Sign Partial Distribution Estate Paperwork

Understanding the Process of Signing Partial Distribution Estate Paperwork

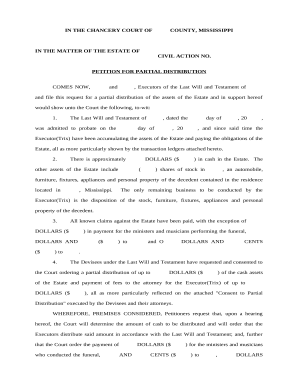

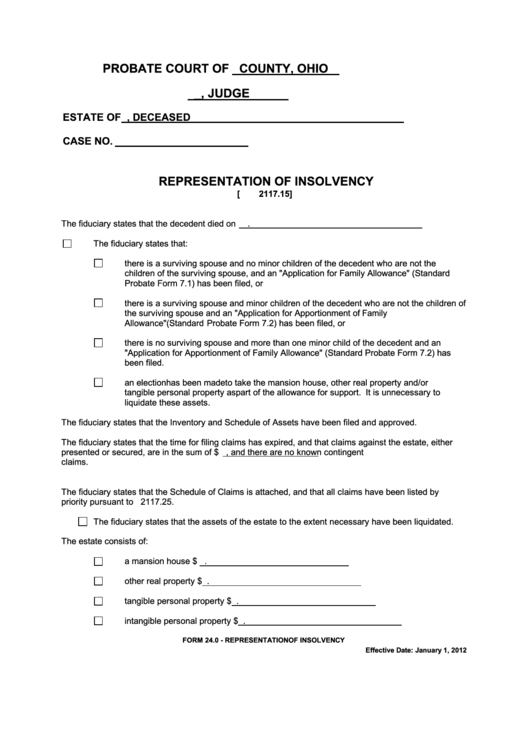

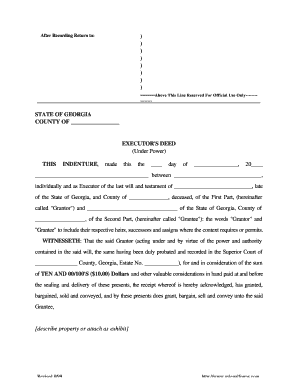

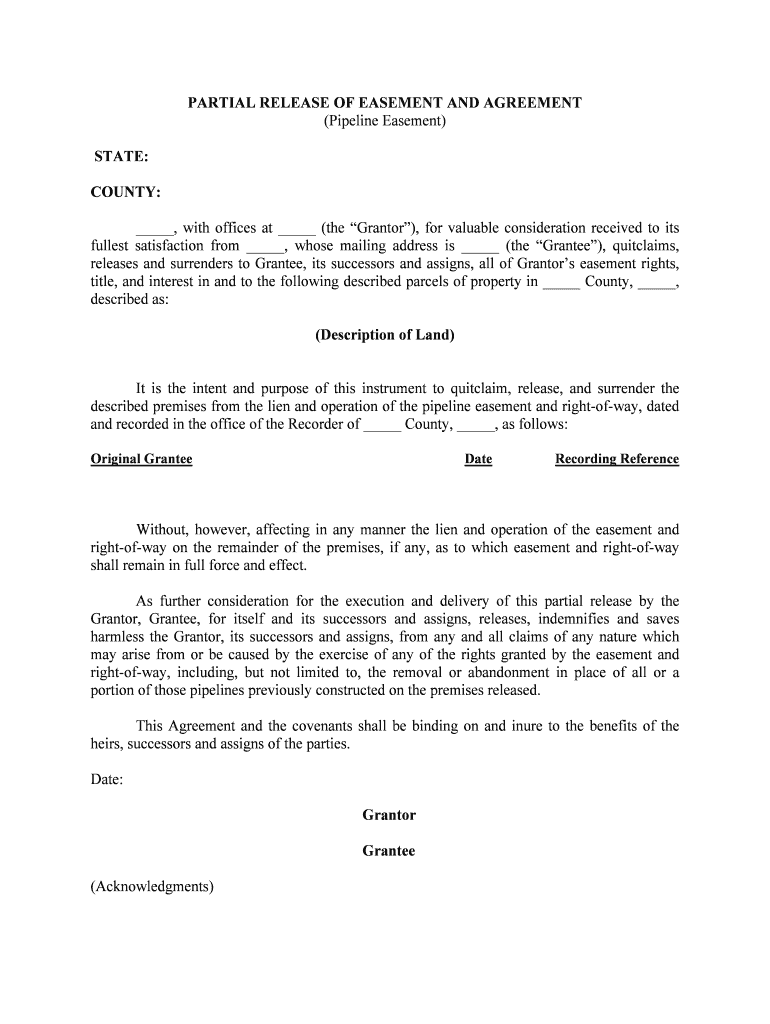

When dealing with the estate of a deceased individual, the process can be complex and involve various legal and financial steps. One of these steps involves the distribution of the estate’s assets to the beneficiaries as outlined in the will or according to the laws of intestacy if there is no will. In some cases, the executor of the estate may need to sign paperwork for a partial distribution of the estate’s assets. This process is crucial for ensuring that the beneficiaries receive their inheritance in a timely manner while also allowing the estate to continue its administration if necessary.

Why Partial Distribution?

Partial distribution refers to the process where a portion of the estate’s assets is distributed to the beneficiaries before the estate administration is fully completed. This can happen for several reasons: - Immediate Needs: Beneficiaries may have immediate financial needs that necessitate an early distribution of funds. - Tax Efficiency: Distributing assets can help in reducing the estate’s tax liability, as the distributed assets are then taxed according to the individual tax brackets of the beneficiaries rather than the estate’s tax bracket. - Complexity of Estate Administration: Estates with complex assets, such as businesses, real estate, or investments, may require more time to administer, making partial distribution a viable option to provide beneficiaries with some assets while the rest of the estate is being settled.

