Paperwork

Fannie Mae Bankruptcy Paperwork Requirements

Introduction to Fannie Mae Bankruptcy Paperwork Requirements

When dealing with bankruptcy, particularly in relation to properties financed through Fannie Mae, understanding the required paperwork is crucial for a smooth process. Fannie Mae, or the Federal National Mortgage Association, is a government-sponsored enterprise that provides financing for mortgages. If a homeowner is facing financial difficulties and is considering bankruptcy, they must navigate through specific requirements to avoid foreclosure and manage their debt effectively.

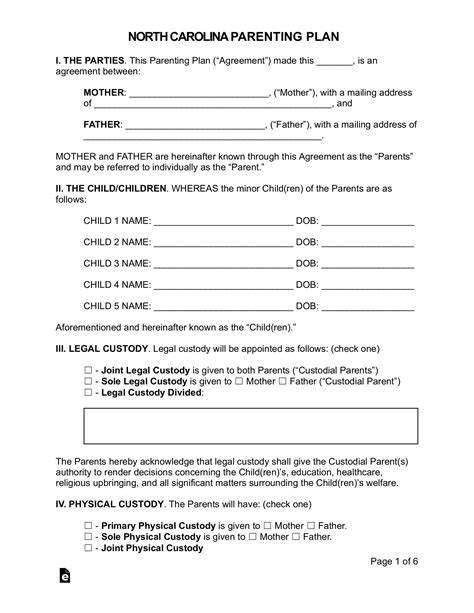

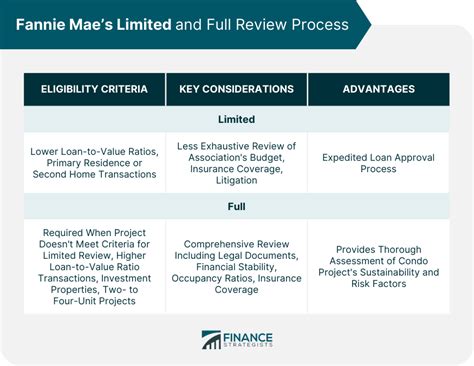

Understanding Bankruptcy Types

There are primarily two types of bankruptcy that individuals can file: Chapter 7 and Chapter 13. Chapter 7 bankruptcy involves the liquidation of assets to pay off debts, while Chapter 13 bankruptcy involves creating a repayment plan to pay off a portion or all of the debts over time. Each type has its own set of requirements and implications for mortgage debt.

