Paperwork

Incfile Files IRS Nonprofit Paperwork

Introduction to Incfile and Nonprofit Paperwork

When it comes to forming a nonprofit organization, there are several steps that must be taken to ensure that the organization is properly established and recognized by the state and federal governments. One of the key steps in this process is filing the necessary paperwork with the Internal Revenue Service (IRS). Incfile is a company that specializes in helping individuals and organizations form and maintain their businesses, including nonprofits. In this article, we will discuss the process of filing IRS nonprofit paperwork with Incfile.

Understanding Nonprofit Organizations

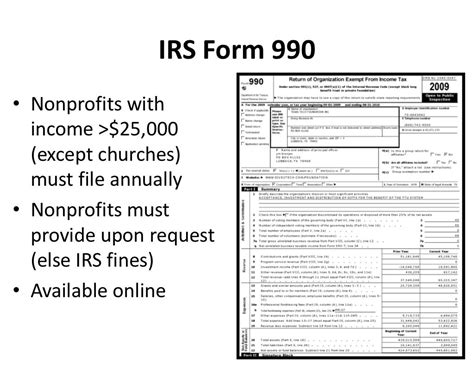

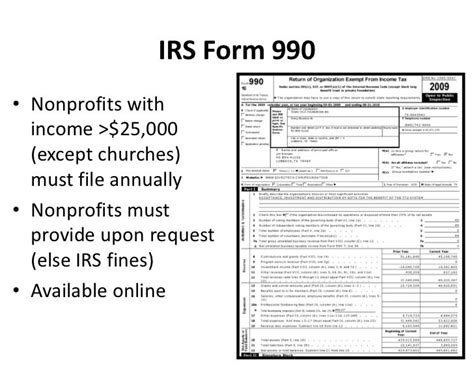

Before we dive into the specifics of filing nonprofit paperwork, it’s essential to understand what a nonprofit organization is. A nonprofit organization is a type of organization that is formed for a purpose other than to make a profit. Nonprofits can be formed for a variety of purposes, including charitable, educational, scientific, and religious purposes. Nonprofits are exempt from paying income tax on their earnings, but they are still required to file annual information returns with the IRS.

The Importance of Filing Nonprofit Paperwork

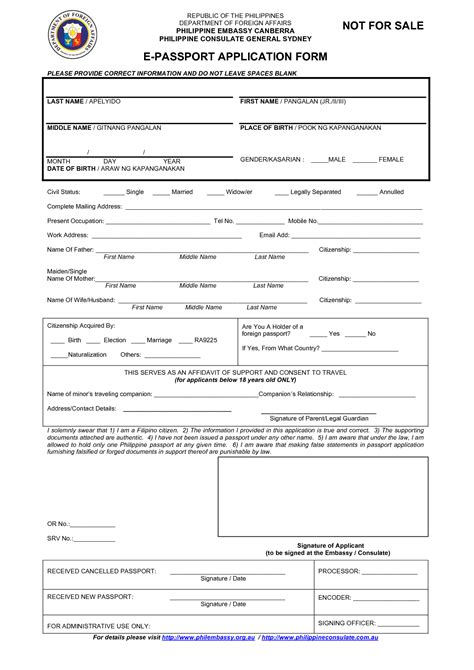

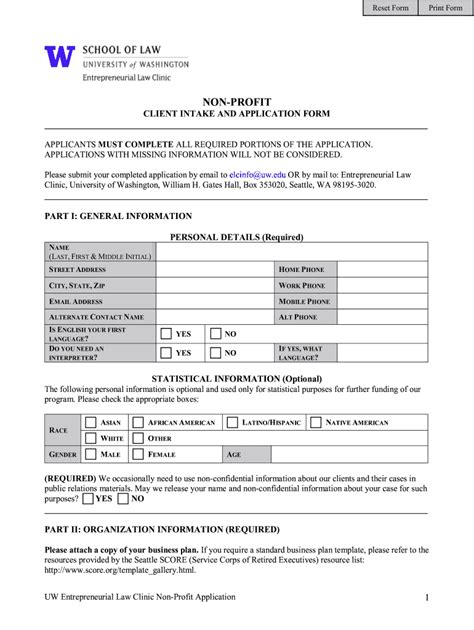

Filing nonprofit paperwork is a critical step in the process of forming a nonprofit organization. The paperwork that must be filed includes the Articles of Incorporation, which is the document that establishes the nonprofit organization, and Form 1023, which is the application for tax-exempt status. Failure to file the necessary paperwork can result in the nonprofit organization being denied tax-exempt status, which can have serious consequences for the organization.

