5 Ways QuickBooks Helps S Corps

Introduction to QuickBooks for S Corps

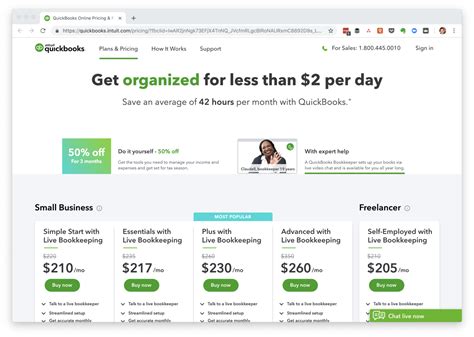

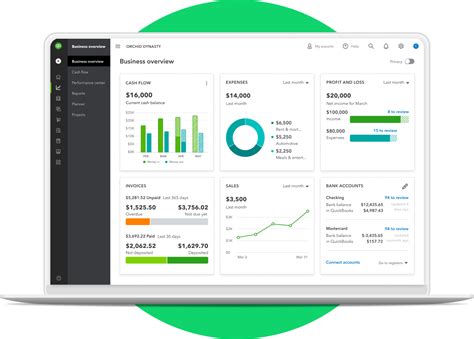

As an S Corporation, managing finances effectively is crucial for success. One of the most popular accounting software used by S Corps is QuickBooks. With its user-friendly interface and robust features, QuickBooks helps S Corps streamline their financial management, reduce errors, and make informed decisions. In this article, we will explore five ways QuickBooks helps S Corps, highlighting its benefits and features that cater to the specific needs of S Corporations.

1. Accurate Financial Reporting and Compliance

QuickBooks provides S Corps with accurate and timely financial reporting, which is essential for compliance with regulatory requirements. With QuickBooks, S Corps can easily generate financial statements, such as balance sheets, income statements, and cash flow statements. These reports help S Corps track their financial performance, identify areas for improvement, and make informed decisions about their business. Additionally, QuickBooks helps S Corps comply with tax laws and regulations, reducing the risk of errors and penalties. Accurate financial reporting is critical for S Corps, as it enables them to demonstrate their financial health and stability to stakeholders, including investors, lenders, and the IRS.

2. Efficient Accounts Payable and Accounts Receivable Management

QuickBooks helps S Corps manage their accounts payable and accounts receivable efficiently, ensuring that they pay their bills on time and collect payments from customers promptly. With QuickBooks, S Corps can track their invoices, payments, and credits, reducing the risk of errors and disputes. The software also allows S Corps to set up automatic payment reminders, send invoices electronically, and track customer payments. By streamlining their accounts payable and accounts receivable processes, S Corps can improve their cash flow, reduce administrative burdens, and focus on growing their business. Some of the key features of QuickBooks that support efficient accounts payable and accounts receivable management include: * Automatic payment reminders * Electronic invoicing * Payment tracking * Credit memo management

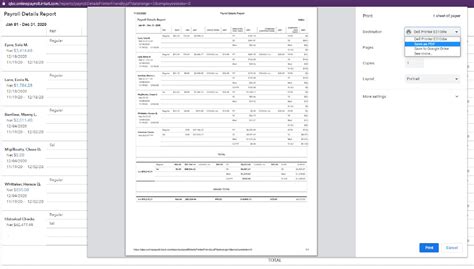

3. Simplified Payroll Processing and Compliance

QuickBooks offers a range of payroll processing and compliance features that help S Corps manage their payroll obligations efficiently. With QuickBooks, S Corps can easily process payroll, calculate taxes, and generate payroll reports. The software also helps S Corps comply with payroll tax laws and regulations, reducing the risk of errors and penalties. Some of the key features of QuickBooks that support simplified payroll processing and compliance include: * Automated payroll processing * Tax calculation and compliance * Payroll reporting * Employee benefits management

4. Enhanced Inventory Management and Control

QuickBooks provides S Corps with advanced inventory management and control features, enabling them to track their inventory levels, monitor stock movements, and optimize their inventory management processes. With QuickBooks, S Corps can set up inventory items, track inventory quantities, and generate inventory reports. The software also allows S Corps to set up automatic inventory alerts, monitor inventory levels, and optimize their inventory management processes. By improving their inventory management and control, S Corps can reduce waste, minimize stockouts, and improve their overall operational efficiency. Some of the key features of QuickBooks that support enhanced inventory management and control include: * Inventory item setup * Inventory quantity tracking * Inventory reporting * Automatic inventory alerts

5. Improved Budgeting and Forecasting

QuickBooks helps S Corps improve their budgeting and forecasting processes, enabling them to make informed decisions about their business. With QuickBooks, S Corps can create budgets, track expenses, and generate financial forecasts. The software also allows S Corps to set up automatic budgeting alerts, monitor budget variances, and optimize their budgeting processes. By improving their budgeting and forecasting, S Corps can reduce financial risks, identify areas for cost savings, and improve their overall financial performance. Some of the key features of QuickBooks that support improved budgeting and forecasting include: * Budget creation * Expense tracking * Financial forecasting * Automatic budgeting alerts

💡 Note: It's essential for S Corps to regularly review and update their budgets and forecasts to ensure they remain accurate and relevant.

In summary, QuickBooks provides S Corps with a range of features and benefits that help them manage their finances effectively, reduce errors, and make informed decisions. By leveraging the power of QuickBooks, S Corps can improve their financial reporting and compliance, streamline their accounts payable and accounts receivable management, simplify their payroll processing and compliance, enhance their inventory management and control, and improve their budgeting and forecasting processes.

What are the benefits of using QuickBooks for S Corps?

+

The benefits of using QuickBooks for S Corps include accurate financial reporting and compliance, efficient accounts payable and accounts receivable management, simplified payroll processing and compliance, enhanced inventory management and control, and improved budgeting and forecasting.

How does QuickBooks help S Corps with financial reporting and compliance?

+

QuickBooks provides S Corps with accurate and timely financial reporting, which is essential for compliance with regulatory requirements. The software generates financial statements, such as balance sheets, income statements, and cash flow statements, and helps S Corps track their financial performance, identify areas for improvement, and make informed decisions about their business.

Can QuickBooks help S Corps with payroll processing and compliance?

+

Yes, QuickBooks offers a range of payroll processing and compliance features that help S Corps manage their payroll obligations efficiently. The software processes payroll, calculates taxes, generates payroll reports, and helps S Corps comply with payroll tax laws and regulations.