German Customs Electronics Paperwork

Introduction to German Customs Electronics Paperwork

When importing or exporting electronics in Germany, it is essential to understand the customs paperwork required to ensure a smooth and compliant process. The German customs authorities have specific regulations and requirements for the import and export of electronic goods, and failure to comply can result in delays, fines, or even the seizure of goods. In this article, we will delve into the world of German customs electronics paperwork, exploring the necessary documents, procedures, and best practices for businesses and individuals involved in the trade of electronic goods.

Required Documents for German Customs Electronics Paperwork

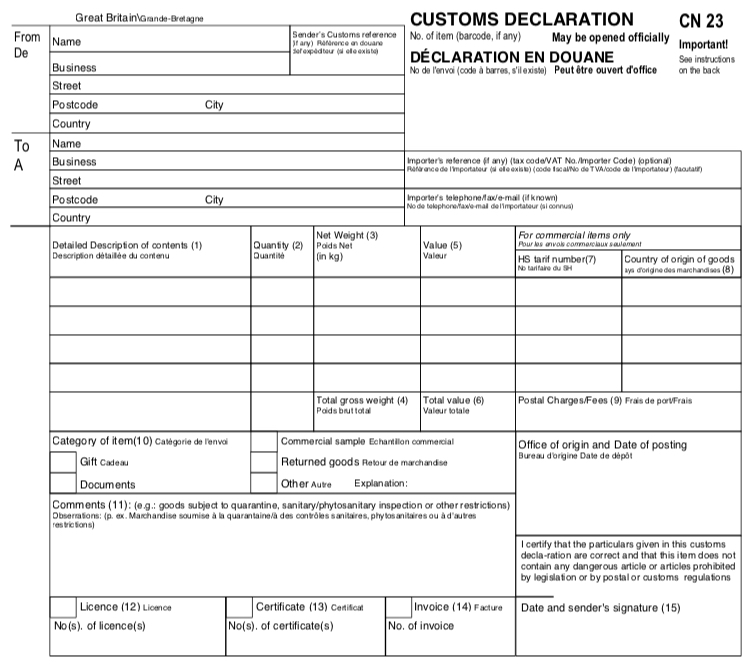

To import or export electronics in Germany, the following documents are typically required: * Commercial Invoice: A document that provides detailed information about the goods being imported or exported, including their value, quantity, and description. * Bill of Lading: A document that serves as a receipt for the goods being transported and provides details about the shipment, such as the shipper, consignee, and cargo. * Packing List: A document that provides a detailed list of the goods being imported or exported, including their weight, dimensions, and packaging. * Certificate of Origin: A document that certifies the country of origin of the goods being imported or exported. * EUR.1 Movement Certificate: A document that certifies the preferential origin of the goods being imported or exported, allowing for reduced or eliminated customs duties. * German Customs Declaration: A document that provides detailed information about the goods being imported or exported, including their value, quantity, and description, as well as the customs duties and taxes payable.

Procedures for German Customs Electronics Paperwork

The procedures for German customs electronics paperwork involve several steps, including: * Registration: The importer or exporter must register with the German customs authorities and obtain an EORI (Economic Operators Registration and Identification) number. * Declaration: The importer or exporter must submit a customs declaration, either electronically or in paper form, providing detailed information about the goods being imported or exported. * Payment of Customs Duties and Taxes: The importer or exporter must pay the applicable customs duties and taxes on the goods being imported or exported. * Clearance: The goods must be cleared through customs, which involves the verification of the customs declaration and the payment of customs duties and taxes.

Best Practices for German Customs Electronics Paperwork

To ensure a smooth and compliant process, the following best practices are recommended: * Accuracy and Completeness: Ensure that all documents are accurate and complete, as errors or omissions can result in delays or fines. * Timeliness: Submit all documents and payments in a timely manner, as delays can result in fines or penalties. * Compliance: Ensure that all goods being imported or exported comply with German customs regulations and requirements. * Record Keeping: Maintain accurate and detailed records of all customs transactions, including documents and payments.

📝 Note: It is essential to stay up-to-date with changes to German customs regulations and requirements, as non-compliance can result in severe penalties and fines.

Challenges and Opportunities in German Customs Electronics Paperwork

The German customs electronics paperwork process can be complex and challenging, particularly for businesses and individuals who are new to the process. However, there are also opportunities for growth and development, such as: * Increased Efficiency: The use of electronic customs declarations and payments can increase efficiency and reduce processing times. * Reduced Costs: Compliance with German customs regulations and requirements can reduce costs associated with delays, fines, and penalties. * Improved Competitiveness: Businesses that are compliant with German customs regulations and requirements can improve their competitiveness in the global market.

| Document | Description |

|---|---|

| Commercial Invoice | A document that provides detailed information about the goods being imported or exported. |

| Bill of Lading | A document that serves as a receipt for the goods being transported and provides details about the shipment. |

| Packing List | A document that provides a detailed list of the goods being imported or exported. |

In summary, German customs electronics paperwork is a complex and challenging process that requires accuracy, completeness, and compliance with regulations and requirements. By understanding the necessary documents, procedures, and best practices, businesses and individuals can ensure a smooth and compliant process, reducing the risk of delays, fines, and penalties. As the global trade landscape continues to evolve, it is essential to stay up-to-date with changes to German customs regulations and requirements, and to capitalize on opportunities for growth and development.

The key points to take away from this article are the importance of accuracy and completeness in customs declarations, the need for compliance with German customs regulations and requirements, and the opportunities for growth and development in the global market. By following best practices and staying informed, businesses and individuals can navigate the complex world of German customs electronics paperwork with confidence and success.

What is the purpose of the Commercial Invoice in German customs electronics paperwork?

+

The Commercial Invoice is a document that provides detailed information about the goods being imported or exported, including their value, quantity, and description.

What is the difference between a Bill of Lading and a Packing List?

+

A Bill of Lading is a document that serves as a receipt for the goods being transported and provides details about the shipment, while a Packing List is a document that provides a detailed list of the goods being imported or exported.

What are the consequences of non-compliance with German customs regulations and requirements?

+

Non-compliance with German customs regulations and requirements can result in delays, fines, and penalties, as well as the seizure of goods.