5 De Incorporation Tips

Introduction to De Incorporation

De incorporation, also known as deregistration or dissolution, is the process of removing a company from the register of companies at the relevant registry, such as the Companies House in the UK or the Secretary of State in the US. This process involves several steps and requires careful consideration to ensure that it is done correctly and efficiently. In this article, we will provide 5 de incorporation tips to help you navigate this complex process.

Tip 1: Understand the Reasons for De Incorporation

Before starting the de incorporation process, it is essential to understand the reasons behind it. Common reasons for de incorporation include: * The company is no longer trading or is dormant * The company has been sold or merged with another company * The company is insolvent and cannot pay its debts * The company’s directors or shareholders want to avoid ongoing compliance costs and obligations Understanding the reasons for de incorporation will help you determine the best approach and ensure that you comply with all relevant laws and regulations.

Tip 2: Meet the Eligibility Criteria

To be eligible for de incorporation, the company must meet certain criteria, such as: * The company must be dormant or have ceased trading * The company must have no outstanding debts or liabilities * The company must have filed all required tax returns and paid any taxes due * The company must have obtained the consent of all directors, shareholders, and creditors It is crucial to review the eligibility criteria carefully to ensure that your company qualifies for de incorporation.

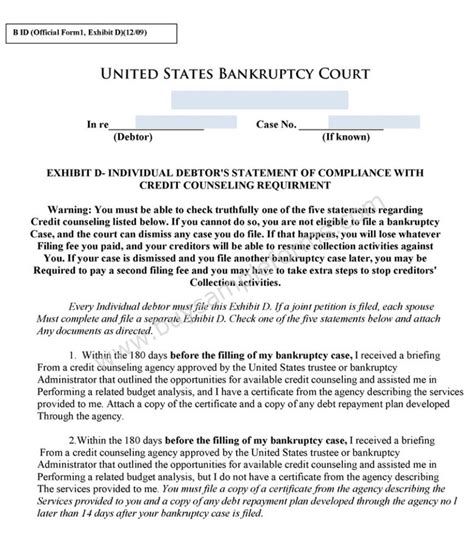

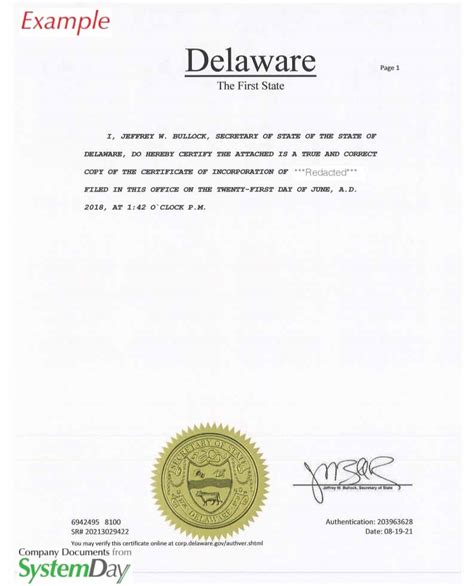

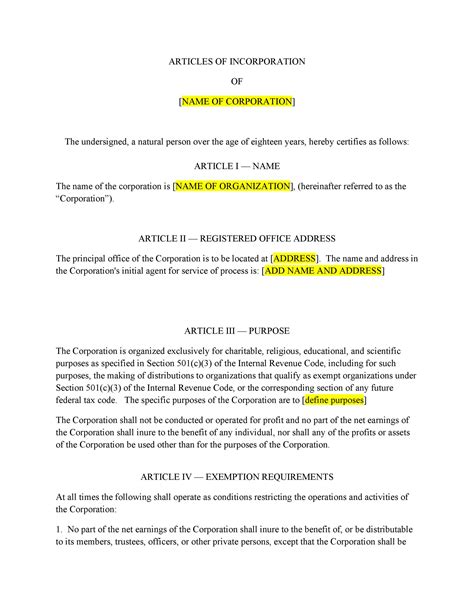

Tip 3: Prepare the Necessary Documents

The de incorporation process requires the preparation and submission of various documents, including: * Articles of dissolution: a document that outlines the company’s intention to dissolve and be removed from the register * Certificate of dissolution: a document that confirms the company’s dissolution and removal from the register * Tax clearance certificate: a document that confirms the company has paid all taxes due and has no outstanding tax liabilities * Director’s resolution: a document that confirms the directors’ decision to dissolve the company It is essential to prepare these documents carefully and ensure that they are accurate and complete.

Tip 4: Notify Relevant Parties

The de incorporation process requires notification of relevant parties, including: * Creditors: the company must notify all creditors and obtain their consent to the de incorporation * Shareholders: the company must notify all shareholders and obtain their consent to the de incorporation * Employees: the company must notify all employees and provide them with necessary information and support * Regulatory bodies: the company must notify relevant regulatory bodies, such as the tax authority and the companies registry It is crucial to notify all relevant parties in a timely and transparent manner to avoid any potential issues or disputes.

Tip 5: Consider the Tax Implications

De incorporation can have significant tax implications, including: * Capital gains tax: the company may be liable for capital gains tax on the disposal of its assets * Income tax: the company may be liable for income tax on any profits or income earned during the de incorporation process * Value-added tax: the company may be liable for value-added tax on any goods or services sold during the de incorporation process It is essential to consider the tax implications carefully and seek professional advice to ensure that the company is in compliance with all tax laws and regulations.

📝 Note: De incorporation can be a complex and time-consuming process, and it is recommended that you seek professional advice from a lawyer or accountant to ensure that you comply with all relevant laws and regulations.

In summary, de incorporation is a significant decision that requires careful consideration and planning. By understanding the reasons for de incorporation, meeting the eligibility criteria, preparing the necessary documents, notifying relevant parties, and considering the tax implications, you can ensure that the process is done correctly and efficiently.

What is de incorporation, and why is it necessary?

+

De incorporation, also known as deregistration or dissolution, is the process of removing a company from the register of companies at the relevant registry. It is necessary when a company is no longer trading or is dormant, has been sold or merged with another company, is insolvent, or when the directors or shareholders want to avoid ongoing compliance costs and obligations.

What are the eligibility criteria for de incorporation?

+

The company must be dormant or have ceased trading, have no outstanding debts or liabilities, have filed all required tax returns and paid any taxes due, and have obtained the consent of all directors, shareholders, and creditors.

What documents are required for de incorporation?

+

The documents required for de incorporation include articles of dissolution, certificate of dissolution, tax clearance certificate, and director’s resolution.