Freelancing Paperwork Requirements

Introduction to Freelancing Paperwork

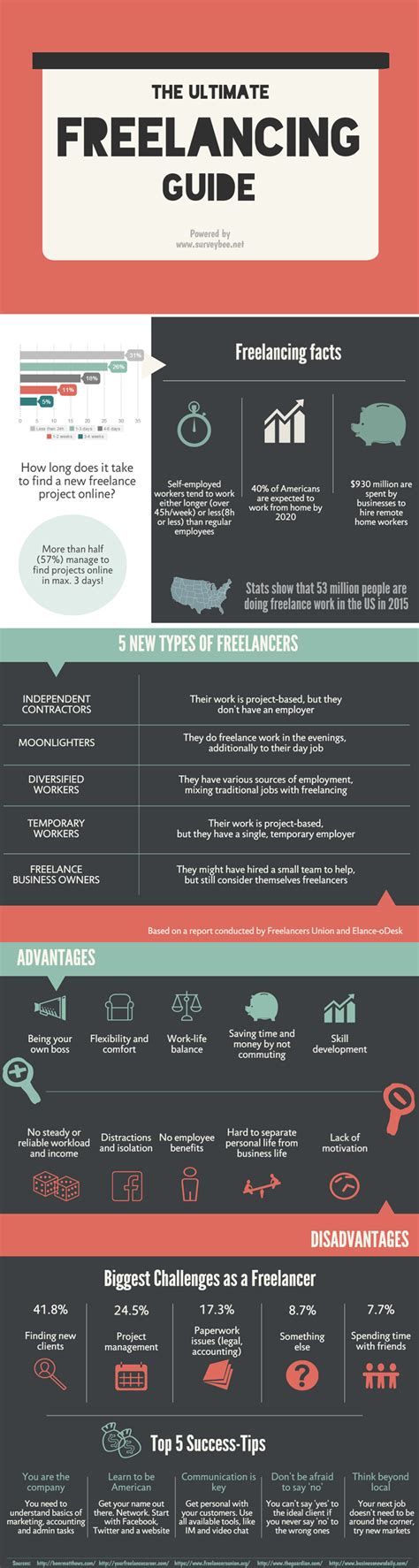

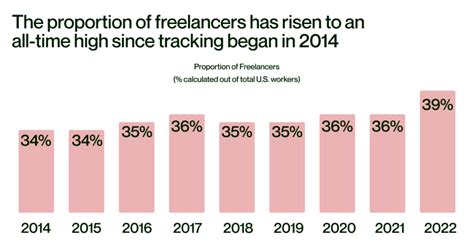

As a freelancer, managing paperwork is a crucial aspect of running a successful business. While freelancing offers the flexibility to work on your own terms, it also requires a significant amount of administrative work, including handling paperwork. Effective paperwork management is essential to ensure compliance with laws and regulations, maintain accurate financial records, and build a professional reputation. In this article, we will explore the various paperwork requirements for freelancers, including contracts, invoices, and tax documents.

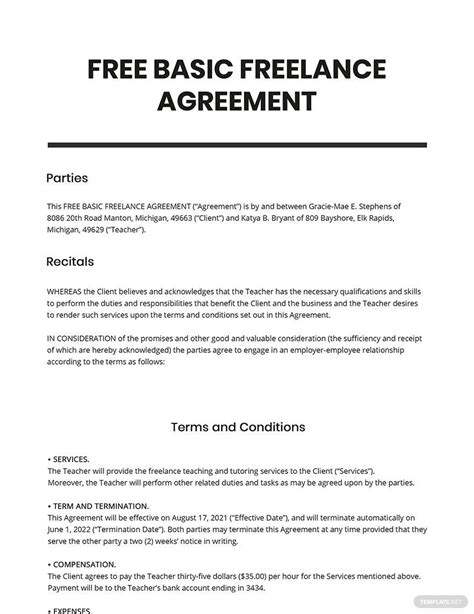

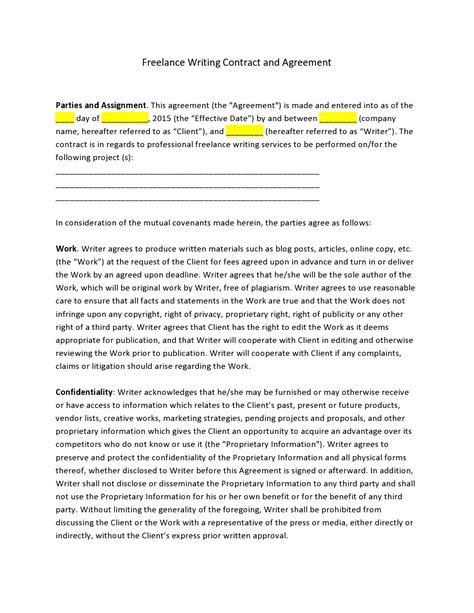

Contracts and Agreements

When starting a new project, it’s essential to have a clear and comprehensive contract in place. A contract outlines the scope of work, payment terms, deadlines, and expectations for both the freelancer and the client. A well-written contract can help prevent disputes and ensure that both parties are on the same page. Some key elements to include in a freelance contract are: * Project description and scope of work * Payment terms and rates * Deadlines and milestones * Confidentiality and non-disclosure agreements * Cancellation or termination clauses * Dispute resolution processes

Invoices and Payment Terms

As a freelancer, you need to send professional invoices to your clients to receive payment for your work. An invoice should include: * Your business name and contact information * Client name and contact information * Project description and scope of work * Payment amount and terms * Due date and payment methods * Any applicable taxes or fees It’s also important to establish clear payment terms, including the payment schedule, late payment fees, and acceptable payment methods.

Tax Documents and Financial Records

Freelancers are responsible for their own taxes, and accurate financial records are essential for tax purposes. You’ll need to keep track of: * Income and expenses * Business deductions and credits * Tax payments and deadlines * Financial statements, such as balance sheets and income statements It’s recommended to consult with an accountant or tax professional to ensure you’re meeting your tax obligations and taking advantage of available deductions and credits.

Benefits and Insurance

As a freelancer, you’re responsible for your own benefits and insurance, including: * Health insurance * Retirement savings * Disability insurance * Liability insurance * Business insurance You may need to provide proof of insurance or benefits to clients or vendors, so it’s essential to keep accurate records and documentation.

Business Registration and Licenses

Depending on your location and type of business, you may need to register your business and obtain necessary licenses and permits. This can include: * Business registration with the state or local government * Obtaining a business license or permit * Registering for taxes and obtaining an Employer Identification Number (EIN) * Compliance with local zoning and land-use regulations

| Document | Purpose | Frequency |

|---|---|---|

| Contract | Outlines scope of work and payment terms | Per project |

| Invoice | Requests payment for work completed | Per project or monthly |

| Tax return | Reports income and expenses for tax purposes | Annually |

| Financial statements | Provides an overview of business financials | Quarterly or annually |

📝 Note: It's essential to keep accurate and detailed records of all paperwork, including contracts, invoices, and tax documents, to ensure compliance with laws and regulations and to maintain a professional reputation.

As a freelancer, managing paperwork is an ongoing process that requires attention to detail and organization. By understanding the various paperwork requirements and staying on top of deadlines and documentation, you can build a successful and sustainable freelance business.

In the end, effective paperwork management is crucial for freelancers to ensure compliance, maintain accurate financial records, and build a professional reputation. By following the guidelines outlined in this article, freelancers can streamline their paperwork processes and focus on what they do best – delivering high-quality work to their clients.