Metlife Short Term Disability Paperwork Timeline

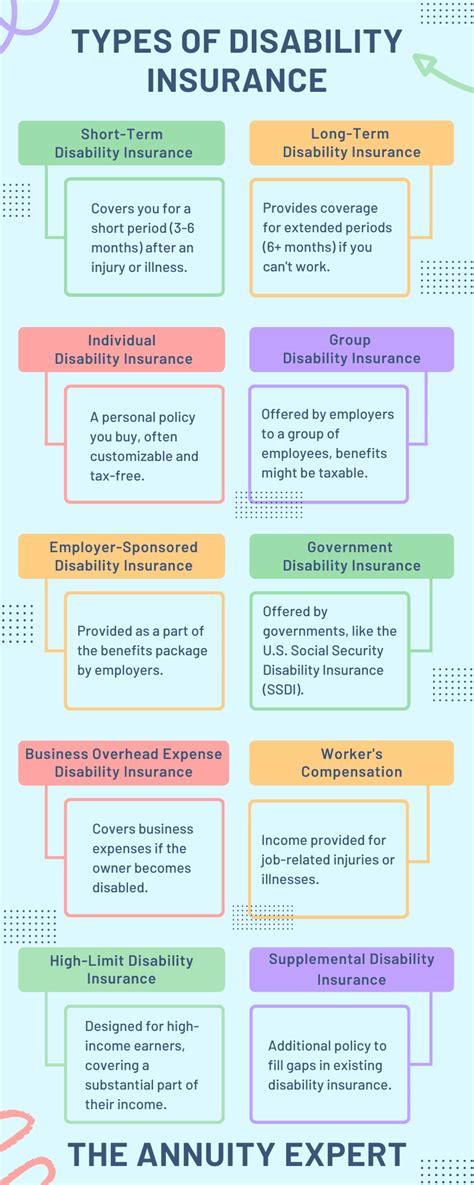

Understanding the Metlife Short Term Disability Paperwork Timeline

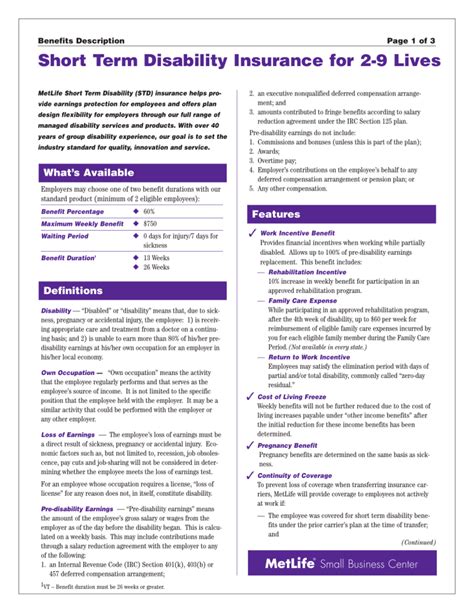

When dealing with short term disability claims, it’s essential to have a clear understanding of the paperwork timeline to ensure a smooth and efficient process. Metlife, a leading provider of disability insurance, has a specific timeline for submitting and processing short term disability claims. In this article, we will delve into the details of the Metlife short term disability paperwork timeline, highlighting key milestones and requirements.

