PPi Claim Paperwork Needed

Introduction to PPI Claims

The Payment Protection Insurance (PPI) scandal has been a major issue in the financial industry, with many consumers being mis-sold PPI policies alongside their loans, credit cards, and mortgages. As a result, the UK’s Financial Conduct Authority (FCA) has introduced rules to allow consumers to claim back the premiums they paid for these policies. In this blog post, we will guide you through the process of making a PPI claim and the necessary paperwork required.

Eligibility for a PPI Claim

Before starting the claim process, it is essential to determine if you are eligible for a PPI claim. You may be eligible if:

- You were mis-sold a PPI policy, meaning you were not adequately informed about the policy or it was not suitable for your needs.

- You were sold a PPI policy that you did not need or want.

- You were not told about the commissions earned by the seller on the sale of the PPI policy.

- You were pressurized into buying the PPI policy.

Gathering Necessary Paperwork

To make a PPI claim, you will need to gather the necessary paperwork to support your claim. This may include:

- Loan or credit agreement documents: These documents will show whether you were sold a PPI policy and the terms of the policy.

- Policy documents: If you have the policy documents, these will provide detailed information about the policy, including the premium amounts and the commission earned by the seller.

- Bank statements: Your bank statements will show the premium payments you made for the PPI policy.

- Cancellation letters: If you cancelled the PPI policy, you may have received a cancellation letter, which can be used as evidence.

Claim Process

The claim process typically involves the following steps:

- Check if you have a valid claim: Review your loan or credit agreement documents to see if you were sold a PPI policy.

- Gather evidence: Collect all the necessary paperwork to support your claim.

- Submit your claim: You can submit your claim to the lender or use a claims management company to do it on your behalf.

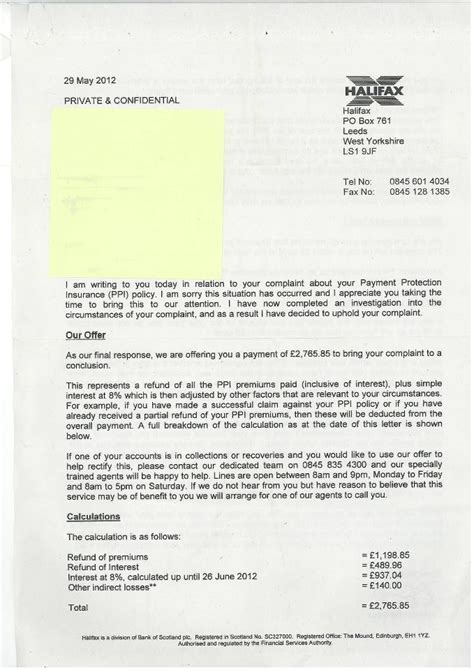

- Wait for the decision: The lender will review your claim and make a decision. If your claim is successful, you will receive a refund of the premiums you paid, plus interest.

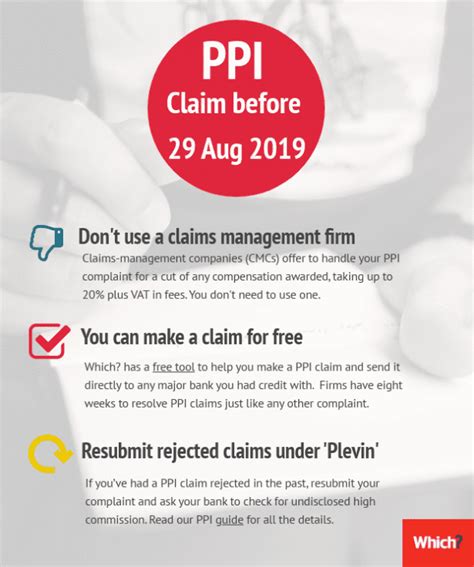

Using a Claims Management Company

If you are unsure about the claim process or do not have the time to deal with it, you can use a claims management company to handle your claim. These companies will:

- Review your paperwork to determine if you have a valid claim.

- Submit your claim to the lender on your behalf.

- Negotiate with the lender to ensure you receive the maximum refund possible.

Table of PPI Claim Refund Amounts

The refund amount you receive will depend on the premium amounts you paid and the interest earned on those premiums. The following table provides an estimate of the refund amounts you may receive:

| Premium Amounts | Refund Amount |

|---|---|

| £1,000 - £5,000 | £2,000 - £10,000 |

| £5,001 - £10,000 | £10,001 - £20,000 |

| £10,001 - £20,000 | £20,001 - £40,000 |

📝 Note: The refund amounts in the table are estimates and may vary depending on the individual circumstances of your claim.

To summarize the key points, making a PPI claim requires gathering the necessary paperwork, submitting your claim, and waiting for the decision. It is essential to keep all your documents safe and to be aware of the claim process and the fees charged by claims management companies. By following these steps and being informed, you can successfully make a PPI claim and receive a refund of the premiums you paid.

What is the deadline for making a PPI claim?

+

The deadline for making a PPI claim was August 29, 2019. However, if you were not aware of the deadline or were prevented from making a claim, you may still be able to claim.

How long does the claim process take?

+

The claim process can take several weeks to several months. It depends on the complexity of your claim and the speed at which the lender processes your claim.

Can I make a claim if I have already paid off my loan or credit card?

+

Yes, you can still make a claim even if you have already paid off your loan or credit card. You will need to provide evidence of the PPI policy and the premium payments you made.