Iowa Tax Abatement Paperwork Signing Requirements

Introduction to Iowa Tax Abatement

The state of Iowa offers various tax abatement programs to encourage economic development, job creation, and investment in the state. These programs provide tax incentives to businesses, individuals, and organizations that meet specific criteria. One of the key aspects of these programs is the paperwork signing requirements, which can be complex and require careful attention to detail. In this article, we will explore the Iowa tax abatement paperwork signing requirements and provide guidance on how to navigate the process.

Types of Tax Abatements in Iowa

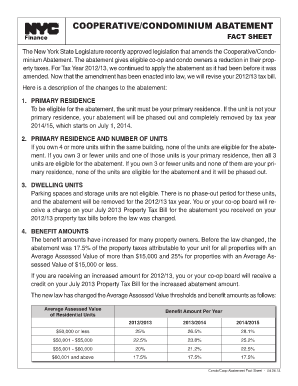

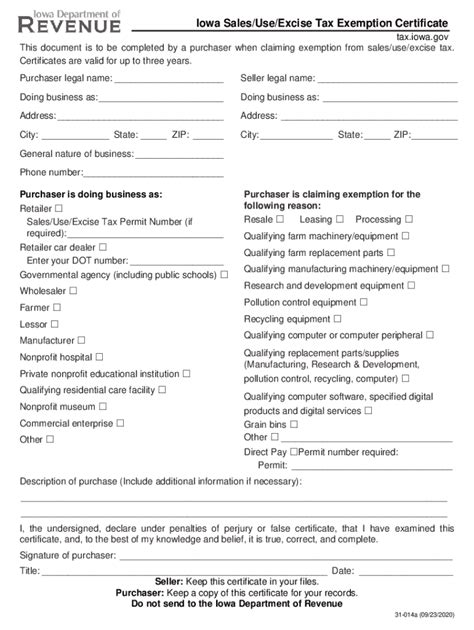

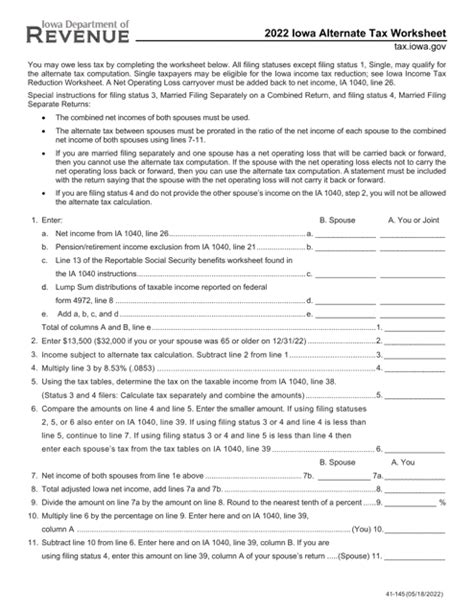

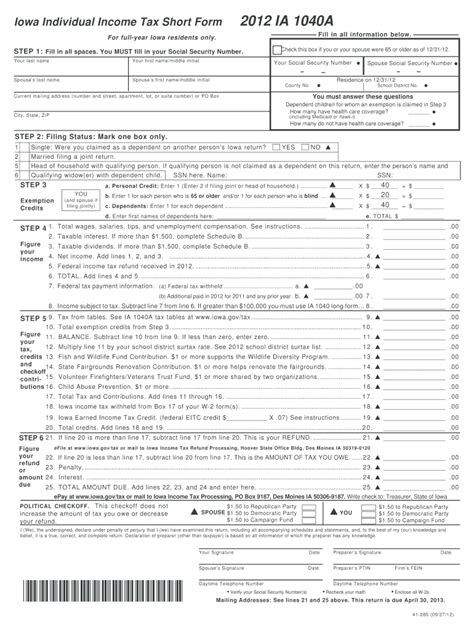

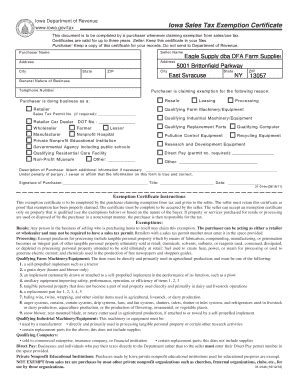

Iowa offers several types of tax abatements, including: * Property Tax Abatement: This type of abatement provides a reduction in property taxes for a specified period. * Income Tax Abatement: This type of abatement provides a reduction in income taxes for a specified period. * Sales Tax Abatement: This type of abatement provides a reduction in sales taxes for a specified period. Each type of abatement has its own set of requirements and paperwork signing requirements.

