5 Bankruptcy Tips

Introduction to Bankruptcy

Bankruptcy is a legal process that allows individuals or businesses to reorganize or eliminate debts when they are unable to pay them. It can be a complex and overwhelming experience, but with the right guidance, it can also be a fresh start. In this article, we will explore five bankruptcy tips to help you navigate the process and make informed decisions about your financial future.

Understanding Bankruptcy Options

There are several types of bankruptcy, including Chapter 7, Chapter 13, and Chapter 11. Chapter 7 bankruptcy involves the liquidation of assets to pay off debts, while Chapter 13 bankruptcy involves creating a repayment plan to pay off debts over time. It is essential to understand the differences between these options and to choose the one that best suits your financial situation. Here are some key factors to consider: * The type of debts you have (secured, unsecured, priority) * The value of your assets * Your income and expenses * Your financial goals (e.g., keeping your home, paying off debts)

Tips for Filing Bankruptcy

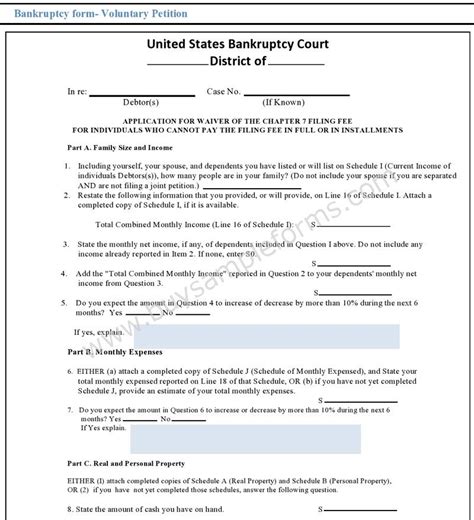

Here are five bankruptcy tips to help you navigate the process: * Tip 1: Seek professional advice: Filing bankruptcy can be a complex and time-consuming process. It is essential to seek the advice of a qualified bankruptcy attorney who can guide you through the process and help you make informed decisions about your financial future. * Tip 2: Gather all necessary documents: To file bankruptcy, you will need to gather a range of documents, including financial records, tax returns, and payroll stubs. Make sure you have all the necessary documents before filing to avoid delays and complications. * Tip 3: Choose the right bankruptcy option: As mentioned earlier, there are several types of bankruptcy. Choose the one that best suits your financial situation and goals. For example, if you have a lot of secured debts (e.g., mortgage, car loan), Chapter 13 bankruptcy may be a better option than Chapter 7. * Tip 4: Be honest and transparent: When filing bankruptcy, it is essential to be honest and transparent about your financial situation. Failure to disclose assets or income can result in your bankruptcy case being dismissed or even lead to criminal charges. * Tip 5: Plan for the future: Bankruptcy is not a permanent solution to financial problems. To avoid future financial difficulties, it is essential to create a budget, prioritize your spending, and make smart financial decisions.

Bankruptcy Process

The bankruptcy process typically involves the following steps: 1. Filing a petition with the bankruptcy court 2. Providing financial information and documents 3. Attending a meeting of creditors 4. Confirming a repayment plan (if filing Chapter 13) 5. Receiving a discharge of debts The process can take several months to several years to complete, depending on the type of bankruptcy and the complexity of the case.

💡 Note: Bankruptcy laws and regulations can vary by state and country, so it is essential to seek the advice of a qualified bankruptcy attorney who is familiar with the laws in your area.

Rebuilding Credit After Bankruptcy

Bankruptcy can have a significant impact on your credit score, but it is not impossible to rebuild your credit after filing. Here are some tips: * Make timely payments: Make all payments on time, including rent, utilities, and loan payments. * Monitor your credit report: Check your credit report regularly to ensure it is accurate and up-to-date. * Avoid new credit inquiries: Avoid applying for new credit cards or loans, as this can negatively impact your credit score. * Consider a secured credit card: A secured credit card can help you rebuild your credit by providing a secure line of credit.

| Bankruptcy Type | Description |

|---|---|

| Chapter 7 | Liquidation of assets to pay off debts |

| Chapter 13 | Repayment plan to pay off debts over time |

| Chapter 11 | Reorganization of debts for businesses |

In summary, bankruptcy can be a complex and overwhelming experience, but with the right guidance, it can also be a fresh start. By understanding your bankruptcy options, seeking professional advice, gathering all necessary documents, choosing the right bankruptcy option, being honest and transparent, and planning for the future, you can navigate the process and make informed decisions about your financial future.

To move forward, it’s essential to create a plan for rebuilding your credit and avoiding future financial difficulties. This can involve making smart financial decisions, prioritizing your spending, and seeking professional advice when needed. With time and effort, you can recover from bankruptcy and build a stronger financial future.

What are the different types of bankruptcy?

+

There are several types of bankruptcy, including Chapter 7, Chapter 13, and Chapter 11. Each type has its own unique characteristics and requirements, and the right type for you will depend on your individual financial situation and goals.

How long does the bankruptcy process take?

+

The length of the bankruptcy process can vary depending on the type of bankruptcy and the complexity of the case. In general, Chapter 7 bankruptcy can take several months to complete, while Chapter 13 bankruptcy can take several years.

Will bankruptcy affect my credit score?

+

Yes, bankruptcy can have a significant impact on your credit score. However, it is not impossible to rebuild your credit after filing for bankruptcy. By making timely payments, monitoring your credit report, and avoiding new credit inquiries, you can start to rebuild your credit over time.