5 Trust Paperwork Tips

Understanding the Importance of Trust Paperwork

When it comes to managing and distributing assets, trusts have become a popular choice for individuals seeking to ensure that their wishes are respected and their loved ones are protected. However, the process of setting up a trust involves a significant amount of paperwork, which can be overwhelming for those who are not familiar with the legal and financial aspects of trust creation. In this article, we will provide five trust paperwork tips to help individuals navigate the process with ease and confidence.

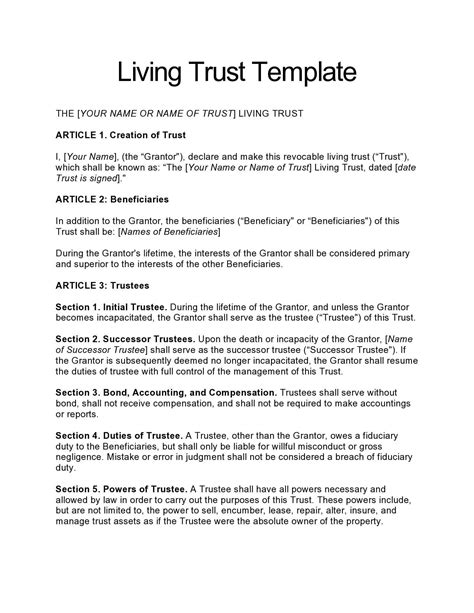

Tip 1: Define the Purpose and Scope of the Trust

Before starting the paperwork, it is essential to define the purpose and scope of the trust. This involves identifying the assets to be included, the beneficiaries, and the terms of the trust. A clear understanding of the trust’s purpose will help guide the paperwork process and ensure that all necessary documents are completed accurately. Some key considerations include: * The type of trust being created (e.g., living trust, irrevocable trust) * The assets to be included in the trust (e.g., real estate, investments, personal property) * The beneficiaries and their respective interests in the trust * Any specific terms or conditions that must be met for the trust to be effective

