Power of Attorney Payment Rules

Introduction to Power of Attorney Payment Rules

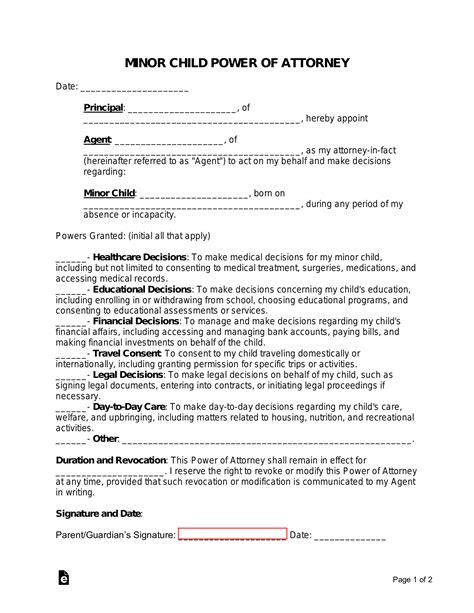

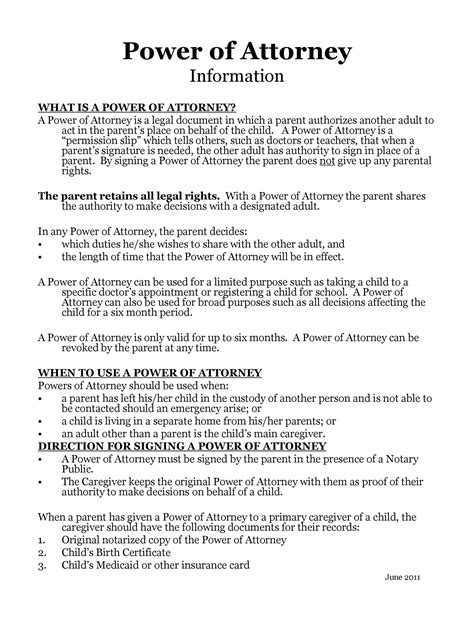

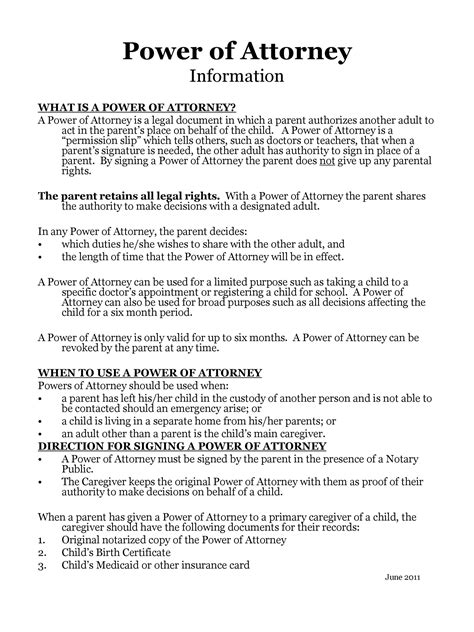

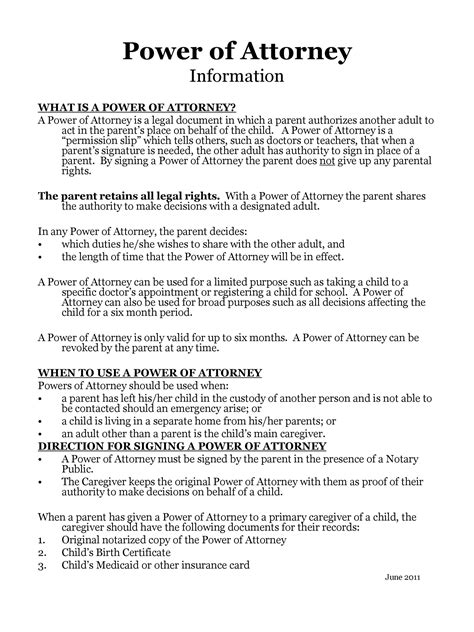

When an individual grants a Power of Attorney (POA) to another person, it allows the agent to manage their financial and legal affairs. This is particularly useful when the grantor is unable to handle these matters themselves due to illness, disability, or absence. However, with this authority comes significant responsibility, especially regarding financial transactions and payments. Understanding the rules and guidelines surrounding Power of Attorney payment rules is crucial to ensure that the agent acts in the best interest of the grantor and complies with legal requirements.

