Corporations File State Paperwork

Understanding the Process of Filing State Paperwork for Corporations

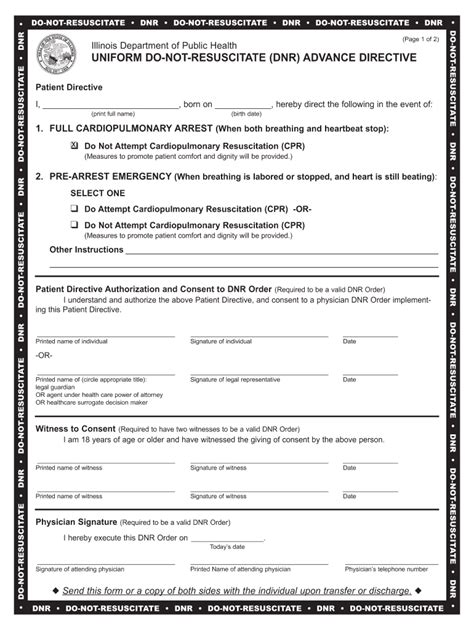

When it comes to forming and maintaining a corporation, there are numerous legal and regulatory requirements that must be met. One of the critical steps in this process is filing state paperwork. This involves submitting various documents to the relevant state authorities to ensure that the corporation is properly registered and compliant with all applicable laws and regulations. In this blog post, we will delve into the details of filing state paperwork for corporations, exploring the key documents involved, the filing process, and the importance of compliance.

