5 Tips Quarterly Taxes

Understanding Quarterly Taxes: A Beginner’s Guide

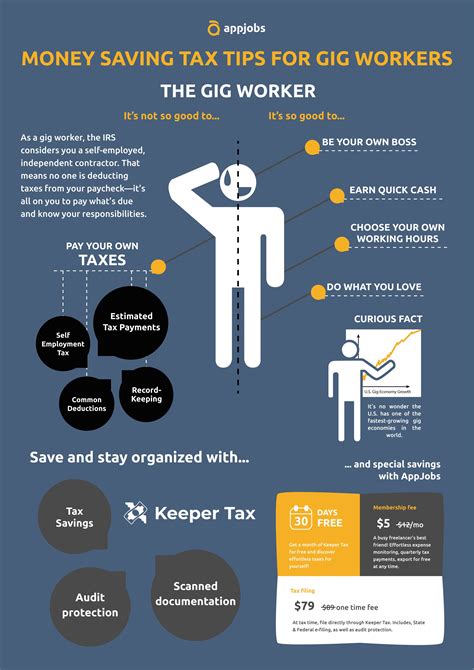

As a self-employed individual or a business owner, managing your finances effectively is crucial for the success and sustainability of your venture. One of the key aspects of financial management is understanding and navigating the complex world of taxes. For many, the concept of quarterly taxes can be daunting, especially for those who are new to the self-employment tax landscape. In this article, we will delve into the world of quarterly taxes, exploring what they are, who needs to pay them, and most importantly, providing you with 5 invaluable tips to manage your quarterly taxes efficiently.

What Are Quarterly Taxes?

Quarterly taxes, also known as estimated taxes, are payments made each quarter to the Internal Revenue Service (IRS) by individuals who expect to owe $1,000 or more in taxes for the year. This includes self-employed individuals, freelancers, independent contractors, and small business owners. The purpose of quarterly taxes is to prepay a portion of your annual tax liability in quarterly installments, rather than paying your entire tax bill when you file your annual tax return.

Who Needs to Pay Quarterly Taxes?

Not everyone is required to pay quarterly taxes. Generally, individuals who receive a regular salary and have taxes withheld by their employer do not need to make estimated tax payments. However, if you are in any of the following categories, you likely need to make quarterly tax payments: - Self-employed individuals - Freelancers - Independent contractors - Small business owners - Individuals with significant investment income - Those who have withdrawn money from their retirement accounts

5 Tips for Managing Quarterly Taxes

Managing quarterly taxes can seem overwhelming, but with the right strategies, you can ensure you’re meeting your tax obligations without undue stress. Here are five tips to help you navigate the process:

