Paperwork

Can I Bring Cash to Closing

Understanding the Process of Bringing Cash to Closing

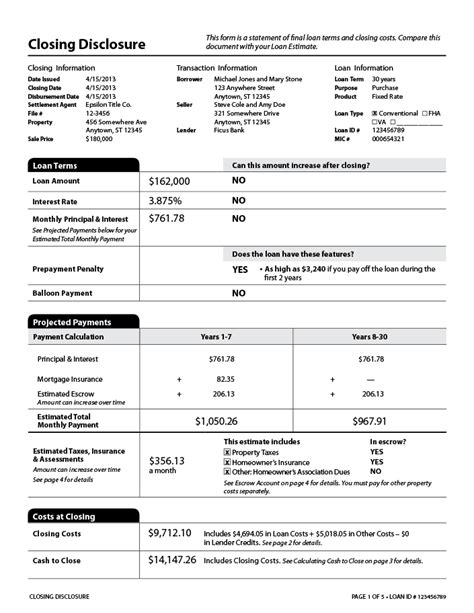

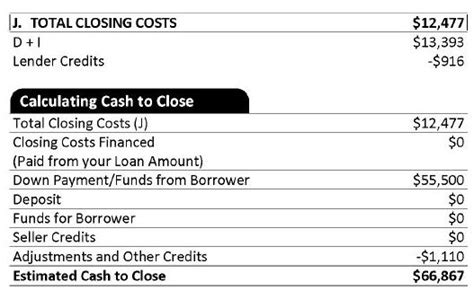

When it comes to finalizing a real estate transaction, the concept of bringing cash to closing can be a bit confusing. In general, cash to closing refers to the amount of money that a buyer needs to bring to the table in order to complete the purchase of a property. This amount typically includes down payment, closing costs, and other expenses associated with the transaction. However, the question remains: can you bring cash to closing, and if so, what are the implications?

Types of Payments Accepted at Closing

In most cases, wire transfers or certified checks are the preferred methods of payment for closing transactions. This is because these methods provide a secure and verifiable way to transfer funds. However, some buyers may wonder if it’s possible to bring cash to closing. The answer is generally no, as cash is not typically accepted due to money laundering concerns and the need for a papera trail to verify the source of funds.

Why Cash is Not Typically Accepted

There are several reasons why cash is not typically accepted at closing: * Money laundering concerns: Large cash transactions can raise red flags and may be subject to additional scrutiny or reporting requirements. * Lack of paper trail: Cash transactions can be difficult to verify and may not provide a clear record of the source of funds. * Security concerns: Handling large amounts of cash can be a security risk, and title companies or attorneys may not be equipped to handle cash transactions.

Alternatives to Bringing Cash to Closing

If you’re wondering how to bring cash to closing, there are alternative solutions: * Wire transfer: This is a secure and convenient way to transfer funds electronically. * Certified check: A certified check is a type of check that is guaranteed by the bank and can be used to verify the availability of funds. * Cashier’s check: A cashier’s check is a type of check that is drawn on the bank’s own account and can be used to verify the availability of funds.

📝 Note: It's essential to check with your title company or attorney to determine the accepted methods of payment for your specific transaction.

Best Practices for Closing Transactions

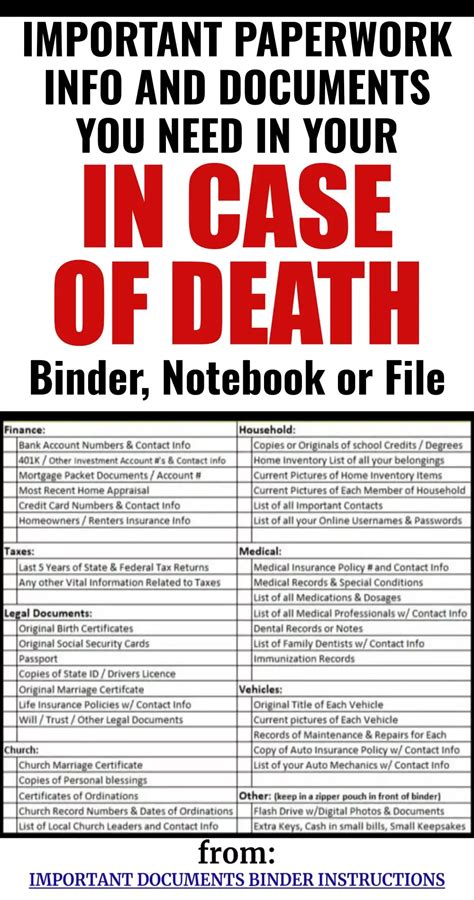

To ensure a smooth closing process, it’s essential to follow best practices: * Verify accepted payment methods: Check with your title company or attorney to determine the accepted methods of payment. * Plan ahead: Make sure you have sufficient funds available and arrange for payment in advance. * Keep records: Keep a record of all transactions, including receipts and confirmations, to verify the source of funds.

Conclusion and Next Steps

In conclusion, while it’s generally not possible to bring cash to closing, there are alternative solutions available. By understanding the process and following best practices, you can ensure a smooth and successful closing transaction. Remember to verify accepted payment methods, plan ahead, and keep records to avoid any potential issues.

What is the preferred method of payment for closing transactions?

+

The preferred method of payment for closing transactions is typically a wire transfer or certified check.

Why is cash not typically accepted at closing?

+

Cash is not typically accepted at closing due to money laundering concerns, lack of paper trail, and security concerns.

What are the alternatives to bringing cash to closing?

+

Alternatives to bringing cash to closing include wire transfer, certified check, and cashier’s check.