Paperwork

Tax Refund Before 8885 Paperwork

Introduction to Tax Refund and 8885 Paperwork

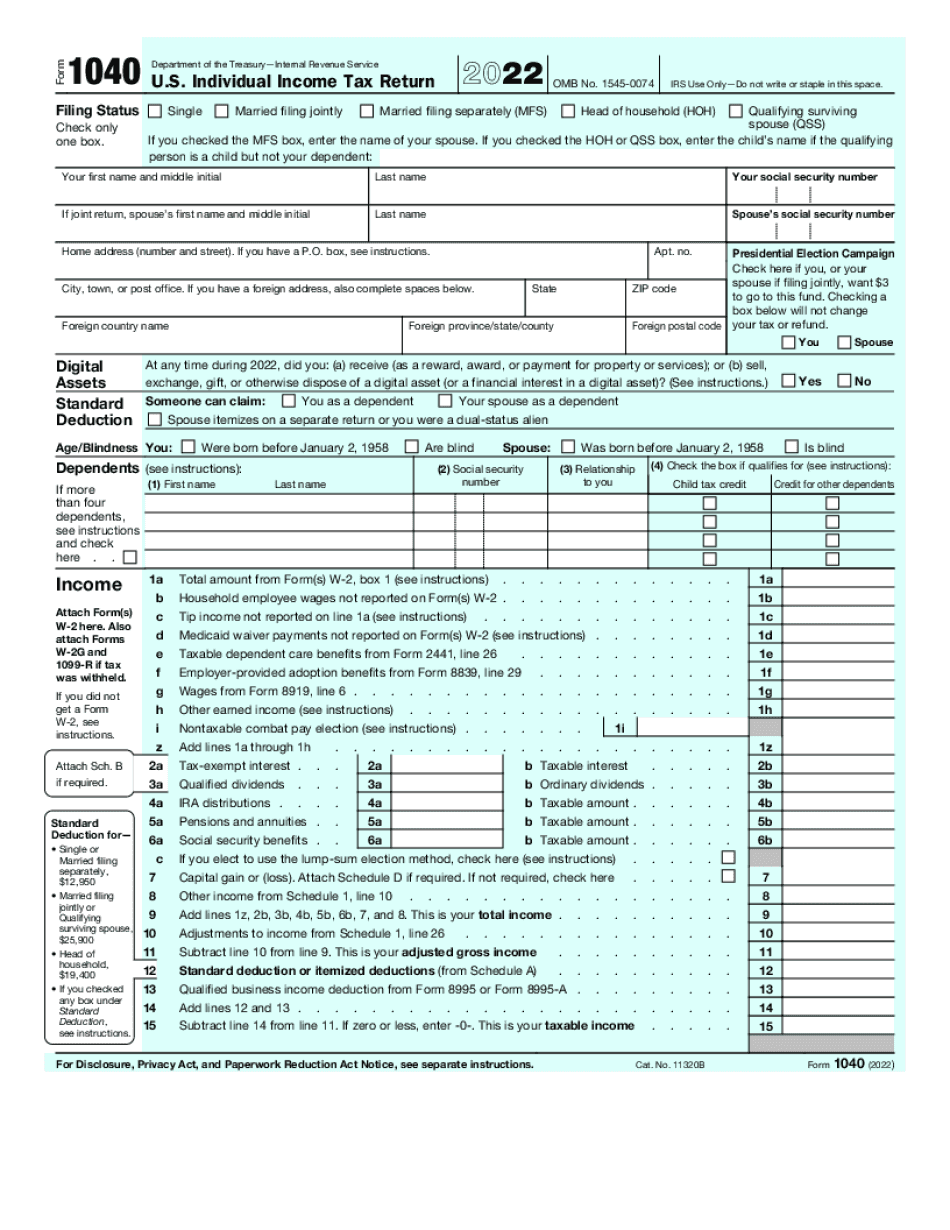

The process of obtaining a tax refund can be complex, especially when dealing with specific forms like the 8885 paperwork. For individuals who have overpaid their taxes or are eligible for a refund due to various tax credits, understanding the steps to claim a refund and the role of the 8885 form is crucial. This guide aims to walk through the process of claiming a tax refund, particularly focusing on the scenarios where a refund might be issued before the completion of the 8885 paperwork.

