Paperwork

Request Original School Loan Paperwork

Introduction to Requesting Original School Loan Paperwork

When dealing with school loans, it’s essential to have all the necessary documents in order. One crucial step in managing your school loans is requesting the original paperwork. This can be necessary for various reasons, such as consolidating loans, applying for forgiveness programs, or simply understanding the terms of your loan. In this article, we will guide you through the process of requesting your original school loan paperwork, highlighting the importance of these documents and providing step-by-step instructions on how to obtain them.

Why Request Original School Loan Paperwork?

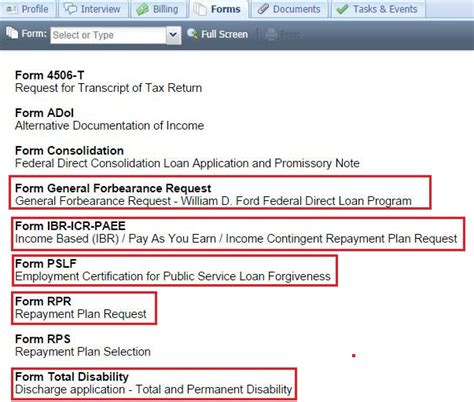

Requesting your original school loan paperwork is a significant step in taking control of your financial obligations. Here are a few reasons why you might need to request this documentation: - Loan Consolidation: If you’re planning to consolidate your loans, you’ll likely need the original paperwork to understand the terms of each loan, including interest rates and repayment schedules. - Forgiveness Programs: Some loan forgiveness programs require detailed information about your loans, which can only be found in the original paperwork. - Repayment Plans: Understanding your loan terms is crucial for choosing the right repayment plan. The original paperwork will contain vital information such as the loan amount, interest rate, and repayment terms.

Steps to Request Original School Loan Paperwork

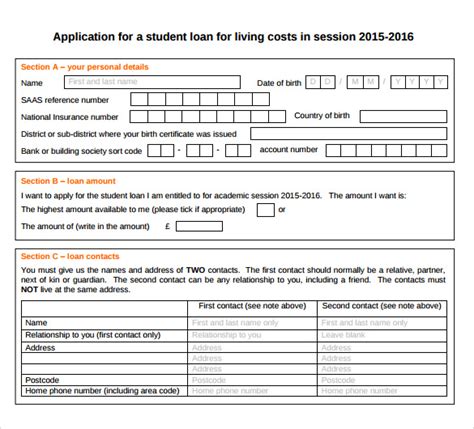

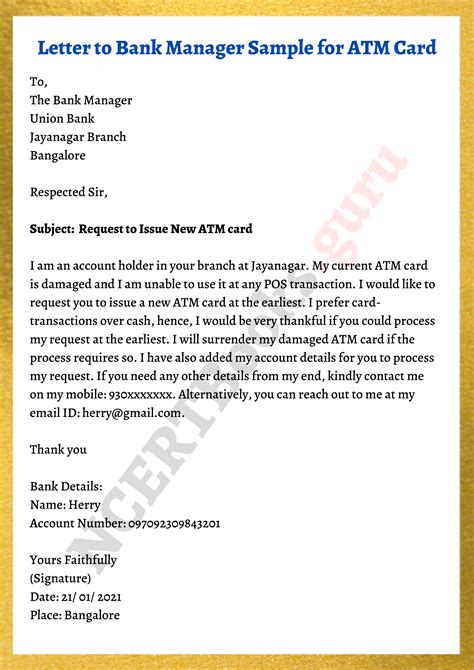

Requesting your original school loan paperwork involves several steps. It’s crucial to follow these steps carefully to ensure you receive the necessary documents: 1. Identify Your Loan Servicer: The first step is to identify who your loan servicer is. Your loan servicer is the company that manages your loan and handles payments. You can find this information by checking your loan statements or the National Student Loan Data System (NSLDS) for federal loans. 2. Contact Your Loan Servicer: Once you’ve identified your loan servicer, you’ll need to contact them. They usually have a customer service number or an email address where you can submit your request. Be prepared to provide your loan account number and other identifying information. 3. Submit Your Request: Clearly state your request for the original loan paperwork. Be specific about which documents you need, such as the Master Promissory Note (MPN) or the loan disclosure statements. 4. Follow Up: After submitting your request, follow up with your loan servicer to ensure they have received your request and to inquire about the status of your documents.

Understanding Your Loan Documents

Once you receive your original school loan paperwork, it’s essential to understand what each document means. Key documents include: - Master Promissory Note (MPN): This is your promise to repay your loan. It includes the terms and conditions of your loan. - Loan Disclosure Statements: These statements provide detailed information about your loan, including the loan amount, interest rate, and repayment terms.

Managing Your School Loans

Managing your school loans effectively requires a thorough understanding of your loan terms and conditions. Here are some tips to help you manage your loans: - Keep Detailed Records: Keep all your loan documents in a safe place. This will help you refer to them when needed. - Stay in Touch with Your Loan Servicer: Regular communication with your loan servicer can help you stay on top of your loan repayments and avoid any issues. - Explore Repayment Options: There are several repayment options available, including income-driven repayment plans. Research these options to find the one that best suits your financial situation.

💡 Note: Always keep your loan documents secure to protect your personal and financial information.

Conclusion and Final Thoughts

In conclusion, requesting your original school loan paperwork is a crucial step in managing your financial obligations. By understanding the process and the importance of these documents, you can better navigate the world of school loans. Remember, taking control of your loans starts with having the right information at your fingertips. Stay informed, and don’t hesitate to reach out to your loan servicer when you need assistance.

What is the Master Promissory Note (MPN)?

+

The Master Promissory Note (MPN) is a legal document in which you promise to repay your loan(s) and any accrued interest and fees to the U.S. Department of Education. It also explains the terms and conditions of your loan(s).

How do I find my loan servicer?

+

You can find your loan servicer by checking your loan statements or by logging in to the National Student Loan Data System (NSLDS) for federal loans.

Why is it important to keep my loan documents?

+

Keeping your loan documents is crucial for managing your loans effectively. These documents contain important information about your loan terms, repayment options, and contact information for your loan servicer.