Life Insurance for Taxes

Understanding Life Insurance and Its Impact on Taxes

Life insurance is a crucial aspect of financial planning, providing a safety net for loved ones in the event of the policyholder’s passing. While its primary purpose is to offer a death benefit, life insurance can also have implications for taxes. It’s essential to comprehend how life insurance interacts with taxes to make informed decisions about your financial strategy. In this article, we’ll delve into the world of life insurance and taxes, exploring the different types of life insurance, their tax implications, and how to leverage life insurance for tax benefits.

Types of Life Insurance and Their Tax Implications

There are several types of life insurance, each with its unique characteristics and tax implications. The most common types include: * Term Life Insurance: This type of insurance provides coverage for a specified period (e.g., 10, 20, or 30 years). Term life insurance is generally less expensive than permanent life insurance and has no cash value accumulation. From a tax perspective, term life insurance premiums are not tax-deductible, but the death benefit is typically tax-free. * Whole Life Insurance: Also known as permanent life insurance, whole life insurance provides lifetime coverage as long as premiums are paid. It accumulates a cash value over time, which can be borrowed against or used to pay premiums. The cash value growth is tax-deferred, meaning you won’t pay taxes on the gains until you withdraw them. * Universal Life Insurance: This type of insurance combines a death benefit with a savings component. Universal life insurance policies often have flexible premiums and can earn interest based on the performance of the insurance company’s investments. The cash value growth is tax-deferred, and withdrawals are taxed as ordinary income.

Tax Benefits of Life Insurance

Life insurance can provide several tax benefits, making it an attractive component of a comprehensive financial plan: * Tax-free death benefit: The death benefit paid to beneficiaries is generally tax-free, ensuring that loved ones receive the full amount without incurring income tax liabilities. * Tax-deferred cash value growth: The cash value of permanent life insurance policies grows tax-deferred, allowing you to accumulate wealth without paying taxes on the gains until you withdraw them. * Tax-free loans: You can borrow against the cash value of your life insurance policy without incurring taxes, as long as the policy remains in force. * Charitable donations: Donating a life insurance policy to a charity can provide a tax deduction for the donor, while the charity receives the death benefit.

