File Financial Disclosure with Initial Divorce Paperwork

Introduction to Financial Disclosure in Divorce Proceedings

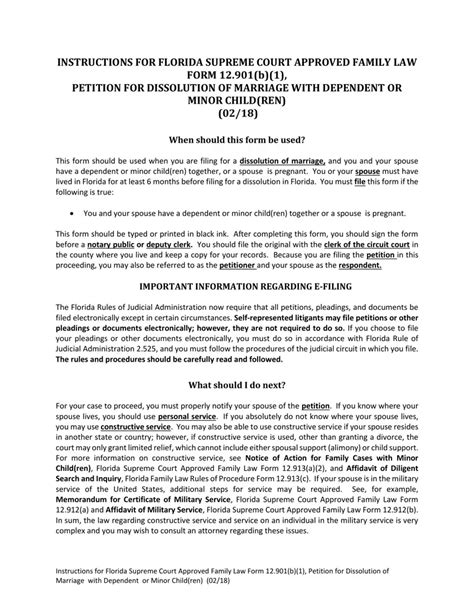

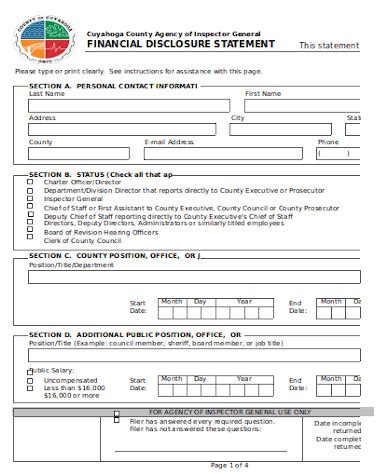

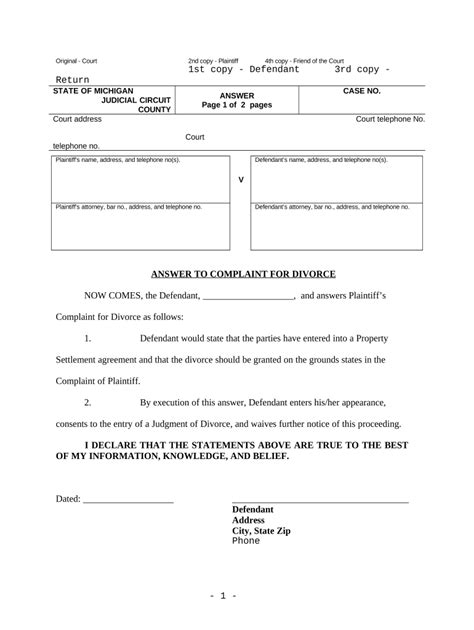

When a couple decides to divorce, one of the critical steps in the divorce process is the financial disclosure. This step is essential as it ensures that both parties have a clear understanding of their financial situation, which is crucial for making informed decisions regarding the division of assets, debts, and other financial matters. Filing financial disclosure with initial divorce paperwork is a standard practice that helps in streamlining the divorce process and avoiding potential disputes that may arise due to lack of transparency.

Why is Financial Disclosure Important?

Financial disclosure is a vital component of divorce proceedings because it provides a comprehensive overview of both parties’ financial standings. This includes income, expenses, assets, debts, and any other financial obligations. By having this information, couples can negotiate fair and reasonable settlements that consider the financial needs and capabilities of both parties. It also helps in identifying any potential financial discrepancies or hidden assets that one party might be trying to conceal.

What Information is Typically Included in Financial Disclosure?