Key Principles of Power of Attorney Payment Rules

The primary goal of a Power of Attorney is to allow the agent to act on behalf of the grantor in a way that is consistent with the grantor’s wishes and best interests. When it comes to payments, the agent must follow certain principles to avoid any potential legal or financial issues. These principles include: - Acting in the Best Interest: The agent must make decisions that benefit the grantor, avoiding any actions that could be seen as self-serving or detrimental to the grantor’s financial well-being. - Accountability and Transparency: The agent should keep detailed records of all financial transactions, including payments, to ensure transparency and accountability. - Compliance with the Grantor’s Instructions: If the grantor has provided specific instructions regarding financial matters, the agent must adhere to these guidelines.

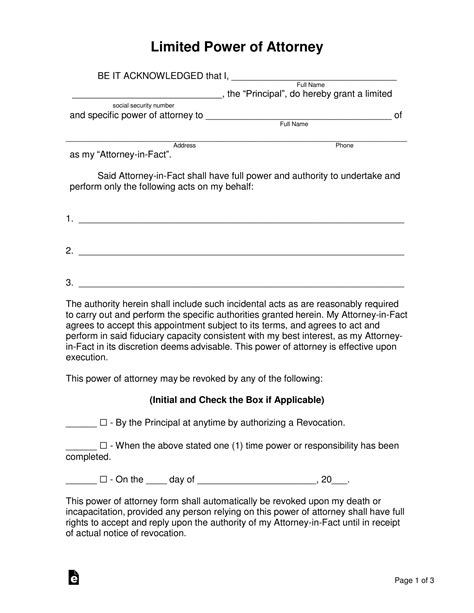

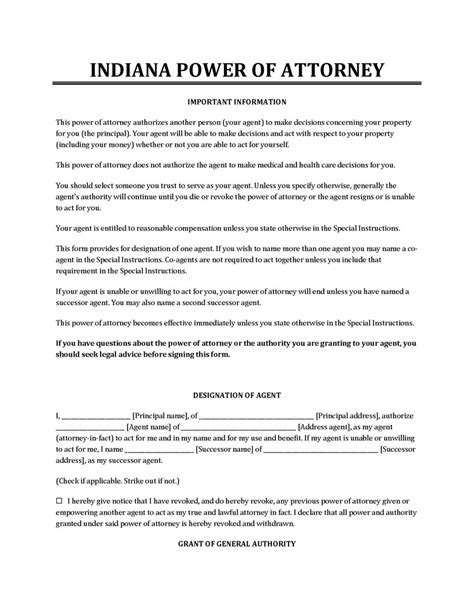

Types of Power of Attorney and Their Implications on Payment Rules

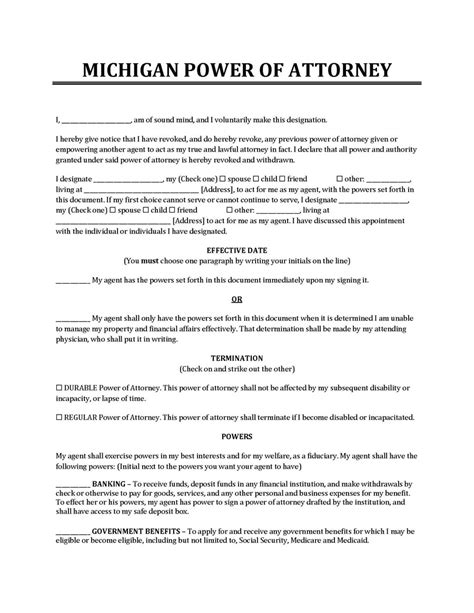

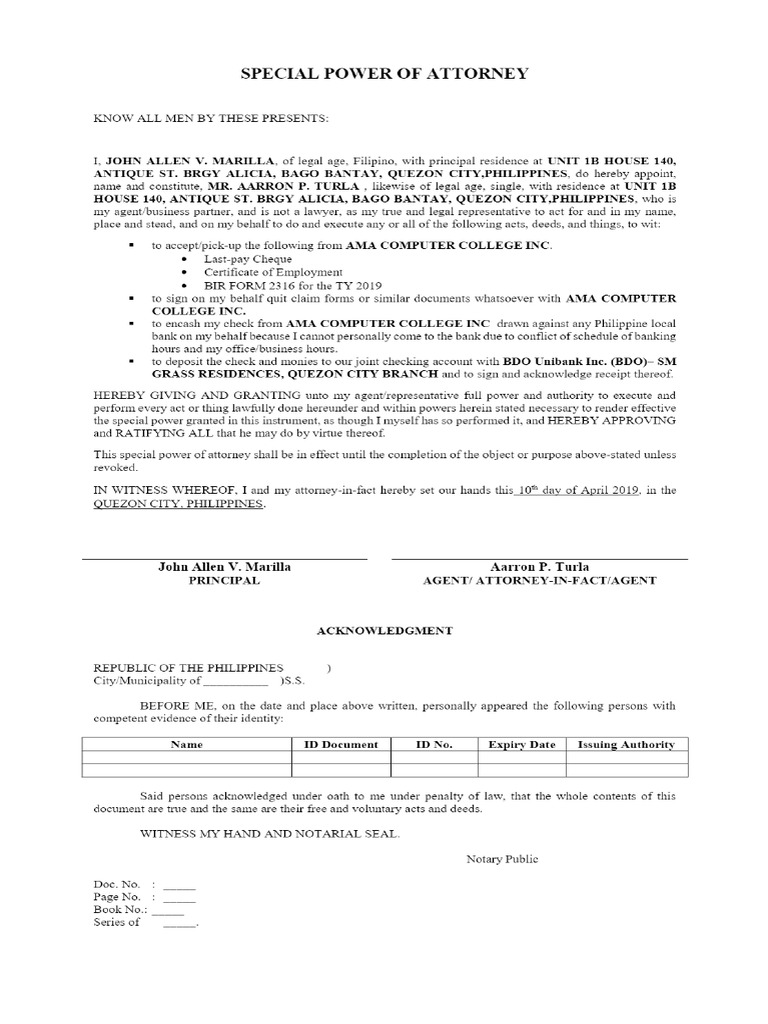

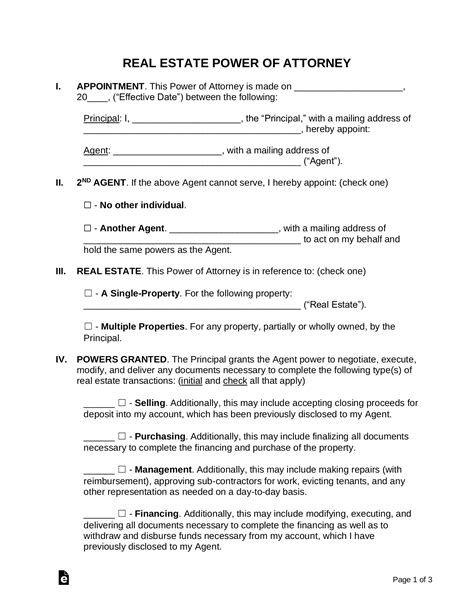

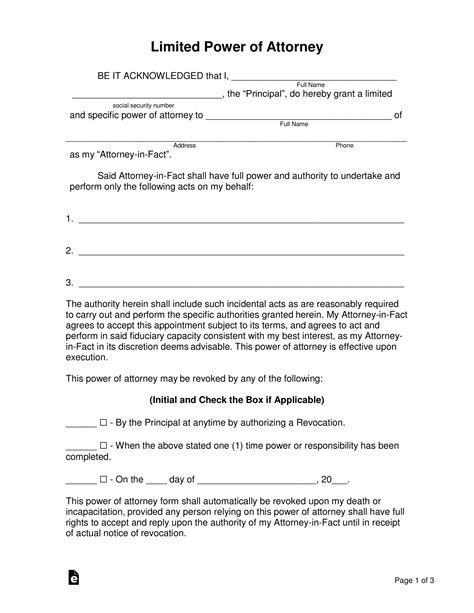

There are several types of Power of Attorney, each with its own implications for payment rules: - General Power of Attorney: Grants broad powers to the agent, allowing them to manage all aspects of the grantor’s financial affairs. This includes making payments on behalf of the grantor. - Special Power of Attorney: Limits the agent’s powers to specific financial tasks or decisions, such as managing a particular bank account or making certain types of payments. - Durable Power of Attorney: Remains in effect even if the grantor becomes incapacitated, ensuring continuity in financial management and payment decisions. - Springing Power of Attorney: Becomes effective only upon the occurrence of a specified event, such as the grantor’s incapacitation, and is often used to manage payments and financial affairs at that time.

