Buy Car with Lien Sale Paperwork

Understanding the Process of Buying a Car with a Lien Sale

When purchasing a vehicle, it’s essential to understand the different types of sales and the paperwork involved. A lien sale, also known as a lienholder sale, occurs when a lender or financial institution has a claim on the vehicle due to an outstanding loan or debt. In this scenario, the seller is not the sole owner of the vehicle, and the buyer must navigate the process of satisfying the lien to gain clear ownership. This article will guide you through the process of buying a car with a lien sale, including the necessary paperwork and considerations.

What is a Lien Sale?

A lien sale arises when a vehicle owner defaults on their loan payments, and the lender repossesses the vehicle. The lender then sells the vehicle to recover the outstanding debt. The buyer of the vehicle must purchase it with the understanding that there is an existing lien, which must be addressed as part of the sale. The lienholder is the entity that holds the claim on the vehicle, and their interests must be satisfied before the sale can be completed.

Key Considerations for Buying a Car with a Lien Sale

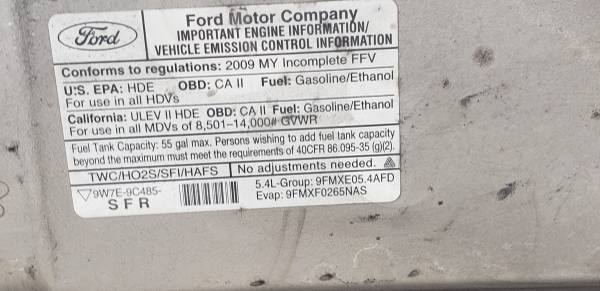

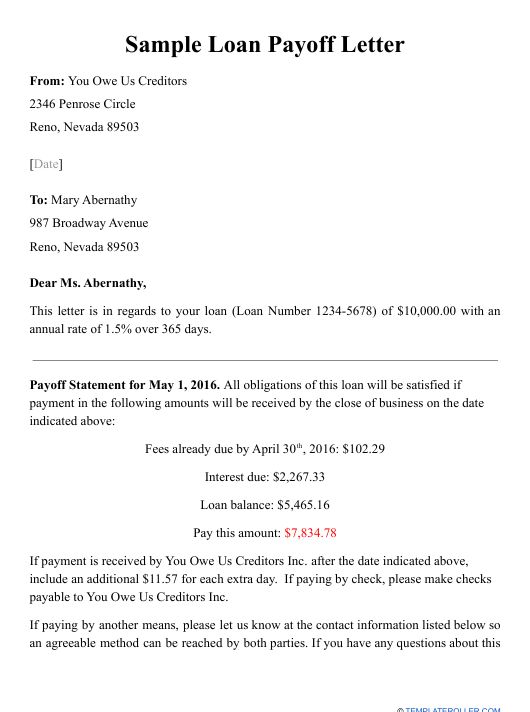

Before purchasing a vehicle with a lien sale, it’s crucial to consider the following factors: * Outstanding debt: The buyer must understand the amount of the outstanding debt and how it will be satisfied as part of the sale. * Lienholder involvement: The lienholder will typically be involved in the sale process to ensure their interests are protected. * Additional fees: The buyer may be responsible for paying additional fees, such as repossession fees or storage fees, associated with the lien sale. * Vehicle condition: The buyer should carefully inspect the vehicle to determine its condition and any potential issues that may affect its value.

Steps to Buying a Car with a Lien Sale

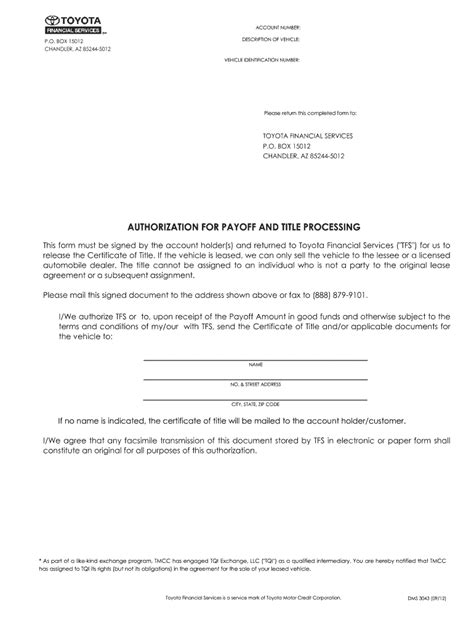

The process of buying a car with a lien sale involves several steps: * Research the vehicle: The buyer should research the vehicle’s history, including any accidents, previous owners, and outstanding debt. * Contact the lienholder: The buyer should contact the lienholder to discuss the outstanding debt and the terms of the sale. * Negotiate the price: The buyer should negotiate the price of the vehicle, taking into account the outstanding debt and any additional fees. * Complete the paperwork: The buyer must complete the necessary paperwork, including the bill of sale, title transfer, and lien satisfaction documents.

