Navy Federal Mortgage Paperwork Signing

Introduction to Navy Federal Mortgage Paperwork Signing

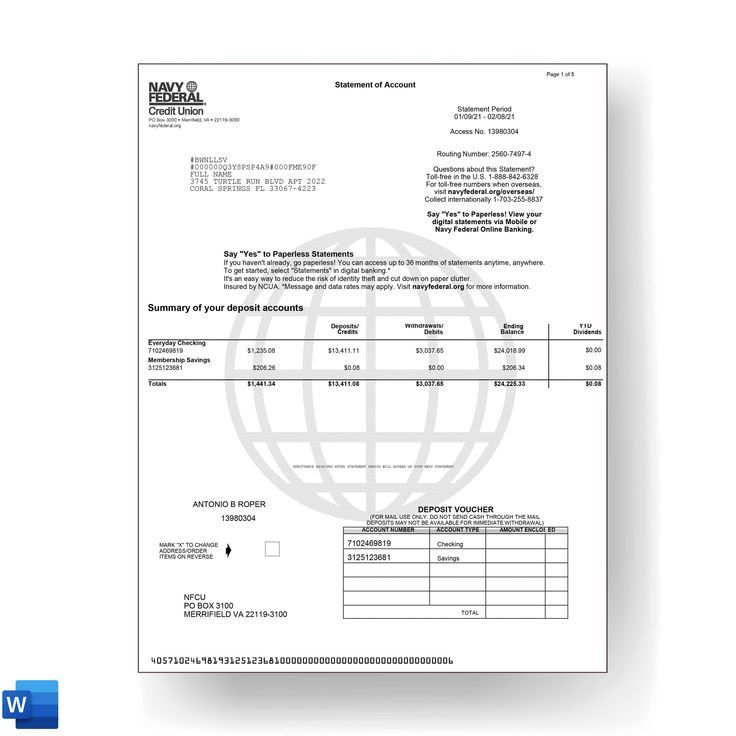

The process of signing mortgage paperwork with Navy Federal can seem daunting, but understanding the steps involved can make it more manageable. Navy Federal, being one of the largest credit unions in the world, offers a range of mortgage products tailored to meet the diverse needs of its members, including active-duty personnel, veterans, and their families. The mortgage paperwork signing process is a critical step in finalizing a home purchase or refinance, and being prepared can ensure a smooth transaction.

Preparation for Signing

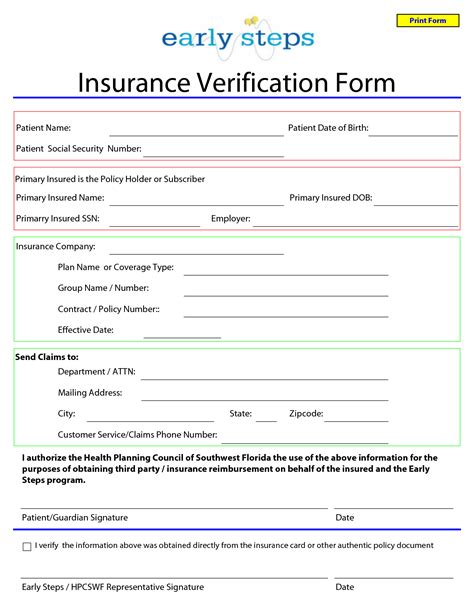

Before the actual signing of the mortgage paperwork, several steps must be completed. These include pre-approval, home inspection, appraisal, and final approval. During the pre-approval stage, Navy Federal reviews the borrower’s creditworthiness and provides a pre-approval letter stating the amount they are eligible to borrow. The home inspection and appraisal are crucial for assessing the property’s condition and value, respectively. Once these steps are completed, the borrower receives a final approval, and the loan is cleared to close.

The Signing Process

The signing of mortgage paperwork typically takes place at a title company or attorney’s office, although some lenders may offer in-home or online signing options. It’s essential to review all documents carefully before signing, as these documents are legally binding. The borrower should ensure they understand all terms and conditions, including the interest rate, loan amount, repayment terms, and any penalties associated with early payment or default.

