Paperwork

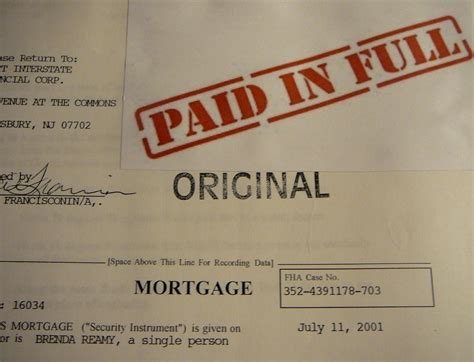

Keep Old Mortgage Papers

Introduction to Mortgage Papers

When you finalize a mortgage, whether for a new home purchase or a refinance, you receive a plethora of documents. These documents are crucial for your records and can be necessary for various reasons over the life of your loan. It’s essential to understand what these papers are, why they’re important, and how long you should keep them.

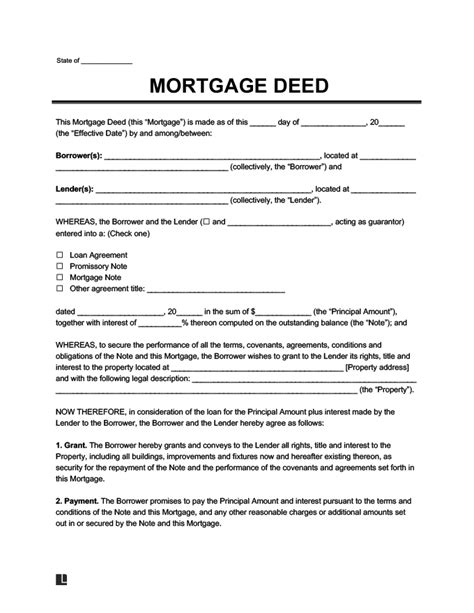

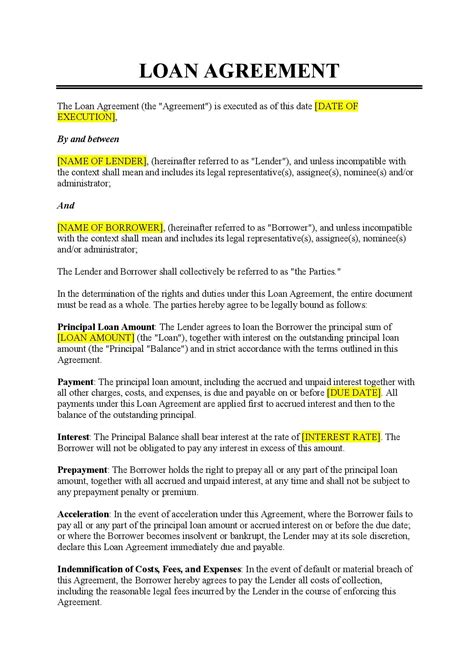

Understanding Mortgage Documents

Mortgage documents include the note, which is your promise to repay the loan, and the mortgage or deed of trust, which gives the lender a lien on your property as security for the loan. Other critical documents might include the title report, appraisal, and insurance information. Each of these documents serves a vital purpose in the mortgage process and beyond.

Why Keep Old Mortgage Papers?

There are several reasons why keeping old mortgage papers is advisable: - Tax Purposes: Certain mortgage documents can be necessary for tax deductions, such as interest payments on your primary residence or a second home. - Property Disputes: If there’s ever a dispute over property ownership or boundaries, having these documents can provide critical evidence. - Refinancing or Selling: When refinancing your home or selling it, having easy access to your original mortgage documents can streamline the process. - Insurance and Liability: Keeping records of insurance coverage and any liability waivers can protect you in case of disputes or claims.

What to Keep and for How Long

It’s recommended to keep all original mortgage documents for as long as you own the property, and even for a period after you’ve sold it. Here are some guidelines: - Mortgage Note and Deed: Keep these indefinitely, as they prove your ownership and the terms of your loan. - Title Report and Insurance: These should also be kept indefinitely, as they verify the ownership and any claims against the property. - Appraisal: While not as critical to keep long-term, it can be useful for future refinancing or if you dispute the property’s value. - Tax-Related Documents: The IRS recommends keeping tax-related documents for at least three years in case of an audit, but it’s safer to keep them for seven years.

Organizing Your Documents

To ensure you can find your mortgage documents when needed, consider organizing them in a secure, easily accessible place. This could be a fireproof safe in your home or a safe deposit box at your bank. Digital copies can also be stored securely online, but make sure to use a reputable service that offers encryption and secure access controls.

Digital Storage Options

In today’s digital age, storing documents electronically is a viable option. Consider the following: - Cloud Storage: Services like Dropbox, Google Drive, or Microsoft OneDrive offer secure storage options. Ensure you understand their privacy policies and security measures. - Password Management: Tools like LastPass or 1Password can securely store passwords and notes, including information about your mortgage documents.

📝 Note: When storing documents digitally, always prioritize security to protect your personal and financial information.

Conclusion Without Closure

Maintaining a comprehensive and organized record of your mortgage documents is crucial for your financial health and security. By understanding the importance of these documents and taking steps to secure them, you protect yourself against potential disputes, audits, or other issues that may arise. Whether you choose physical storage, digital storage, or a combination of both, the key is to ensure that your documents are safe, accessible, and can be easily referenced when needed.

What are the most critical mortgage documents to keep?

+

The most critical documents include the mortgage note, deed of trust, title report, and any insurance documents. These prove ownership, outline the loan terms, and verify the property’s legal status.

How long should I keep my mortgage documents?

+

It’s advisable to keep original mortgage documents for as long as you own the property and potentially for several years after selling it. Tax-related documents should be kept for at least seven years.

Is digital storage a secure option for mortgage documents?

+

Yes, digital storage can be secure if you use reputable services that offer strong encryption and secure access controls. Always research the service’s security measures and privacy policies before storing sensitive documents.