Missing Cobra Paperwork

Introduction to Missing Cobra Paperwork

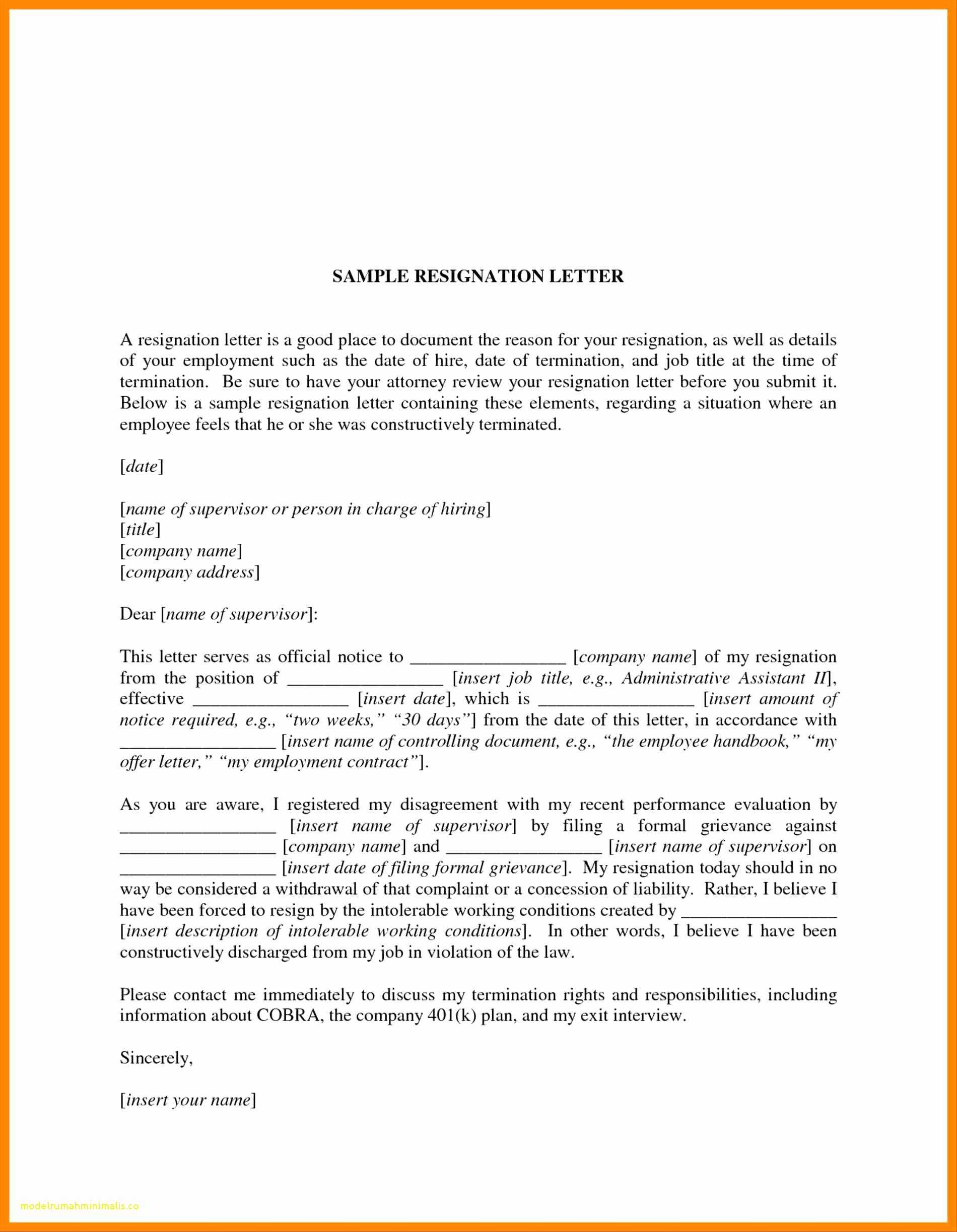

When an individual leaves their job, whether due to resignation, termination, or any other reason, they are often eligible for Continuation of Health Coverage, commonly referred to as COBRA. This federal law allows them to continue their health insurance coverage for a limited period. However, the process of managing COBRA benefits can be complex, especially when it comes to paperwork. Missing COBRA paperwork can lead to a range of issues, from delayed coverage to legal complications. In this article, we will delve into the world of COBRA, the importance of its paperwork, and how to manage it effectively.

