File Paperwork for Partnership

Introduction to Partnership Paperwork

When two or more individuals decide to start a business together, they form a partnership. This business structure is popular among small businesses and entrepreneurs due to its simplicity and flexibility. However, to ensure the partnership runs smoothly and to protect the interests of all parties involved, it is essential to file the necessary paperwork. In this article, we will discuss the various documents required to establish a partnership and the steps involved in filing them.

Types of Partnerships

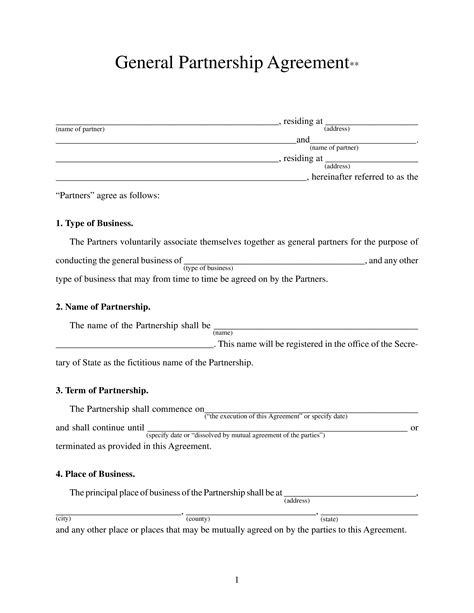

Before we dive into the paperwork, it’s essential to understand the different types of partnerships. The most common types include: * General Partnership: A general partnership is the most basic form of partnership, where all partners have equal ownership and responsibility. * Limited Partnership: A limited partnership has both general and limited partners. General partners manage the business and have unlimited liability, while limited partners have limited liability and do not participate in the day-to-day management. * Limited Liability Partnership (LLP): An LLP provides personal liability protection for all partners, similar to a corporation.

