Paperwork

5 Ways Claim PPI

Introduction to PPI Claims

The Payment Protection Insurance (PPI) scandal has been one of the most significant financial controversies in recent history, affecting millions of people worldwide. PPI was initially designed to protect borrowers from defaulting on loan repayments if they became ill, had an accident, or lost their job. However, it was widely mis-sold by banks and other financial institutions, leading to a massive wave of complaints and claims. If you believe you were mis-sold PPI, you might be eligible for a refund. Here’s how you can claim back your money.

Understanding the PPI Claim Process

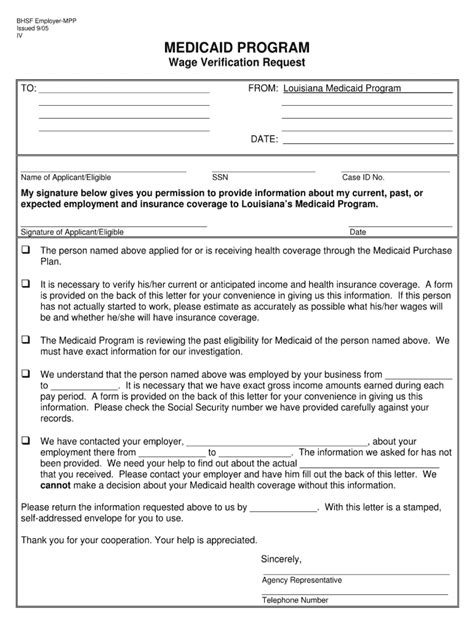

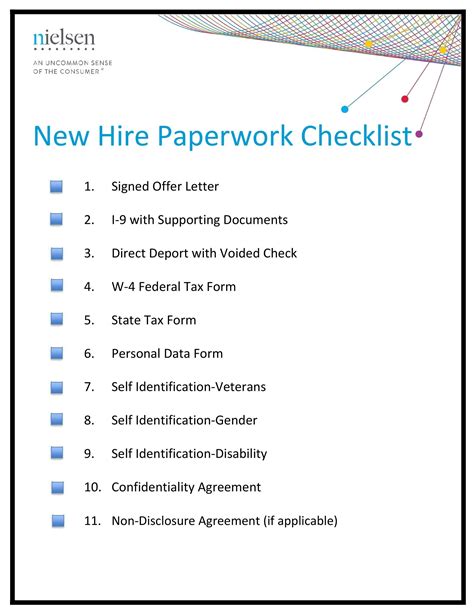

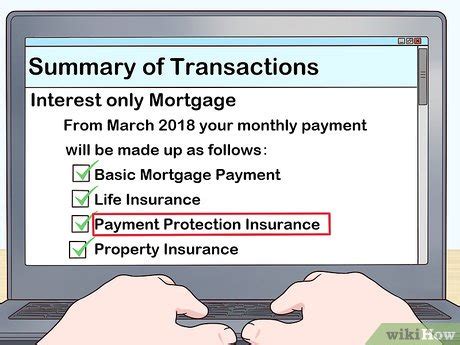

Before you start the claim process, it’s essential to understand how PPI claims work. The process typically involves checking if you had PPI attached to any of your financial products, such as loans, credit cards, or mortgages. You’ll need to gather all relevant documents, including your loan or credit agreement, to support your claim. Gathering evidence is crucial to build a strong case, so make sure you have all the necessary paperwork.

5 Ways to Claim PPI

There are several ways to claim PPI, and we’ll explore five of the most common methods:

- Method 1: Claim Directly from the Bank - You can contact your bank or lender directly to inquire about PPI claims. They will guide you through the process and provide the necessary forms to fill out. This method is straightforward, but be prepared for a potentially lengthy process.

- Method 2: Use a Claims Management Company - Claims management companies specialize in handling PPI claims on behalf of clients. They will handle all the paperwork and negotiations with the bank, but be aware that they will charge a fee for their services.

