5 Nanny Paperwork Tips

Introduction to Nanny Paperwork

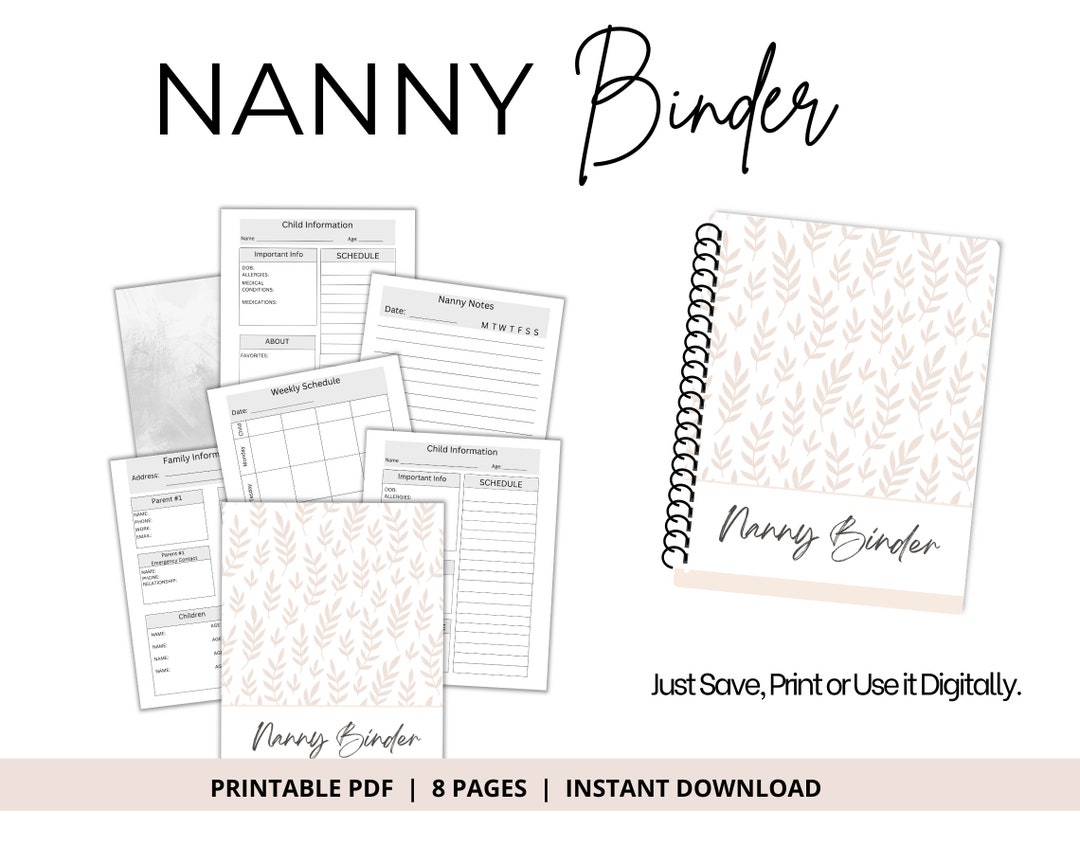

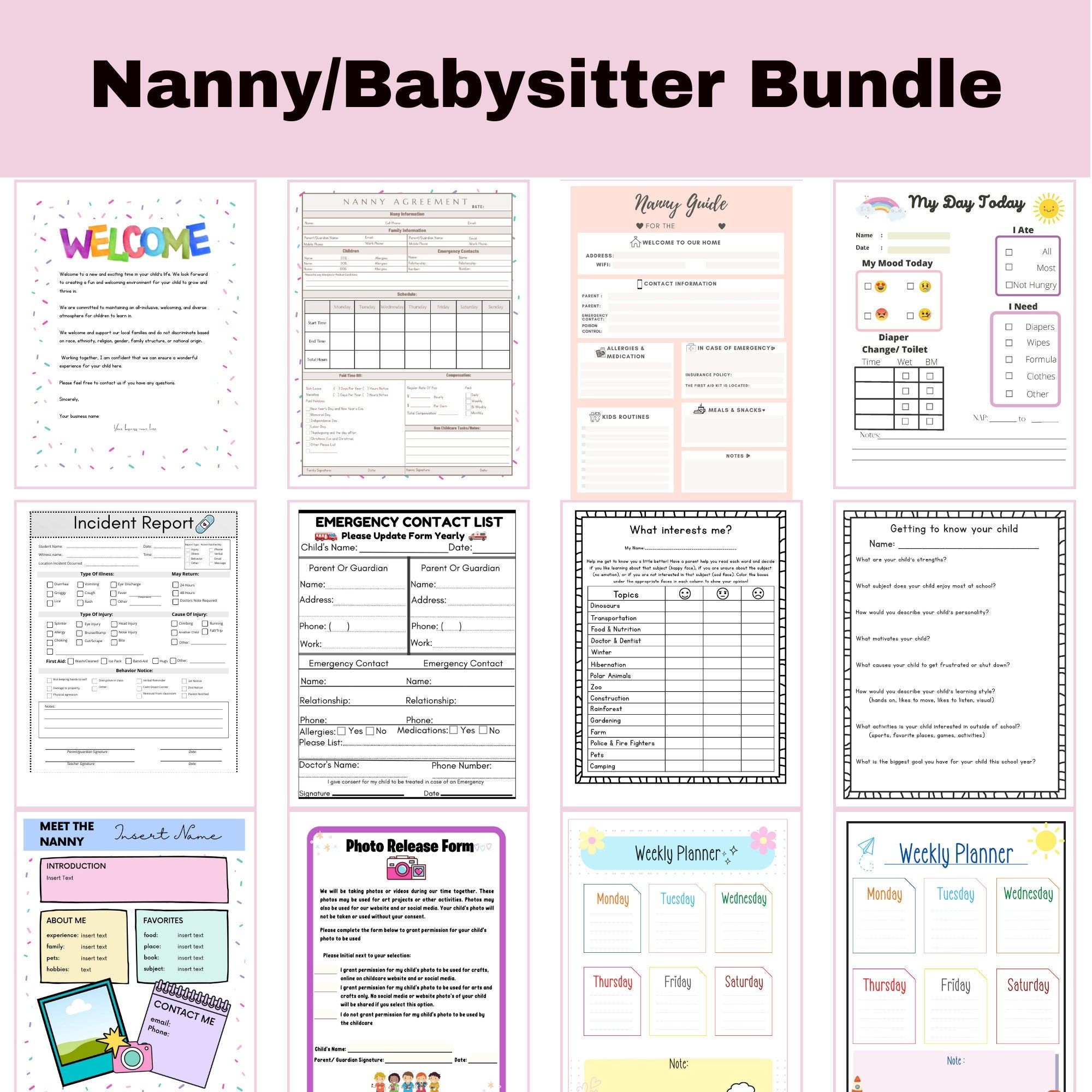

When hiring a nanny, it’s essential to have the right paperwork in place to ensure a smooth and legal working relationship. This includes contracts, tax forms, and other documents that outline the terms of employment, payment, and responsibilities. In this article, we will provide 5 nanny paperwork tips to help you navigate the process with ease.

