Sign Title Company Papers Before Buying

Understanding the Importance of Title Company Papers

When purchasing a property, there are numerous documents to sign, and it can be overwhelming for first-time buyers. Among these documents, title company papers play a crucial role in ensuring a smooth and secure transaction. In this article, we will delve into the world of title company papers, exploring their significance, the process of signing them, and what to expect during this critical phase of the home buying process.

The Role of Title Companies in Real Estate Transactions

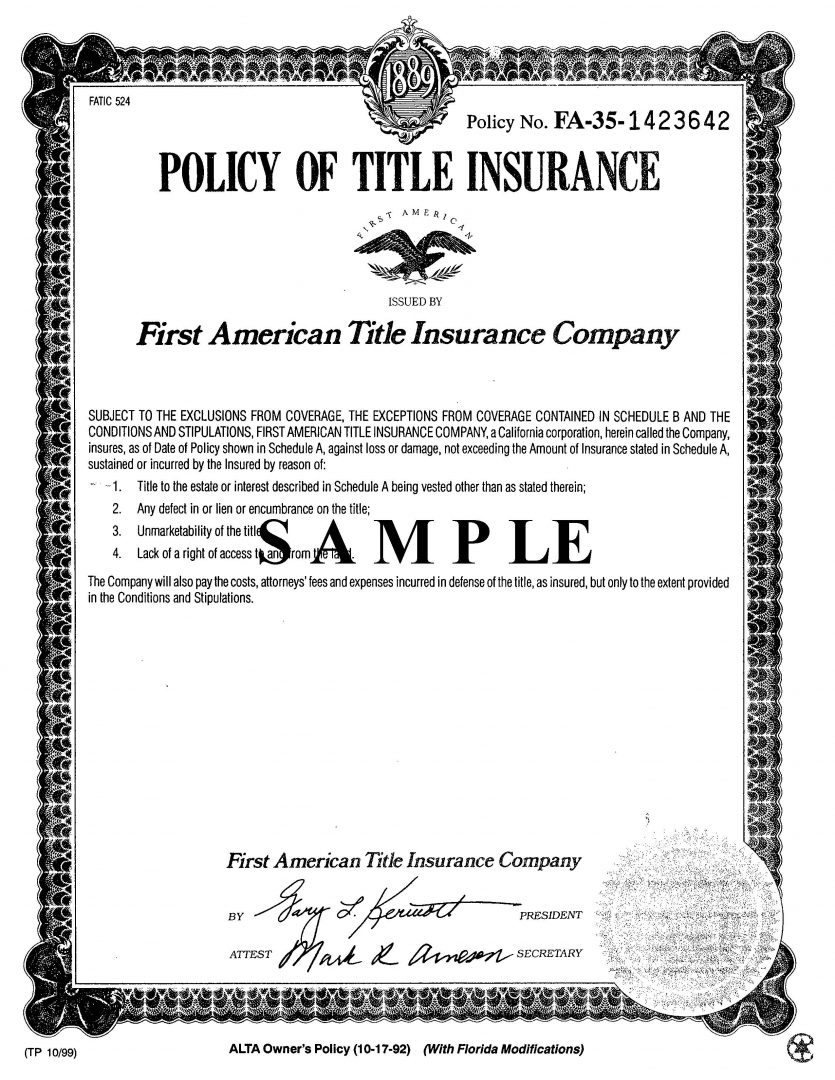

Title companies are responsible for conducting a thorough search of the property’s title to identify any potential issues or defects. This search involves reviewing public records to verify the property’s ownership, checking for any outstanding liens or mortgages, and ensuring that the property is free from any unexpected surprises. The title company’s primary goal is to provide a clear title, which guarantees that the buyer will have full ownership of the property without any encumbrances.

