Keep Old Mortgage Paperwork

Why You Should Keep Old Mortgage Paperwork

When it comes to managing your financial documents, it’s essential to know what to keep and what to discard. Old mortgage paperwork might seem like something you can get rid of once you’ve paid off your mortgage or refinanced your home. However, there are several reasons why you should consider keeping these documents. In this article, we’ll explore the importance of keeping old mortgage paperwork and provide guidance on how to organize and store these documents.

Benefits of Keeping Old Mortgage Paperwork

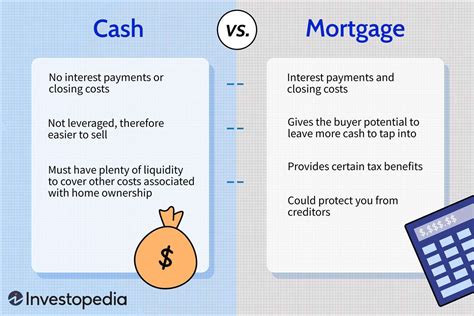

Keeping old mortgage paperwork can provide several benefits, including: * Proof of ownership: Your mortgage documents serve as proof of ownership and can be useful in case of a dispute or if you need to establish your property rights. * Tax purposes: You may need to access your old mortgage documents for tax purposes, such as when claiming mortgage interest deductions or capital gains exemptions. * Refinancing or selling your home: If you decide to refinance or sell your home, you’ll need to provide documentation of your current mortgage, including the original loan documents. * Insurance and liability: In case of a natural disaster or other catastrophic event, your mortgage documents can help establish the value of your property and support insurance claims.

What to Keep and For How Long

So, what old mortgage paperwork should you keep, and for how long? Here are some guidelines: * Mortgage note: Keep your original mortgage note for at least 10 years after the loan is paid off. * Deed of trust: Retain your deed of trust for at least 10 years after the loan is paid off. * Property tax records: Keep property tax records for at least 3-5 years after the tax year. * Insurance records: Retain insurance records, including policy documents and claims, for at least 5-7 years.

📝 Note: The length of time you should keep old mortgage paperwork may vary depending on your location and local regulations. It's essential to check with your local government or a financial advisor to determine the specific requirements for your area.

How to Organize and Store Old Mortgage Paperwork

To keep your old mortgage paperwork organized and easily accessible, consider the following tips: * Use a file folder or binder: Store your mortgage documents in a designated file folder or binder, labeled clearly with the property address and loan information. * Scan and digitize: Scan your mortgage documents and save them electronically, using a secure cloud storage service or external hard drive. * Store in a safe location: Keep your physical mortgage documents in a safe location, such as a fireproof safe or a secure offsite storage facility.

| Document | Retention Period |

|---|---|

| Mortgage note | 10 years after loan payoff |

| Deed of trust | 10 years after loan payoff |

| Property tax records | 3-5 years after tax year |

| Insurance records | 5-7 years |

Conclusion and Final Thoughts

In summary, keeping old mortgage paperwork is essential for maintaining proof of ownership, supporting tax claims, and providing documentation for refinancing or selling your home. By understanding what to keep and for how long, and organizing your documents in a secure and accessible manner, you can ensure that you’re prepared for any situation that may arise. Remember to check with local regulations and consult with a financial advisor to determine the specific requirements for your area.

What happens if I lose my mortgage documents?

+

If you lose your mortgage documents, you can contact your lender or local government to obtain replacement copies. You may need to provide identification and proof of ownership to access the documents.

How long should I keep my property tax records?

+

You should keep your property tax records for at least 3-5 years after the tax year. This will help you support tax claims and provide documentation for any audits or disputes.

Can I digitize my mortgage documents and discard the physical copies?

+

While digitizing your mortgage documents is a good idea, it’s recommended that you keep the physical copies as well. This will provide an additional layer of security and ensure that you have access to the documents even if your digital copies are lost or compromised.