5 Ways Get Mortgage Papers

Introduction to Mortgage Papers

When it comes to purchasing a home, one of the most crucial steps is obtaining a mortgage. A mortgage is a loan from a lender that allows you to borrow money to purchase a house, with the promise to repay the loan, plus interest, over a specified period. To secure this loan, you will need to provide various documents, collectively known as mortgage papers. These papers are essential for the lender to assess your creditworthiness and ability to repay the loan. In this article, we will explore the 5 ways to get mortgage papers, emphasizing the importance of each document in the mortgage application process.

Understanding the Mortgage Application Process

Before diving into the ways to get mortgage papers, it’s essential to understand the mortgage application process. The process typically begins with pre-approval, where the lender provides an estimate of how much you can borrow based on your income, credit score, and other factors. Once you find a home and make an offer, you will need to submit a formal mortgage application, which includes providing detailed financial information and supporting documents. The lender will then review your application, order an appraisal of the property, and finally, approve or deny your loan application.

5 Ways to Get Mortgage Papers

Here are the 5 ways to get mortgage papers, which are crucial for a successful mortgage application:

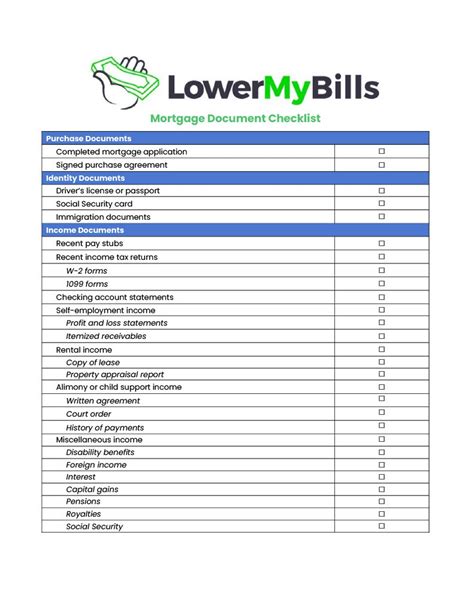

- 1. Income Verification: This includes documents such as pay stubs, W-2 forms, and tax returns. Lenders need these documents to verify your income and ensure that you can afford the monthly mortgage payments. It’s essential to provide accurate and up-to-date income information to avoid any delays in the application process.

- 2. Credit Reports: Your credit report is a critical component of the mortgage application process. Lenders use credit reports to evaluate your creditworthiness and determine the interest rate you qualify for. You can obtain a free credit report from each of the three major credit reporting bureaus (Equifax, Experian, and TransUnion) once a year.

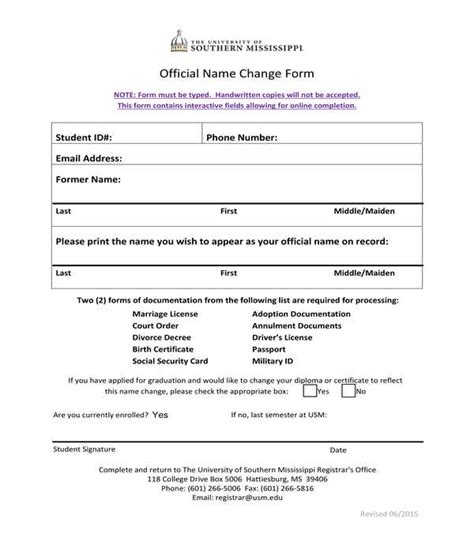

- 3. Identification and Assets: You will need to provide identification documents such as a driver’s license, passport, or state ID. Additionally, you will need to provide proof of assets, including bank statements, investment accounts, and retirement accounts. Make sure to provide all required identification and asset documents to avoid any delays.

- 4. Employment Verification: Lenders need to verify your employment status to ensure that you have a stable income. You can provide employment verification documents such as a letter from your employer or a copy of your employment contract.

- 5. Property-Related Documents: Once you find a home, you will need to provide property-related documents such as the purchase agreement, title report, and appraisal report. These documents provide information about the property’s value, ownership, and any potential issues.

Additional Requirements

In addition to the above documents, you may need to provide additional information, such as:

| Document | Description |

|---|---|

| Divorce or separation documents | If you are divorced or separated, you may need to provide documents related to your divorce or separation agreement |

| Bankruptcy documents | If you have filed for bankruptcy, you may need to provide documents related to your bankruptcy filing |

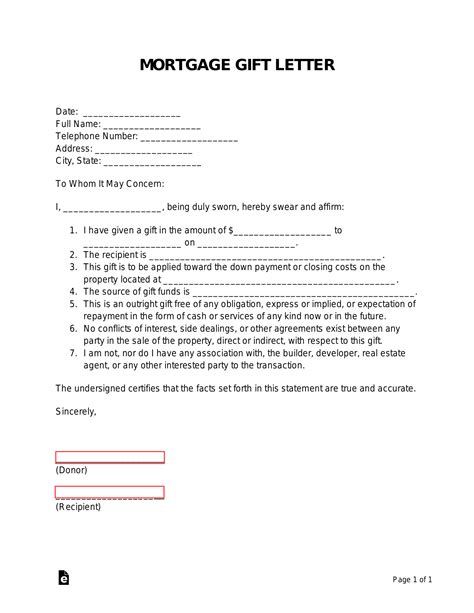

| Gift letters | If you are using a gift from a relative or friend as part of your down payment, you may need to provide a gift letter |

📝 Note: The specific documents required may vary depending on your lender, location, and individual circumstances. It's essential to check with your lender to ensure you provide all necessary documents

Finalizing Your Mortgage Application

Once you have gathered all the necessary mortgage papers, you can submit your application to the lender. The lender will review your application, and if approved, you will receive a loan offer. It’s essential to carefully review the loan offer and ask questions if you don’t understand any of the terms. After accepting the loan offer, the lender will finalize the loan, and you can proceed with the home buying process.

As you move forward with your mortgage application, remember that providing accurate and complete mortgage papers is crucial for a successful application. By following these 5 ways to get mortgage papers, you can ensure a smooth and efficient mortgage application process, and ultimately, achieve your dream of homeownership. The key to a successful mortgage application is to be prepared, provide all necessary documents, and carefully review the loan terms before accepting the offer. With the right approach, you can navigate the mortgage application process with confidence and secure the home of your dreams.