The Process of Signing Title Company Papers

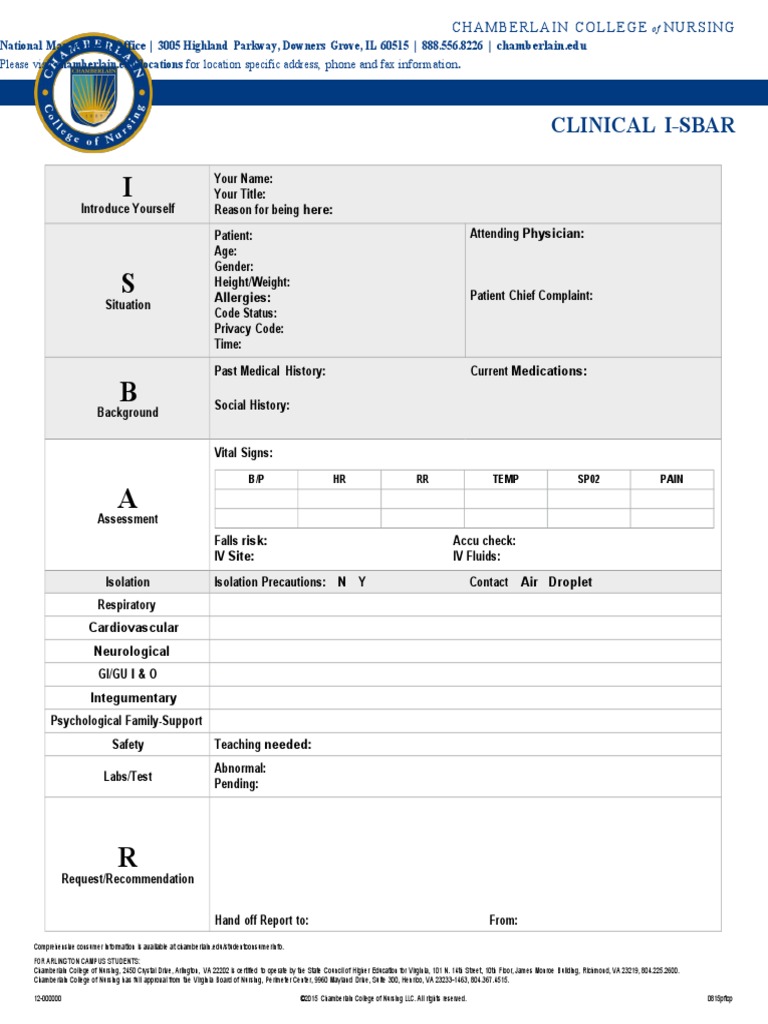

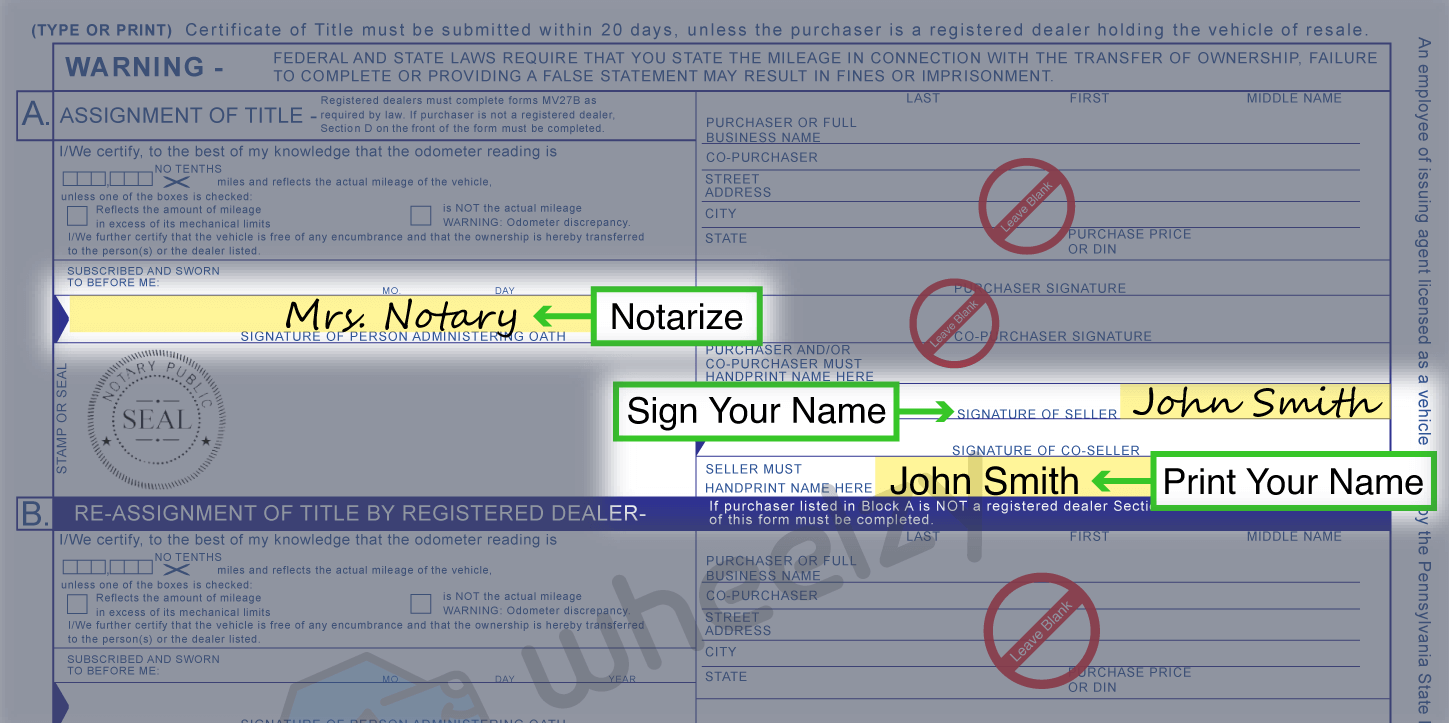

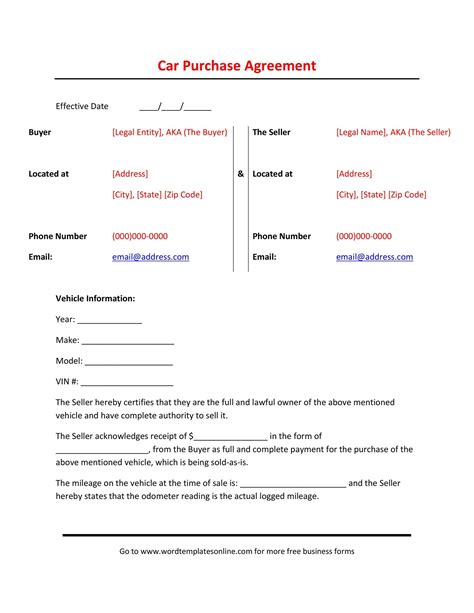

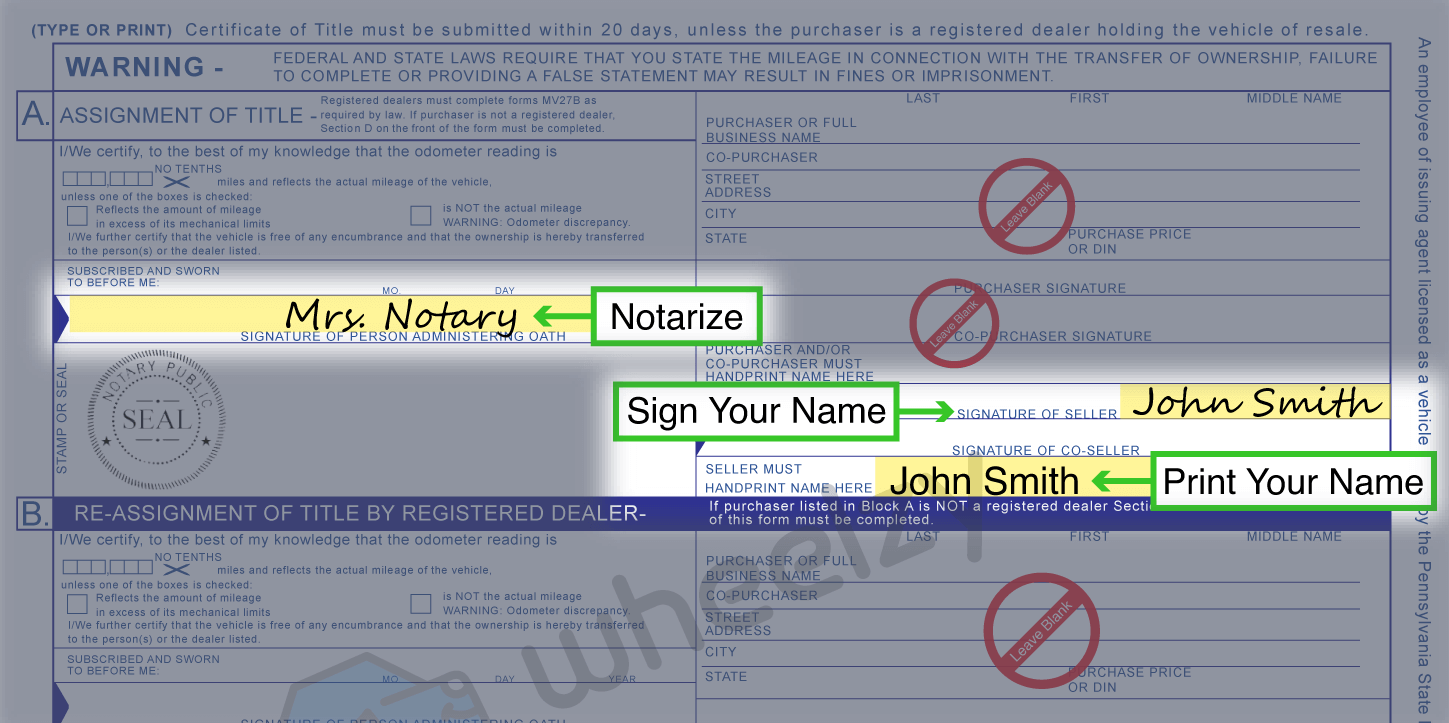

When signing title company papers, it is essential to understand what each document represents and what you are agreeing to. The process typically involves the following steps: * Reviewing the title report to ensure that the property’s title is clear and free from any issues * Signing the title deed, which transfers the property’s ownership from the seller to the buyer * Completing the mortgage deed, which secures the property as collateral for the loan * Reviewing and signing the settLEMENT statement, which outlines the final costs and fees associated with the transaction

Key Documents Involved in the Title Company Paper Signing Process

The following documents are typically involved in the title company paper signing process: * Title report: A document that outlines the results of the title search, including any potential issues or defects * Title deed: A document that transfers the property’s ownership from the seller to the buyer * Mortgage deed: A document that secures the property as collateral for the loan * Settlement statement: A document that outlines the final costs and fees associated with the transaction * Loan documents: Documents that outline the terms and conditions of the loan, including the interest rate, repayment terms, and any other relevant details

What to Expect During the Signing Process

