5 Pay Rules

Understanding the 5 Pay Rules for a Successful Financial Life

The concept of the 5 Pay Rule has been gaining popularity as a simple yet effective strategy for managing finances and achieving financial stability. This rule suggests that by allocating your income into five distinct categories, you can create a balanced financial plan that covers all your needs and helps you build wealth over time. In this article, we will delve into the details of the 5 Pay Rule, exploring its components, benefits, and how to implement it in your financial life.

What are the 5 Pay Rules?

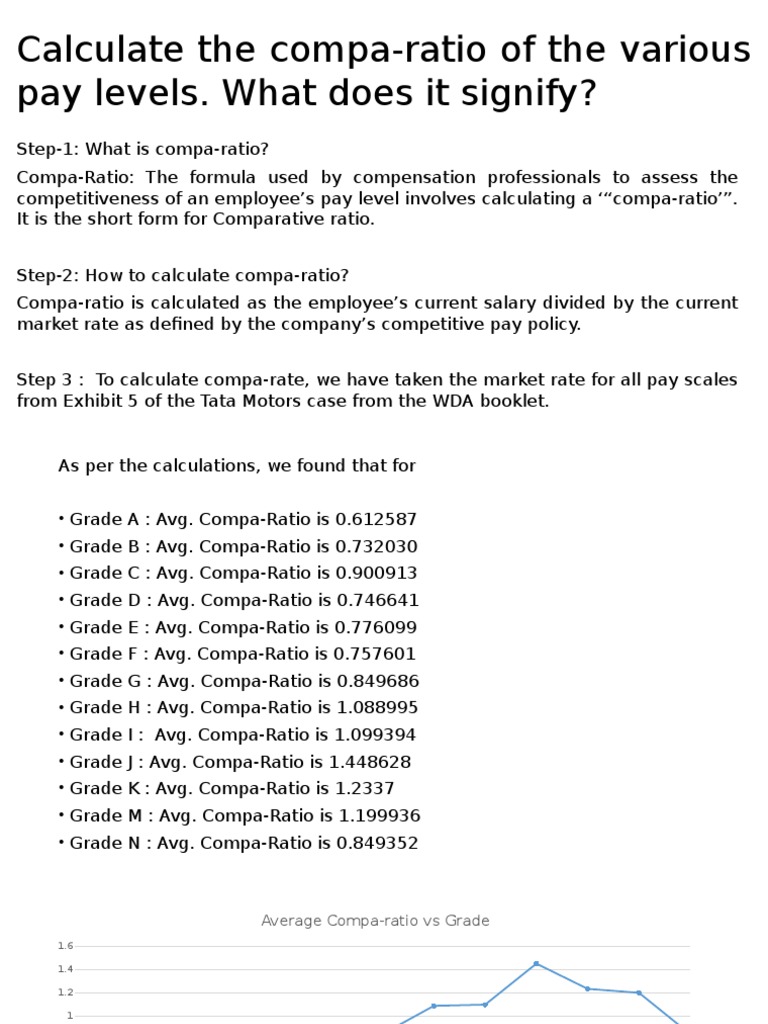

The 5 Pay Rule is based on allocating your income into five categories, each representing a crucial aspect of your financial life. These categories are: - Savings: This includes any form of savings, such as emergency funds, retirement savings, and other long-term savings goals. - Necessities: Expenses that are essential for living, including rent/mortgage, utilities, groceries, transportation, and minimum payments on debts. - Debt Repayment: Payments towards debts, aiming to reduce or eliminate high-interest loans and credit card debts. - Retirement: Contributions to retirement accounts, such as 401(k), IRA, or other pension plans. - Discretionary Spending: Money allocated for entertainment, hobbies, travel, and any other non-essential expenses.