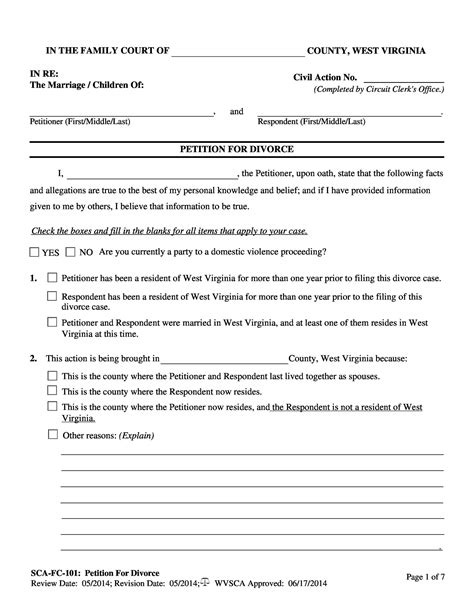

Steps Involved in Signing Partial Distribution Estate Paperwork

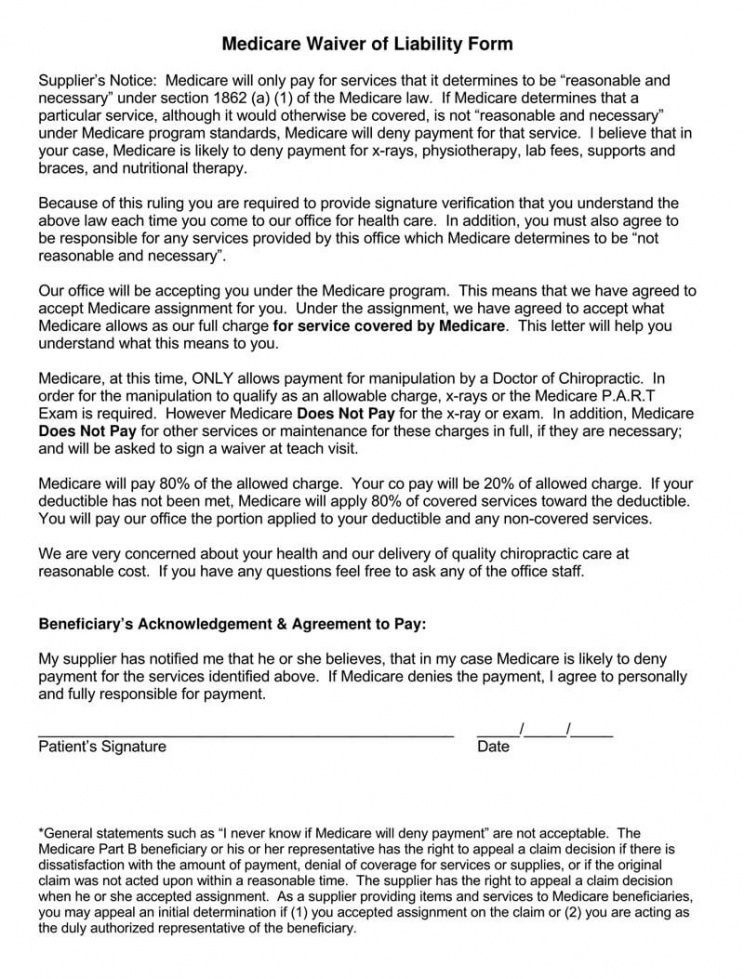

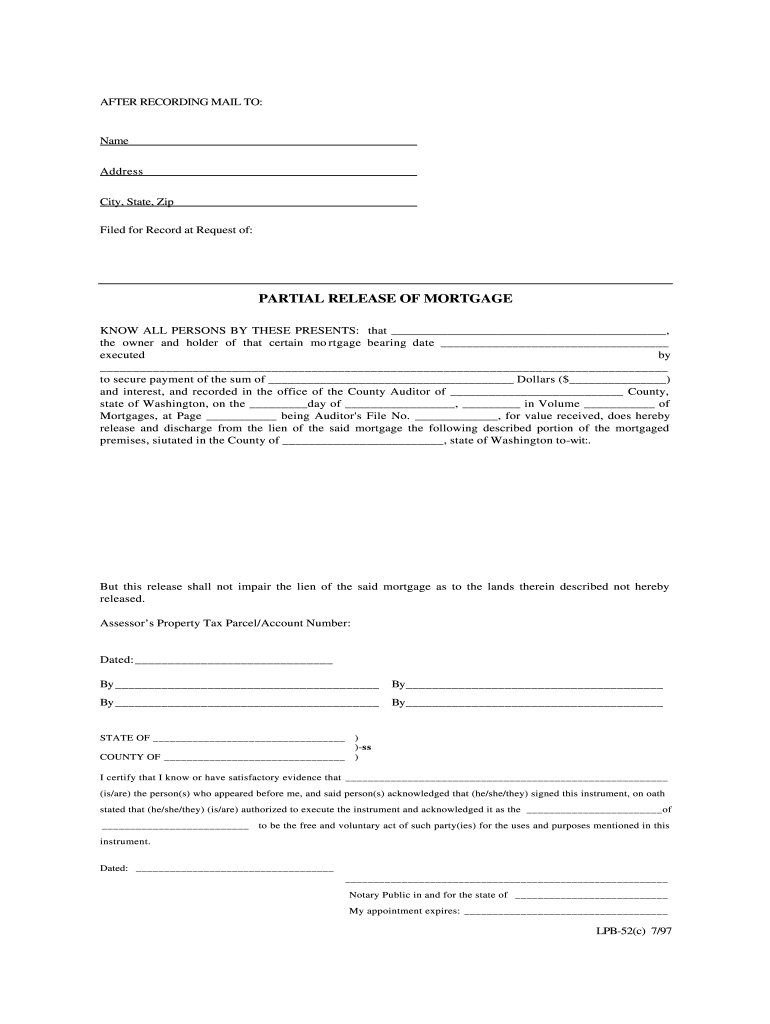

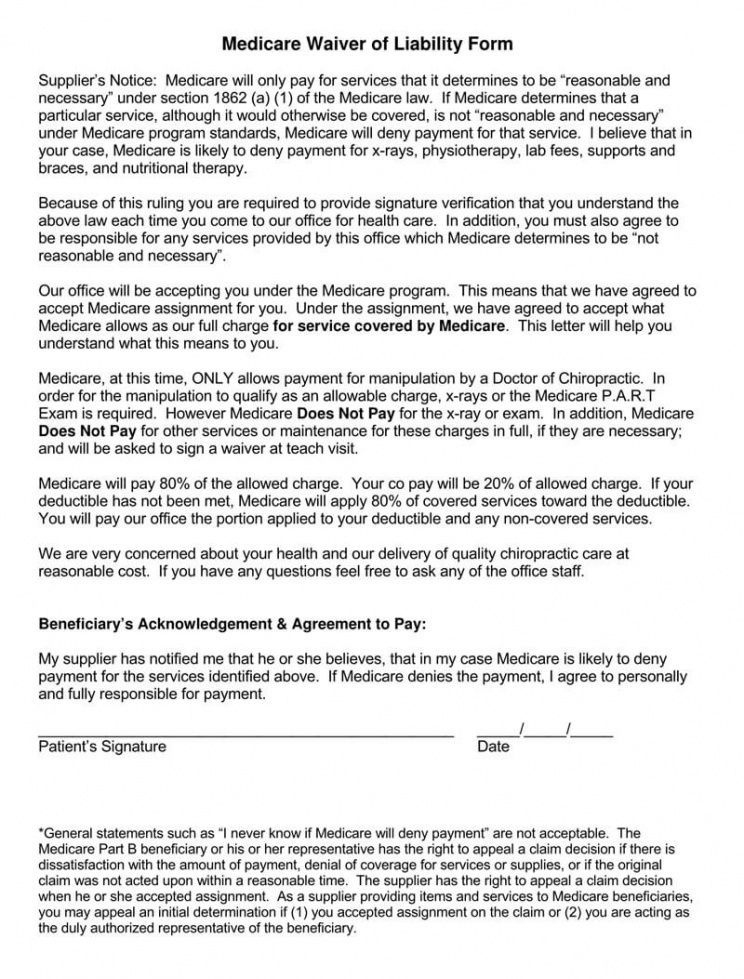

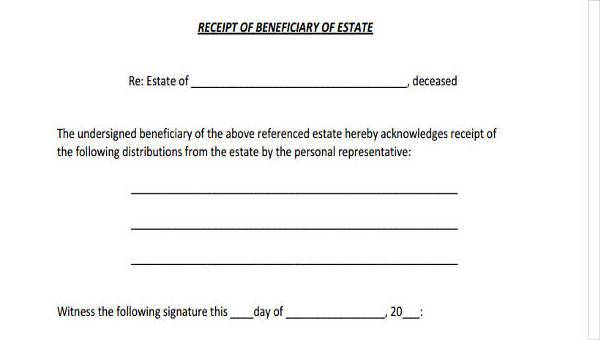

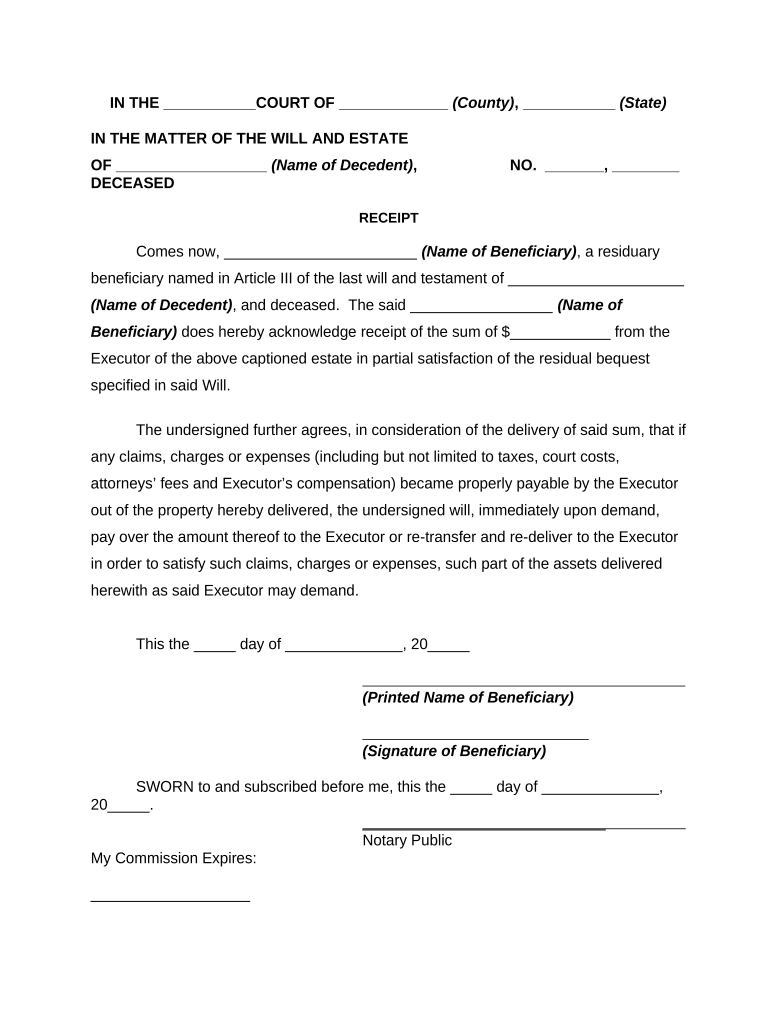

The process of signing partial distribution estate paperwork involves several key steps: - Identification of Distributable Assets: The executor must identify which assets can be distributed partially without interfering with the ongoing administration of the estate. - Valuation of Assets: Accurate valuation of the assets to be distributed is essential to ensure that the distribution is fair and in accordance with the will or the laws of intestacy. - Preparation of Distribution Agreement: A distribution agreement outlining the terms of the partial distribution, including which assets are to be distributed, to whom, and the timing of the distribution, must be prepared. - Beneficiary Consent: In