5 Tax Paperwork Rights

Understanding Your Rights with Tax Paperwork

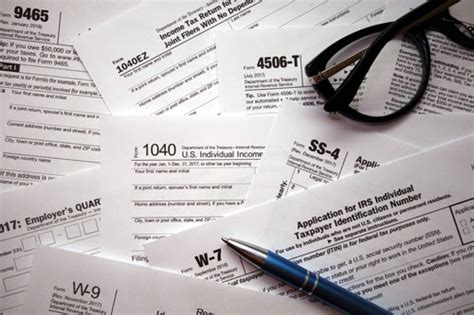

When dealing with tax paperwork, it’s essential to understand your rights as a taxpayer. The tax system can be complex and overwhelming, but knowing your rights can help you navigate the process with confidence. In this article, we will explore five key rights related to tax paperwork that you should be aware of.

Right to Clear and Concise Communication

The first right is the right to clear and concise communication from the tax authority. This means that any communication you receive from the tax authority, including tax paperwork, should be easy to understand and free from ambiguity. Clear communication is crucial in ensuring that you can comply with tax requirements without confusion or misinterpretation. If you receive any tax paperwork that you don’t understand, you have the right to request clarification or seek help from a tax professional.

Right to Privacy and Confidentiality

The second right is the right to privacy and confidentiality. Your tax information is sensitive and should be treated as such. The tax authority has a duty to protect your personal and financial information from unauthorized access or disclosure. When submitting tax paperwork, you should ensure that you are using secure methods, such as encrypted online portals or sealed envelopes, to protect your information. Privacy and confidentiality are essential in maintaining trust between taxpayers and the tax authority.

Right to Appeal and Dispute

The third right is the right to appeal and dispute any tax decisions or assessments. If you receive tax paperwork that you disagree with, such as a tax bill or a notice of audit, you have the right to appeal or dispute the decision. This right allows you to challenge any errors or inaccuracies in your tax assessment and ensures that you are treated fairly. When appealing or disputing a tax decision, it’s essential to follow the correct procedures and deadlines to ensure that your case is heard.

Right to Representation

The fourth right is the right to representation. When dealing with tax paperwork, you have the right to seek professional help or representation from a tax expert or attorney. This right is essential in ensuring that your interests are protected and that you receive the best possible outcome. A tax professional can help you navigate the complex tax system, identify potential errors or issues, and represent you in any dealings with the tax authority.

Right to Transparency and Accountability

The fifth right is the right to transparency and accountability. The tax authority has a duty to be transparent in its dealings with taxpayers and to provide clear and concise information about tax requirements and procedures. This right also ensures that the tax authority is accountable for its actions and decisions, and that you have access to information about how your tax money is being used. Transparency and accountability are essential in maintaining trust and confidence in the tax system.

Some key points to remember when dealing with tax paperwork include: * Always keep accurate and detailed records of your tax-related documents and correspondence. * Ensure that you understand your tax obligations and requirements. * Seek professional help or representation if you are unsure or uncomfortable with any aspect of the tax process. * Be aware of your rights and don’t hesitate to assert them if you feel that they are being violated.

📝 Note: It's essential to stay informed about your rights and obligations as a taxpayer to avoid any potential issues or penalties.

In summary, understanding your rights with tax paperwork is crucial in ensuring that you are treated fairly and that your interests are protected. By knowing your rights, you can navigate the complex tax system with confidence and avoid any potential issues or penalties. Whether you are dealing with tax returns, audits, or appeals, it’s essential to remember that you have the right to clear communication, privacy and confidentiality, appeal and dispute, representation, and transparency and accountability.

What are my rights as a taxpayer when dealing with tax paperwork?

+

As a taxpayer, you have the right to clear and concise communication, privacy and confidentiality, appeal and dispute, representation, and transparency and accountability.

How can I ensure that my tax paperwork is accurate and complete?

+

To ensure that your tax paperwork is accurate and complete, always keep accurate and detailed records, seek professional help if needed, and double-check your documents for any errors or omissions.

What should I do if I receive a tax bill or notice that I disagree with?

+

If you receive a tax bill or notice that you disagree with, you should follow the correct procedures and deadlines to appeal or dispute the decision. It’s essential to seek professional help or representation to ensure that your case is heard and that you receive the best possible outcome.