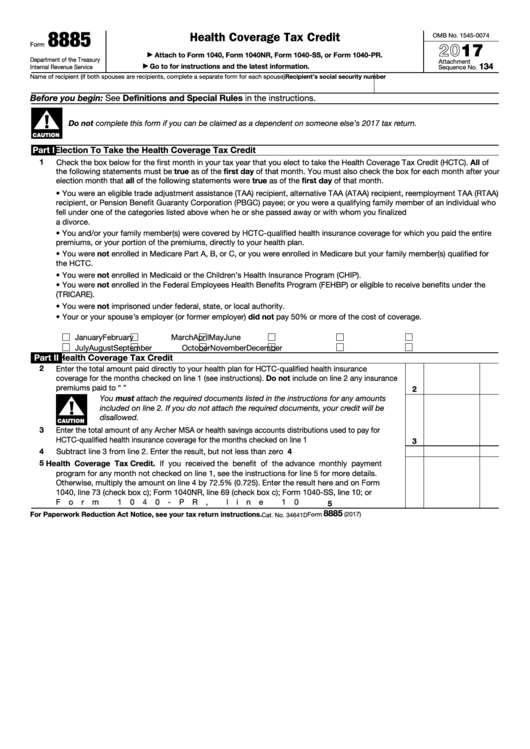

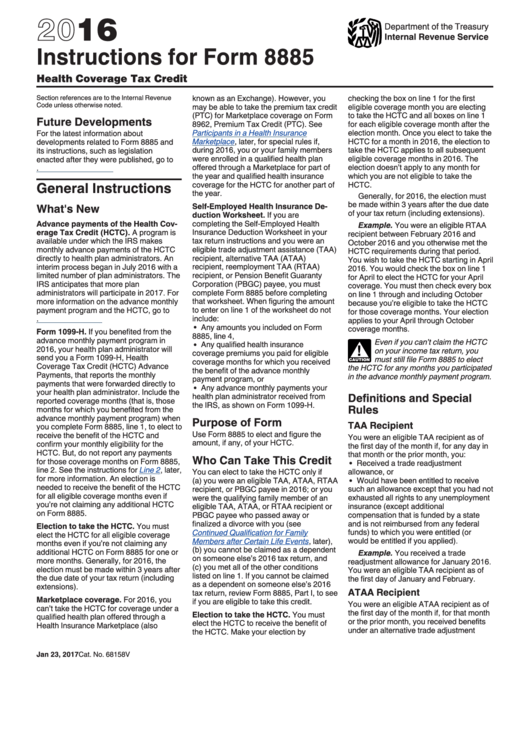

Understanding the 8885 Form

The 8885 form is related to the Health Coverage Tax Credit (HCTC), which is a tax credit designed to help certain individuals and families pay for their health insurance premiums. This form is critical for those eligible for the HCTC, as it aids in calculating the advance payments of the Premium Tax Credit (APTC) or in claiming the HCTC. However, the specifics of this form and its processing times can sometimes delay the tax refund process for affected taxpayers.