many cases, beneficiaries must consent to the partial distribution, especially if it affects their eventual inheritance. - Signing the Paperwork: The executor, and sometimes the beneficiaries, must sign the paperwork to formalize the partial distribution. This paperwork may include distribution agreements, receipts, and possibly tax forms.

Important Considerations

When signing partial distribution estate paperwork, several important considerations must be kept in mind: - Tax Implications: The tax implications of the distribution must be considered to avoid unintended tax liabilities for either the estate or the beneficiaries. - Legal Requirements: All legal requirements, including notices to beneficiaries and filing requirements with the court, must be met. - Accounting and Record-Keeping: Accurate accounting and record-keeping are crucial to track the distribution and ensure that all parties are aware of the transactions.

📝 Note: It is advisable to consult with an attorney specializing in estate law to ensure that all legal and tax implications are considered and that the partial distribution is carried out in accordance with the law and the wishes of the deceased as outlined in their will.

Benefits of Partial Distribution

Partial distribution can offer several benefits to both the estate and the beneficiaries: - Timely Receipt of Inheritance: Beneficiaries can receive a portion of their inheritance sooner, which can be particularly beneficial for those with immediate financial needs. - Efficient Estate Administration: By distributing assets that are not required for the ongoing administration of the estate, the executor can streamline the estate settlement process. - Reduced Estate Taxes: As mentioned, distributing assets can reduce the estate’s tax liability, potentially preserving more of the estate’s value for the beneficiaries.

Challenges and Potential Conflicts

Despite the benefits, partial distribution can also present challenges and potential conflicts: - Disagreements Among Beneficiaries: Beneficiaries may disagree on the timing or amount of the partial distribution, requiring mediation or legal intervention. - Complex Asset Distribution: Distributing complex assets, such as real estate or businesses, can be challenging and may require additional legal and financial expertise. - Ensuring Fairness: The executor must ensure that the partial distribution is fair and in accordance with the will or laws of intestacy, which can be a delicate balancing act.

In summary, signing partial distribution estate paperwork is a significant step in the estate administration process, offering benefits such as timely distribution of assets to beneficiaries and potential tax savings. However, it requires careful consideration of legal, tax, and financial implications, as well as the potential for conflicts among beneficiaries. Consulting with legal and financial professionals is essential to navigate these complexities and ensure that the process is carried out smoothly and in accordance with the law.