- Method 3: Use the Financial Ombudsman Service (FOS) - If your claim is rejected by the bank, you can take your case to the FOS. They will review your claim and make a decision based on the evidence provided.

- Method 4: Claim through the Financial Conduct Authority (FCA) - The FCA has set up a dedicated website to help consumers claim PPI. You can use their online tool to check if you had PPI and start the claim process.

- Method 5: Use a Solicitor - If you’re not comfortable dealing with the claim process yourself, you can hire a solicitor to handle your case. They will provide expert advice and representation, but this method can be more expensive than the others.

Benefits of Claiming PPI

Claiming PPI can have several benefits, including:

- Receiving a refund for mis-sold PPI premiums

- Compensation for any financial losses incurred due to the mis-sale

- Closure and peace of mind knowing that you’ve taken action

- Potential improvement in your credit score if the mis-sold PPI is removed from your credit record

Common Mistakes to Avoid

When claiming PPI, there are some common mistakes to avoid:

- Not gathering enough evidence to support your claim

- Not checking the deadline for making a claim

- Not understanding the fees charged by claims management companies

- Not keeping records of all correspondence with the bank or claims company

💡 Note: It's essential to be patient and persistent when claiming PPI, as the process can take several months to complete.

Conclusion and Next Steps

In summary, claiming PPI requires careful consideration and attention to detail. By understanding the claim process and avoiding common mistakes, you can increase your chances of a successful claim. Remember to stay patient and persistent, and don’t hesitate to seek help if you need it. With the right approach, you can reclaim your mis-sold PPI premiums and move forward with confidence.

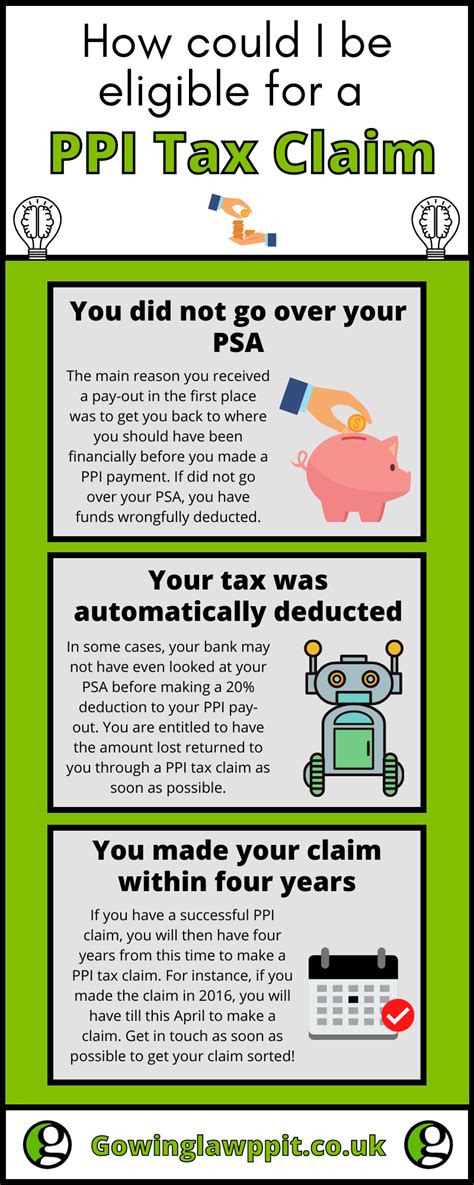

What is the deadline for making a PPI claim?

+

The deadline for making a PPI claim was August 29, 2019, but you may still be able to claim if you have a valid reason for not claiming earlier.

How long does the PPI claim process take?

+

The PPI claim process can take several months to complete, depending on the complexity of the case and the responsiveness of the bank or claims company.

Can I claim PPI if I’ve already paid off my loan or credit card?

+

Yes, you can still claim PPI even if you’ve already paid off your loan or credit card. You’ll need to provide evidence of the mis-sold PPI and complete the claim form.