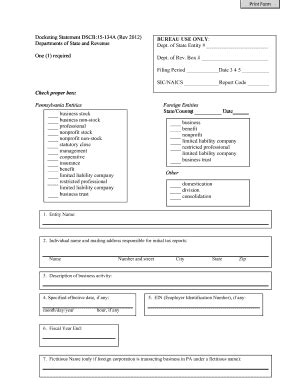

Key Documents Involved in Filing State Paperwork

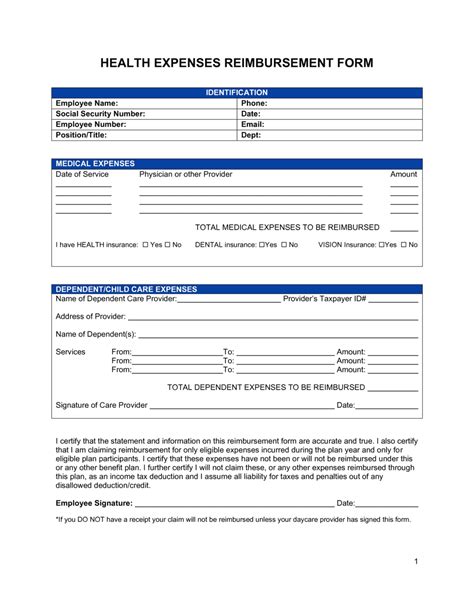

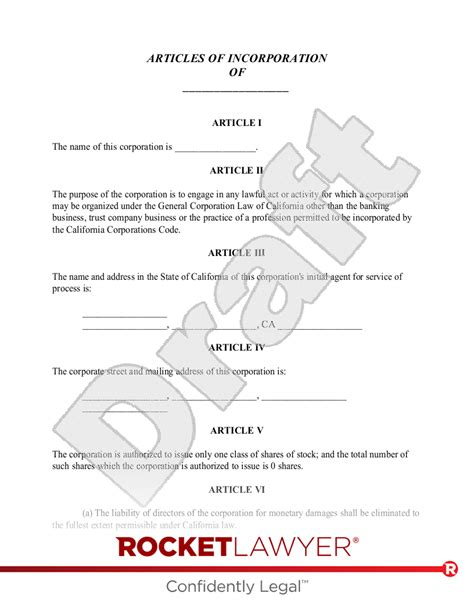

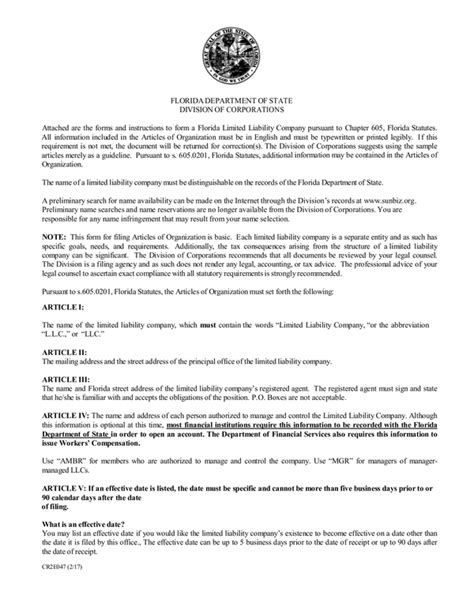

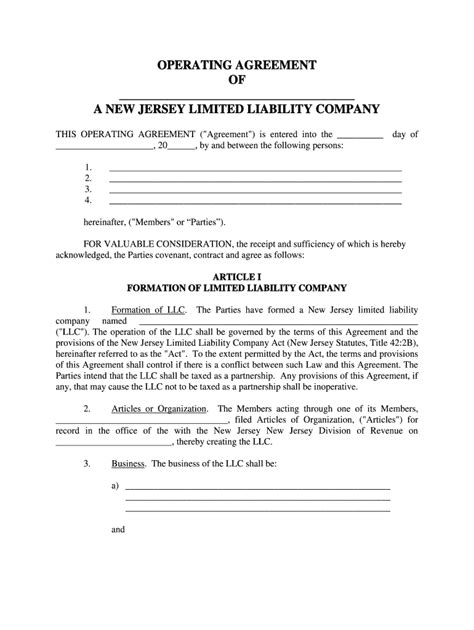

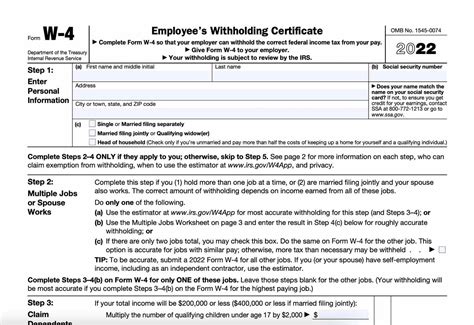

Several key documents are typically involved in the process of filing state paperwork for corporations. These may include: * Articles of Incorporation: This is the primary document filed with the state to form a corporation. It includes essential information such as the corporation’s name, purpose, address, and the number of shares it is authorized to issue. * Corporate Bylaws: While not always required to be filed with the state, corporate bylaws are crucial internal documents that outline the rules and procedures for the corporation’s operation and management. * Annual Reports: Most states require corporations to file annual reports, which provide updated information about the corporation, such as its current address, officers, and directors. * Statement of Information: Some states require corporations to file a Statement of Information, which may include details about the corporation’s business activities, officers, and directors.