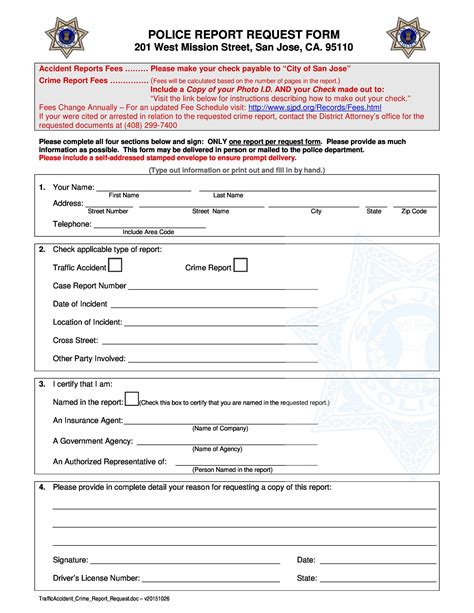

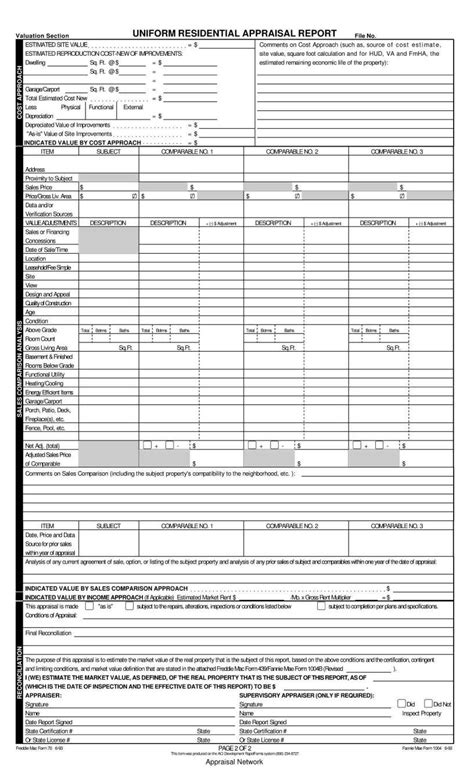

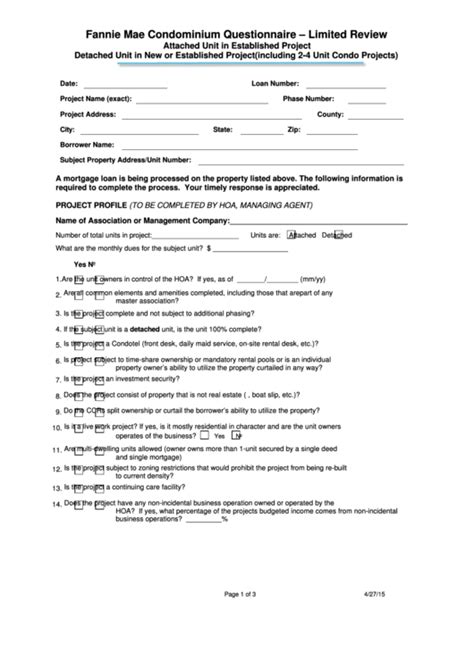

Fannie Mae Bankruptcy Paperwork Requirements

To file for bankruptcy related to a Fannie Mae mortgage, several documents are necessary. These include: - Petition for Bankruptcy: The initial document filed with the court to begin the bankruptcy process. - Schedules and Statement of Financial Affairs: These documents provide detailed information about the debtor’s financial situation, including income, expenses, assets, and debts. - Plan (for Chapter 13): A proposal for how the debtor intends to repay debts over time. - Credit Counseling Certificate: Proof that the debtor has received credit counseling from an approved agency before filing for bankruptcy. - Income Documentation: Proof of income, which can include pay stubs, tax returns, and other financial documents. - Bank Statements and Investment Information: To disclose all financial assets and transactions. - Identification and Social Security Number: To verify the debtor’s identity.