Tax Refund Process

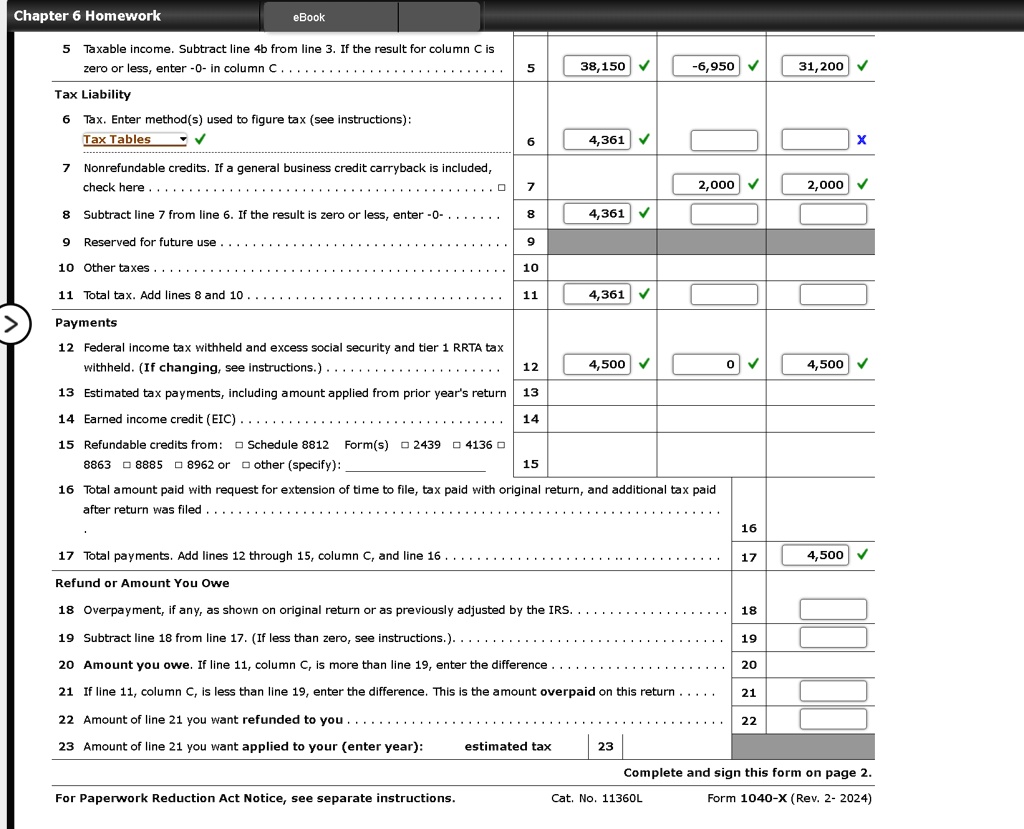

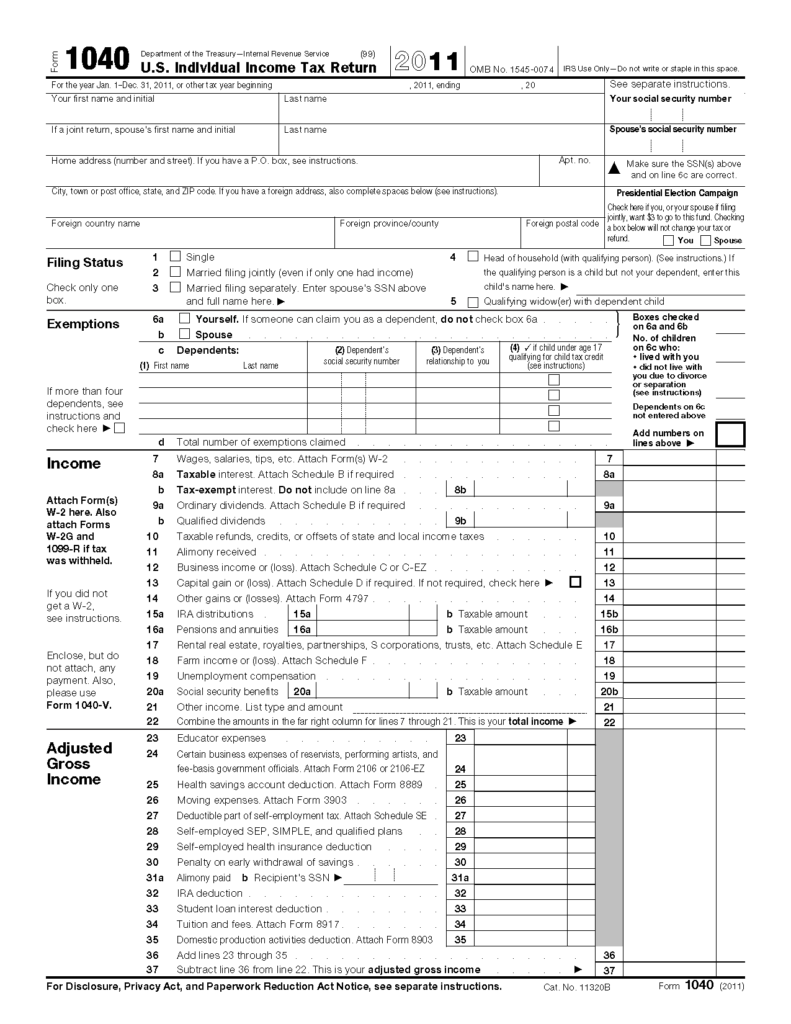

The tax refund process typically begins after an individual files their tax return. The Internal Revenue Service (IRS) reviews the return, calculates the amount of refund due (if any), and then issues the refund. This process can take several weeks, depending on the filing method (electronic or paper) and the chosen refund method (direct deposit, check, etc.).

Scenarios for Early Tax Refund

There are scenarios where the IRS might issue a tax refund before completing all the necessary paperwork, including the 8885 form: - Automatic Refund Processing: In some cases, the IRS may automatically process refunds for taxpayers who have filed their returns electronically and chosen direct deposit, even before all supporting forms like the 8885 are fully processed. - Preliminary Refund Calculation: Based on the initial tax return information, the IRS might calculate and issue a preliminary refund, with adjustments made later if necessary, after all forms, including the 8885, are processed. - Priority Processing for Electronic Filers: Taxpayers who file electronically often receive their refunds more quickly than those who file paper returns. This expedited process might result in a refund being issued before all paperwork is finalized.

Importance of Completing the 8885 Form

Despite the possibility of receiving a tax refund before the 8885 paperwork is completed, it is crucial for eligible taxpayers to file the 8885 form accurately and on time. This form ensures that the taxpayer receives the correct amount of Health Coverage Tax Credit and helps in reconciling any advance payments of the Premium Tax Credit. Failure to file the 8885 form or errors in its completion can lead to delays in receiving the full refund amount or even result in additional taxes owed.

Steps to Ensure Smooth Refund Processing