Understanding COBRA

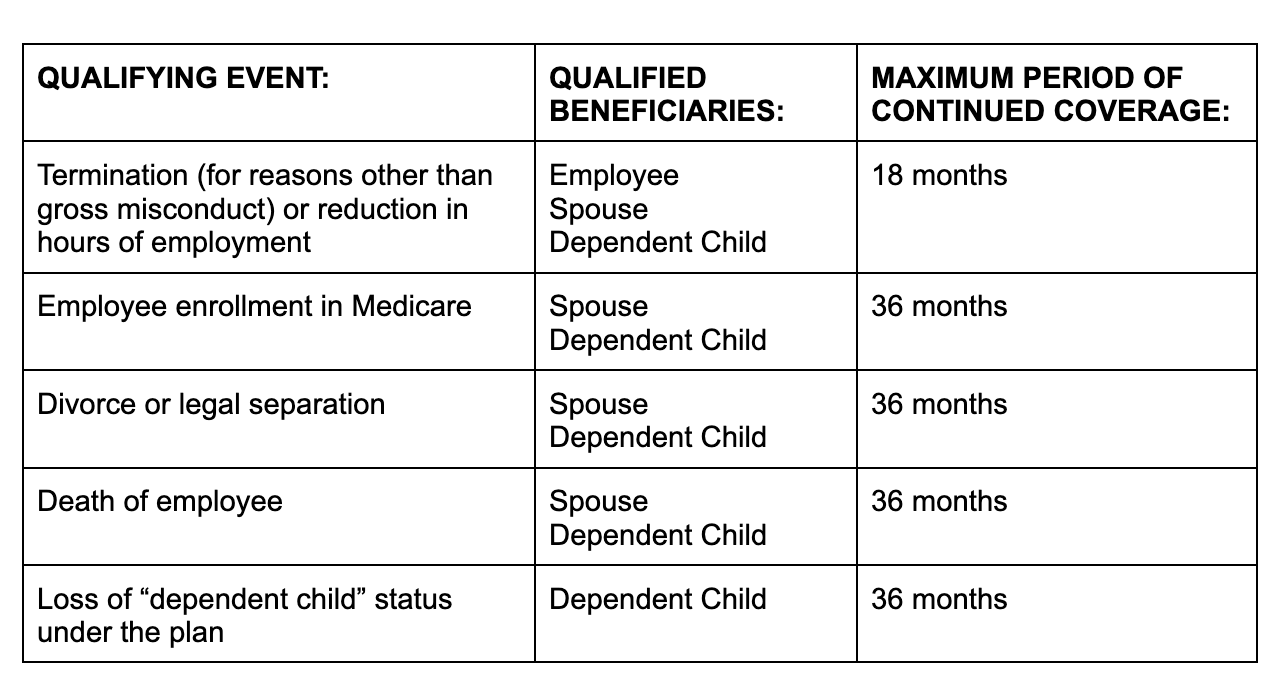

The Consolidated Omnibus Budget Reconciliation Act (COBRA) of 1985 is a federal law that gives workers and their families the right to continue their health care coverage under an employer-sponsored group health plan in certain circumstances. These circumstances include voluntary or involuntary job loss, reduction in working hours, death, divorce, or eligibility for Medicare. COBRA coverage is usually available for up to 18 months after the qualifying event, though certain circumstances can extend this period.

