5 Tips IRS Tracks Bitcoin

Introduction to Bitcoin Tracking by the IRS

The Internal Revenue Service (IRS) has been actively working to track Bitcoin and other cryptocurrencies to ensure tax compliance. As the use of digital currencies continues to grow, it’s essential to understand how the IRS monitors and tracks Bitcoin transactions. In this article, we will discuss the top 5 tips on how the IRS tracks Bitcoin and what it means for cryptocurrency users.

Tip 1: Monitoring Crypto Exchanges

The IRS has been monitoring crypto exchanges to track Bitcoin transactions. In 2018, the IRS issued a notice to Coinbase, a popular cryptocurrency exchange, to hand over information on users who had bought, sold, or exchanged cryptocurrencies worth over $20,000 between 2013 and 2015. This move marked the beginning of the IRS’s efforts to track Bitcoin transactions and ensure tax compliance.

Tip 2: Using Blockchain Analysis Tools

The IRS has been using blockchain analysis tools to track Bitcoin transactions. These tools allow the IRS to analyze blockchain data and identify patterns and connections between wallet addresses. This information can be used to track the flow of Bitcoin and identify users who may be evading taxes.

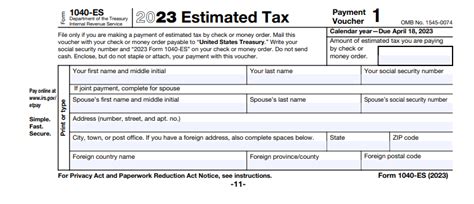

Tip 3: Requiring Taxpayers to Report Crypto Income

The IRS requires taxpayers to report cryptocurrency income on their tax returns. In 2019, the IRS issued new guidance on the tax treatment of cryptocurrencies, which includes the requirement to report crypto income on Form 1040. Taxpayers who fail to report crypto income may face penalties and fines.

Tip 4: Collaborating with International Partners

The IRS has been collaborating with international partners to track Bitcoin transactions. In 2020, the IRS joined the Joint Chiefs of Global Tax Enforcement (J5), a global alliance of tax authorities aimed at combating tax evasion and money laundering. This collaboration allows the IRS to share information and coordinate efforts with other countries to track Bitcoin transactions and ensure tax compliance.

Tip 5: Using AI and Machine Learning

The IRS has been using Artificial Intelligence (AI) and Machine Learning (ML) to track Bitcoin transactions. These technologies allow the IRS to analyze large amounts of blockchain data and identify patterns and anomalies that may indicate tax evasion or other illicit activities.

🚨 Note: The IRS has been actively working to track Bitcoin transactions, and it's essential for cryptocurrency users to understand their tax obligations and comply with tax laws.

| Year | Event | Description |

|---|---|---|

| 2013 | IRS Notice | The IRS issues a notice stating that cryptocurrencies are subject to tax. |

| 2018 | Coinbase Notice | The IRS issues a notice to Coinbase to hand over information on users who had bought, sold, or exchanged cryptocurrencies worth over $20,000. |

| 2019 | New Guidance | The IRS issues new guidance on the tax treatment of cryptocurrencies, which includes the requirement to report crypto income on Form 1040. |

| 2020 | J5 Alliance | The IRS joins the Joint Chiefs of Global Tax Enforcement (J5), a global alliance of tax authorities aimed at combating tax evasion and money laundering. |

In summary, the IRS has been actively working to track Bitcoin transactions using various methods, including monitoring crypto exchanges, using blockchain analysis tools, requiring taxpayers to report crypto income, collaborating with international partners, and using AI and ML. It’s essential for cryptocurrency users to understand their tax obligations and comply with tax laws to avoid penalties and fines.

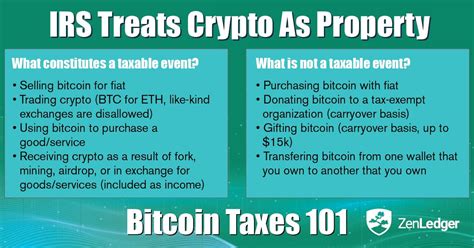

What is the IRS’s stance on Bitcoin?

+

The IRS considers Bitcoin to be property, not currency, and requires taxpayers to report Bitcoin income on their tax returns.

How does the IRS track Bitcoin transactions?

+

The IRS uses various methods to track Bitcoin transactions, including monitoring crypto exchanges, using blockchain analysis tools, and collaborating with international partners.

What are the penalties for not reporting Bitcoin income?

+

Taxpayers who fail to report Bitcoin income may face penalties and fines, including a penalty of up to 75% of the unpaid tax.