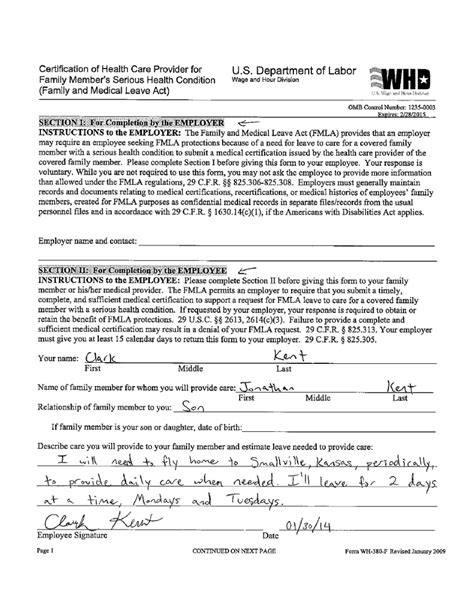

Some key documents to expect during the signing include: - Deed of Trust: This document secures the loan and gives the lender the right to sell the property if the borrower defaults. - Promissory Note: This is the borrower’s promise to repay the loan, including the terms of repayment. - Mortgage Broker Disclosure: If a mortgage broker was used, this document discloses their role and any fees associated with their services. - Truth-in-Lending Disclosure: This document provides a clear disclosure of the loan terms, including the annual percentage rate (APR), finance charges, and the total payments.

📝 Note: It's advisable to have an attorney present during the signing to ensure all legal aspects are covered and understood.

Post-Signing Procedures

After the paperwork has been signed, the lender will fund the loan, which involves disbursing the loan amount to the borrower or the seller, depending on the agreement. The title company then records the deed and mortgage with the local government, officially transferring ownership and securing the lender’s interest in the property. The borrower can then close the transaction, completing the home purchase or refinance process.

Benefits of Navy Federal Mortgage

Navy Federal offers several benefits to its members, including competitive interest rates, lower fees, and flexible repayment terms. Additionally, members may be eligible for VA loans with no down payment requirement or FHA loans with lower down payment options. The credit union’s personalized service and financial counseling can also help members navigate the mortgage process and make informed decisions about their financial future.

| Mortgage Type | Description | Benefits |

|---|---|---|

| VA Loan | No down payment, lower interest rates | Eligible for veterans and active-duty personnel |

| FHA Loan | Lower down payment, easier qualification | Suitable for first-time homebuyers or those with lower credit scores |

| Conventional Loan | Fixed or adjustable rates, various repayment terms | Offers flexibility in loan terms and conditions |

In essence, the process of signing mortgage paperwork with Navy Federal involves careful preparation, a thorough understanding of the documents involved, and an awareness of the post-signing procedures. By leveraging the benefits offered by Navy Federal, members can navigate the mortgage process with confidence, securing the home of their dreams.

As we reflect on the journey of obtaining a mortgage through Navy Federal, it’s clear that understanding the process and being prepared for each step can significantly reduce stress and ensure a successful outcome. By considering the types of mortgages available, the importance of careful document review, and the benefits of working with a credit union like Navy Federal, prospective homeowners can make informed decisions that align with their financial goals and aspirations. This comprehensive approach not only facilitates a smoother transaction but also sets the stage for a brighter financial future.

What are the benefits of choosing Navy Federal for a mortgage?

+

Navy Federal offers competitive interest rates, lower fees, and flexible repayment terms, making it an attractive option for those eligible for membership.

What documents should I expect to sign during the mortgage closing process?

+

Key documents include the Deed of Trust, Promissory Note, Mortgage Broker Disclosure, and Truth-in-Lending Disclosure. It’s crucial to review each document carefully before signing.

How long does the mortgage paperwork signing process typically take?

+

The signing process itself can take about an hour, depending on the complexity of the transaction and the number of documents involved. However, the entire mortgage process, from pre-approval to closing, can take several weeks to a few months.