Importance of COBRA Paperwork

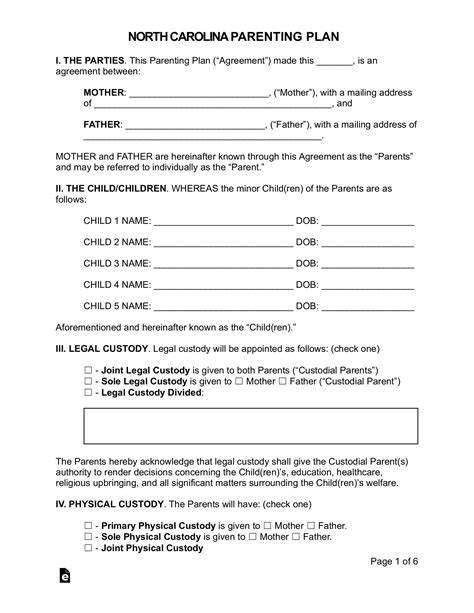

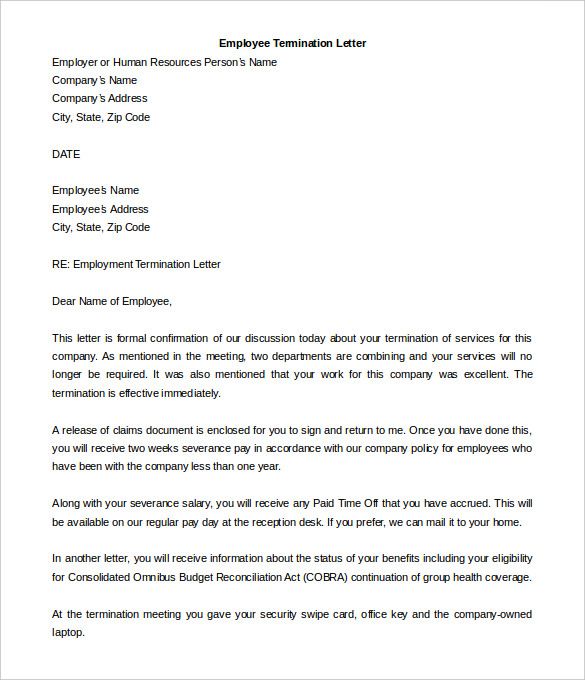

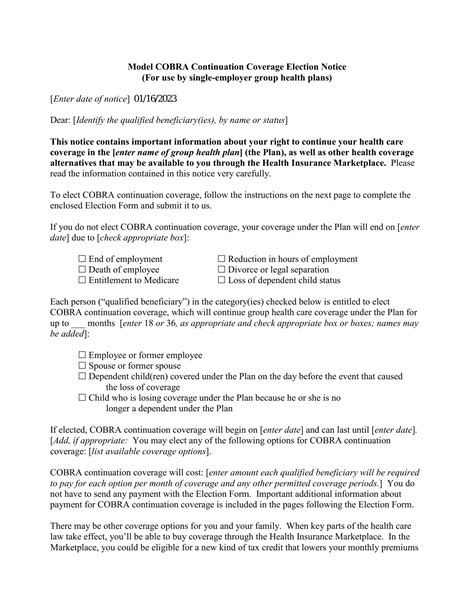

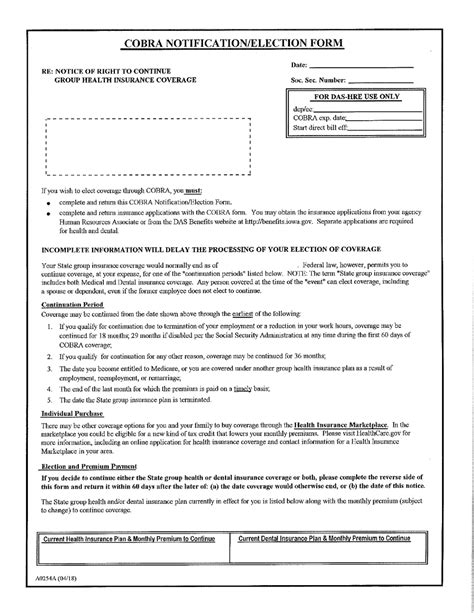

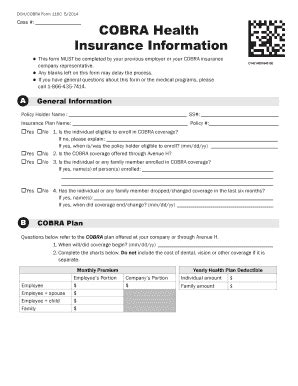

The paperwork associated with COBRA is crucial for both employers and employees. For employers, it involves notifying the plan administrator and the employee about the COBRA rights within specific time frames. For employees, it means receiving and understanding the COBRA election notice, which explains their rights, the cost of coverage, and how to elect COBRA coverage. Missing or incomplete paperwork can lead to misunderstandings, mismanagement of benefits, and potential legal issues.

