5 Ways Insure Rolex

Introduction to Insuring Your Rolex

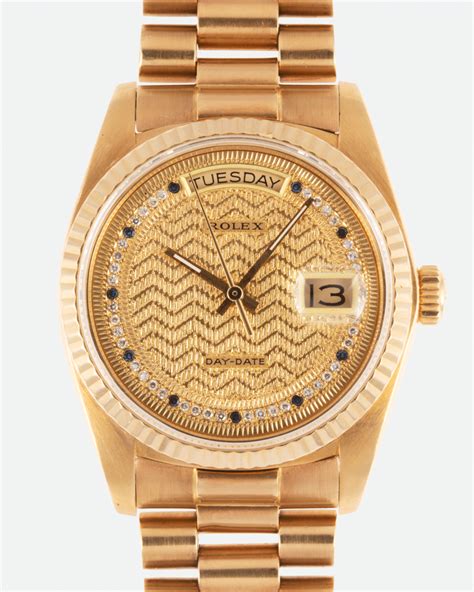

Owning a Rolex is not just a matter of personal style; it’s also a significant investment. These luxury watches are known for their durability and timeless appeal, often becoming family heirlooms. However, like any valuable item, they can be stolen, lost, or damaged. Insuring your Rolex is a critical step in protecting your financial investment. In this article, we will explore five ways to insure your Rolex, providing you with peace of mind and financial security against unforeseen circumstances.

Understanding Rolex Insurance

Before diving into the ways to insure your Rolex, it’s essential to understand what Rolex insurance entails. Rolex insurance is a type of coverage designed specifically for luxury watches, offering protection against theft, loss, damage, and sometimes even maintenance costs. The coverage and premiums can vary widely depending on the insurance provider, the value of the watch, and the terms of the policy.

5 Ways to Insure Your Rolex

1. Homeowners or Renters Insurance

Many homeowners or renters insurance policies offer coverage for personal items, including jewelry and watches. However, the coverage limit for these items might be lower than the actual value of your Rolex. You may need to purchase an additional rider or floater to cover the full value of your watch. This option is convenient but might not provide the specialized coverage that a luxury item like a Rolex requires.

2. Specialized Jewelry Insurance

Companies that specialize in jewelry insurance often provide policies tailored to luxury watches. These policies can offer more comprehensive coverage, including accidental damage, loss, and theft, with the option to insure your Rolex for its appraised value. Specialized insurance providers understand the unique needs of luxury watch owners and can offer more flexible and comprehensive coverage options.

3. Dedicated Watch Insurance

Some insurance companies specialize exclusively in watch insurance, providing detailed coverage that caters to the specific needs of watch collectors and owners. These policies might include coverage for mechanical failures, damage during servicing, and even the cost of repairing or replacing the watch if it’s lost or stolen. Dedicated watch insurance is ideal for those who own multiple luxury watches or for collectors who need specialized coverage.

4. Collector’s Insurance

For those who own multiple luxury items, including Rolex watches, collector’s insurance can be a viable option. This type of insurance is designed for collectors of various luxury goods, providing a blanket coverage for all items. Collector’s insurance can be more cost-effective than insuring each item separately and often offers flexible coverage options tailored to the collector’s specific needs.

5. Luxury Item Insurance Policies

Some insurance companies offer luxury item insurance policies that cover a wide range of high-value items, including watches, jewelry, art, and more. These policies are designed to provide comprehensive coverage for luxury goods, often including worldwide coverage, no deductible, and the option to cover items at their agreed value. Luxury item insurance policies are ideal for those who own a collection of luxury goods and want a single policy to cover all their valuables.

📝 Note: When selecting an insurance policy for your Rolex, it's crucial to read the policy terms carefully, understanding what is covered, the premiums, and any conditions or limitations that might apply.

