5 Ways SSI Drop Off

Introduction to SSI Drop Off

Supplemental Security Income (SSI) is a federal program that provides financial assistance to individuals with disabilities, blindness, or age (65 or older). However, there are situations where SSI recipients may experience a drop off in their benefits. This can be due to various reasons, and it’s essential to understand these factors to navigate the complexities of the SSI system. In this article, we will explore five ways SSI drop off can occur and provide guidance on how to manage these changes.

Understanding SSI Eligibility

To be eligible for SSI, an individual must meet specific requirements, including having a limited income, resources, and a qualifying disability. The Social Security Administration (SSA) uses a complex formula to determine SSI benefits, taking into account an individual’s income, living arrangements, and other factors. Any changes to these factors can result in a drop off in SSI benefits.

5 Ways SSI Drop Off Can Occur

Here are five ways SSI drop off can occur: * Marital Status Changes: If an SSI recipient gets married, their benefits may be affected. The SSA considers the income and resources of both spouses when determining eligibility and benefit amounts. If the combined income and resources exceed the allowed limits, SSI benefits may be reduced or terminated. * Income Increases: An increase in income can also lead to a drop off in SSI benefits. This can happen if an SSI recipient starts working, receives a raise, or experiences an increase in other sources of income, such as investments or gifts. * Resource Limits: SSI recipients are subject to resource limits, which include cash, stocks, bonds, and other assets. If an individual’s resources exceed the allowed limits (2,000 for an individual, 3,000 for a couple), their SSI benefits may be reduced or terminated. * Living Arrangement Changes: Changes in living arrangements can also affect SSI benefits. For example, if an SSI recipient moves in with a family member or friend, their benefits may be reduced or terminated, depending on the specific circumstances. * Disability Status Changes: If an SSI recipient’s disability status changes, their benefits may be affected. For example, if an individual’s condition improves, they may no longer be considered disabled, and their SSI benefits may be terminated.

📝 Note: It's essential to report any changes in income, resources, or living arrangements to the SSA to avoid overpayments or penalties.

Managing SSI Drop Off

If an individual experiences a drop off in their SSI benefits, there are steps they can take to manage the situation: * Contact the SSA: The first step is to contact the SSA to report any changes and understand how they will affect SSI benefits. * Explore Alternative Benefits: Depending on the circumstances, an individual may be eligible for alternative benefits, such as Social Security Disability Insurance (SSDI) or Medicaid. * Seek Assistance: Non-profit organizations, such as the Disability Rights Education and Defense Fund, can provide guidance and support to individuals navigating the SSI system.

| Factor | Effect on SSI Benefits |

|---|---|

| Marital Status Changes | May reduce or terminate benefits |

| Income Increases | May reduce or terminate benefits |

| Resource Limits | May reduce or terminate benefits if exceeded |

| Living Arrangement Changes | May reduce or terminate benefits |

| Disability Status Changes | May reduce or terminate benefits |

In summary, SSI drop off can occur due to various factors, including changes in marital status, income, resources, living arrangements, and disability status. It’s essential to understand these factors and take steps to manage any changes to ensure continued eligibility for SSI benefits. By reporting changes to the SSA, exploring alternative benefits, and seeking assistance, individuals can navigate the complexities of the SSI system and maintain their financial stability.

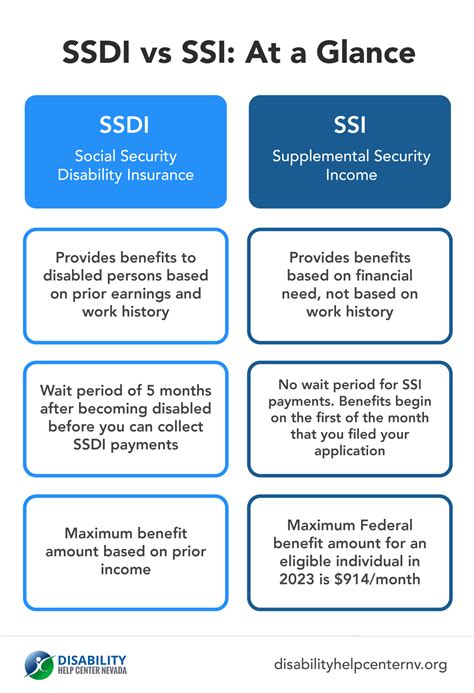

What is the difference between SSI and SSDI?

+

SSI (Supplemental Security Income) is a federal program that provides financial assistance to individuals with disabilities, blindness, or age (65 or older), while SSDI (Social Security Disability Insurance) is a program that provides benefits to individuals who have worked and paid Social Security taxes.

How do I report changes to the SSA?

+

You can report changes to the SSA by calling their toll-free number, visiting their website, or visiting your local SSA office in person.

Can I appeal an SSI decision?

+

Yes, you can appeal an SSI decision if you disagree with the SSA’s determination. You can file an appeal online, by phone, or in person at your local SSA office.