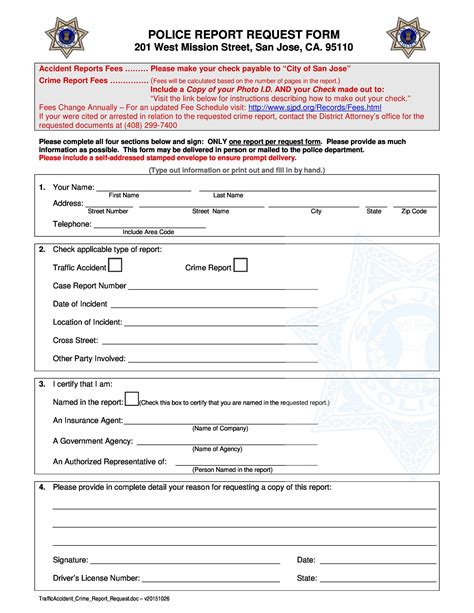

Managing COBRA Paperwork

Effective management of COBRA paperwork involves several steps: - Notification: Employers must notify their plan administrator within 30 days of a qualifying event. - Election Notice: The plan administrator must provide the COBRA election notice to the qualified beneficiaries within 14 days after receiving the notification of the qualifying event. - Election Period: Beneficiaries have 60 days from the date the notice is provided or the date coverage would otherwise end, whichever is later, to elect COBRA coverage. - Payment of Premiums: Once COBRA coverage is elected, beneficiaries must make timely payments of premiums to maintain coverage.

Consequences of Missing Paperwork

Missing COBRA paperwork can have significant consequences, including: - Delayed Coverage: Failure to receive or submit necessary paperwork on time can delay the start of COBRA coverage, leaving individuals without health insurance. - Legal Issues: Employers who fail to comply with COBRA regulations can face legal penalties, including fines and lawsuits from affected employees. - Loss of Benefits: If paperwork is not managed correctly, individuals might lose their right to continue their health coverage under COBRA.

Best Practices for Avoiding Missing Paperwork

To avoid issues with missing COBRA paperwork, consider the following best practices: - Automate Processes: Utilize software or services that automate COBRA administration to reduce the chance of human error. - Clear Communication: Ensure that all parties involved understand their responsibilities and the timelines for COBRA paperwork. - Record Keeping: Maintain detailed records of all COBRA-related communications and actions.

📝 Note: Employers should regularly review their COBRA administration processes to ensure compliance with federal regulations and to minimize the risk of missing paperwork.

Conclusion and Future Considerations

In conclusion, managing COBRA paperwork is a critical aspect of benefits administration for both employers and employees. By understanding the importance of COBRA, the process of managing its paperwork, and implementing best practices to avoid missing documents, individuals can ensure a smoother transition during significant life changes. As health care laws and regulations continue to evolve, staying informed about updates to COBRA and other benefits will be essential for navigating the complex landscape of employee benefits.

What is COBRA and how does it work?

+

COBRA stands for the Consolidated Omnibus Budget Reconciliation Act. It’s a law that allows workers and their families to continue their health care coverage under an employer-sponsored group health plan in certain circumstances, such as job loss or reduction in working hours.

How long does COBRA coverage last?

+

COBRA coverage is usually available for up to 18 months after the qualifying event. However, certain circumstances, such as disability or a second qualifying event, can extend this period.

What happens if an employer fails to provide COBRA notification?

+

If an employer fails to provide the necessary COBRA notification, they can face legal penalties, including fines and lawsuits from affected employees. It’s crucial for employers to comply with COBRA regulations to avoid these consequences.

Related Terms:

- COBRA Letter to terminated employee

- COBRA election notice

- COBRA letter template

- COBRA notice requirements after termination

- COBRA forms PDF

- Does COBRA coverage begin immediately