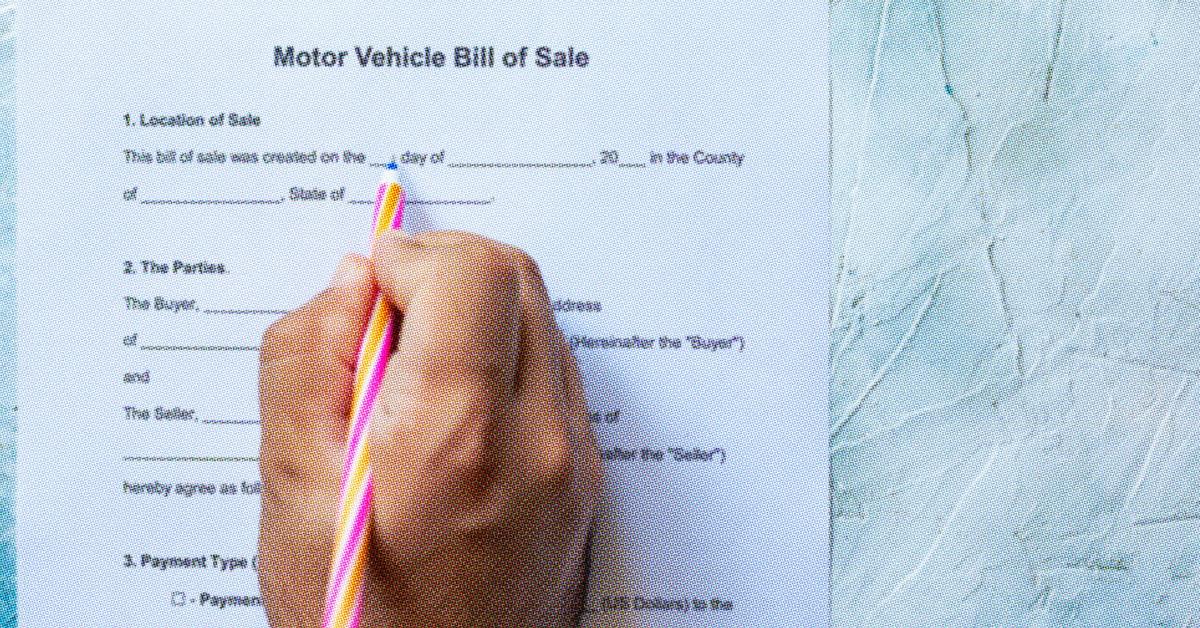

Additional Requirements for Fannie Mae

Fannie Mae may require additional documentation to process the bankruptcy and determine the best course of action for the mortgage. This can include: - Hardship Letter: Explaining the circumstances that led to the bankruptcy filing. - Financial Information: Detailed breakdowns of income, expenses, and any other financial obligations. - Mortgage Statements: Current statements showing the mortgage balance, payment history, and any outstanding fees. - Proof of Insurance: Confirmation that the property is adequately insured.

Process After Filing

After the bankruptcy paperwork is filed, the court will review the documents and may request additional information. For Chapter 7 bankruptcies, the trustee will liquidate non-exempt assets to pay off creditors. For Chapter 13, the debtor will begin making payments according to the approved plan. Fannie Mae will work with the debtor or the court-appointed trustee to determine how the mortgage debt will be handled, which could involve a temporary suspension of payments, a loan modification, or ultimately, foreclosure if the debt cannot be resolved.

Implications for Credit Score

Bankruptcy has significant implications for a debtor’s credit score. A bankruptcy filing can remain on a credit report for up to 10 years, affecting the ability to secure new credit, including mortgages. However, by following the repayment plan and making timely payments, individuals can begin to rebuild their credit over time.

📝 Note: It's essential to consult with a bankruptcy attorney to understand the specific requirements and implications of filing for bankruptcy related to a Fannie Mae mortgage, as laws and regulations can vary by state and change over time.

Rebuilding Credit After Bankruptcy

Rebuilding credit after a bankruptcy involves demonstrating responsible financial behavior over time. This can be achieved by: - Making all payments on time. - Keeping credit utilization low. - Monitoring credit reports for errors. - Avoiding new debt. - Considering a secured credit card or becoming an authorized user on someone else’s credit account to begin rebuilding credit history.

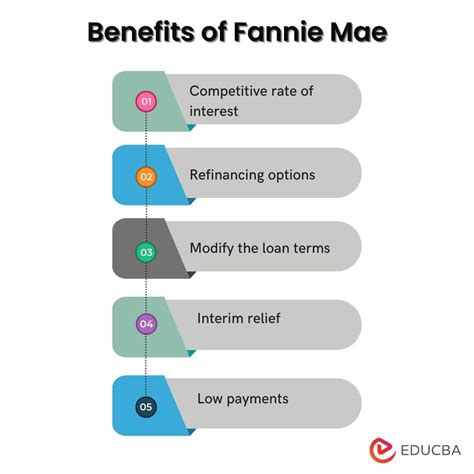

Conclusion and Final Thoughts

Navigating the process of bankruptcy related to a Fannie Mae mortgage requires careful consideration and adherence to specific paperwork requirements. By understanding the types of bankruptcy, the necessary documents, and the process after filing, individuals can better manage their debt and work towards financial recovery. It’s also important to look beyond the immediate resolution of debt and plan for rebuilding credit and financial stability in the long term.

What is the primary difference between Chapter 7 and Chapter 13 bankruptcy?

+

The primary difference is that Chapter 7 involves the liquidation of assets to pay off debts, while Chapter 13 involves creating a repayment plan to pay off debts over time.

How long does a bankruptcy filing remain on a credit report?

+

A bankruptcy filing can remain on a credit report for up to 10 years.

What is required to rebuild credit after bankruptcy?

+

To rebuild credit, one must make timely payments, keep credit utilization low, monitor credit reports, avoid new debt, and consider secured credit cards or becoming an authorized user.