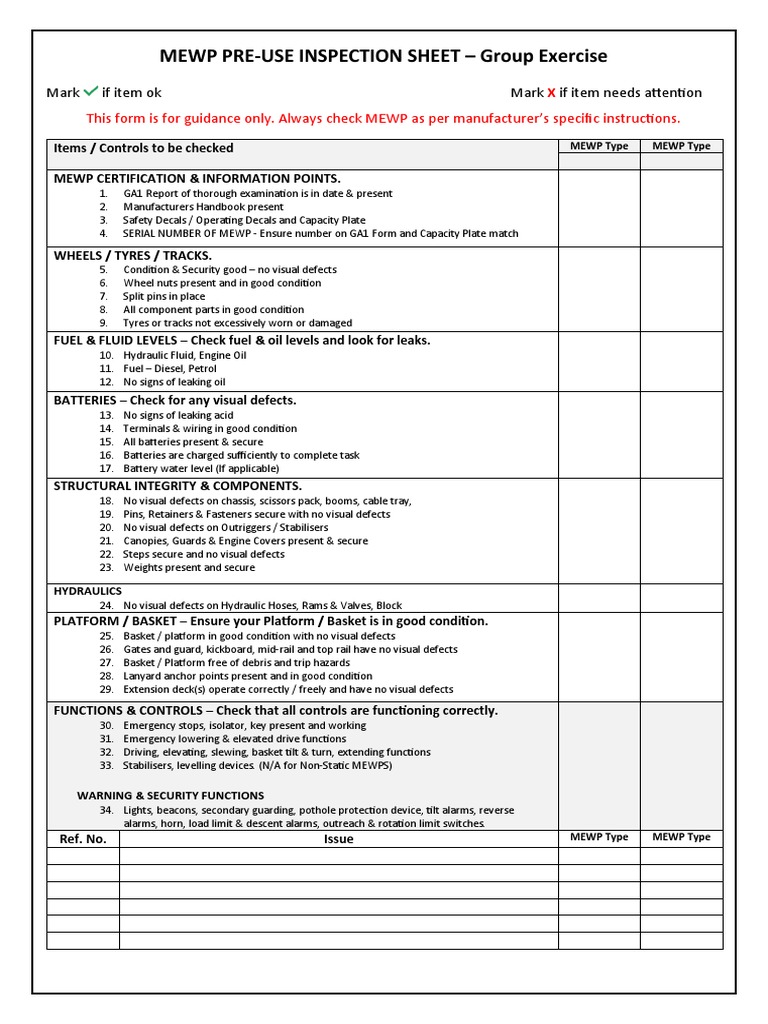

To further illustrate the process and considerations involved in partial distribution, the following table outlines some key aspects:

| Aspect | Description |

|---|---|

| Identification of Assets | Determining which assets can be distributed without interfering with estate administration. |

| Valuation of Assets | Accurately valuing assets to ensure fair distribution. |

| Preparation of Distribution Agreement | Outlining the terms of the partial distribution. |

| Beneficiary Consent | Obtaining consent from beneficiaries for the partial distribution. |

| Signing Paperwork | Finalizing the partial distribution through signed agreements and receipts. |

As the process of estate administration continues to evolve, understanding the intricacies of partial distribution and its implications is crucial for executors, beneficiaries, and legal professionals alike. By navigating these complexities with care and consulting with experts when necessary, the goals of timely and fair distribution of the estate’s assets can be achieved, honoring the wishes of the deceased while also meeting the needs of the beneficiaries.

In wrapping up the discussion on signing partial distribution estate paperwork, it’s clear that this process is a multifaceted aspect of estate administration, requiring meticulous planning, legal compliance, and sensitivity to the interests of all parties involved. By approaching this task with diligence and a deep understanding of its implications, those responsible for estate administration can ensure that the assets of the deceased are distributed in a manner that is both respectful of the deceased’s intentions and beneficial to the beneficiaries.

What is partial distribution in estate administration?

+

Partial distribution refers to the process of distributing a portion of the estate’s assets to the beneficiaries before the estate administration is fully completed.

Why is partial distribution necessary?

+

Partial distribution is necessary to meet the immediate financial needs of beneficiaries, for tax efficiency, and because of the complexity of estate administration which may require more time to settle certain assets.

What are the key steps involved in signing partial distribution estate paperwork?

+

The key steps include identifying distributable assets, valuing these assets, preparing a distribution agreement, obtaining beneficiary consent, and signing the necessary paperwork.