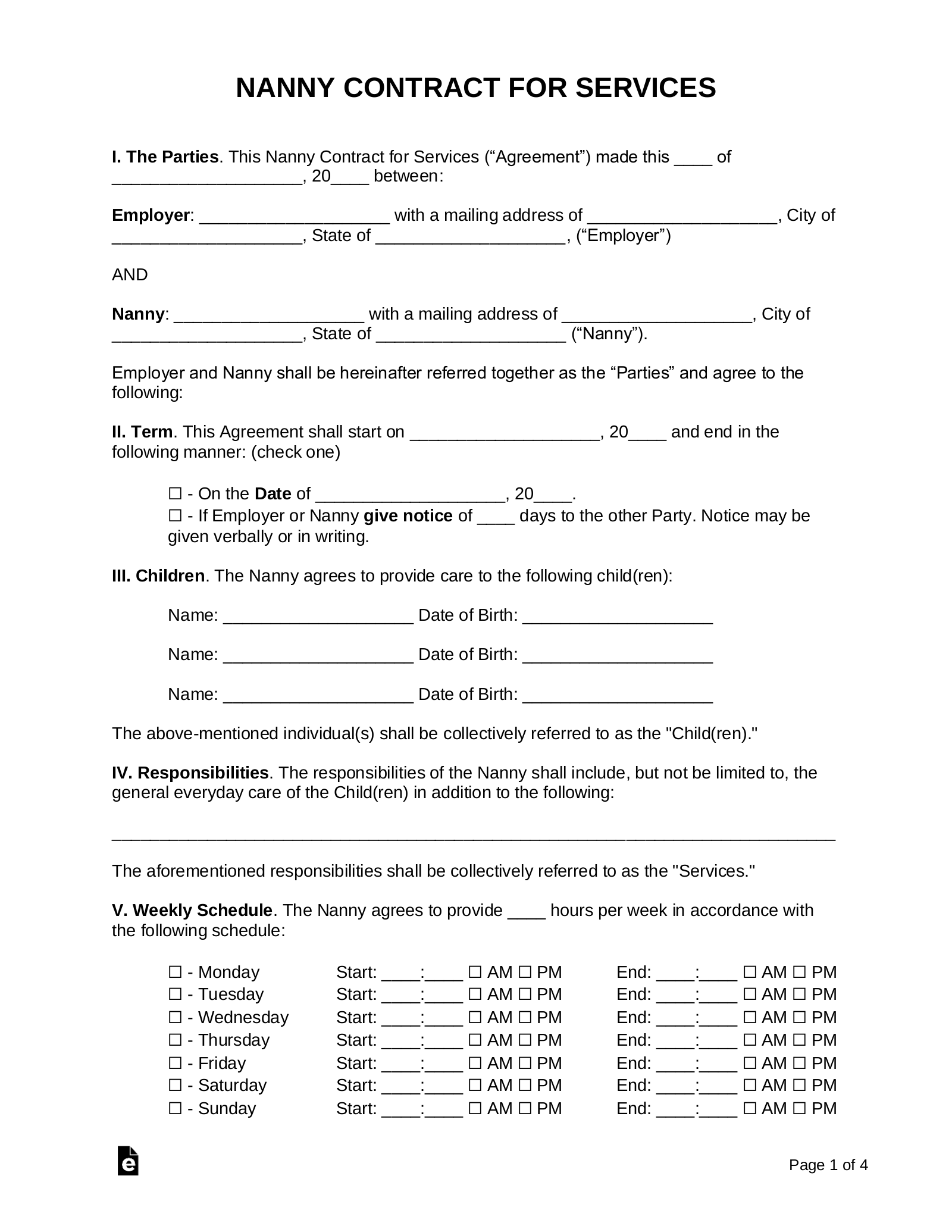

Tip 1: Create a Comprehensive Contract

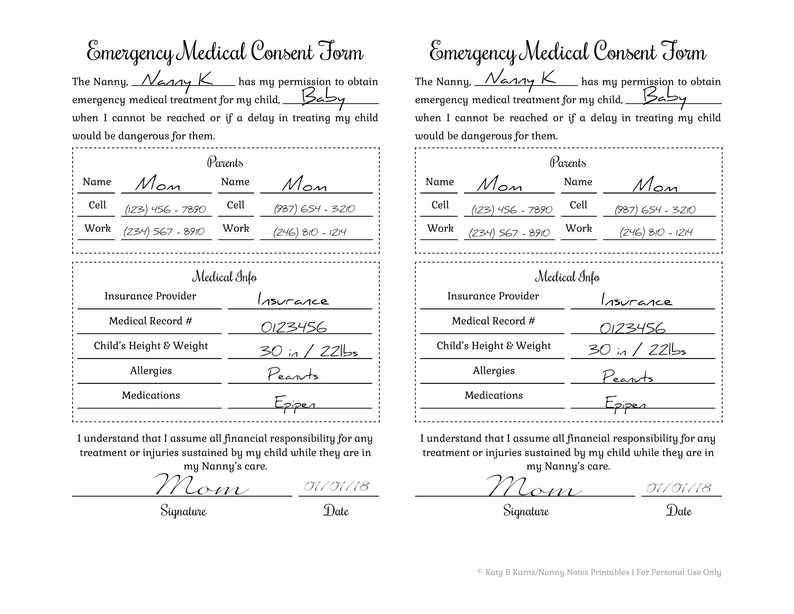

A nanny contract is a crucial document that outlines the terms of employment, including the nanny’s job description, work schedule, payment, and benefits. It’s essential to include the following details in the contract: * Job description and responsibilities * Work schedule and hours * Payment and benefits * Vacation and sick leave policies * Termination notice and severance pay * Confidentiality and non-disclosure agreements

📝 Note: It's recommended to consult with a lawyer or a professional organization to ensure the contract complies with local laws and regulations.

