Paperwork

IRS Audit Paperwork Fees

Introduction to IRS Audit Paperwork Fees

The Internal Revenue Service (IRS) is responsible for collecting taxes and conducting audits to ensure compliance with tax laws. When a taxpayer is selected for an audit, they may incur various expenses, including IRS audit paperwork fees. These fees can be substantial, and it is essential to understand what they cover and how to minimize them. In this article, we will delve into the world of IRS audit paperwork fees, exploring what they are, how they are calculated, and providing tips on how to reduce them.

What are IRS Audit Paperwork Fees?

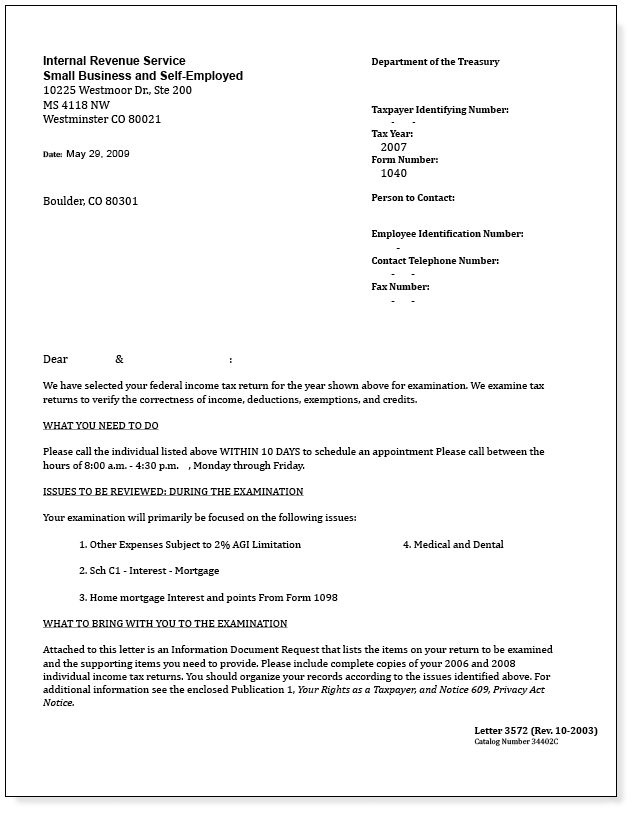

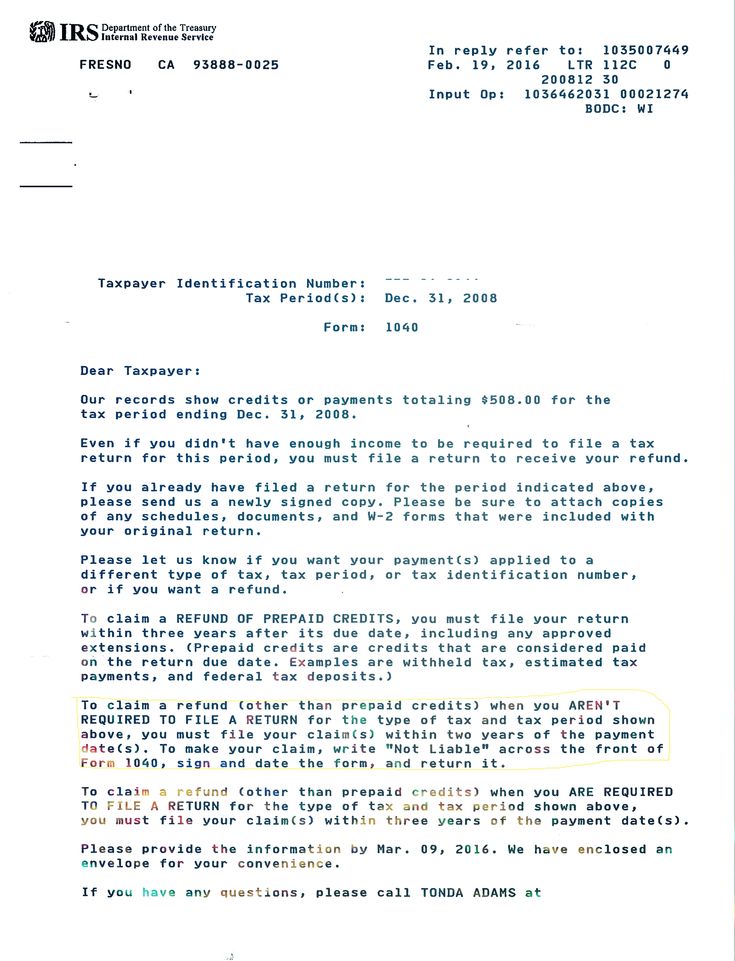

IRS audit paperwork fees refer to the costs associated with preparing and responding to an IRS audit. These fees can include the cost of hiring a tax professional, such as a certified public accountant (CPA) or enrolled agent (EA), to represent the taxpayer during the audit process. Additionally, these fees may cover the cost of gathering and organizing financial documents, as well as the time spent communicating with the IRS.

Types of IRS Audit Paperwork Fees

There are several types of IRS audit paperwork fees that taxpayers may incur, including: * Preparation fees: These fees cover the cost of preparing financial statements and other documents required for the audit. * Representation fees: These fees cover the cost of hiring a tax professional to represent the taxpayer during the audit process. * Document gathering fees: These fees cover the cost of gathering and organizing financial documents required for the audit. * Communication fees: These fees cover the cost of communicating with the IRS, including phone calls, emails, and letters.

How are IRS Audit Paperwork Fees Calculated?

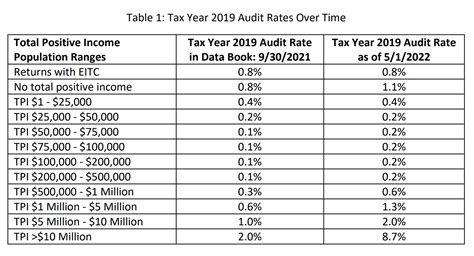

The calculation of IRS audit paperwork fees varies depending on the complexity of the audit and the services required. Some tax professionals may charge an hourly rate, while others may charge a flat fee or a percentage of the tax liability. On average, the cost of hiring a tax professional to represent a taxpayer during an audit can range from 500 to 5,000 or more, depending on the complexity of the case.

Tips for Minimizing IRS Audit Paperwork Fees