The Filing Process: Steps and Considerations

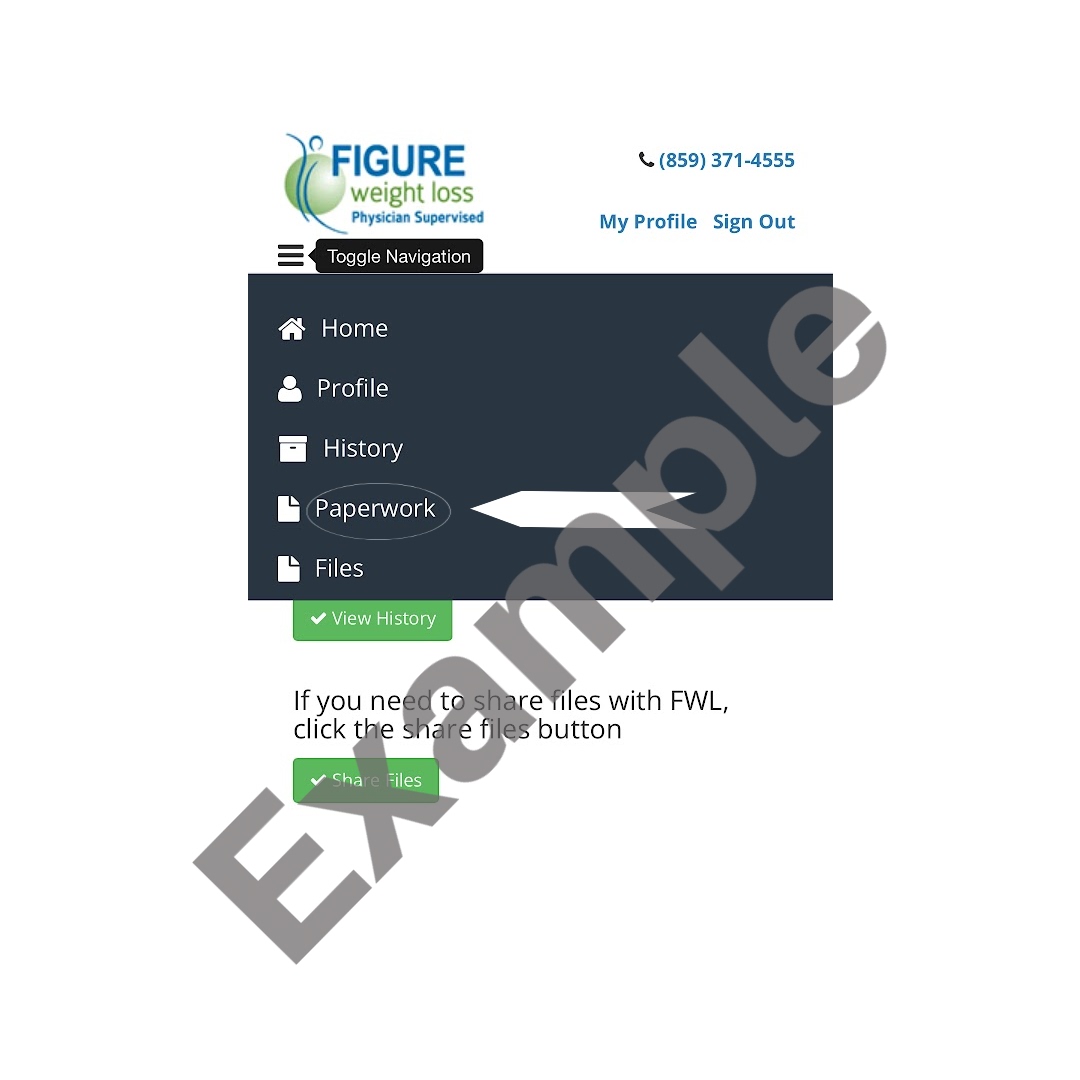

The process of filing state paperwork for corporations involves several steps and considerations: * Research State Requirements: Each state has its own set of requirements and regulations regarding corporate filings. It is essential to research these requirements to ensure compliance. * Prepare Documents: All necessary documents must be prepared and reviewed for accuracy before filing. * File Documents: Documents can usually be filed online, by mail, or in person, depending on the state’s requirements. * Pay Filing Fees: There are typically fees associated with filing state paperwork, which must be paid at the time of filing.

💡 Note: The specific requirements and fees for filing state paperwork can vary significantly from one state to another, so it's crucial to check with the relevant state agency for the most current information.

Importance of Compliance

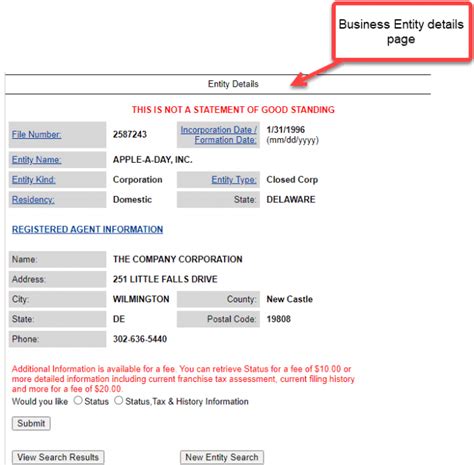

Compliance with state filing requirements is vital for several reasons: * Avoid Penalties and Fines: Failure to file required documents or pay fees can result in penalties and fines. * Maintain Good Standing: Compliance helps maintain the corporation’s good standing with the state, which is essential for conducting business. * Protect Corporate Status: Non-compliance can lead to the loss of corporate status, exposing owners to personal liability.

Best Practices for Filing State Paperwork

To ensure a smooth and compliant filing process, corporations should adopt the following best practices: * Stay Organized: Keep track of filing deadlines and requirements to avoid missed filings. * Seek Professional Advice: Consult with legal or financial professionals if unsure about any aspect of the filing process. * Review and Update Documents: Regularly review corporate documents to ensure they are accurate and up-to-date.

| Document | Purpose | Filing Requirement |

|---|---|---|

| Articles of Incorporation | Form a corporation | Required for initial formation |

| Annual Reports | Update corporate information | Required annually |

| Statement of Information | Provide detailed corporate information | Required in some states |

In summary, filing state paperwork is a critical aspect of forming and maintaining a corporation. It involves submitting key documents to the relevant state authorities to ensure compliance with all applicable laws and regulations. By understanding the key documents involved, the filing process, and the importance of compliance, corporations can navigate this process efficiently and effectively. Additionally, adopting best practices such as staying organized, seeking professional advice, and regularly reviewing and updating documents can help ensure compliance and maintain good corporate standing.

What is the purpose of filing Articles of Incorporation?

+

The purpose of filing Articles of Incorporation is to form a corporation and obtain legal recognition from the state.

How often are annual reports required to be filed?

+

Annual reports are typically required to be filed once a year, although the specific filing deadline can vary by state.

What happens if a corporation fails to file required state paperwork?

+

If a corporation fails to file required state paperwork, it may face penalties, fines, and potentially even loss of corporate status, which can expose owners to personal liability.