Tip 2: Understand Tax Obligations

As a nanny employer, you are responsible for paying employment taxes, including Social Security and Medicare taxes. You will need to: * Obtain an Employer Identification Number (EIN) from the IRS * File Form 1040 and Schedule H to report nanny taxes * Pay quarterly estimated taxes * Provide the nanny with a W-2 form at the end of each year

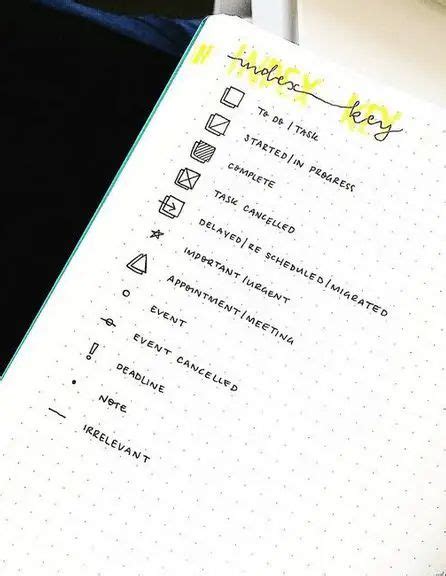

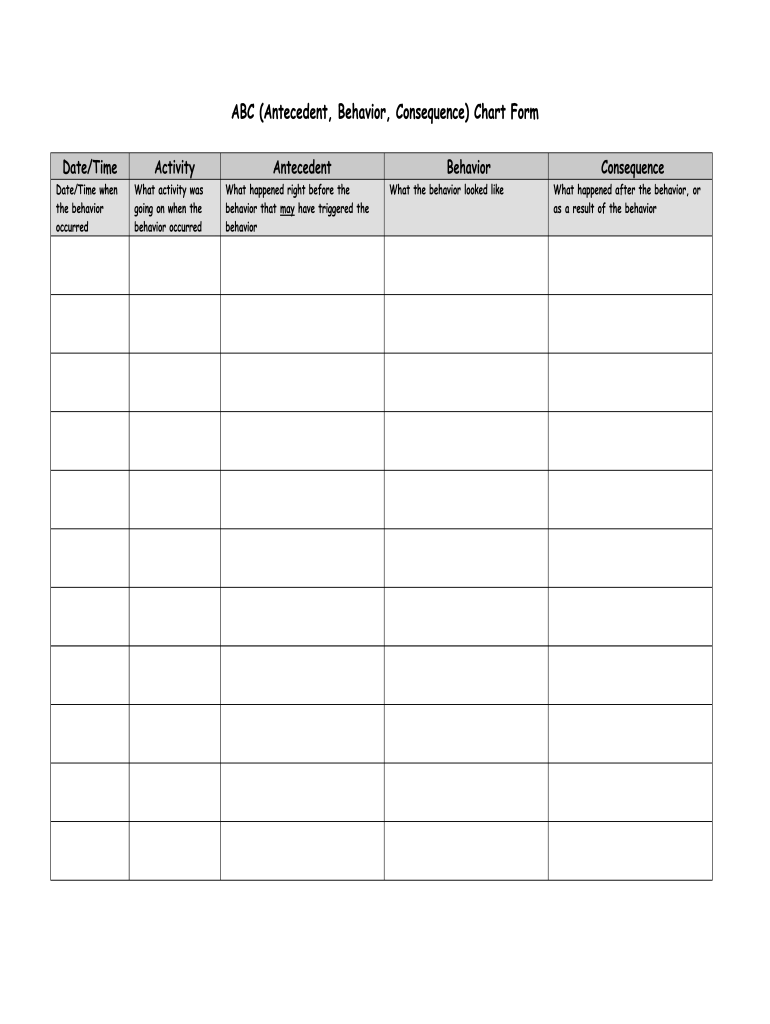

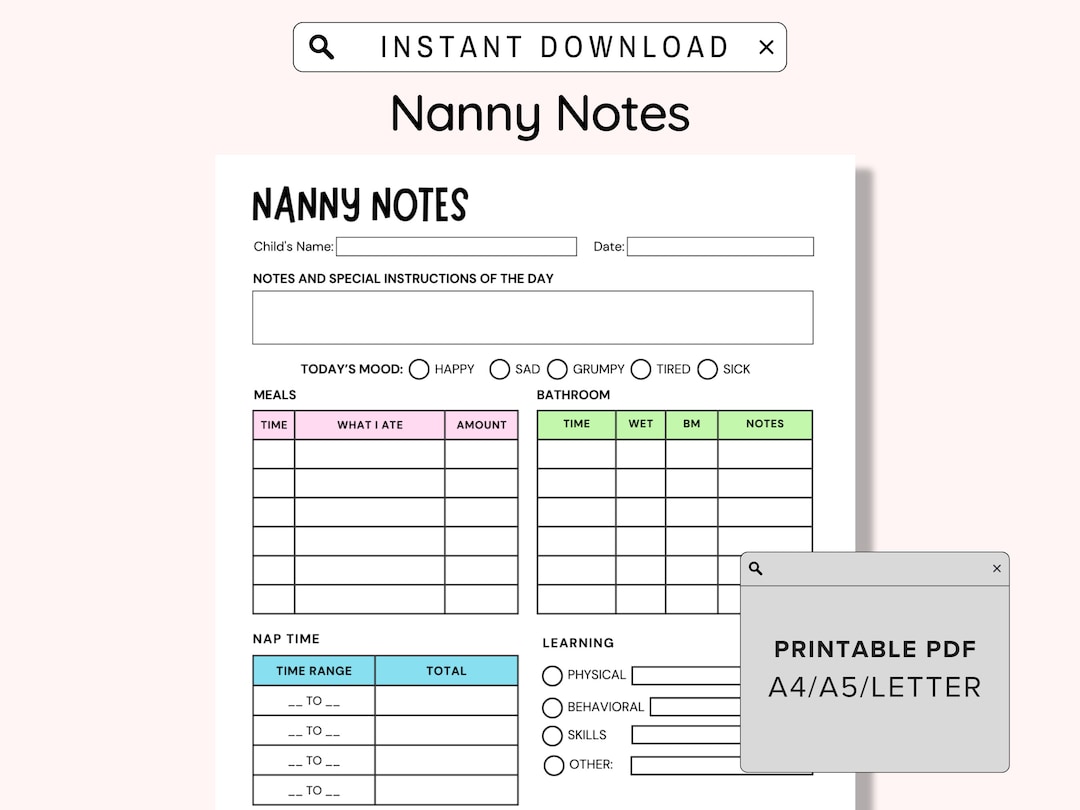

Tip 3: Maintain Accurate Records

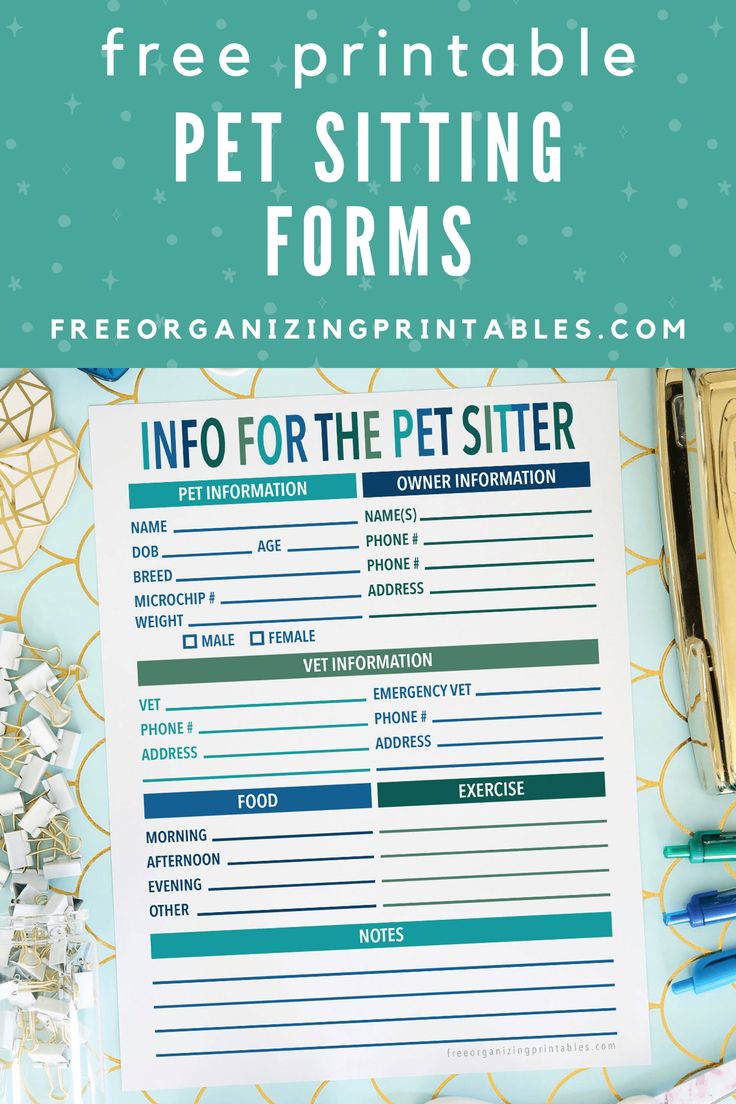

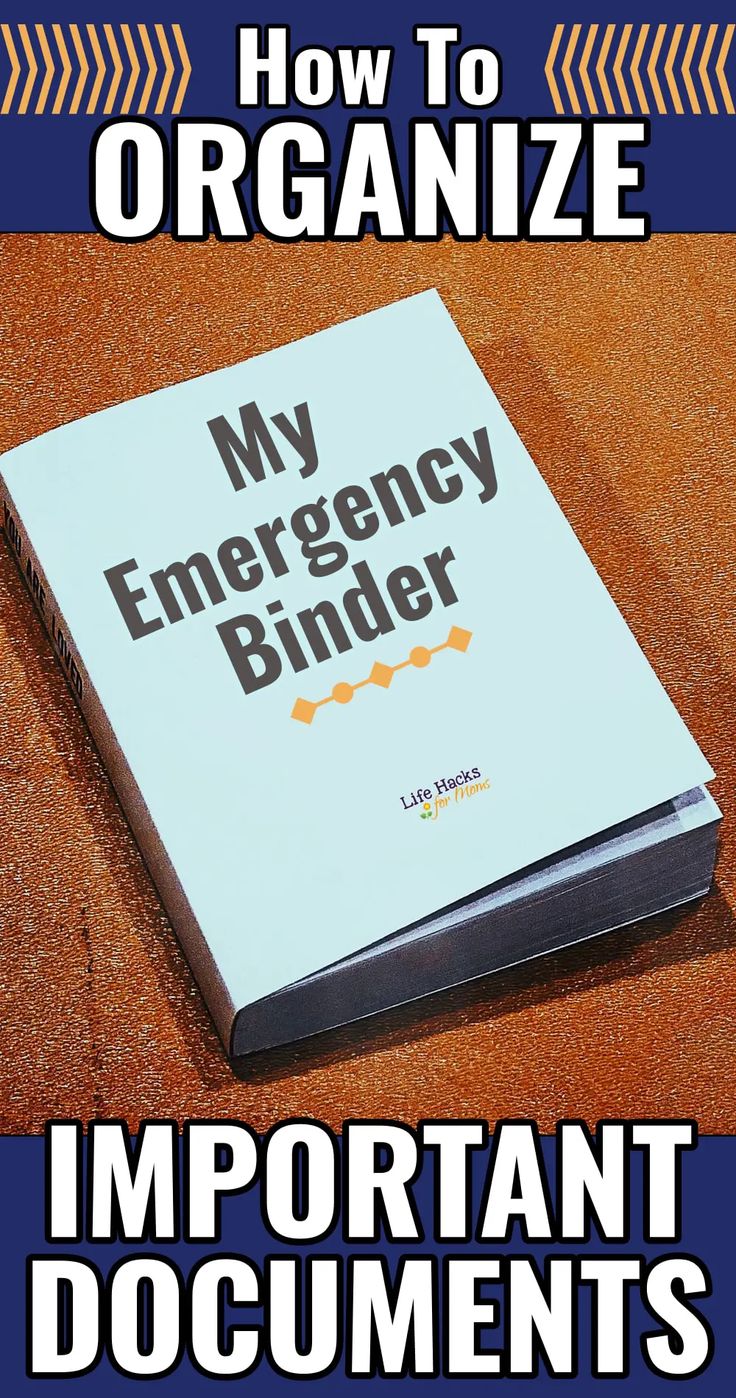

Keeping accurate and up-to-date records is essential for tax purposes and to ensure compliance with labor laws. You should maintain records of: * Payment