FMLA Paperwork Fees Allowed

Introduction to FMLA Paperwork Fees

The Family and Medical Leave Act (FMLA) is a federal law that provides eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons. While the FMLA is designed to provide employees with job protection and benefits during a leave of absence, it also imposes certain requirements and restrictions on employers. One of the key aspects of the FMLA is the paperwork and administrative requirements that employers must follow. In this article, we will discuss the issue of FMLA paperwork fees and whether employers are allowed to charge employees for these fees.

Understanding FMLA Paperwork Requirements

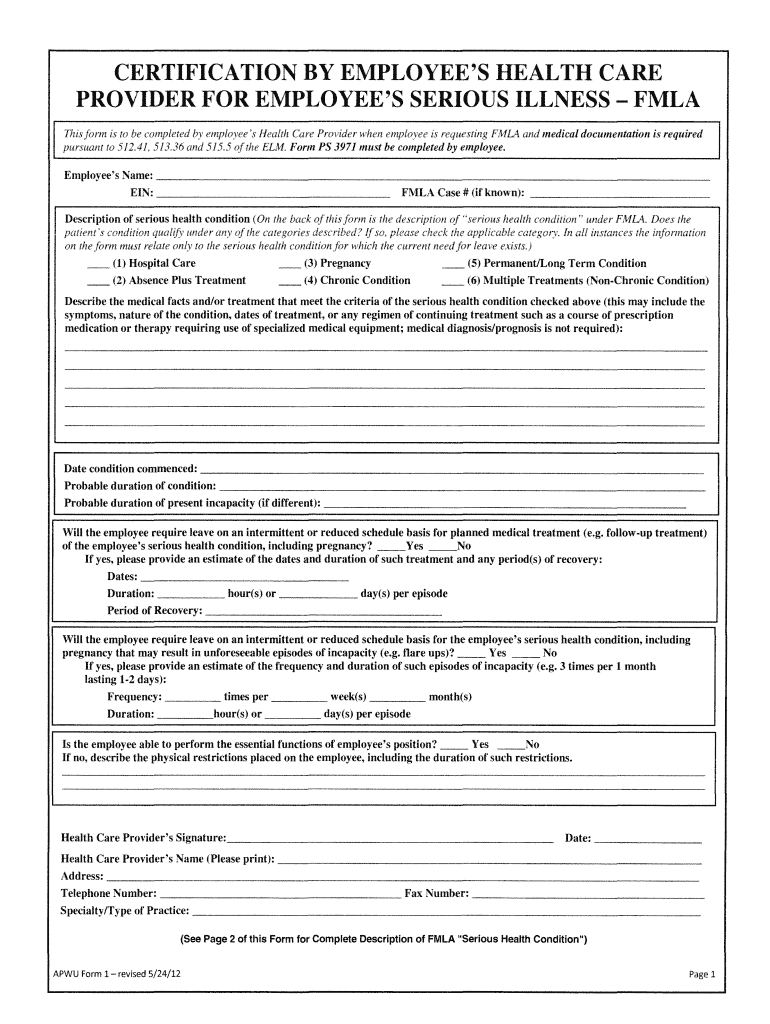

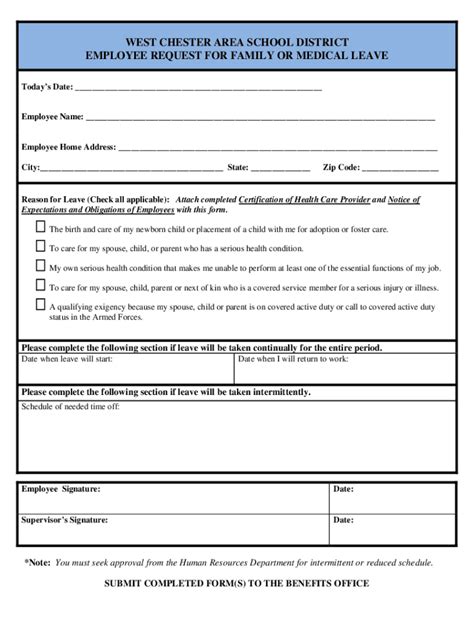

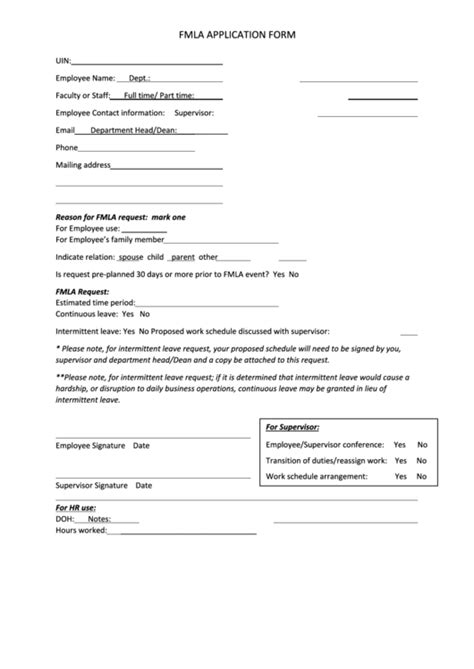

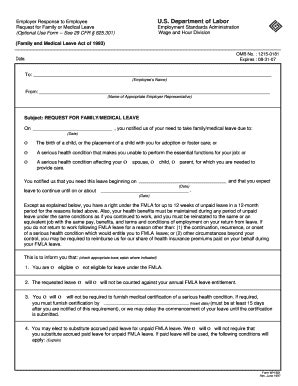

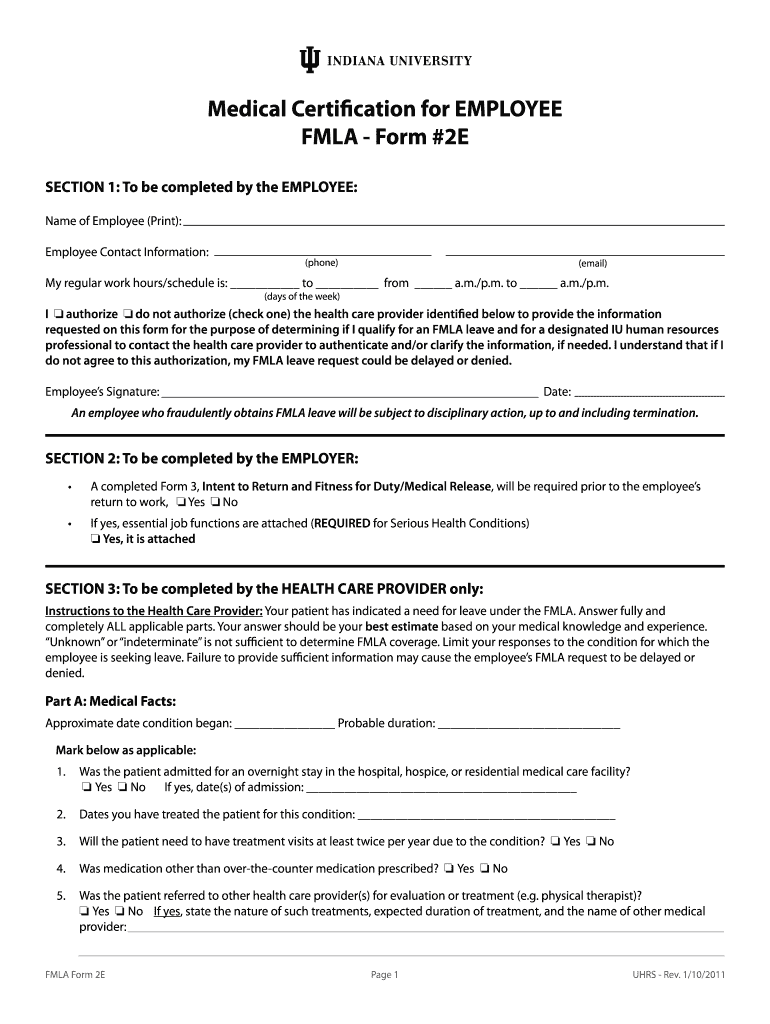

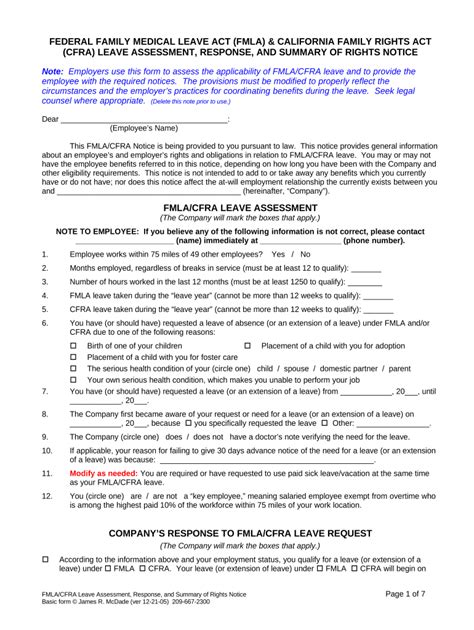

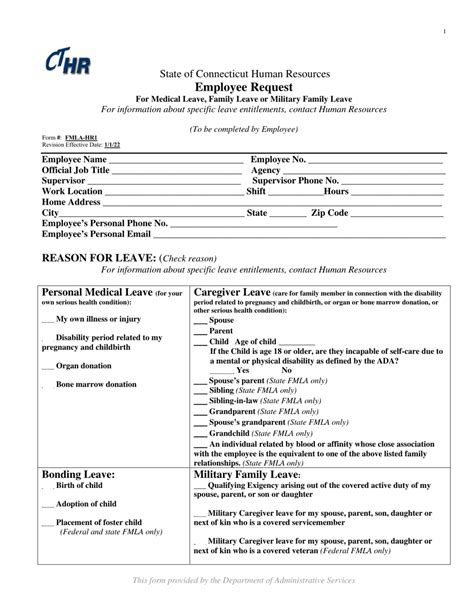

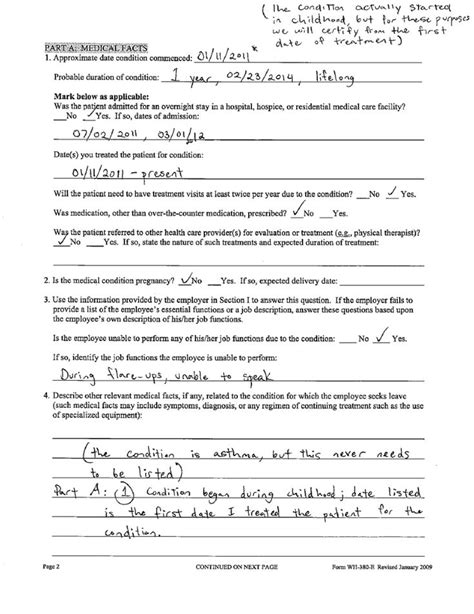

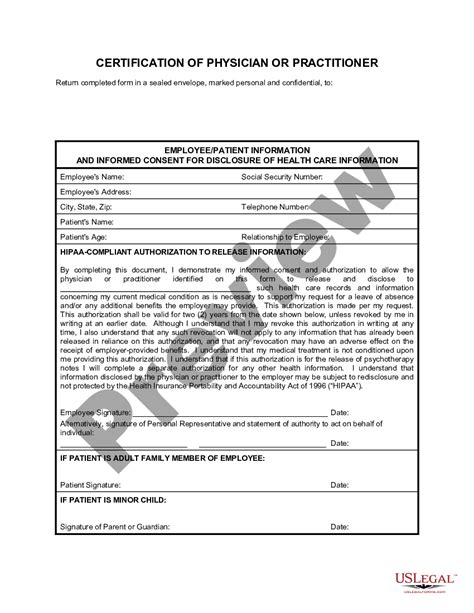

The FMLA requires employers to provide employees with certain notices and forms during the leave process. These include: * Notice of Eligibility: The employer must provide the employee with a notice of eligibility within five business days of the employee’s request for leave. * Notice of Rights and Responsibilities: The employer must provide the employee with a notice of rights and responsibilities within five business days of the employee’s request for leave. * Certification Form: The employer may require the employee to provide a certification form from a healthcare provider to support the leave request. * Designation Notice: The employer must provide the employee with a designation notice within five business days of receiving the certification form.