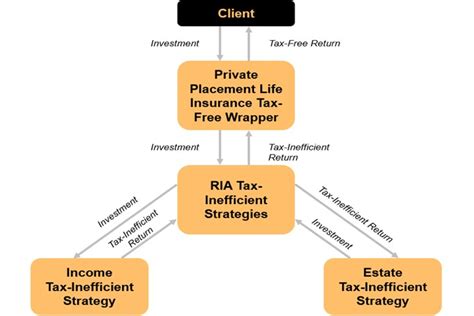

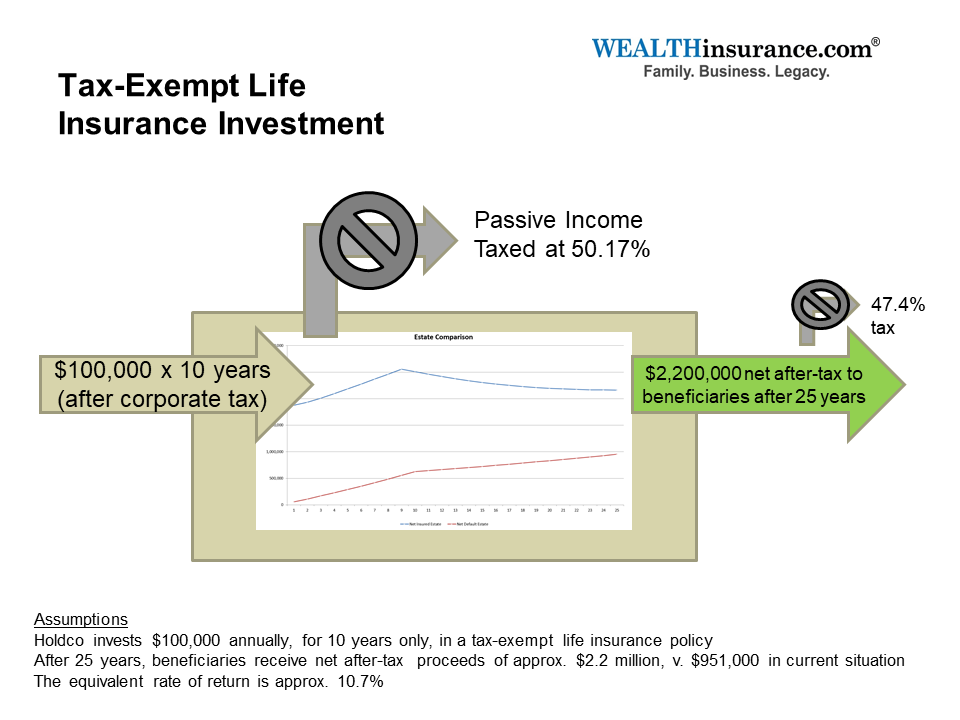

Strategies for Leveraging Life Insurance in Tax Planning

To maximize the tax benefits of life insurance, consider the following strategies: * Use life insurance to supplement retirement income: By leveraging the tax-deferred growth of a life insurance policy, you can create a tax-efficient retirement income stream. * Utilize life insurance for estate planning: Life insurance can help pay estate taxes, ensuring that your loved ones inherit the full value of your estate without incurring significant tax liabilities. * Combine life insurance with other tax-advantaged vehicles: Pairing life insurance with other tax-advantaged vehicles, such as 401(k) or IRA accounts, can create a comprehensive tax strategy.

📝 Note: It's essential to consult with a tax professional or financial advisor to determine the best life insurance strategy for your individual circumstances and tax situation.

Life Insurance and Tax Implications: A Comparison

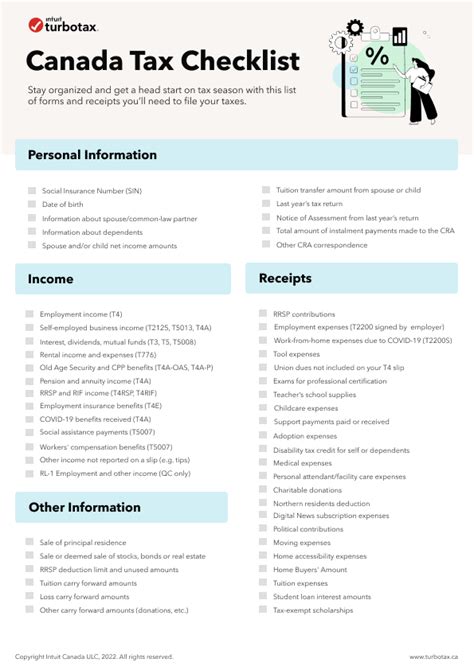

The following table illustrates the tax implications of different life insurance types:

| Life Insurance Type | Premiums | Death Benefit | Cash Value Growth |

|---|---|---|---|

| Term Life Insurance | Not tax-deductible | Tax-free | No cash value accumulation |

| Whole Life Insurance | Not tax-deductible | Tax-free | Tax-deferred growth |

| Universal Life Insurance | Not tax-deductible | Tax-free | Tax-deferred growth |

In summary, life insurance can play a vital role in tax planning, offering tax benefits and strategies to optimize your financial situation. By understanding the different types of life insurance and their tax implications, you can make informed decisions about your financial strategy and create a more tax-efficient plan.

As we wrap up our discussion on life insurance and taxes, it’s clear that this complex topic requires careful consideration and planning. By leveraging the tax benefits of life insurance and combining it with other tax-advantaged vehicles, you can create a comprehensive financial strategy that meets your unique needs and goals.

What are the tax implications of life insurance premiums?

+

Life insurance premiums are generally not tax-deductible, except in certain circumstances, such as when used for business purposes or as part of a qualified retirement plan.

Can I borrow against my life insurance policy without incurring taxes?

+

Yes, you can borrow against the cash value of your life insurance policy without incurring taxes, as long as the policy remains in force. However, if you surrender the policy or it lapses, you may be subject to taxes on the gains.

How can I use life insurance for estate planning and tax purposes?

+

Life insurance can be used to pay estate taxes, ensuring that your loved ones inherit the full value of your estate without incurring significant tax liabilities. You can also use life insurance to create a tax-efficient inheritance for your beneficiaries.