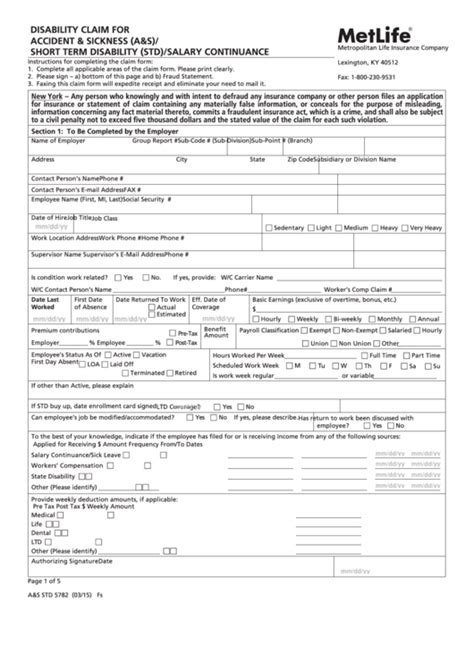

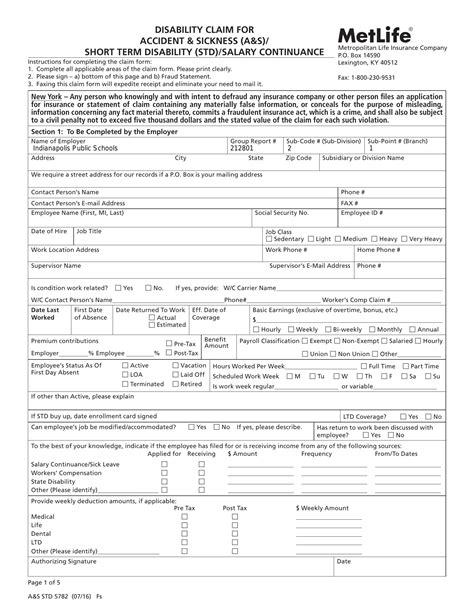

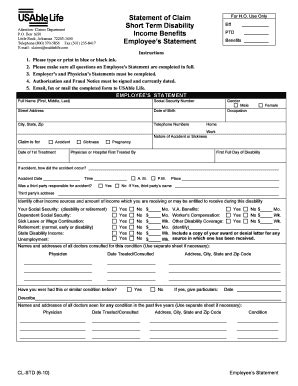

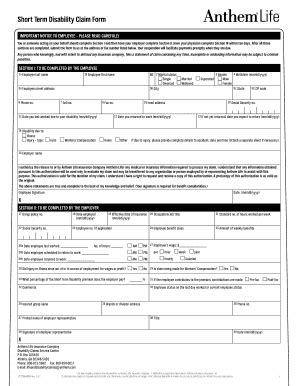

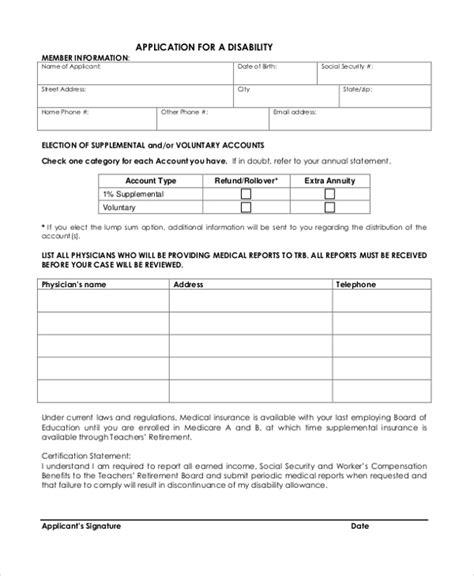

Initial Claim Submission

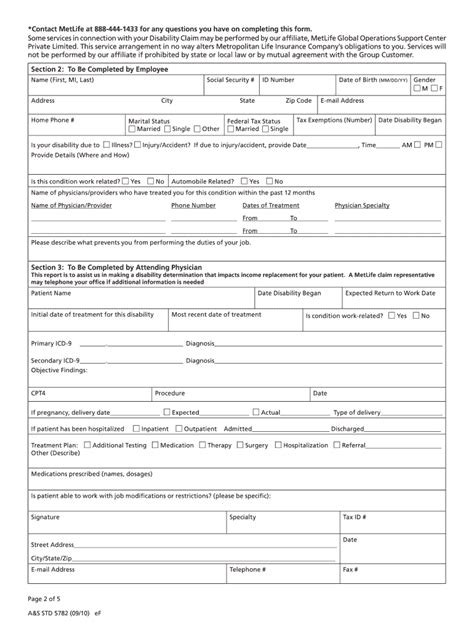

The process begins with the initial claim submission, which typically occurs when an employee becomes unable to work due to a medical condition or injury. The employee or their employer must submit a claim to Metlife, providing detailed information about the disability, including medical records and documentation. It’s crucial to submit the claim as soon as possible, as delays can impact the processing time and potentially affect the outcome of the claim.