Necessary Documents

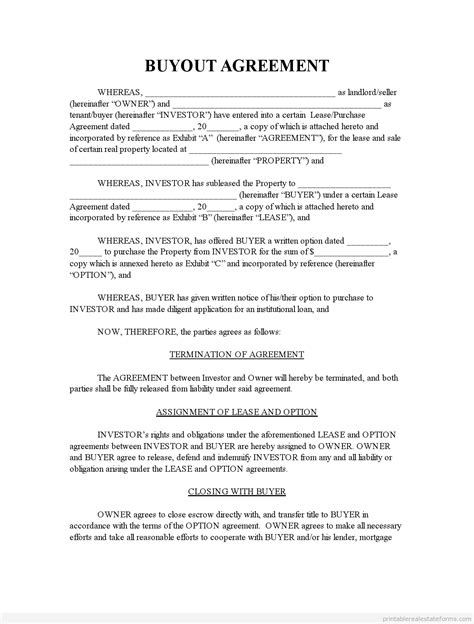

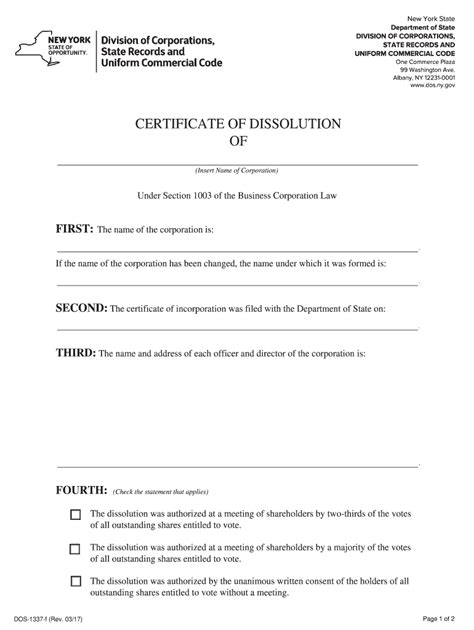

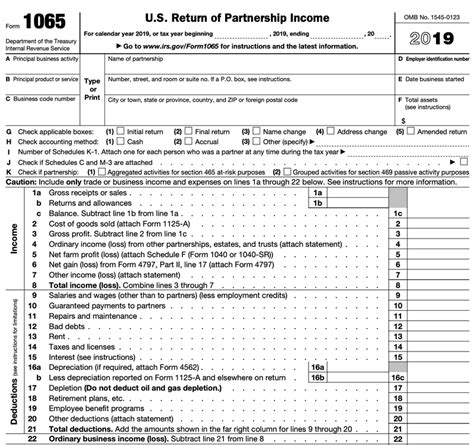

To establish a partnership, the following documents are required: * Partnership Agreement: A partnership agreement is a contract between partners that outlines the terms and conditions of the partnership, including ownership, management, and profit-sharing. * Articles of Partnership: Articles of partnership are filed with the state and provide basic information about the partnership, such as its name, address, and purpose. * Partnership Certificate: A partnership certificate is a document that proves the existence of the partnership and is often required for tax purposes. * Tax Identification Number: A tax identification number, also known as an Employer Identification Number (EIN), is required for tax purposes and to open a business bank account.

Filing Partnership Paperwork

The steps involved in filing partnership paperwork vary depending on the state and type of partnership. However, the general process is as follows: * Choose a Business Name: Choose a unique and descriptive name for the partnership. * File Articles of Partnership: File the articles of partnership with the state and pay the required fee. * Obtain an EIN: Apply for an EIN from the IRS. * Draft a Partnership Agreement: Draft a partnership agreement that outlines the terms and conditions of the partnership. * File for Licenses and Permits: Obtain any necessary licenses and permits to operate the business.

📝 Note: It's essential to consult with an attorney or accountant to ensure all necessary documents are filed correctly and in compliance with state and federal regulations.

Benefits of Filing Partnership Paperwork

Filing partnership paperwork provides several benefits, including: * Personal Liability Protection: Filing for an LLP or LP provides personal liability protection for partners. * Tax Benefits: Partnerships are pass-through entities, meaning partners report their share of income and expenses on their personal tax returns. * Credibility: Filing partnership paperwork establishes the partnership as a legitimate business, making it easier to obtain loans and attract investors. * Dispute Resolution: A well-drafted partnership agreement can help resolve disputes between partners.

Common Mistakes to Avoid

When filing partnership paperwork, it’s essential to avoid common mistakes, such as: * Insufficient Capital: Failing to contribute sufficient capital to the partnership can lead to financial difficulties. * Poorly Drafted Partnership Agreement: A poorly drafted partnership agreement can lead to disputes and misunderstandings between partners. * Failure to File Necessary Documents: Failing to file necessary documents, such as articles of partnership or an EIN, can result in penalties and fines.

| Document | Purpose | Filing Fee |

|---|---|---|

| Articles of Partnership | Establishes the partnership | Varies by state |

| Partnership Agreement | Outlines terms and conditions of the partnership | No filing fee |

| EIN | Required for tax purposes | No filing fee |

In summary, filing partnership paperwork is a crucial step in establishing a partnership. It provides personal liability protection, tax benefits, and credibility, while also helping to resolve disputes between partners. By avoiding common mistakes and seeking professional advice, partners can ensure their business is set up for success.

As we wrap up this discussion, it’s clear that filing partnership paperwork is a complex process that requires careful planning and attention to detail. By following the steps outlined above and seeking professional advice, partners can ensure their business is established on a solid foundation.

What is the purpose of a partnership agreement?

+

A partnership agreement is a contract between partners that outlines the terms and conditions of the partnership, including ownership, management, and profit-sharing.

How do I obtain an EIN?

+

You can apply for an EIN online through the IRS website or by mail using Form SS-4.

What is the difference between a general partnership and a limited partnership?

+

A general partnership has all partners with equal ownership and responsibility, while a limited partnership has both general and limited partners, with general partners managing the business and limited partners having limited liability.