Benefits of the 5 Pay Rule

Implementing the 5 Pay Rule can have several benefits for your financial health: - Structured Budgeting: It provides a clear and structured approach to budgeting, ensuring that all aspects of your financial life are considered. - Prioritization: Helps in prioritizing expenses and savings, ensuring that essential needs and long-term goals are addressed first. - Debt Management: Facilitates effective debt repayment by allocating a specific portion of your income towards reducing debts. - Savings and Retirement: Encourages saving and investing for the future, including building an emergency fund and securing your retirement.

How to Implement the 5 Pay Rule

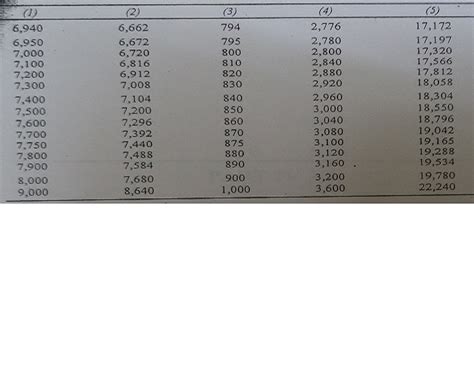

To start using the 5 Pay Rule, follow these steps: 1. Calculate Your Net Income: Begin by determining how much you take home each month after taxes. 2. Assign Percentages: Allocate percentages of your income to each category. A common allocation might be: - Savings: 10% to 20% - Necessities: 50% to 60% - Debt Repayment: 5% to 10% - Retirement: 5% to 10% - Discretionary Spending: 10% to 20% 3. Adjust Based on Needs: These are general guidelines. You may need to adjust the percentages based on your individual circumstances, such as high-interest debt, low income, or specific savings goals. 4. Automate Payments: Set up automatic transfers for savings, debt repayment, and retirement contributions to ensure consistency. 5. Review and Adjust: Regularly review your budget to see if the allocations are working for you and make adjustments as necessary.

Common Challenges and Solutions

Implementing the 5 Pay Rule can come with its challenges, such as: - High Expenses: If your necessities category is too high, consider ways to reduce expenses, such as finding a more affordable living situation or negotiating a better deal on utilities and services. - Low Income: If your income is limited, prioritize needs over wants, and look for ways to increase your income, such as taking on a side job or pursuing additional education/training. - Debt: For significant debt, consider debt consolidation or balance transfer options, and prioritize high-interest debt repayment.

| Category | Percentage of Income | Description |

|---|---|---|

| Savings | 10% to 20% | Emergency fund, long-term savings |

| Necessities | 50% to 60% | Essential living expenses |

| Debt Repayment | 5% to 10% | Paying off debts |

| Retirement | 5% to 10% | Retirement savings |

| Discretionary Spending | 10% to 20% | Non-essential expenses |

📝 Note: The percentages provided are general guidelines. It's essential to adjust them according to your personal financial situation and goals.

As you embark on your financial journey with the 5 Pay Rule, remember that patience and consistency are key. Financial stability and security are long-term goals that require dedication and perseverance. By following the 5 Pay Rule and making necessary adjustments along the way, you can set yourself up for financial success and peace of mind.

In wrapping up our discussion on the 5 Pay Rule, it’s clear that this approach offers a straightforward and effective method for managing your finances. By allocating your income into these five critical categories, you can ensure that you’re addressing all aspects of your financial life, from immediate needs to long-term goals. This structured approach to budgeting can help reduce financial stress, promote savings, and support your journey towards financial independence.

What is the primary benefit of using the 5 Pay Rule?

+

The primary benefit is that it provides a structured approach to budgeting, ensuring that all financial aspects are considered and prioritized.

How do I determine the right percentages for each category?

+

The right percentages depend on your individual financial situation, goals, and priorities. You may need to adjust the general guidelines based on factors like high-interest debt, low income, or specific savings goals.

Can the 5 Pay Rule help with debt repayment?

+

Yes, the 5 Pay Rule allocates a specific portion of your income towards debt repayment, which can help in systematically reducing debts, especially high-interest ones.

Related Terms:

- Is unpaid orientation legal