5 Ways Lenders Hold Paperwork

Introduction to Lender Paperwork

When dealing with lenders, whether for a personal loan, mortgage, or business loan, paperwork is an inevitable part of the process. Lenders require a significant amount of documentation to assess the creditworthiness of borrowers, ensure compliance with regulatory requirements, and mitigate potential risks. The way lenders hold and manage this paperwork can vary, impacting the efficiency, security, and overall experience of the lending process. In this article, we will explore five ways lenders manage paperwork, highlighting the benefits and challenges associated with each method.

Digital Documentation

One of the most modern and efficient ways lenders manage paperwork is through digital documentation. This involves converting all physical documents into digital formats, such as PDFs, and storing them securely on cloud-based platforms or internal servers. Digital signatures and electronic consent are used to validate agreements and contracts, reducing the need for physical paperwork. This method offers several benefits, including: - Enhanced Security: Digital documents are less prone to physical damage, loss, or unauthorized access. - Increased Efficiency: Digital documentation facilitates faster processing and review of loan applications. - Environmental Benefits: Reduced use of paper contributes to a more sustainable lending process.

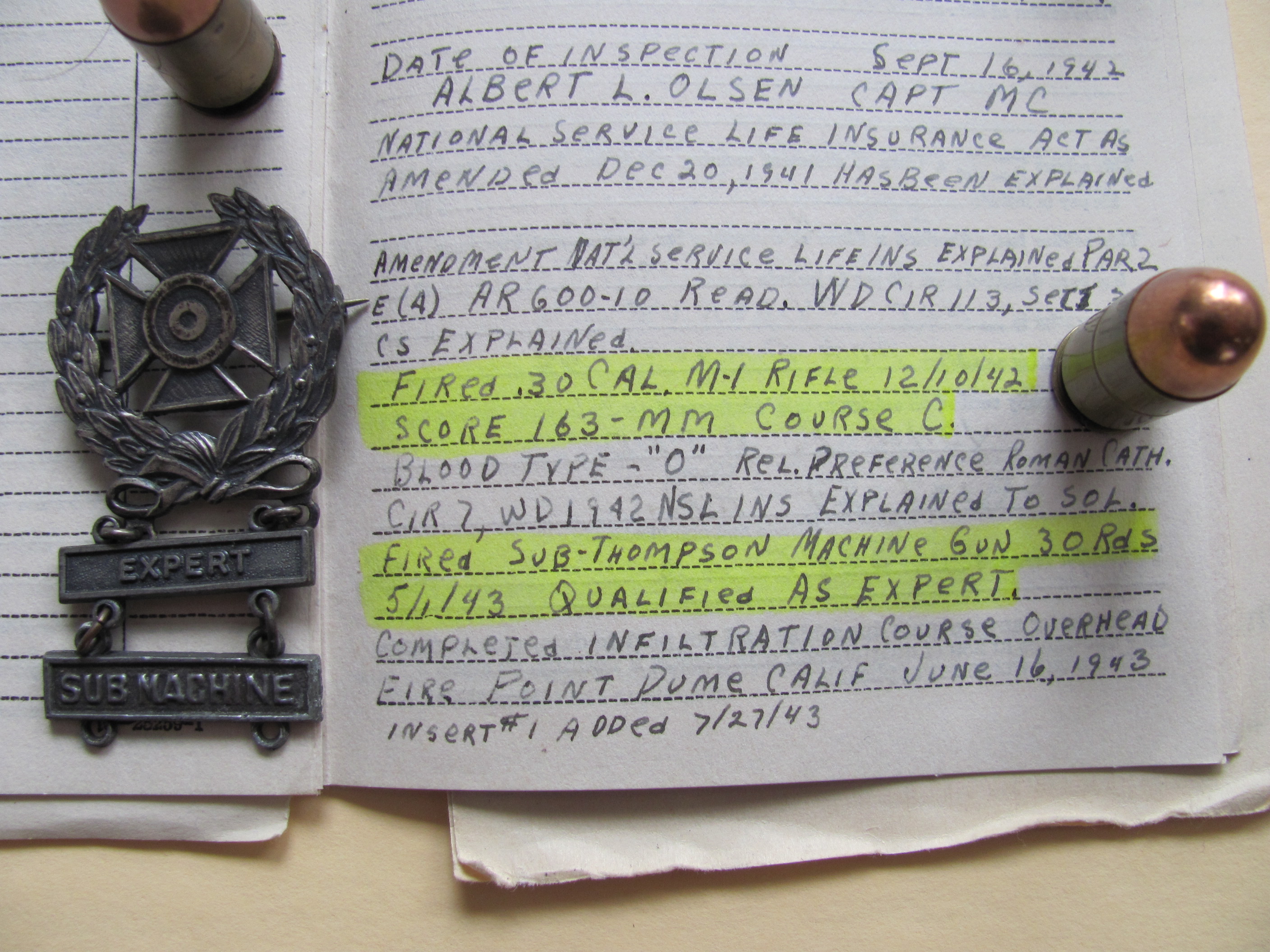

Physical File Storage

Despite the advancements in digital technology, some lenders still rely on physical file storage for managing paperwork. This traditional method involves storing loan documents, contracts, and other relevant papers in filing cabinets or secure rooms. While this approach may seem outdated, it has its advantages: - Tangible Records: Physical documents provide a tangible record of transactions and agreements. - Compliance: For certain regulatory requirements, physical documentation may be necessary or preferred.

However, physical file storage also presents challenges, such as the need for significant storage space, the risk of document loss or damage, and the inefficiency in retrieving and updating records.

Hybrid Approach

A hybrid approach combines elements of both digital and physical documentation methods. Lenders may digitize certain documents while maintaining physical copies of critical or legally required papers. This method allows for: - Flexibility: Lenders can choose which documents to digitize and which to keep in physical form, based on regulatory, security, or practical considerations. - Compliance and Security: The hybrid approach ensures that lenders can meet specific compliance requirements while also benefiting from the security and efficiency of digital documentation.

Outsourced Document Management

Some lenders opt to outsource their document management to third-party services. These providers specialize in storing, securing, and managing documents on behalf of the lender. The benefits of outsourced document management include: - Cost Savings: Outsourcing can reduce the costs associated with maintaining in-house document management systems. - Expertise: Third-party providers often have advanced security measures and compliance expertise, ensuring that documents are handled according to the highest standards.