To minimize IRS audit paperwork fees, taxpayers can take several steps, including: * Keeping accurate and detailed financial records: This can help reduce the time spent gathering and organizing documents, thereby reducing the overall cost of the audit. * Hiring a tax professional with experience in IRS audits: A tax professional with experience in IRS audits can help navigate the process more efficiently, reducing the overall cost. * Responding promptly to IRS requests: Failing to respond promptly to IRS requests can lead to additional fees and penalties, so it is essential to respond quickly and efficiently. * Negotiating fees with the tax professional: Taxpayers can negotiate fees with their tax professional to ensure they are getting the best value for their money.

📝 Note: Taxpayers should always keep detailed records of their financial transactions, including receipts, invoices, and bank statements, to help minimize the cost of an IRS audit.

Conclusion and Next Steps

In conclusion, IRS audit paperwork fees can be a significant expense for taxpayers. However, by understanding what these fees cover and taking steps to minimize them, taxpayers can reduce their overall cost. It is essential to keep accurate and detailed financial records, hire a tax professional with experience in IRS audits, respond promptly to IRS requests, and negotiate fees with the tax professional. By following these tips, taxpayers can navigate the IRS audit process more efficiently and reduce their overall cost.

What is the average cost of hiring a tax professional to represent a taxpayer during an IRS audit?

+

The average cost of hiring a tax professional to represent a taxpayer during an IRS audit can range from 500 to 5,000 or more, depending on the complexity of the case.

How can taxpayers minimize IRS audit paperwork fees?

+

Taxpayers can minimize IRS audit paperwork fees by keeping accurate and detailed financial records, hiring a tax professional with experience in IRS audits, responding promptly to IRS requests, and negotiating fees with the tax professional.

What types of fees are included in IRS audit paperwork fees?

+

IRS audit paperwork fees can include preparation fees, representation fees, document gathering fees, and communication fees.