Incfile’s Role in Filing Nonprofit Paperwork

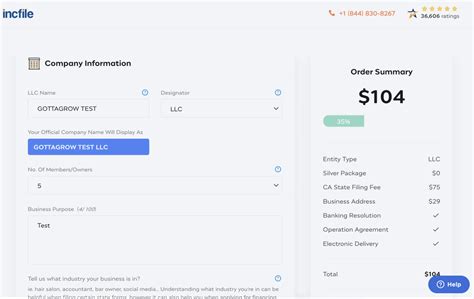

Incfile is a company that specializes in helping individuals and organizations form and maintain their businesses, including nonprofits. Incfile offers a range of services, including preparing and filing the necessary paperwork to establish a nonprofit organization. Incfile’s team of experts will work with the organization to prepare the Articles of Incorporation and Form 1023, and will file the paperwork with the state and federal governments.

Steps to File Nonprofit Paperwork with Incfile

The process of filing nonprofit paperwork with Incfile is straightforward. Here are the steps: * Step 1: Choose a Business Name: The first step in forming a nonprofit organization is to choose a business name. The name must be unique and must include the words “incorporated” or “corporation” or the abbreviation “inc.” or “corp.” * Step 2: Prepare the Articles of Incorporation: The next step is to prepare the Articles of Incorporation, which is the document that establishes the nonprofit organization. The Articles of Incorporation must include the name and address of the organization, the purpose of the organization, and the names and addresses of the directors and officers. * Step 3: Prepare Form 1023: The next step is to prepare Form 1023, which is the application for tax-exempt status. Form 1023 requires detailed information about the organization, including its purpose, activities, and financial information. * Step 4: File the Paperwork: Once the Articles of Incorporation and Form 1023 have been prepared, Incfile will file the paperwork with the state and federal governments.

Benefits of Using Incfile to File Nonprofit Paperwork

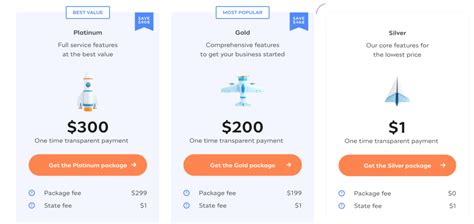

There are several benefits to using Incfile to file nonprofit paperwork. Here are a few: * Expertise: Incfile’s team of experts has extensive experience in preparing and filing nonprofit paperwork. * Convenience: Incfile will handle all of the paperwork, allowing the organization to focus on its mission and activities. * Time-Saving: Incfile will prepare and file the paperwork quickly, which can save the organization a significant amount of time. * Cost-Effective: Incfile’s services are cost-effective, which can help the organization to save money.

📝 Note: It's essential to ensure that all paperwork is filed correctly and on time to avoid any delays or penalties.

Additional Requirements for Nonprofit Organizations

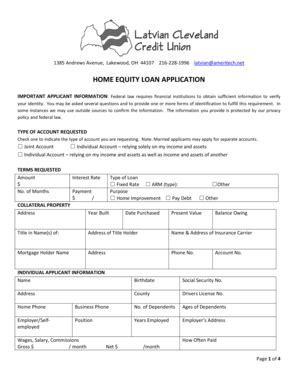

In addition to filing the necessary paperwork, nonprofit organizations must also comply with other requirements, including: * Obtaining an Employer Identification Number (EIN): An EIN is a unique number assigned to the organization by the IRS. * Obtaining a Tax ID Number: A tax ID number is required to open a bank account and to file tax returns. * Filing Annual Information Returns: Nonprofit organizations are required to file annual information returns with the IRS, which includes Form 990.

Conclusion and Final Thoughts

In conclusion, filing nonprofit paperwork is a critical step in the process of forming a nonprofit organization. Incfile is a company that specializes in helping individuals and organizations form and maintain their businesses, including nonprofits. By using Incfile to file nonprofit paperwork, organizations can ensure that their paperwork is filed correctly and on time, which can help to avoid any delays or penalties. It’s essential to ensure that all paperwork is filed correctly and on time to avoid any delays or penalties.

What is the purpose of filing nonprofit paperwork?

+

The purpose of filing nonprofit paperwork is to establish the nonprofit organization and to obtain tax-exempt status.

What is the difference between a nonprofit organization and a for-profit organization?

+

A nonprofit organization is formed for a purpose other than to make a profit, while a for-profit organization is formed to make a profit.

What is the role of Incfile in filing nonprofit paperwork?

+

Incfile is a company that specializes in helping individuals and organizations form and maintain their businesses, including nonprofits. Incfile’s team of experts will work with the organization to prepare and file the necessary paperwork.