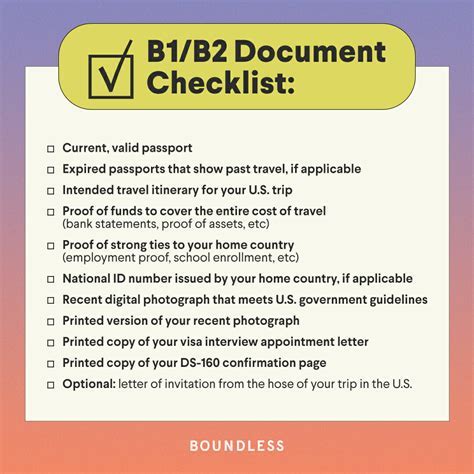

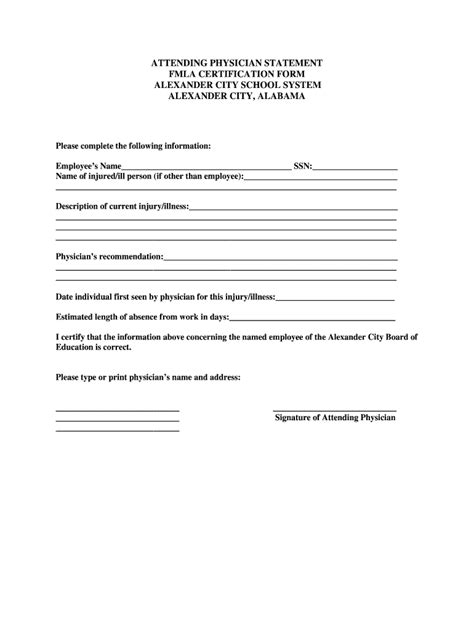

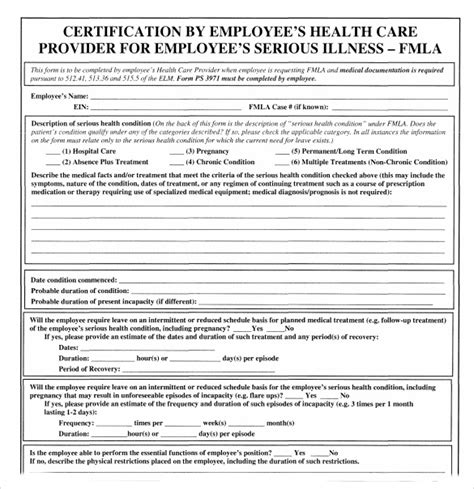

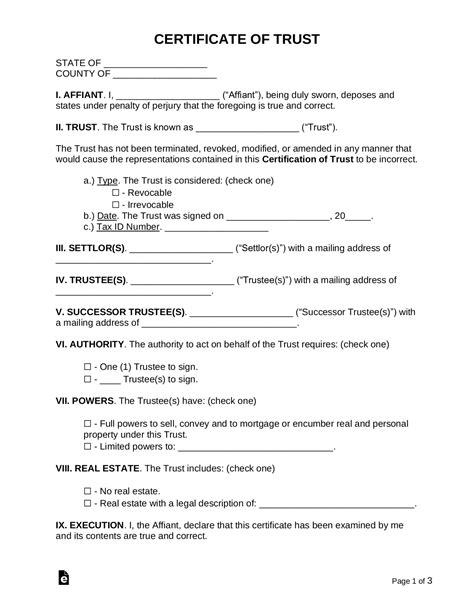

Tip 2: Choose the Right Trust Documents

The type of trust documents required will depend on the specific circumstances of the trust. Some common documents include: * Trust agreement: This document outlines the terms of the trust, including the purpose, assets, beneficiaries, and any conditions or restrictions. * Deed of trust: This document transfers ownership of real property to the trust. * Assignment of assets: This document transfers ownership of personal property, such as investments or business interests, to the trust. * Certificate of trust: This document provides a summary of the trust’s terms and is often used to verify the existence of the trust.

Tip 3: Ensure Proper Execution and Signing

Once the trust documents have been prepared, it is crucial to ensure that they are properly executed and signed. This typically involves: * Signing the documents in the presence of a notary public * Obtaining any necessary witness signatures * Recording the documents with the relevant authorities (e.g., county recorder’s office) * Maintaining a record of the signed documents and any subsequent amendments or updates

Tip 4: Consider Tax Implications

Trusts can have significant tax implications, and it is essential to consider these implications when preparing the paperwork. Some key considerations include: * Tax identification number: The trust will need to obtain a tax identification number (EIN) from the IRS. * Tax filing requirements: The trust may be required to file annual tax returns, depending on the type of trust and the assets involved. * Tax deductions and credits: The trust may be eligible for certain tax deductions and credits, such as the mortgage interest deduction or charitable contribution deduction.

Tip 5: Review and Update the Trust Paperwork Regularly

Finally, it is essential to review and update the trust paperwork regularly to ensure that it remains accurate and effective. This may involve: * Reviewing the trust agreement and other documents to ensure that they reflect any changes in the trust’s purpose or scope * Updating the beneficiary designations or asset allocations as needed * Ensuring that the trust is in compliance with any applicable laws or regulations * Considering the impact of any changes in the tax laws or regulations on the trust

| Trust Document | Purpose |

|---|---|

| Trust Agreement | Outlines the terms of the trust |

| Deed of Trust | Transfers ownership of real property to the trust |

| Assignment of Assets | Transfers ownership of personal property to the trust |

| Certificate of Trust | Provides a summary of the trust's terms |

📝 Note: It is essential to consult with an attorney or other qualified professional to ensure that the trust paperwork is prepared and executed correctly.

In summary, creating a trust involves a significant amount of paperwork, but by following these five trust paperwork tips, individuals can navigate the process with ease and confidence. It is essential to define the purpose and scope of the trust, choose the right trust documents, ensure proper execution and signing, consider tax implications, and review and update the trust paperwork regularly. By taking the time to carefully prepare and maintain the trust paperwork, individuals can ensure that their wishes are respected and their loved ones are protected.

What is the purpose of a trust agreement?

+

The trust agreement outlines the terms of the trust, including the purpose, assets, beneficiaries, and any conditions or restrictions.

What is the difference between a living trust and an irrevocable trust?

+

A living trust is a trust that is created during the grantor’s lifetime, while an irrevocable trust is a trust that cannot be changed or terminated once it is created.

Do I need to obtain a tax identification number for my trust?

+

Yes, the trust will need to obtain a tax identification number (EIN) from the IRS in order to file tax returns and conduct other financial transactions.