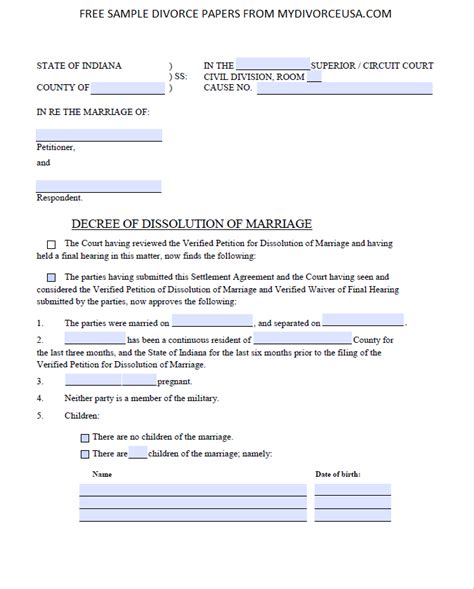

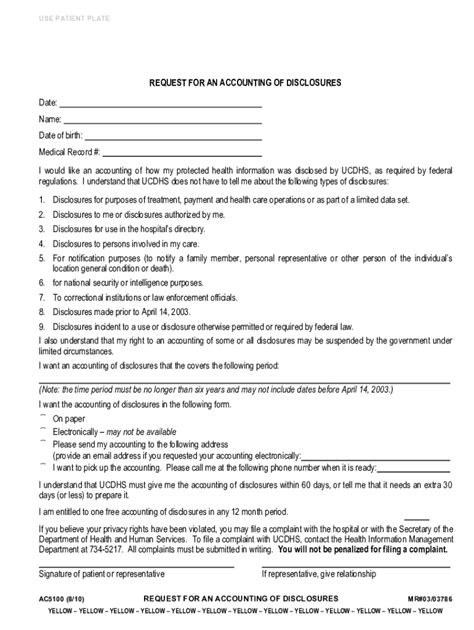

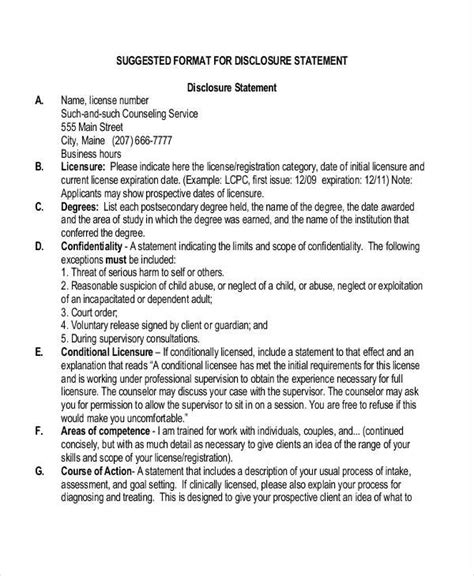

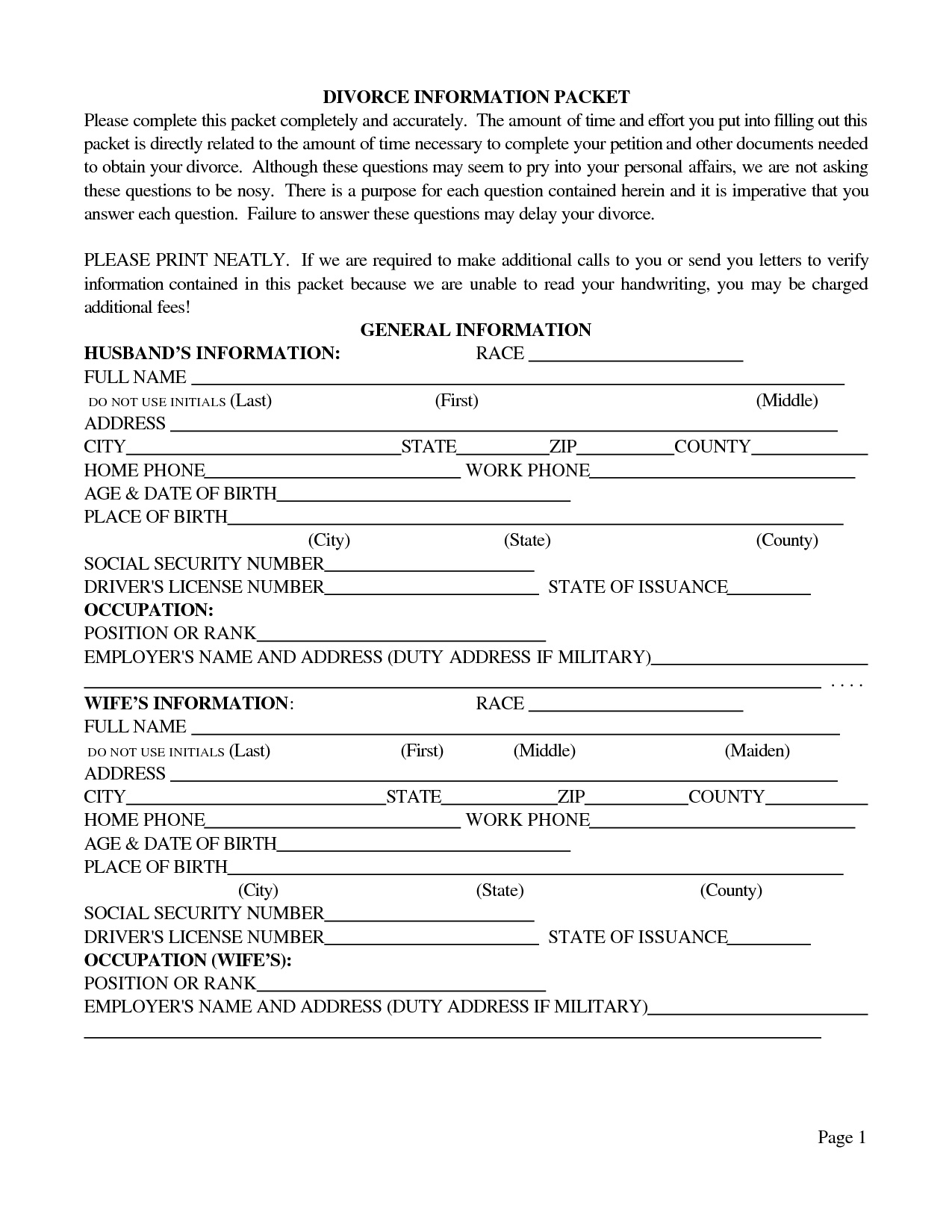

The financial disclosure document usually includes a wide range of financial information. Some of the key details that are typically required include: - Income details: Salary, wages, bonuses, investments, and any other sources of income. - Expense breakdown: Monthly expenses, including rent/mortgage, utilities, food, transportation, and entertainment. - Assets: Real estate properties, vehicles, savings accounts, investments, retirement accounts, and personal belongings of significant value. - Debts: Credit card debts, loans, mortgages, and any other financial obligations. - Tax information: Tax returns for the previous years to understand the tax obligations and potential refunds or liabilities.

