5 Tips Paying Employees

Introduction to Paying Employees

Paying employees is a crucial aspect of any business, as it directly affects the morale, productivity, and overall job satisfaction of the workforce. Timely and accurate payment of wages is essential for maintaining a positive employer-employee relationship. In this blog post, we will discuss five tips for paying employees, highlighting the importance of compliance with labor laws, the use of technology, and effective communication.

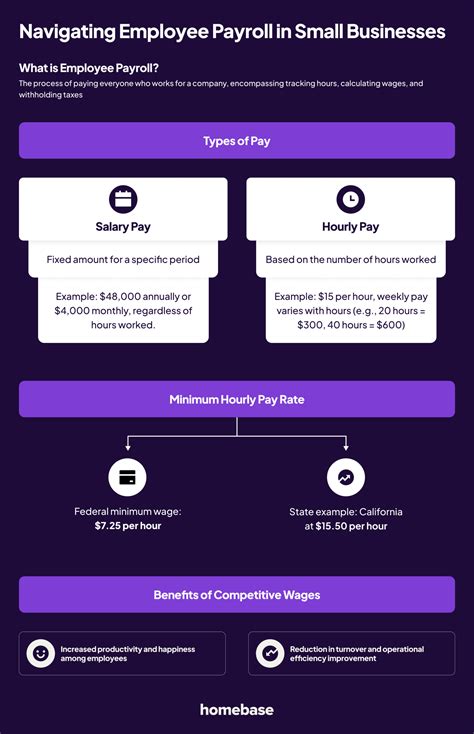

Tip 1: Understand Labor Laws and Regulations

Before paying employees, it is essential to understand the labor laws and regulations that govern wage payment in your country or state. Minimum wage rates, overtime pay, and tax deductions are some of the critical aspects that employers must comply with. Failure to comply with these regulations can result in severe penalties, fines, and damage to the company’s reputation. Employers must stay up-to-date with the latest changes in labor laws and regulations to ensure that they are paying their employees correctly and fairly.

Tip 2: Choose the Right Payment Method

There are various payment methods that employers can use to pay their employees, including direct deposit, paychecks, and paycards. Each payment method has its advantages and disadvantages, and employers must choose the method that best suits their business needs and employee preferences. Direct deposit is a popular payment method, as it is convenient, efficient, and reduces the risk of lost or stolen paychecks.

Tip 3: Use Payroll Software

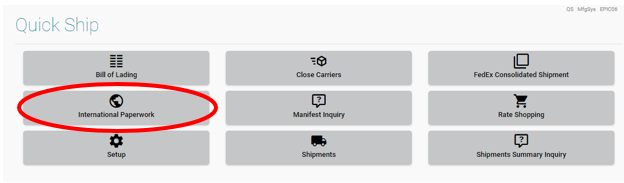

Payroll software can simplify the process of paying employees, reducing the risk of errors and increasing efficiency. Automated payroll systems can calculate wages, deductions, and taxes, and generate pay stubs and reports. Employers can also use payroll software to track employee hours, manage benefits, and comply with labor laws and regulations. Some popular payroll software includes QuickBooks, ADP, and Paychex.

Tip 4: Communicate with Employees

Effective communication is essential for maintaining a positive employer-employee relationship. Employers must communicate clearly and transparently with their employees about their pay, benefits, and any changes to the payment process. Pay stubs and payroll reports can provide employees with detailed information about their wages, deductions, and taxes. Employers can also use employee self-service portals to provide employees with access to their payroll information and benefits.

Tip 5: Monitor and Audit Payroll

Finally, employers must monitor and audit their payroll processes regularly to ensure accuracy, completeness, and compliance with labor laws and regulations. Payroll audits can help identify errors, discrepancies, and potential fraud, and employers can take corrective action to prevent future mistakes. Employers can also use payroll analytics to track payroll trends, identify areas for improvement, and optimize their payroll processes.

📝 Note: Employers must keep accurate and detailed payroll records, including employee hours, wages, deductions, and taxes, to comply with labor laws and regulations.

In summary, paying employees is a critical aspect of any business, and employers must ensure that they are paying their employees correctly, fairly, and in compliance with labor laws and regulations. By following these five tips, employers can simplify the process of paying employees, reduce errors, and maintain a positive employer-employee relationship.

What is the minimum wage rate in the United States?

+

The minimum wage rate in the United States is $7.25 per hour, as of 2022.

What is the purpose of a pay stub?

+

A pay stub provides employees with detailed information about their wages, deductions, and taxes, and serves as a record of their payment.

What is payroll software, and how does it work?

+

Payroll software is a computer program that automates the process of paying employees, calculating wages, deductions, and taxes, and generating pay stubs and reports.

Related Terms:

- Is unpaid orientation legal