5 Ways Employers Withhold Wages

Introduction to Wage Withholding

Employers withholding wages from their employees is a serious issue that affects millions of workers worldwide. Wage theft, as it is commonly known, can take many forms, including unpaid overtime, incorrect pay rates, and deductions from pay without consent. In this blog post, we will explore five ways employers withhold wages from their employees and discuss the importance of fair labor practices.

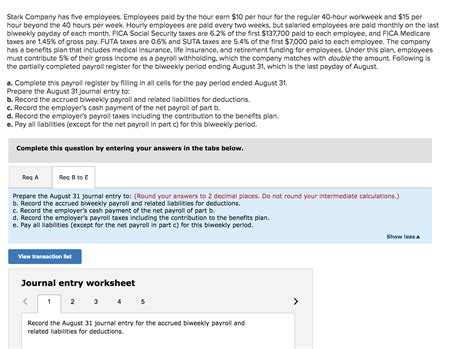

1. Unpaid Overtime

One of the most common ways employers withhold wages is by not paying their employees for overtime work. The Fair Labor Standards Act (FLSA) requires employers to pay their employees at least one and a half times their regular rate of pay for any work done beyond 40 hours in a workweek. However, some employers may try to avoid paying overtime by miscalculating work hours, misclassifying employees as exempt, or requiring employees to work off the clock. Employees who are not paid for their overtime work can suffer significant financial losses and may be entitled to back pay and damages.

2. Incorrect Pay Rates

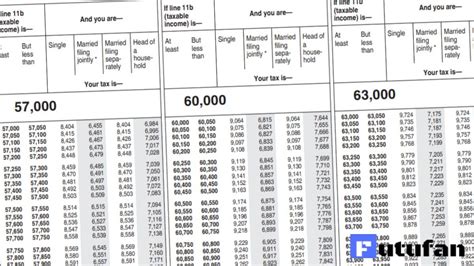

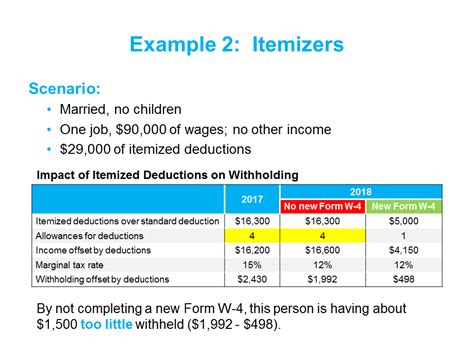

Employers may also withhold wages by paying their employees at an incorrect rate. This can occur when an employer miscalculates an employee’s hourly wage, fails to pay minimum wage, or deducts excessive amounts from an employee’s pay for things like uniforms or equipment. Employees who are paid at an incorrect rate may be entitled to back pay and other remedies under the FLSA.

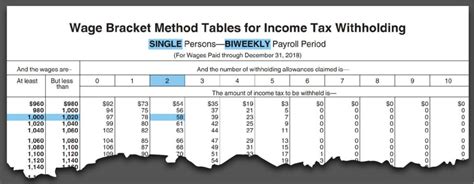

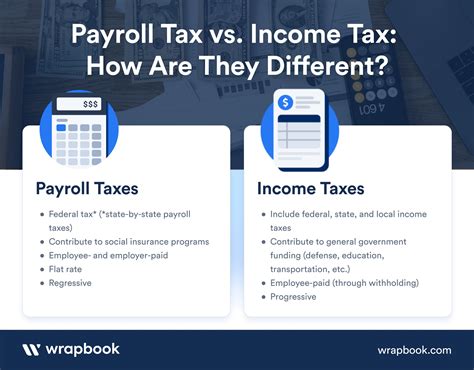

3. Deductions from Pay

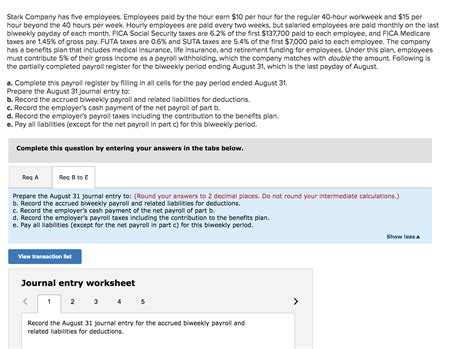

Employers may withhold wages by making deductions from pay without an employee’s consent. The FLSA allows employers to make certain deductions from an employee’s pay, such as taxes and benefit premiums, but other deductions may be prohibited. For example, an employer may not deduct the cost of uniforms or equipment from an employee’s pay if it would reduce the employee’s wage below the minimum wage. Employees who have unauthorized deductions made from their pay may be entitled to back pay and other remedies.

4. Misclassification of Employees

Another way employers withhold wages is by miscalculating an employee’s status. The FLSA requires employers to pay their employees minimum wage and overtime pay unless the employee is exempt. Some employers may try to avoid paying minimum wage and overtime by miscalculating an employee’s status as an independent contractor or exempt employee. However, the FLSA has specific tests for determining whether an employee is exempt or non-exempt, and employers who misclassify their employees may be liable for back pay and other penalties.

5. Failure to Pay Final Wages

Finally, employers may withhold wages by failing to pay final wages to employees who have been terminated or resigned. The FLSA requires employers to pay their employees all wages due on the next regular payday or sooner if the employee has been terminated. Employers who fail to pay final wages may be liable for back pay and other penalties, including attorney’s fees and costs.

💡 Note: Employees who believe their employer has withheld wages from them should consult with an attorney or government agency to determine their rights and options.

In summary, employers withhold wages from their employees in many ways, including unpaid overtime, incorrect pay rates, deductions from pay, misclassification of employees, and failure to pay final wages. Employees who have had wages withheld from them may be entitled to back pay and other remedies under the FLSA. It is essential for employers to follow fair labor practices and for employees to be aware of their rights to ensure that they receive the wages they have earned.

What is wage theft?

+

Wage theft refers to the practice of employers withholding wages from their employees, including unpaid overtime, incorrect pay rates, and deductions from pay without consent.

What are the consequences of wage theft?

+

Employers who engage in wage theft may be liable for back pay, damages, and other penalties, including attorney’s fees and costs. Employees who have had wages withheld from them may also suffer significant financial losses.

How can employees prevent wage theft?

+

Employees can prevent wage theft by keeping accurate records of their work hours and pay, reviewing their pay stubs and paychecks, and reporting any discrepancies to their employer or a government agency.