Claim PPI Without Paperwork

Introduction to PPI Claims

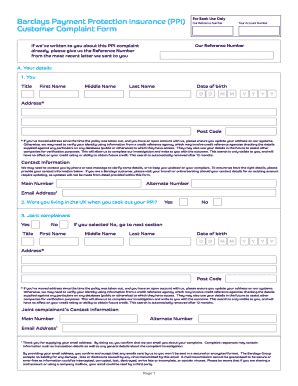

Payment Protection Insurance (PPI) has been a highly controversial financial product in the UK, with millions of policies sold to consumers who may not have needed them or were not eligible to claim. The mis-selling of PPI has led to a massive scandal, resulting in billions of pounds being paid out in compensation. If you believe you were mis-sold PPI, you might be eligible to claim back the money you’ve paid, even if you don’t have the original paperwork.

Understanding PPI and Its Mis-Selling

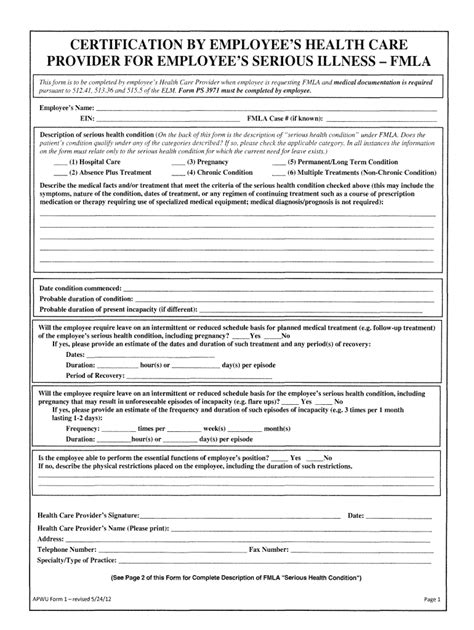

PPI was designed to cover loan or credit card payments if the policyholder became unable to work due to illness, accident, or unemployment. However, many policies were sold to people who would never be able to claim, such as the self-employed or those with pre-existing medical conditions. The Financial Conduct Authority (FCA) has found that many PPI policies were mis-sold, and consumers have the right to claim compensation.

Can You Claim PPI Without Paperwork?

While having the original paperwork can make the claims process easier, it’s not necessarily a requirement. Many people have successfully claimed PPI compensation without their original documents. You can start by contacting your bank or the lender directly to inquire about any PPI policies you might have had. They should be able to tell you if you had PPI and provide you with information on how to proceed with a claim.

📝 Note: Keep in mind that lenders are obligated to keep records for a certain period, so even if you don't have your paperwork, they might still have the information you need.

Steps to Claim PPI Without Paperwork

Claiming PPI without paperwork involves several steps: - Check your loan and credit card statements for any evidence of PPI payments. Even if you don’t have the original policy documents, these statements can provide proof that you were paying for PPI. - Contact your lender to ask about PPI on your accounts. They can check their records to see if you had PPI and guide you through the next steps. - Gather alternative evidence. If you have any records showing payments that you believe might be related to PPI, gather these. This could include bank statements showing regular payments to the lender that are not explained by your loan or credit card payments alone. - Use a claims management company, if you wish. These companies can help you navigate the process, including finding out if you had PPI and making a claim on your behalf. Be cautious, as they will charge a fee for their services.

What to Expect from the Claims Process

The process of claiming PPI compensation can vary depending on the lender and the complexity of your case. Generally, you can expect the following: - Initial Contact: You contact the lender or a claims management company to inquire about potential PPI policies. - Information Gathering: The lender checks their records, and you might need to provide some personal and account information to facilitate the search. - Claim Submission: If PPI is found on your accounts, you’ll need to submit a formal claim. This can usually be done over the phone, by post, or online, depending on the lender’s preferred method. - Decision and Payout: The lender reviews your claim and makes a decision. If your claim is successful, you’ll receive compensation, which typically includes a refund of the PPI premiums plus interest.

Tips for a Successful Claim

To increase the chances of a successful PPI claim without paperwork: - Be thorough in your search for any documents that might relate to your PPI policy. - Keep detailed records of your communications with the lender or claims management company. - Be patient, as the claims process can take several weeks to several months. - Understand your rights, including the right to claim directly without using a claims management company.

Conclusion and Final Thoughts

Claiming PPI compensation without the original paperwork is entirely possible and has been a reality for many consumers. It’s essential to approach the process with patience and diligence, ensuring you follow each step carefully. Remember, you have the right to claim back money you’ve unnecessarily paid for PPI, and seeking assistance when needed can make the process smoother. With the right approach and information, you can navigate the claims process effectively, even without your original documents.

What is the deadline for making a PPI claim?

+

The deadline for making a PPI claim was August 29, 2019, as set by the Financial Conduct Authority. However, claims can still be made if they are directly related to a previous complaint about PPI that was rejected on or after August 29, 2015.

Do I need to use a claims management company to claim PPI?

+

No, you do not need to use a claims management company. You can make a claim directly to your lender. Using a claims management company will incur a fee, typically a percentage of your compensation.

How long does a PPI claim typically take to process?

+

The time it takes to process a PPI claim can vary significantly depending on the lender and the complexity of the case. It can take anywhere from a few weeks to several months. Keeping detailed records of your claim and following up with the lender can help ensure the process moves as quickly as possible.