Creditors Get Debtors Bankruptcy Paperwork

Understanding the Process of Creditors Receiving Debtors’ Bankruptcy Paperwork

When an individual or business files for bankruptcy, it can be a complex and overwhelming process for all parties involved. One crucial aspect of bankruptcy proceedings is the exchange of paperwork between debtors and creditors. In this context, creditors are entities to which the debtor owes money, and they have a significant interest in the bankruptcy process. The primary goal of this paperwork is to ensure that creditors are informed and involved throughout the bankruptcy proceedings.

The Role of Creditors in Bankruptcy Proceedings

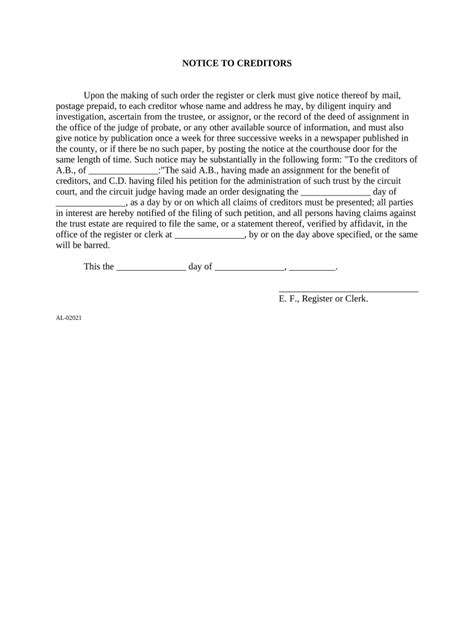

Creditors play a vital role in bankruptcy cases. They have the right to receive notification of the bankruptcy filing, which is typically done through the court. The court notifies creditors by sending them a copy of the bankruptcy petition and a notice of the first meeting of creditors, also known as the 341 meeting. This meeting provides creditors with an opportunity to question the debtor under oath about their financial affairs.

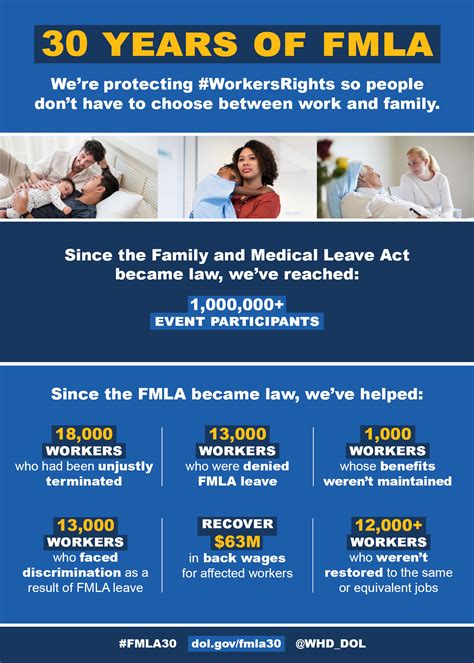

Types of Bankruptcy and Their Impact on Creditors

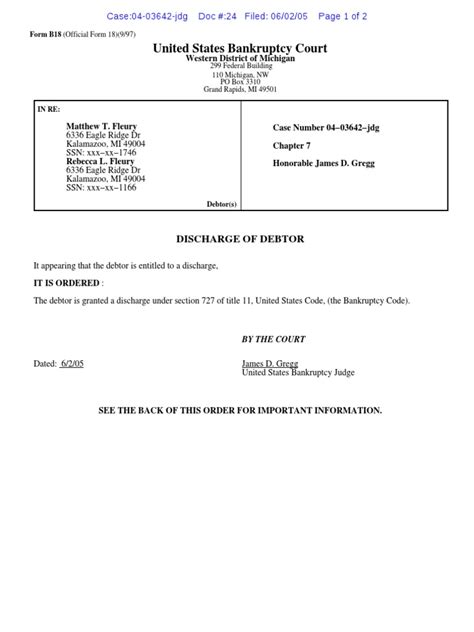

There are several types of bankruptcy, including Chapter 7, Chapter 11, and Chapter 13. The type of bankruptcy filed affects how creditors will be treated during the process. - Chapter 7 Bankruptcy: This type of bankruptcy involves the liquidation of the debtor’s assets to pay off creditors. Creditors may receive some payment, but it’s often a fraction of what they are owed. - Chapter 11 Bankruptcy: Typically used by businesses, this type of bankruptcy allows the debtor to restructure their debts and continue operating. Creditors are involved in the restructuring process. - Chapter 13 Bankruptcy: This type of bankruptcy is for individuals and involves creating a repayment plan to pay off debts over time. Creditors receive payments according to the plan.