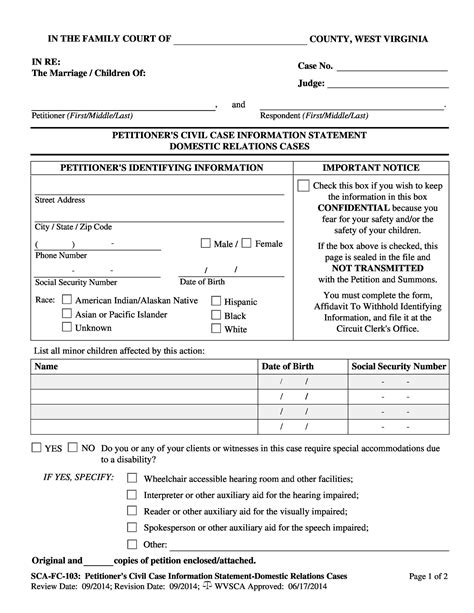

Steps to File Financial Disclosure with Initial Divorce Paperwork

Filing financial disclosure with the initial divorce paperwork involves several steps: 1. Gather all necessary documents: Collect pay stubs, bank statements, tax returns, deeds to properties, vehicle titles, and any other documents that provide a clear picture of your financial situation. 2. Fill out the financial disclosure form: Most courts provide a standard form for financial disclosure. Fill this form out accurately and thoroughly, making sure to include all required financial information. 3. Attach supporting documents: Along with the filled form, attach all the gathered documents as supporting evidence. 4. Review and sign the document: Carefully review the completed form for accuracy and completeness. Once satisfied, sign the document as required. 5. Submit the document: File the financial disclosure document along with your initial divorce paperwork with the court. Ensure you follow the court’s specific guidelines for submission.

📝 Note: It is crucial to be honest and comprehensive when filling out the financial disclosure form. Providing false information or omitting significant details can lead to legal complications and potentially undermine your position in the divorce proceedings.

Benefits of Early Financial Disclosure

Early financial disclosure offers several benefits: - Reduces conflict: By being transparent about financial matters from the outset, couples can reduce the potential for conflict and disputes. - Streamlines the process: Having all financial information on the table early on can help in reaching a settlement more quickly. - Encourages fairness: It ensures that the division of assets and debts is fair and based on the actual financial situation of both parties.

Challenges and Considerations

Despite its importance, financial disclosure can sometimes be challenging, especially if one party is uncooperative or attempting to hide assets. In such cases, it may be necessary to seek legal assistance to ensure that all relevant financial information is disclosed. Additionally, the emotional aspect of divorce should not be underestimated, as discussing financial matters can be stressful and sensitive.

Technology and Financial Disclosure

The use of technology can significantly facilitate the financial disclosure process. Online platforms and software designed for divorce proceedings can help in organizing financial information, generating the necessary forms, and even facilitating communication between spouses and their attorneys. However, it’s essential to ensure that any technology used is secure to protect sensitive financial information.

| Category | Description |

|---|---|

| Income | Salary, wages, investments, etc. |

| Expenses | Monthly expenditures including rent, utilities, etc. |

| Assets | Properties, vehicles, savings, investments, etc. |

| Debts | Loans, credit card debts, mortgages, etc. |

In essence, filing financial disclosure with initial divorce paperwork is a critical step that sets the stage for a smoother and more transparent divorce process. By understanding the importance of financial disclosure and following the necessary steps, couples can navigate the financial aspects of their divorce with clarity and fairness.

As the divorce process unfolds, it becomes clear that the initial steps, including financial disclosure, lay the groundwork for the entire proceedings. The goal is to achieve a mutually acceptable agreement that considers the financial well-being of both parties. With patience, transparency, and the right guidance, couples can work through the financial disclosure process and move forward with their lives.

What is the purpose of financial disclosure in divorce proceedings?

+

The purpose of financial disclosure is to provide a comprehensive overview of both parties’ financial standings, ensuring transparency and fairness in the division of assets and debts.

What information is typically included in financial disclosure?

+

Financial disclosure typically includes income details, expense breakdown, assets, debts, and tax information.

Why is honesty important in financial disclosure?

+

Honesty is crucial in financial disclosure to avoid legal complications and ensure that the division of assets and debts is fair and based on the actual financial situation of both parties.