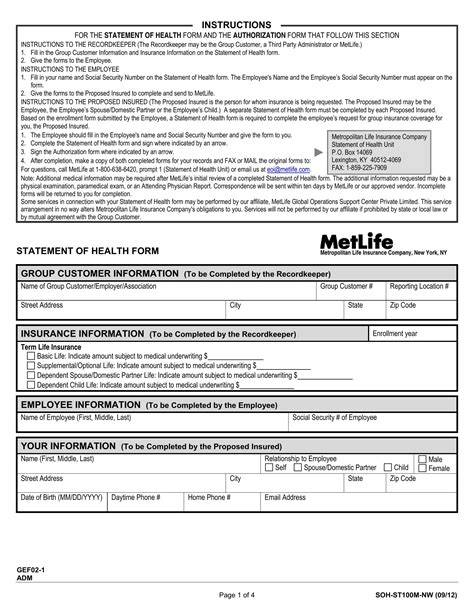

Claim Review and Processing

Once the claim is submitted, Metlife will review and process the application. This stage typically takes 7-10 business days, although it may vary depending on the complexity of the claim. During this time, Metlife may request additional information or documentation to support the claim. Responding promptly to these requests is essential to avoid delays in the processing timeline.

Approval or Denial

After reviewing the claim, Metlife will either approve or deny the application. If approved, the employee will begin receiving short term disability benefits, which typically replace a portion of their income. If denied, the employee may appeal the decision, providing additional information or evidence to support their claim. Understanding the reasons for denial is vital to determine the best course of action for appealing the decision.

Benefit Payment Timeline

If the claim is approved, Metlife will typically begin paying benefits within 2-4 weeks after the approval date. The benefit payment timeline may vary depending on the specific policy and the employee’s eligibility. Regular communication with Metlife is essential to ensure timely payment of benefits and to address any issues that may arise during the payment period.

Continuation of Benefits

To continue receiving benefits, employees may need to provide ongoing medical documentation to support their claim. This documentation helps Metlife determine whether the employee remains eligible for benefits. Failing to provide required documentation may result in the termination of benefits, emphasizing the importance of staying on top of paperwork requirements.

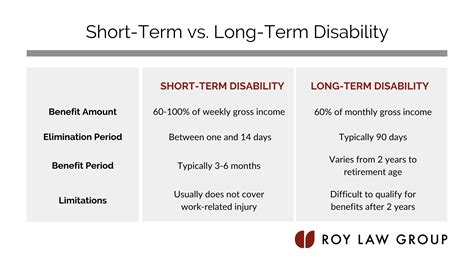

Return to Work or Transition to Long Term Disability

As the short term disability period comes to an end, employees may be eligible to return to work or transition to long term disability benefits. Metlife will typically review the employee’s medical status to determine the best course of action. In some cases, employees may need to provide additional documentation or participate in a return-to-work program to facilitate a smooth transition.

📝 Note: It's essential to carefully review and understand the terms of your Metlife short term disability policy to ensure compliance with the paperwork timeline and requirements.

Key Takeaways and Recommendations

To navigate the Metlife short term disability paperwork timeline efficiently, consider the following key takeaways and recommendations: * Submit claims promptly to avoid delays in processing * Respond quickly to requests for additional information or documentation * Understand the reasons for denial and appeal decisions when necessary * Stay on top of ongoing medical documentation requirements * Communicate regularly with Metlife to ensure timely payment of benefits and address any issues that may arise

| Stage | Timeline | Requirements |

|---|---|---|

| Initial Claim Submission | As soon as possible | Medical records, documentation, and claim form |

| Claim Review and Processing | 7-10 business days | Additional information or documentation as requested |

| Approval or Denial | Varies | Understanding reasons for denial, appeal options |

| Benefit Payment Timeline | Within 2-4 weeks after approval | Regular communication with Metlife |

| Continuation of Benefits | Ongoing | Ongoing medical documentation, regular communication with Metlife |

In summary, navigating the Metlife short term disability paperwork timeline requires careful attention to detail, prompt submission of claims and documentation, and regular communication with Metlife. By understanding the key milestones and requirements, employees can ensure a smooth and efficient process, minimizing delays and maximizing the benefits they receive. As we conclude this overview of the Metlife short term disability paperwork timeline, it’s clear that staying informed and proactive is essential to successfully navigating the process and achieving a positive outcome.

What is the typical processing time for a Metlife short term disability claim?

+

The typical processing time for a Metlife short term disability claim is 7-10 business days, although it may vary depending on the complexity of the claim.

What documentation is required to support a short term disability claim?

+

Documentation required to support a short term disability claim includes medical records, documentation of the disability, and a claim form. Additional information or documentation may be requested during the processing stage.

Can I appeal a denied short term disability claim?

+

Yes, you can appeal a denied short term disability claim. Understanding the reasons for denial and providing additional information or evidence to support your claim is essential to determine the best course of action for appealing the decision.