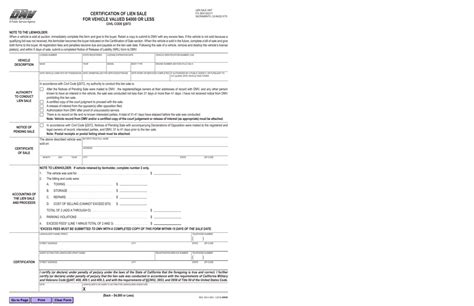

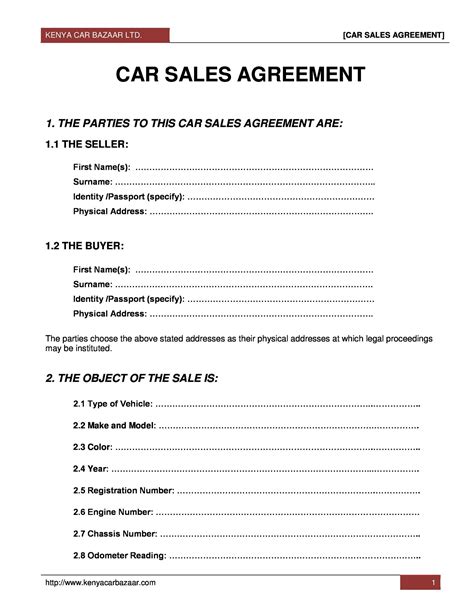

Lien Sale Paperwork

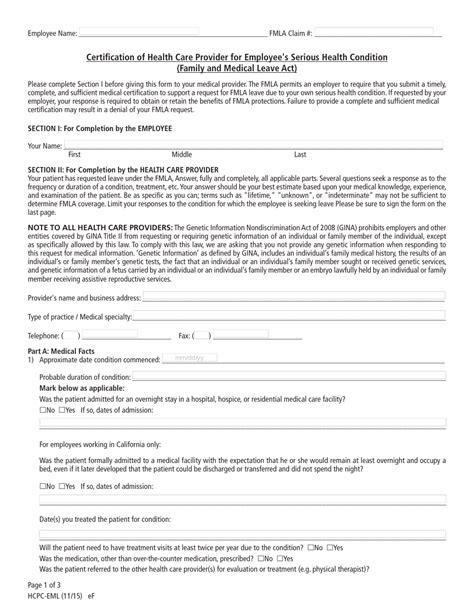

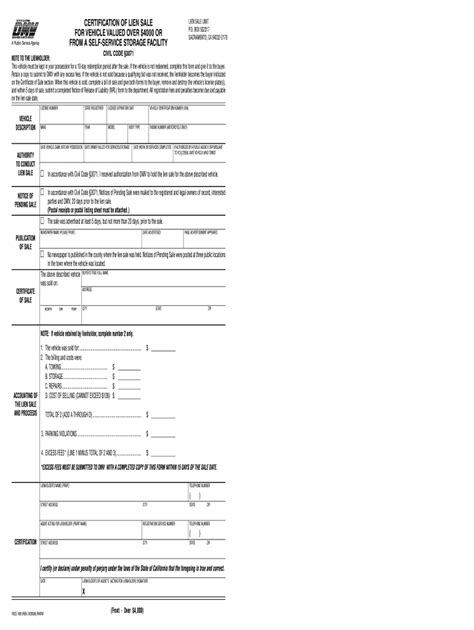

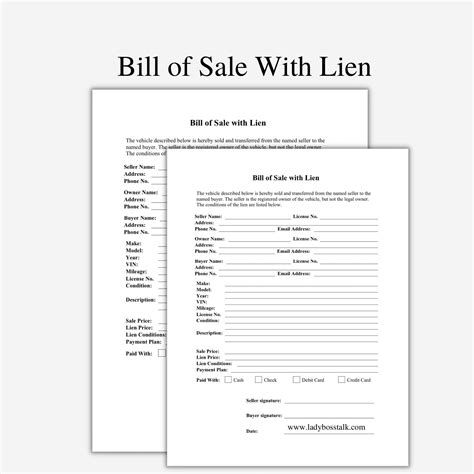

The paperwork involved in a lien sale can be complex and varies by state. The following documents are typically required: * Bill of sale: A document that transfers ownership of the vehicle from the seller to the buyer. * Title transfer: A document that transfers the title of the vehicle from the seller to the buyer. * Lien satisfaction: A document that releases the lienholder’s claim on the vehicle. * Repossession affidavit: A document that verifies the vehicle was repossessed and sold to satisfy the outstanding debt.

| Document | Description |

|---|---|

| Bill of sale | Transfers ownership of the vehicle from the seller to the buyer |

| Title transfer | Transfers the title of the vehicle from the seller to the buyer |

| Lien satisfaction | Releases the lienholder's claim on the vehicle |

| Repossession affidavit | Verifies the vehicle was repossessed and sold to satisfy the outstanding debt |

📝 Note: The specific paperwork required for a lien sale may vary by state, so it's essential to consult with a local authority or attorney to ensure compliance with local regulations.

Benefits and Risks of Buying a Car with a Lien Sale

Buying a car with a lien sale can offer several benefits, including: * Lower purchase price: The buyer may be able to purchase the vehicle at a lower price due to the outstanding debt. * Opportunity to negotiate: The buyer may have the opportunity to negotiate the price and terms of the sale. However, there are also risks associated with buying a car with a lien sale, including: * Unclear ownership: The buyer may not have clear ownership of the vehicle until the lien is satisfied. * Additional fees: The buyer may be responsible for paying additional fees associated with the lien sale.

In summary, buying a car with a lien sale requires careful consideration of the outstanding debt, lienholder involvement, and additional fees. The buyer must navigate the complex paperwork and ensure compliance with local regulations to gain clear ownership of the vehicle. By understanding the process and potential risks, buyers can make informed decisions when purchasing a vehicle with a lien sale.

What is a lien sale?

+

A lien sale occurs when a lender or financial institution has a claim on a vehicle due to an outstanding loan or debt, and the vehicle is sold to satisfy the debt.

What is the role of the lienholder in a lien sale?

+

The lienholder is the entity that holds the claim on the vehicle and is typically involved in the sale process to ensure their interests are protected.

What paperwork is required for a lien sale?

+

The paperwork required for a lien sale typically includes a bill of sale, title transfer, lien satisfaction, and repossession affidavit, although the specific documents may vary by state.