5 Trump Filing Facts

Introduction to Trump Filing Facts

The process of filing for bankruptcy or dealing with financial restructurings can be complex and daunting, especially when considering high-profile cases such as those involving former President Donald Trump. Understanding the key aspects of such filings can provide insight into the financial management and legal strategies employed by individuals and businesses. This discussion will delve into five critical facts related to Trump’s filing history, highlighting the significance of each in the context of financial and legal proceedings.

Fact 1: Multiple Bankruptcy Filings

One of the most notable aspects of Trump’s financial history is the multiple bankruptcy filings associated with his businesses. These filings were primarily related to his casino and hotel ventures in Atlantic City, New Jersey. The first of these filings occurred in 1990, with subsequent filings happening in 2004 and 2009. These bankruptcies allowed Trump’s companies to restructure their debts, reducing the financial burden and enabling the continuation of operations. This strategy, while controversial, is a legitimate tool in business for managing debt and avoiding complete financial collapse.

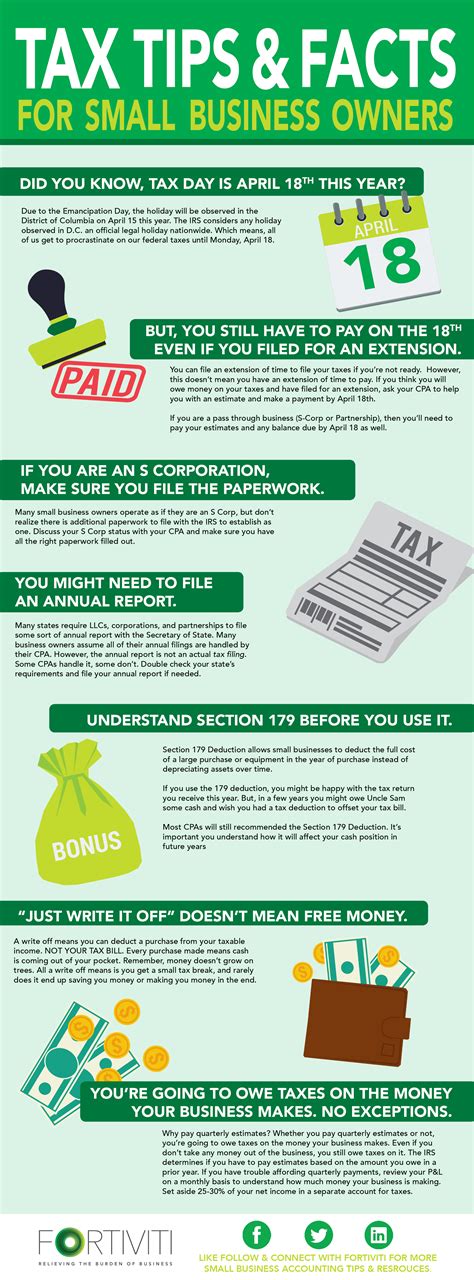

Fact 2: Chapter 11 Bankruptcy

Trump’s filings were predominantly under Chapter 11 of the U.S. Bankruptcy Code, which permits businesses to reorganize and restructure their debts while remaining operational. This chapter is often used by large businesses facing financial distress, as it allows for a more controlled and organized approach to debt management compared to liquidation under Chapter 7. The use of Chapter 11 by Trump’s businesses reflects a strategic approach to financial restructuring, aiming to preserve the value of the companies and protect stakeholders’ interests.

Fact 3: Debt Restructuring and Financial Implications

The bankruptcies filed by Trump’s companies involved significant debt restructuring efforts. These efforts included negotiations with creditors to reduce debt obligations, extend payment periods, and in some cases, secure additional financing. The financial implications of these restructurings were substantial, affecting not only Trump’s personal wealth but also the economic outcomes for investors, employees, and other stakeholders. Understanding these implications is crucial for assessing the impact of such financial maneuvers on both the businesses involved and the broader economic landscape.

Fact 4: Public Perception and Political Impact

The public perception of Trump’s bankruptcy filings has been varied, with some viewing these actions as a demonstration of poor financial management and others seeing them as a shrewd business strategy. In the context of Trump’s political career, these filings have been subject to scrutiny and debate, with opponents often citing them as evidence of his unsuitability for public office. Conversely, supporters have argued that Trump’s ability to navigate complex financial situations and emerge with viable businesses is a testament to his entrepreneurial acumen and leadership abilities.

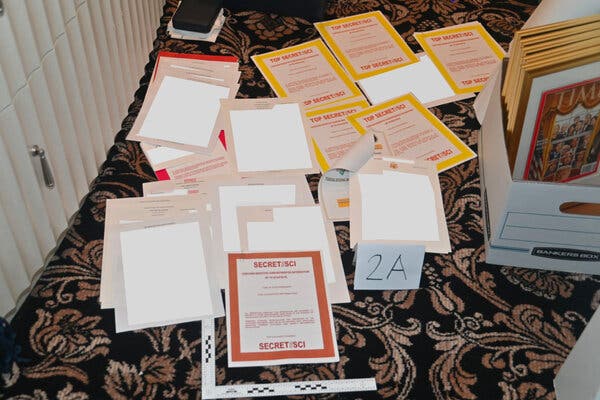

Fact 5: Legal and Ethical Considerations

The legal and ethical considerations surrounding Trump’s bankruptcy filings are multifaceted. From a legal standpoint, the filings were subject to the oversight of bankruptcy courts, which ensured that the restructurings complied with federal bankruptcy laws. Ethically, the use of bankruptcy as a strategic financial tool raises questions about responsibility to creditors, the impact on employees and local communities, and the potential for abuse of the bankruptcy system. These considerations highlight the need for transparency and accountability in financial dealings, especially for public figures and large corporations.

💡 Note: Understanding the complexities of bankruptcy law and the strategic use of bankruptcy filings by businesses can provide valuable insights into financial management and legal strategies.

In summarizing the key points related to Trump’s filing history, it becomes clear that the process of bankruptcy and financial restructuring is complex and influenced by a variety of factors, including legal, financial, and ethical considerations. The ability to navigate these complexities successfully can be a critical component of business strategy, especially for large and high-profile entities. By examining the specifics of Trump’s filings and their outcomes, individuals can gain a deeper understanding of the role that bankruptcy can play in financial management and the importance of strategic decision-making in business.

What is the main difference between Chapter 11 and Chapter 7 bankruptcy?

+

Chapter 11 bankruptcy allows businesses to reorganize and restructure their debts while remaining operational, whereas Chapter 7 involves the liquidation of assets to pay off creditors.

How do Trump’s bankruptcy filings reflect on his business acumen?

+

Trump’s use of bankruptcy as a strategic tool can be seen as both a reflection of his ability to navigate complex financial situations and a critique of his financial management practices, depending on one’s perspective.

What are the ethical considerations surrounding the use of bankruptcy filings by large corporations and public figures?

+

The ethical considerations include the responsibility to creditors, the impact on employees and local communities, and the potential for abuse of the bankruptcy system, highlighting the need for transparency and accountability.