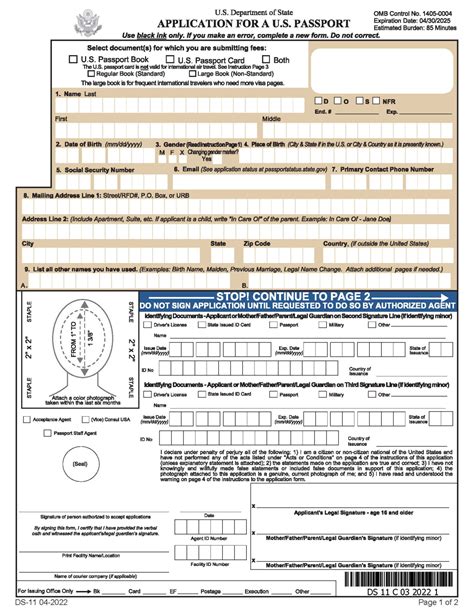

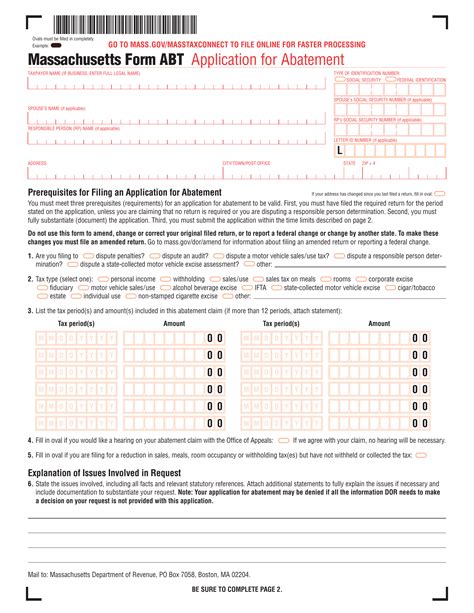

Paperwork Signing Requirements

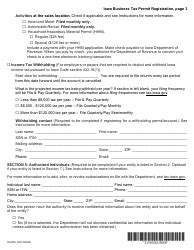

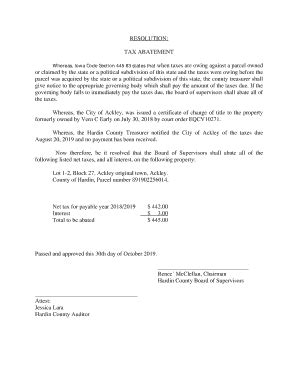

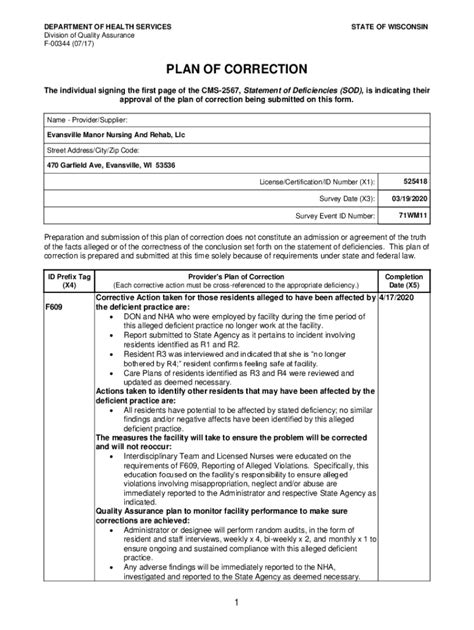

The paperwork signing requirements for Iowa tax abatements vary depending on the type of abatement and the specific program. However, there are some general requirements that apply to most programs. These include: * Application: The applicant must submit a completed application form, which includes providing detailed information about the project, including the location, type of project, and estimated cost. * Agreement: The applicant must sign an agreement that outlines the terms and conditions of the abatement, including the amount of the abatement, the duration of the abatement, and any requirements for reporting and compliance. * Resolution: The applicant must obtain a resolution from the local governing body, such as a city council or county board of supervisors, approving the abatement. * Notification: The applicant must notify the Iowa Department of Revenue and the local assessor’s office of the abatement.

📝 Note: The applicant should carefully review the paperwork signing requirements for the specific program they are applying for, as the requirements may vary.

Steps to Complete the Paperwork

To complete the paperwork for an Iowa tax abatement, the applicant should follow these steps: * Step 1: Review the program requirements and eligibility criteria to ensure that the project meets the necessary conditions. * Step 2: Complete the application form and gather all required supporting documentation. * Step 3: Submit the application and supporting documentation to the Iowa Department of Revenue or the local governing body, depending on the program. * Step 4: Obtain a resolution from the local governing body approving the abatement. * Step 5: Sign the agreement outlining the terms and conditions of the abatement. * Step 6: Notify the Iowa Department of Revenue and the local assessor’s office of the abatement.

Benefits of Iowa Tax Abatements

Iowa tax abatements can provide significant benefits to businesses, individuals, and organizations, including: * Reduced Tax Liability: The abatement can reduce the amount of taxes owed, freeing up funds for investment and growth. * Increased Cash Flow: The abatement can provide a source of cash flow, which can be used to finance new projects or expand existing operations. * Job Creation: The abatement can encourage job creation and economic development, which can have a positive impact on the local community.

Conclusion

In summary, Iowa tax abatements can provide significant benefits to businesses, individuals, and organizations. However, the paperwork signing requirements can be complex and require careful attention to detail. By understanding the requirements and following the steps outlined in this article, applicants can navigate the process and take advantage of the benefits offered by Iowa tax abatements. The key is to carefully review the program requirements, complete the application and supporting documentation, and obtain the necessary approvals and notifications.

What is the purpose of the Iowa tax abatement program?

+

The purpose of the Iowa tax abatement program is to encourage economic development, job creation, and investment in the state by providing tax incentives to businesses, individuals, and organizations that meet specific criteria.

What types of tax abatements are available in Iowa?

+

Iowa offers several types of tax abatements, including property tax abatement, income tax abatement, and sales tax abatement.

What are the paperwork signing requirements for Iowa tax abatements?

+

The paperwork signing requirements for Iowa tax abatements include submitting a completed application form, signing an agreement outlining the terms and conditions of the abatement, obtaining a resolution from the local governing body, and notifying the Iowa Department of Revenue and the local assessor’s office.