Kay Insurance Paperwork Requirements

Understanding Kay Insurance Paperwork Requirements

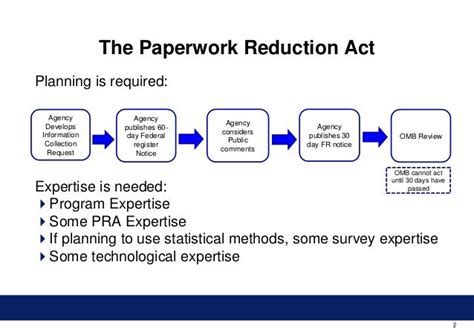

When dealing with insurance, whether it’s for your vehicle, home, health, or life, paperwork is an inevitable part of the process. Kay Insurance, like any other insurance provider, has its own set of requirements and documents that policyholders need to understand and comply with. In this article, we will delve into the world of Kay Insurance paperwork, exploring the various documents you might encounter, their purposes, and how to navigate the process efficiently.

The Importance of Accurate Paperwork

Accurate and complete paperwork is crucial for a smooth experience with Kay Insurance. It ensures that your policies are properly set up, claims are processed without unnecessary delays, and that you receive the coverage you are entitled to. Incomplete or incorrect paperwork can lead to a range of issues, including denied claims, policy cancellations, or even legal complications. Therefore, it’s essential to understand what documents are required and how to fill them out correctly.