However, outsourcing also means that lenders have less direct control over their documents and must ensure that the service provider meets all necessary regulatory and security standards.

Automated Document Processing

Automated document processing involves using software and algorithms to extract, categorize, and verify information from loan documents. This method can significantly streamline the lending process by: - Reducing Manual Labor: Automation minimizes the need for manual data entry and document review, increasing efficiency and reducing errors. - Improving Accuracy: Automated systems can verify information against databases and detect discrepancies or fraudulent activities more effectively than human reviewers.

Despite these advantages, implementing automated document processing requires significant upfront investment in technology and training, and there may be limitations in handling complex or unconventional loan applications.

💡 Note: When adopting any of these methods, lenders must ensure compliance with relevant data protection and financial regulations, such as GDPR or CCPA, to safeguard borrower information and maintain trust.

In the lending industry, the management of paperwork is a critical aspect that directly influences the borrower’s experience, the lender’s operational efficiency, and the overall security of financial transactions. By understanding the various methods lenders use to hold paperwork, from digital documentation to automated processing, we can appreciate the complexities and opportunities within the lending process. Whether through traditional physical storage, modern digital solutions, or a combination thereof, the goal remains to balance efficiency, security, and compliance in a way that benefits both lenders and borrowers.

The evolution of document management in lending reflects broader technological and societal trends, emphasizing the need for flexibility, innovation, and stringent security measures. As the financial sector continues to adapt to new technologies and regulatory requirements, the way lenders manage paperwork will play a pivotal role in shaping the future of lending.

In final consideration, the effective management of paperwork by lenders is not merely an operational necessity but a strategic advantage in today’s competitive financial landscape. By leveraging the right mix of technology, outsourcing, and traditional methods, lenders can enhance their services, protect sensitive information, and build stronger relationships with their clients.

What are the primary benefits of digital documentation in lending?

+

The primary benefits include enhanced security, increased efficiency, and environmental benefits through reduced paper use.

How does automated document processing improve the lending process?

+

Automated document processing reduces manual labor, improves accuracy, and enhances the detection of discrepancies or fraudulent activities, thereby streamlining the lending process.

What considerations must lenders keep in mind when outsourcing document management?

+

Lenders must ensure that the third-party provider meets all necessary regulatory and security standards to protect borrower information and maintain compliance.