers should consult with an attorney or HR expert to ensure that their FMLA policies and procedures are compliant with the law.

Best Practices for Administering the FMLA

To avoid potential issues and ensure compliance with the FMLA, employers should follow these best practices: * Develop a clear and comprehensive FMLA policy that outlines the procedures for requesting and approving leave * Provide regular training to HR staff and managers on the FMLA and its requirements * Maintain open and transparent communication with employees regarding their rights and responsibilities under the law * Regularly review and update FMLA policies and procedures to ensure compliance with changing regulations and court decisions

| Employer Size | Number of Employees Eligible for FMLA Leave |

|---|---|

| Private sector employers with 50 or more employees | All eligible employees |

| Public agencies, including federal, state, and local governments | All eligible employees |

| Public and private elementary and secondary schools | All eligible employees |

In the end, it is essential for employers to understand their obligations under the FMLA and to develop policies and procedures that ensure compliance with the law. By doing so, employers can avoid potential penalties and ensure that their employees are able to balance their work and family responsibilities.

What is the purpose of the Family and Medical Leave Act (FMLA)?

+

The purpose of the FMLA is to provide eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons, while also protecting their jobs.

Can employers charge employees for FMLA paperwork fees?

+

Generally, no, employers are not allowed to charge employees for the costs associated with administering the FMLA, including paperwork fees.

What are the consequences of violating the FMLA?

+

Employers who violate the FMLA can face significant consequences, including back pay and benefits, civil penalties, reinstatement of employees, and damage to the employer’s reputation.