Types of Paperwork

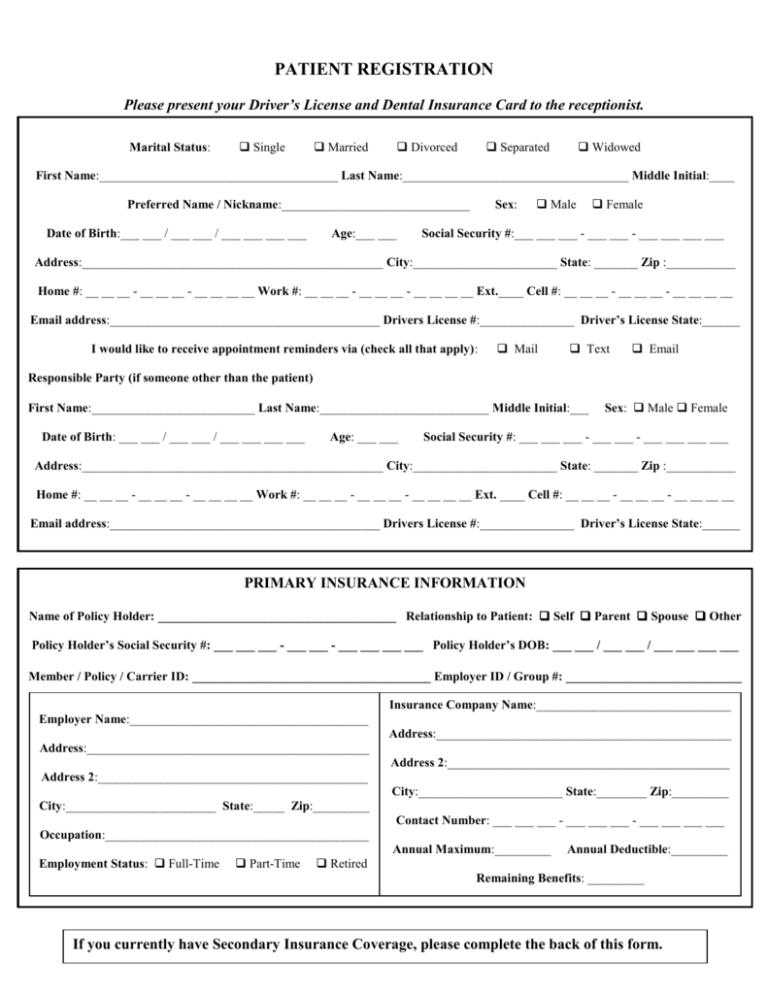

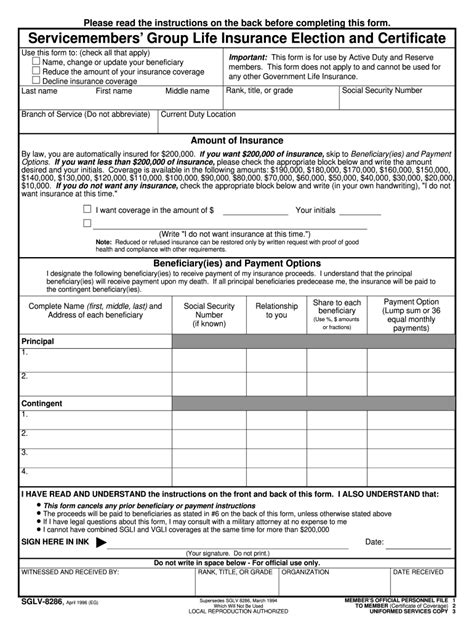

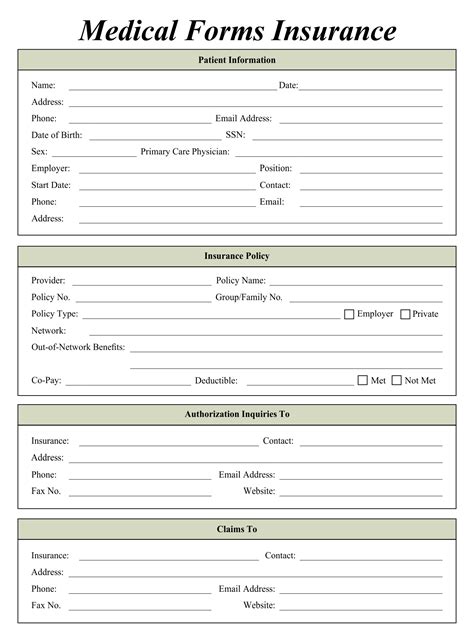

There are several types of paperwork you might encounter when dealing with Kay Insurance. These include: - Application Forms: These are the initial documents you fill out when applying for a new policy. They require personal and financial information to assess your risk profile and determine your premium. - Policy Documents: Once your application is approved, you will receive policy documents that outline the terms and conditions of your insurance coverage, including what is covered, the premium amount, and the duration of the policy. - Claims Forms: If you need to make a claim, you will be required to fill out a claims form. This form will ask for details about the incident or event that led to the claim, and you may need to provide supporting documentation such as police reports, medical bills, or estimates for repairs. - Renewal Notices: Before your policy expires, Kay Insurance will send you a renewal notice. This document will inform you about the upcoming expiry of your policy and provide instructions on how to renew it, including any changes to the premium or terms.

How to Navigate the Paperwork Process

Navigating the paperwork process with Kay Insurance can seem daunting, but with the right approach, it can be managed efficiently. Here are some steps to follow: - Read Carefully: Before filling out any form, read it carefully. Understand what information is being requested and why. - Fill Out Forms Accurately: Ensure that all information provided is accurate and complete. Inaccurate or incomplete information can lead to delays or even the rejection of your application or claim. - Keep Records: Keep a copy of all paperwork related to your insurance policy. This includes application forms, policy documents, claims forms, and renewal notices. - Seek Help When Needed: If you are unsure about any part of the paperwork process, don’t hesitate to seek help. Kay Insurance customer service can provide guidance and support.

Common Challenges and Solutions

Despite the best intentions, challenges can arise during the paperwork process. Here are some common issues and their solutions: - Lost Documents: If you lose any important insurance documents, contact Kay Insurance immediately. They can provide you with replacements or guide you on how to obtain them. - Deadline Missed: If you miss a deadline for submitting paperwork, such as a claims form or renewal notice, reach out to Kay Insurance. They may be able to provide an extension or offer guidance on the next steps. - Disputes: If you disagree with a decision made by Kay Insurance regarding your policy or claim, you have the right to dispute it. Start by contacting their customer service department to understand their dispute resolution process.

📝 Note: Always keep a record of your communications with Kay Insurance, including dates, times, and the details of what was discussed. This can be helpful if you need to refer back to previous conversations or if there are any disputes.

Technology and Paperwork

In recent years, technology has significantly impacted the way insurance paperwork is handled. Many insurance companies, including Kay Insurance, offer digital platforms where you can access your policy documents, submit claims, and even sign documents electronically. This not only reduces the amount of physical paperwork but also makes the process more efficient and environmentally friendly.

| Service | Description |

|---|---|

| Online Portal | A secure website where policyholders can view their policy documents, pay premiums, and submit claims. |

| Mobile App | A mobile application that allows policyholders to access their insurance information on the go, including submitting claims and viewing policy details. |

| Electronic Signatures | The ability to sign documents electronically, reducing the need for physical paperwork and making the process more efficient. |

Final Thoughts

In conclusion, navigating the paperwork requirements of Kay Insurance or any insurance provider can seem complex, but with the right approach, it can be straightforward. Understanding the types of paperwork, how to fill them out accurately, and where to seek help when needed are key to a smooth experience. As technology continues to evolve, the process is becoming more digital and user-friendly, aiming to reduce hassle and increase efficiency for policyholders.

What types of paperwork do I need to buy insurance from Kay Insurance?

+

To buy insurance from Kay Insurance, you typically need to fill out an application form, which may require personal and financial information to assess your risk profile.

How do I submit a claim to Kay Insurance?

+

To submit a claim, you will need to fill out a claims form and provide supporting documentation such as police reports, medical bills, or estimates for repairs, depending on the type of claim.

Can I access my policy documents online?

+

Yes, Kay Insurance likely offers an online portal or mobile app where you can access your policy documents, submit claims, and manage your account digitally.