Payment Rules and Responsibilities

Agents operating under a Power of Attorney have several responsibilities when it comes to making payments: - Authorization: The agent must ensure they are authorized to make the payment under the terms of the POA. - Beneficial Payments: Payments should be made in the best interest of the grantor, such as paying bills, taxes, and expenses necessary for the grantor’s well-being. - Record Keeping: Maintaining accurate and detailed records of all payments is essential for accountability and transparency. - Tax Compliance: The agent must also consider tax implications of payments and ensure compliance with relevant tax laws.

Challenges and Considerations

Despite the benefits of a Power of Attorney, there are challenges and considerations that both the grantor and the agent must be aware of: - Potential for Abuse: The power granted to the agent can be abused if not monitored properly, highlighting the importance of choosing a trustworthy agent. - Legal and Financial Complexity: Navigating the legal and financial aspects of a Power of Attorney can be complex, making it advisable to seek professional advice when necessary. - Emotional Considerations: Granting a Power of Attorney can be an emotionally challenging decision, as it involves relinquishing control over personal and financial affairs.

Best Practices for Agents

To fulfill their responsibilities effectively and avoid potential issues, agents should follow best practices such as: - Seeking Professional Advice: When unsure about any aspect of the Power of Attorney or financial decisions. - Maintaining Open Communication: With the grantor, when possible, and with other relevant parties such as family members or financial institutions. - Staying Organized: Keeping all financial records and documents related to the Power of Attorney in order.

| Type of Power of Attorney | Description | Implications for Payment Rules |

|---|---|---|

| General Power of Attorney | Grants broad financial management powers | Broad authority to make payments |