To ensure that the tax refund process goes smoothly, especially for those awaiting refunds related to the 8885 form, follow these steps: - File Electronically: Electronic filing can expedite the refund process. - Choose Direct Deposit: Direct deposit is generally faster than receiving a refund check. - Accurately Complete All Forms: Ensure that all tax forms, including the 8885, are completed correctly and submitted on time. - Monitor IRS Communications: Keep an eye on any communications from the IRS regarding the status of your refund or the need for additional information.

Conclusion and Future Planning

In summary, while it’s possible to receive a tax refund before the 8885 paperwork is completed, understanding the process and ensuring all necessary forms are filed correctly is essential for a seamless refund experience. Taxpayers should stay informed about their refund status and be prepared to provide additional information if requested by the IRS. By following these guidelines and staying proactive, individuals can navigate the tax refund process more efficiently, even when dealing with specific forms like the 8885.

What is the purpose of the 8885 form in tax refund processing?

+

The 8885 form is used for the Health Coverage Tax Credit (HCTC), helping eligible individuals and families calculate and claim this credit for their health insurance premiums.

Can I receive my tax refund before completing the 8885 form?

+

Yes, in some scenarios, the IRS might issue a tax refund before all paperwork, including the 8885 form, is completed. However, it’s essential to file the 8885 form accurately and on time to ensure the correct refund amount.

How can I expedite my tax refund processing?

+

Filing your tax return electronically and choosing direct deposit can significantly expedite the refund process. Additionally, ensuring all forms, including the 8885, are completed correctly and submitted on time is crucial.