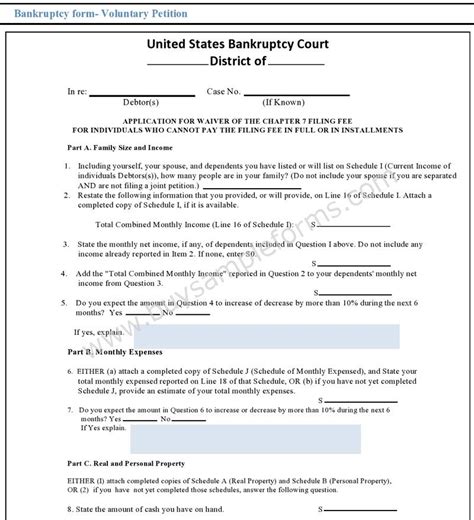

The Bankruptcy Paperwork Process

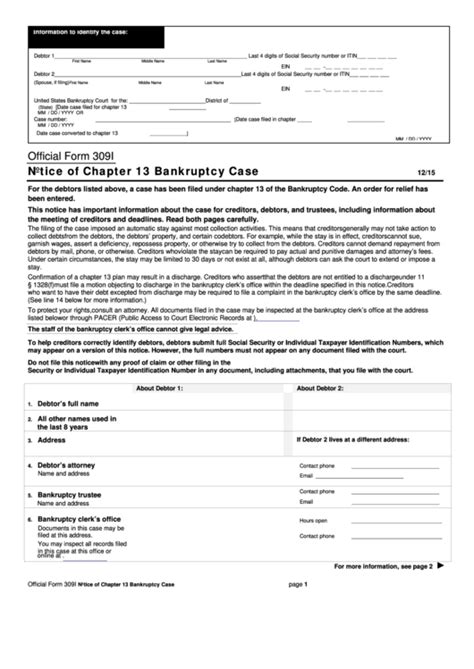

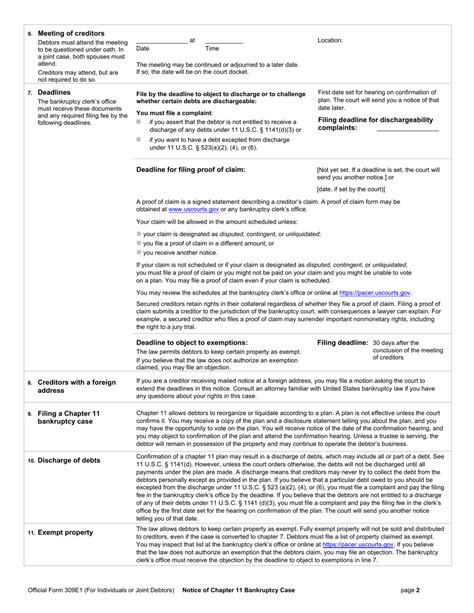

The process of creditors receiving debtors’ bankruptcy paperwork is systematic and governed by federal law. Here’s a general overview: - Initial Filing: The debtor files a bankruptcy petition with the court, which includes detailed financial information. - Court Notification: The court notifies creditors of the bankruptcy filing, providing them with essential information about the case, including the debtor’s name, case number, and the date of the first meeting of creditors. - Creditors’ Meeting: Creditors have the opportunity to attend the 341 meeting, where they can ask the debtor questions under oath. - Claims Filing: Creditors must file a proof of claim with the court to receive payment. The deadline for filing claims is specified in the initial court notification. - Plan Confirmation or Asset Distribution: Depending on the type of bankruptcy, the court may confirm a repayment plan (Chapter 13) or oversee the distribution of assets (Chapter 7).

Key Documents for Creditors

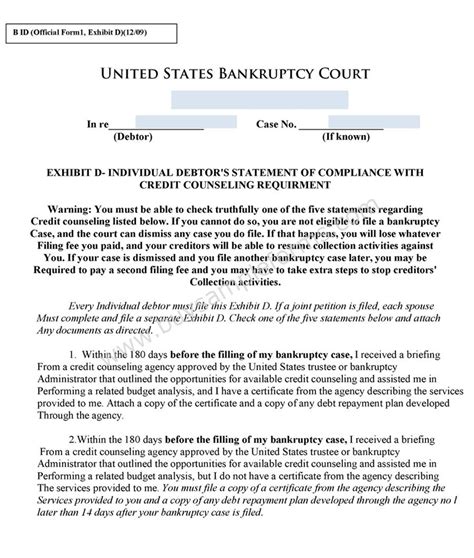

Several documents are crucial for creditors during bankruptcy proceedings: - Bankruptcy Petition: The initial document filed by the debtor that starts the bankruptcy process. - Schedules and Statements: These provide detailed financial information about the debtor, including assets, liabilities, income, and expenses. - Proof of Claim: The form creditors must file to assert their claim against the debtor. - Notice of the First Meeting of Creditors: Informs creditors of the date, time, and location of the 341 meeting.

Importance of Timely Action for Creditors

Creditors must act timely to protect their interests. This includes: - Responding promptly to court notifications - Filing a proof of claim before the deadline - Attending the creditors’ meeting if necessary - Reviewing and objecting to the debtor’s plan or distribution of assets if appropriate

📝 Note: Creditors should consult with a bankruptcy attorney to understand their rights and obligations fully, as the process can be complex and varies by case.

Conclusion of the Bankruptcy Process

The culmination of the bankruptcy process for creditors involves either the confirmation of a repayment plan or the distribution of assets. The outcome depends on the type of bankruptcy and the specifics of the case. Creditors may not always receive full payment, but the bankruptcy process ensures a structured approach to debt resolution. Understanding the paperwork and process is essential for creditors to navigate the system effectively and protect their interests.

What happens if a creditor does not file a proof of claim?

+

If a creditor fails to file a proof of claim before the deadline, they may not receive payment from the debtor’s estate. It’s crucial for creditors to meet the deadline to ensure their claim is considered.

Can creditors object to a debtor’s bankruptcy plan?

+

Yes, creditors have the right to object to a debtor’s plan if they believe it does not fairly treat their claim. This must be done in accordance with the bankruptcy rules and procedures.

What is the role of the trustee in bankruptcy cases?

+

The trustee is appointed by the court to oversee the bankruptcy case. Their duties can include reviewing the debtor’s financial information, conducting the 341 meeting, and ensuring that creditors are treated fairly according to the bankruptcy laws.