FMLA Paperwork Fees

The issue of FMLA paperwork fees arises when employers consider charging employees for the costs associated with processing FMLA leave requests. These costs may include: * Administrative fees: The cost of processing the leave request, including the time and resources required to complete the necessary paperwork. * Certification fees: The cost of obtaining certification from a healthcare provider to support the leave request. * Notice fees: The cost of providing the required notices to the employee.

Are FMLA Paperwork Fees Allowed?

The Department of Labor (DOL) has issued guidance on the issue of FMLA paperwork fees. According to the DOL, employers are not allowed to charge employees for the costs associated with processing FMLA leave requests. This includes administrative fees, certification fees, and notice fees. The DOL considers these costs to be a part of the employer’s administrative responsibilities under the FMLA.

📝 Note: Employers should be aware that charging employees for FMLA paperwork fees may be considered a violation of the FMLA and could result in penalties and fines.

Exceptions to the Rule

While employers are generally not allowed to charge employees for FMLA paperwork fees, there are some exceptions to the rule. For example: * Certification fees: Employers may require employees to pay for the cost of obtaining certification from a healthcare provider, but only if the employer reimburses the employee for the cost. * Medical examination fees: Employers may require employees to pay for the cost of a medical examination to support the leave request, but only if the employer reimburses the employee for the cost.

Best Practices for Employers

To avoid potential penalties and fines, employers should follow best practices when it comes to FMLA paperwork fees. These include: * Not charging employees for administrative fees: Employers should absorb the costs associated with processing FMLA leave requests. * Reimbursing employees for certification fees: Employers should reimburse employees for the cost of obtaining certification from a healthcare provider. * Providing clear notice to employees: Employers should provide employees with clear notice of their rights and responsibilities under the FMLA, including any costs associated with the leave request.

Conclusion

In summary, employers are not allowed to charge employees for FMLA paperwork fees, including administrative fees, certification fees, and notice fees. While there are some exceptions to the rule, employers should follow best practices to avoid potential penalties and fines. By providing clear notice to employees and reimbursing employees for certification fees, employers can ensure compliance with the FMLA and avoid potential liabilities.

What is the FMLA and what are its purpose?

+

The Family and Medical Leave Act (FMLA) is a federal law that provides eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons. The purpose of the FMLA is to provide employees with job protection and benefits during a leave of absence.

What are the paperwork requirements under the FMLA?

+

The FMLA requires employers to provide employees with certain notices and forms during the leave process, including notice of eligibility, notice of rights and responsibilities, certification form, and designation notice.

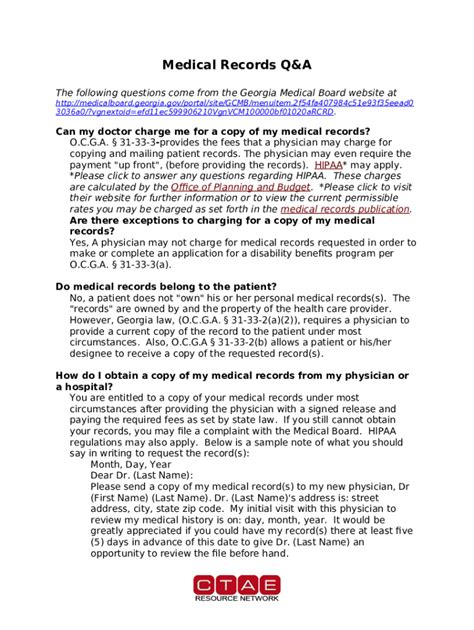

Can employers charge employees for FMLA paperwork fees?

+

No, employers are not allowed to charge employees for FMLA paperwork fees, including administrative fees, certification fees, and notice fees. However, there are some exceptions to the rule, such as reimbursing employees for certification fees.