Choosing the Right Insurance for Your Rolex

Choosing the right insurance for your Rolex involves considering several factors, including the value of your watch, your lifestyle, and the level of coverage you need. Here are some points to consider: - Value of the Watch: Ensure the policy covers the full appraised value of your Rolex. - Coverage Type: Decide whether you need coverage for theft, loss, damage, or all of the above. - Premium Costs: Compare premiums from different providers to ensure you’re getting the best value. - Provider Reputation: Research the insurance provider’s reputation, especially their history with luxury watch claims. - Policy Flexibility: Consider policies that offer flexible coverage options and worldwide protection.

| Insurance Type | Coverage | Premium |

|---|---|---|

| Homeowners/Renters | Theft, Loss, Damage (Limited) | Varies |

| Specialized Jewelry | Theft, Loss, Damage, Accidental Damage | Higher than Basic |

| Dedicated Watch | Comprehensive, Including Mechanical Failures | Specialized |

| Collector's Insurance | Blanket Coverage for Luxury Items | Varies by Collection Value |

| Luxury Item Policies | Comprehensive, Worldwide Coverage | Premium |

In conclusion, insuring your Rolex is a vital step in protecting your investment and ensuring that your luxury watch is covered against any unforeseen circumstances. By understanding the different insurance options available and carefully considering your needs, you can select the policy that best suits you, providing you with peace of mind and financial security. Whether you opt for homeowners insurance, specialized jewelry insurance, dedicated watch insurance, collector’s insurance, or luxury item insurance policies, the key is to ensure that your Rolex is adequately covered.

What is the best way to insure a Rolex?

+

The best way to insure a Rolex depends on your specific needs and the value of your watch. Specialized jewelry insurance or dedicated watch insurance often provide the most comprehensive coverage tailored to luxury watches.

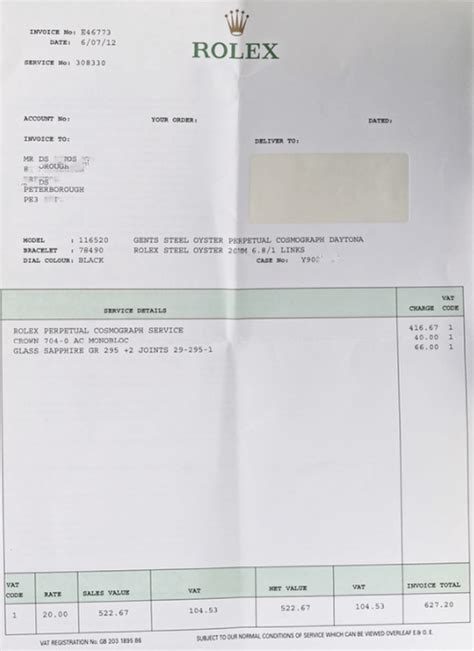

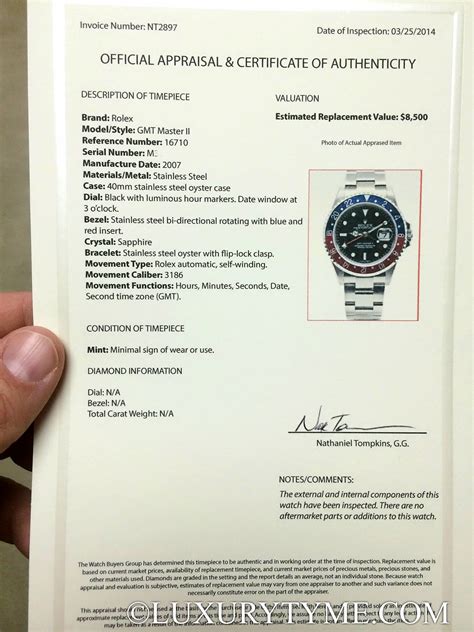

Do I need to appraise my Rolex before insuring it?

+

Yes, it’s recommended to have your Rolex appraised to determine its value. This ensures that your insurance policy covers the full value of your watch in case of theft, loss, or damage.

Can I insure my Rolex through my homeowners insurance?

+

Yes, you can insure your Rolex through your homeowners or renters insurance, but the coverage might be limited. You may need to purchase an additional rider to cover the full value of your Rolex.