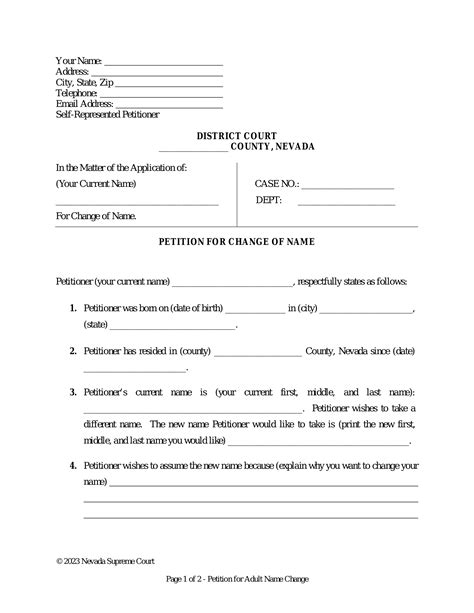

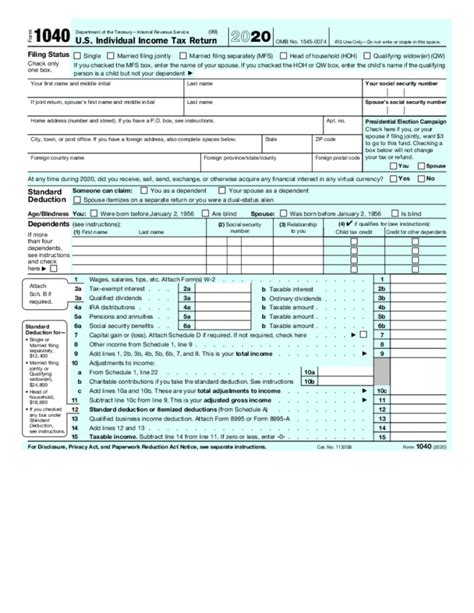

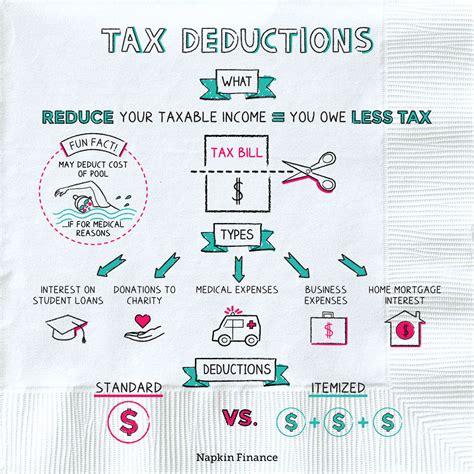

Understand Your Tax Obligations: The first step in managing your quarterly taxes is understanding how much you need to pay. This involves estimating your annual tax liability. You can use Form 1040-ES to calculate your estimated taxes. It’s essential to be as accurate as possible to avoid penalties for underpayment.

Keep Accurate Records: Keeping accurate and detailed records of your income and expenses is crucial for estimating your tax liability. Invest in a good accounting system or software that can help you track your finances. This will make it easier to fill out your quarterly tax forms and ensure you’re taking advantage of all the deductions you’re eligible for.

Make Timely Payments: The IRS has specific due dates for quarterly tax payments: April 15th for the first quarter, June 15th for the second quarter, September 15th for the third quarter, and January 15th of the following year for the fourth quarter. Missing these deadlines can result in penalties, so it’s essential to make your payments on time.

Adjust Your Payments as Needed: Your financial situation may change throughout the year. If you experience fluctuations in income or have changes in your business expenses, you may need to adjust your estimated tax payments accordingly. The IRS allows you to annualize your income if you experience a fluctuation, which can help you avoid penalties for underpayment.

Seek Professional Help: If you’re new to quarterly taxes or find the process confusing, it might be beneficial to seek help from a tax professional. They can provide guidance on estimating your tax liability, help with filling out forms, and ensure you’re in compliance with all tax laws and regulations.

📝 Note: It's always a good idea to review the IRS website for the most current information and deadlines regarding quarterly taxes, as these can change.

Additional Considerations

In addition to the tips provided, it’s also important to consider the following: - Annual Filings: Even if you make quarterly payments, you’re still required to file an annual tax return. This is where you reconcile your estimated payments with your actual tax liability. - Penalties for Underpayment: If you underpay your estimated taxes, you may be subject to penalties. However, if you follow the guidelines and make timely payments based on your estimated tax liability, you can avoid these penalties. - State Taxes: Some states also require quarterly tax payments. Check with your state’s tax authority to understand their requirements and deadlines.

| Quarter | Due Date |

|---|---|

| First Quarter (January 1 - March 31) | April 15th |

| Second Quarter (April 1 - May 31) | June 15th |

| Third Quarter (June 1 - August 31) | September 15th |

| Fourth Quarter (September 1 - December 31) | January 15th of the following year |

As we reflect on the information provided, it becomes clear that managing quarterly taxes, while it may seem daunting at first, can be approached systematically. By understanding your tax obligations, keeping accurate records, making timely payments, adjusting your payments as needed, and seeking professional help when required, you can navigate the world of quarterly taxes with confidence. Remember, staying informed and adapting to changes in your financial situation and tax laws is key to successfully managing your quarterly taxes.

What is the purpose of quarterly taxes?

+

The purpose of quarterly taxes is to prepay a portion of your annual tax liability in quarterly installments, ensuring you meet your tax obligations throughout the year.

Who is required to pay quarterly taxes?

+

Self-employed individuals, freelancers, independent contractors, small business owners, and those with significant investment income are generally required to make quarterly tax payments.

How do I calculate my estimated tax payments?

+

You can use Form 1040-ES to estimate your tax liability. It’s essential to be as accurate as possible to avoid penalties for underpayment.