5 Tips 401k Hardship

Understanding 401k Hardship Withdrawals

When facing financial difficulties, individuals may consider tapping into their 401k retirement savings for assistance. A 401k hardship withdrawal allows participants to access their retirement funds to meet immediate financial needs. However, it is essential to understand the rules, eligibility criteria, and potential consequences before making a withdrawal.

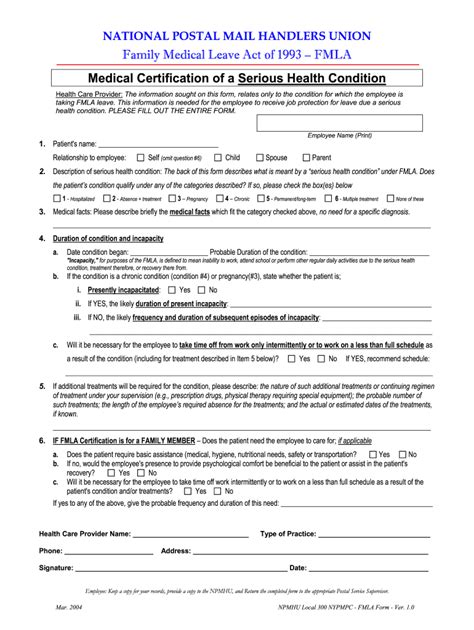

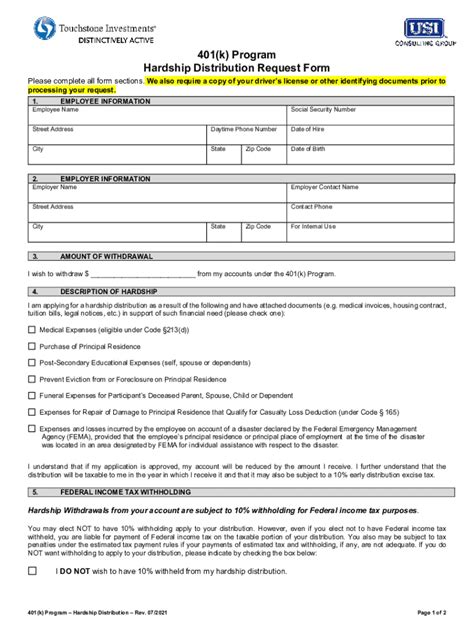

Eligibility Criteria for 401k Hardship Withdrawals

To be eligible for a 401k hardship withdrawal, participants must meet specific requirements, which may vary depending on the plan. Common eligibility criteria include: * Immediate and heavy financial need * Insufficient liquid assets to meet the need * Withdrawal amount limited to the amount necessary to satisfy the financial need * Withdrawal must be made in accordance with the plan’s rules and regulations

Some common examples of immediate and heavy financial needs that may qualify for a hardship withdrawal include: * Medical expenses * Purchase of a primary residence * Tuition and education expenses * Funeral expenses * Repair of damage to a primary residence

5 Tips for 401k Hardship Withdrawals

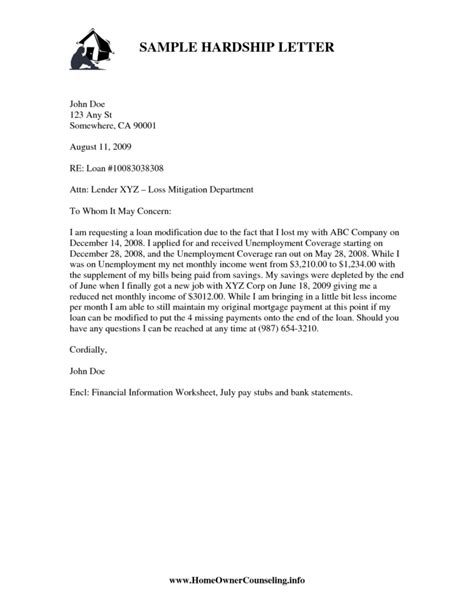

Before making a 401k hardship withdrawal, consider the following tips: * Tip 1: Explore Alternative Options: Before tapping into your 401k, explore alternative options, such as personal loans, credit cards, or home equity loans. These options may have lower fees and penalties compared to a hardship withdrawal. * Tip 2: Understand the Fees and Penalties: 401k hardship withdrawals are subject to a 10% early withdrawal penalty if the participant is under the age of 59 1⁄2. Additionally, the withdrawn amount will be taxed as ordinary income. * Tip 3: Determine the Withdrawal Amount: Only withdraw the amount necessary to meet the financial need. Withdrawing more than necessary can result in unnecessary taxes and penalties. * Tip 4: Consider the Impact on Retirement Savings: A hardship withdrawal can significantly impact retirement savings. Participants should consider the long-term consequences of withdrawing from their 401k and explore alternative options to minimize the impact. * Tip 5: Review the Plan’s Rules and Regulations: Participants should review their plan’s rules and regulations regarding hardship withdrawals to ensure they meet the eligibility criteria and follow the required procedures.

Example Table: 401k Hardship Withdrawal Fees and Penalties

| Fee/Penalty | Amount |

|---|---|

| Early Withdrawal Penalty | 10% of withdrawn amount |

| Income Tax | Ordinary income tax rate |

| Plan Administration Fee | Varies depending on the plan |

📝 Note: Participants should consult with their plan administrator or financial advisor to determine the specific fees and penalties associated with their 401k hardship withdrawal.

As individuals navigate financial difficulties, it is essential to carefully consider the implications of a 401k hardship withdrawal. By understanding the eligibility criteria, fees, and penalties, participants can make informed decisions about their retirement savings. In the end, a 401k hardship withdrawal should be a last resort, and individuals should explore alternative options to minimize the impact on their retirement savings. Ultimately, the key to a successful financial future is to strike a balance between meeting immediate financial needs and preserving retirement savings for the long-term.