| Special Power of Attorney | Limits powers to specific financial tasks | Limited authority to make payments, restricted to specified tasks |

| Durable Power of Attorney | Remains in effect if the grantor becomes incapacitated | Continuity in payment decisions and financial management |

| Springing Power of Attorney | Becomes effective upon a specified event | Payment authority begins upon the occurrence of the specified event |

📝 Note: It's essential for both grantors and agents to understand the specific terms and limitations of the Power of Attorney they are dealing with, as well as the legal requirements and best practices that apply to their situation.

In summary, the power of attorney payment rules are designed to protect the grantor’s interests while allowing the agent to manage their financial affairs effectively. By understanding the types of Power of Attorney, the responsibilities and challenges involved, and following best practices, agents can fulfill their roles with confidence and integrity. This understanding is crucial for navigating the complex legal and financial landscape surrounding Power of Attorney and ensuring that the grantor’s wishes are respected and their well-being is protected.

What is the main purpose of a Power of Attorney?

+

The main purpose of a Power of Attorney is to allow an agent to act on behalf of the grantor in managing their financial and legal affairs, especially when the grantor is unable to do so themselves.

What are the different types of Power of Attorney?

+

There are several types, including General, Special, Durable, and Springing Power of Attorney, each with its own scope of authority and implications for payment rules.

What are the responsibilities of an agent under a Power of Attorney?

+

The agent’s responsibilities include acting in the best interest of the grantor, maintaining detailed records of financial transactions, and complying with the grantor’s instructions and legal requirements.