During the signing process, you can expect to: * Review and sign numerous documents, including the title deed, mortgage deed, and settlement statement * Meet with a representative from the title company, who will guide you through the process and answer any questions you may have * Pay any outstanding fees or costs associated with the transaction * Receive a copy of the signed documents, which will serve as proof of ownership and transfer of the property

📝 Note: It is essential to carefully review each document before signing, as these papers will have a significant impact on your financial situation and ownership of the property.

Tips for a Smooth Signing Process

To ensure a smooth signing process, consider the following tips: * Arrive prepared: Bring all necessary documents, including identification and proof of insurance * Ask questions: Don’t hesitate to ask questions or seek clarification on any documents or terms you don’t understand * Review carefully: Take the time to carefully review each document before signing * Seek professional advice: Consider consulting with a real estate attorney or other professional to ensure that your interests are protected

Common Mistakes to Avoid During the Signing Process

The following are common mistakes to avoid during the signing process: * Rushing through the process: Take the time to carefully review each document and ask questions * Failing to understand the terms: Ensure that you understand the terms and conditions of the loan and any other relevant documents * Not bringing necessary documents: Arrive prepared with all necessary documents, including identification and proof of insurance * Not seeking professional advice: Consider consulting with a real estate attorney or other professional to ensure that your interests are protected

| Document | Description |

|---|---|

| Title report | A document that outlines the results of the title search, including any potential issues or defects |

| Title deed | A document that transfers the property's ownership from the seller to the buyer |

| Mortgage deed | A document that secures the property as collateral for the loan |

| Settlement statement | A document that outlines the final costs and fees associated with the transaction |

In summary, signing title company papers is a critical step in the home buying process. By understanding the importance of these documents and taking the time to carefully review each one, you can ensure a smooth and secure transaction. Remember to arrive prepared, ask questions, and seek professional advice to protect your interests. With the right guidance and preparation, you can navigate the title company paper signing process with confidence.

What is the purpose of a title company in a real estate transaction?

+

The purpose of a title company is to conduct a thorough search of the property’s title to identify any potential issues or defects, providing a clear title and ensuring a smooth transaction.

What documents are typically involved in the title company paper signing process?

+

The documents typically involved in the title company paper signing process include the title report, title deed, mortgage deed, settlement statement, and loan documents.

What should I do if I have questions or concerns during the signing process?

+

If you have questions or concerns during the signing process, don’t hesitate to ask the title company representative or seek professional advice from a real estate attorney or other expert.