5 Tax Errors

Understanding Tax Errors and Their Implications

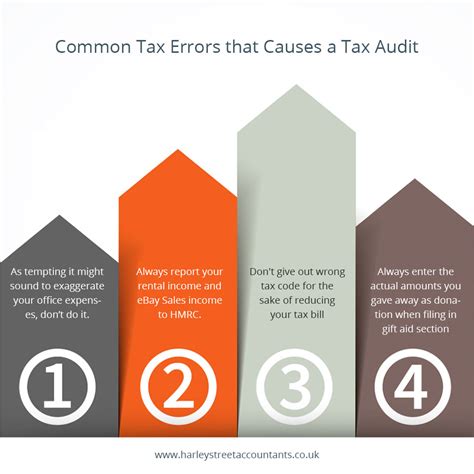

Tax errors can lead to significant financial and legal issues for individuals and businesses. It is essential to understand the common types of tax errors, their causes, and how to prevent them. In this article, we will delve into five critical tax errors, their implications, and provide guidance on how to avoid them.

1. Inaccurate Income Reporting

One of the most common tax errors is inaccurate income reporting. This can occur when individuals or businesses fail to report all their income, overstate deductions, or misclassify income. Inaccurate income reporting can lead to audits, penalties, and fines. To avoid this error, it is crucial to maintain accurate and detailed financial records, including all income statements, receipts, and invoices.

2. Incorrect Filing Status

Another critical tax error is choosing the incorrect filing status. This can affect the amount of taxes owed, as well as the eligibility for certain deductions and credits. Incorrect filing status can lead to delays in processing tax returns, audits, and even penalties. To avoid this error, individuals should carefully review their filing status options, including single, married filing jointly, married filing separately, head of household, and qualifying widow(er).

3. Math Errors and Typos

Math errors and typos are common tax errors that can lead to delays in processing tax returns, audits, and penalties. These errors can occur when individuals or businesses miscalculate their tax liability, forget to sign their tax return, or enter incorrect information. To avoid these errors, it is essential to double-check tax returns for accuracy, use tax preparation software, and seek professional help when needed.

4. Missing or Incomplete Documentation

Missing or incomplete documentation is another critical tax error. This can occur when individuals or businesses fail to keep accurate and detailed financial records, including receipts, invoices, and bank statements. Missing or incomplete documentation can lead to audits, penalties, and fines. To avoid this error, it is crucial to maintain organized and detailed financial records, including all supporting documentation for deductions and credits.

5. Failure to Report Foreign Income

Failure to report foreign income is a critical tax error that can lead to severe penalties and fines. This can occur when individuals or businesses fail to report income earned from foreign sources, including foreign investments, employment, or self-employment. Failure to report foreign income can lead to audits, penalties, and even criminal charges. To avoid this error, it is essential to understand the tax implications of foreign income, maintain accurate and detailed financial records, and seek professional help when needed.

📝 Note: It is crucial to understand the tax laws and regulations in your country or region to avoid tax errors and ensure compliance with tax authorities.

In addition to understanding these common tax errors, it is essential to take proactive steps to prevent them. This can include:

- Maintaining accurate and detailed financial records

- Seeking professional help when needed

- Double-checking tax returns for accuracy

- Understanding tax laws and regulations

- Keeping organized and detailed financial records

By taking these steps, individuals and businesses can reduce the risk of tax errors, avoid penalties and fines, and ensure compliance with tax authorities.

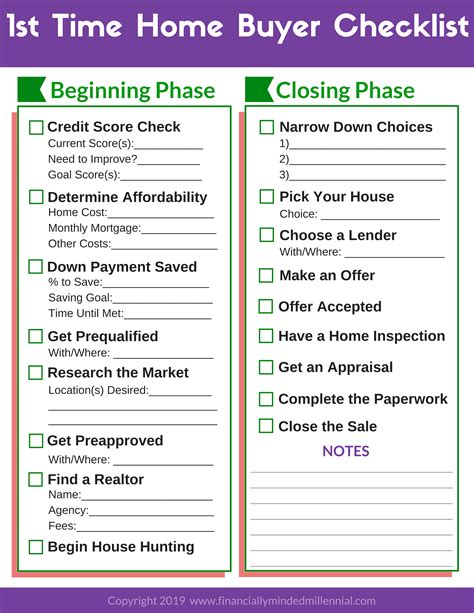

To further illustrate the importance of avoiding tax errors, consider the following table:

| Tax Error | Implication |

|---|---|

| Inaccurate Income Reporting | Audits, penalties, and fines |

| Incorrect Filing Status | Delays in processing tax returns, audits, and penalties |

| Math Errors and Typos | Delays in processing tax returns, audits, and penalties |

| Missing or Incomplete Documentation | Audits, penalties, and fines |

| Failure to Report Foreign Income | Audits, penalties, and even criminal charges |

In summary, tax errors can have severe implications for individuals and businesses. By understanding the common types of tax errors, taking proactive steps to prevent them, and seeking professional help when needed, individuals and businesses can reduce the risk of tax errors, avoid penalties and fines, and ensure compliance with tax authorities. As we reflect on the importance of tax compliance, it becomes clear that accuracy and attention to detail are crucial in avoiding tax errors and ensuring a smooth tax filing process.