and benefits * Work schedule and hours * Time off and vacation days * Performance reviews and evaluations * Any accidents or injuries that occur on the job

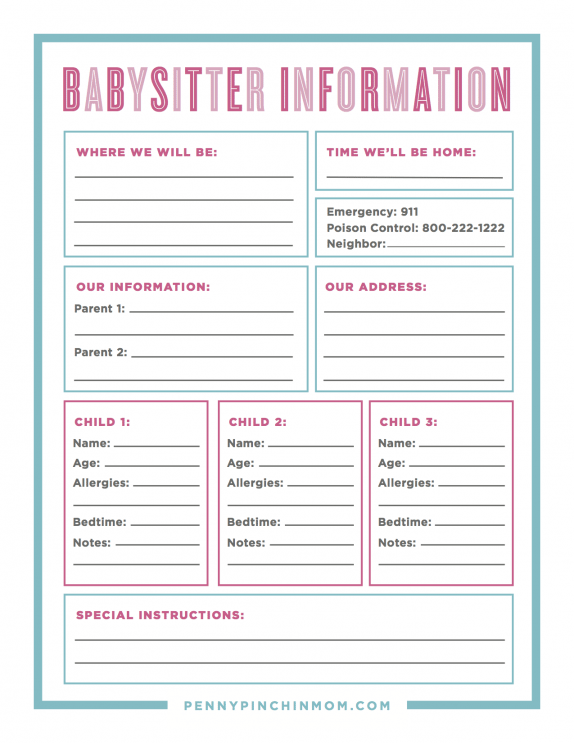

Tip 4: Develop a Clear Communication Plan

Effective communication is key to a successful nanny-employer relationship. You should: * Establish a regular meeting schedule to discuss the child’s care and any issues that arise * Set clear expectations and boundaries * Encourage open and honest communication * Provide feedback and evaluations on a regular basis

Tip 5: Review and Update Paperwork Regularly

It’s essential to review and update your nanny paperwork regularly to ensure it remains accurate and compliant with changing laws and regulations. You should: * Review the contract and update it as necessary * Check for any changes to tax laws or regulations * Update records and paperwork to reflect any changes to the nanny’s employment or the child’s care

| Document | Description |

|---|---|

| Nanny Contract | Outlines the terms of employment, including job description, work schedule, payment, and benefits |

| W-2 Form | Reports the nanny's income and taxes withheld |

| Form 1040 and Schedule H | Reports nanny taxes and employment taxes |

In summary, having the right nanny paperwork in place is crucial to ensuring a smooth and legal working relationship with your nanny. By following these 5 tips, you can create a comprehensive contract, understand tax obligations, maintain accurate records, develop a clear communication plan, and review and update paperwork regularly. This will help you navigate the complexities of nanny employment and ensure a successful and stress-free experience for both you and your nanny.

What is the purpose of a nanny contract?

+

The purpose of a nanny contract is to outline the terms of employment, including the nanny’s job description, work schedule, payment, and benefits.

What taxes do I need to pay as a nanny employer?

+

As a nanny employer, you are responsible for paying employment taxes, including Social Security and Medicare taxes.

How often should I review and update my nanny paperwork?

+

You should review and update your nanny paperwork regularly, at least once a year, to ensure it remains accurate and compliant with changing laws and regulations.